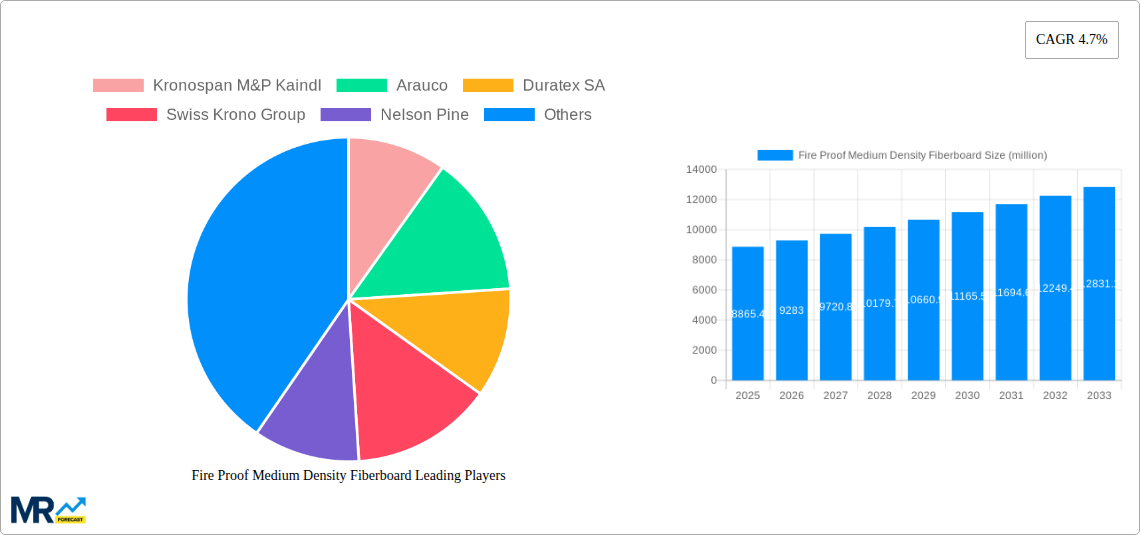

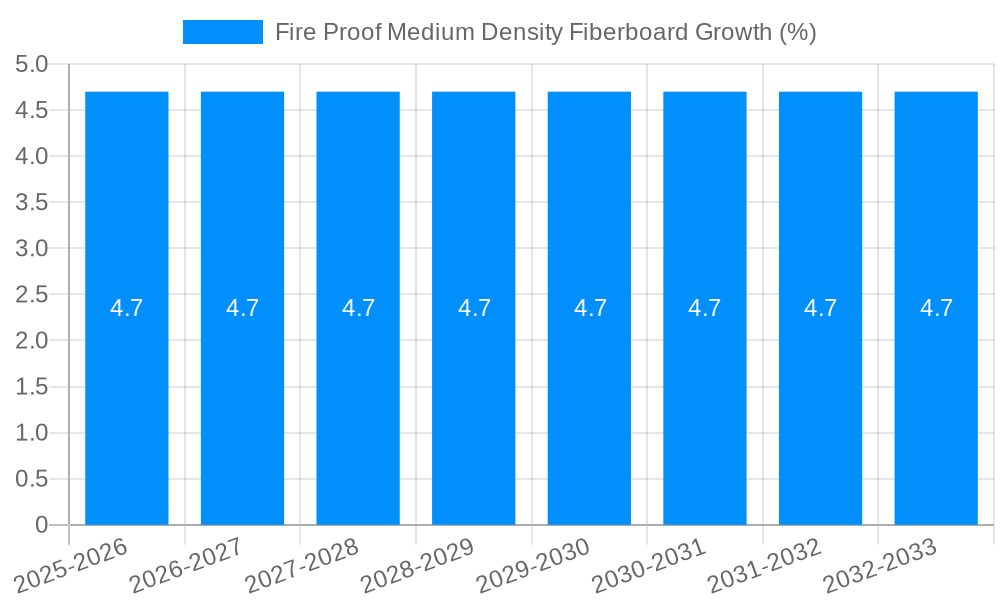

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fire Proof Medium Density Fiberboard?

The projected CAGR is approximately 4.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fire Proof Medium Density Fiberboard

Fire Proof Medium Density FiberboardFire Proof Medium Density Fiberboard by Type (10-20mm, >20mm), by Application (Furniture Industry, Building Materials, Interior Decoration, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Fire Proof Medium Density Fiberboard (MDF) market is projected for steady expansion, currently valued at approximately $8.87 billion in 2025. This growth is driven by increasing stringent fire safety regulations across various sectors, particularly in construction and furniture manufacturing. The demand for fire-resistant materials is escalating as industries prioritize occupant safety and compliance with building codes. The Furniture Industry and Building Materials segments are expected to lead this growth, fueled by new construction projects and renovations requiring enhanced fire performance. Furthermore, the increasing adoption of fire-retardant treatments in interior decoration for both residential and commercial spaces will contribute significantly to market expansion. The market's Compound Annual Growth Rate (CAGR) of 4.7% over the forecast period (2025-2033) indicates a robust and sustained upward trajectory, reflecting the persistent need for safer building and furnishing solutions.

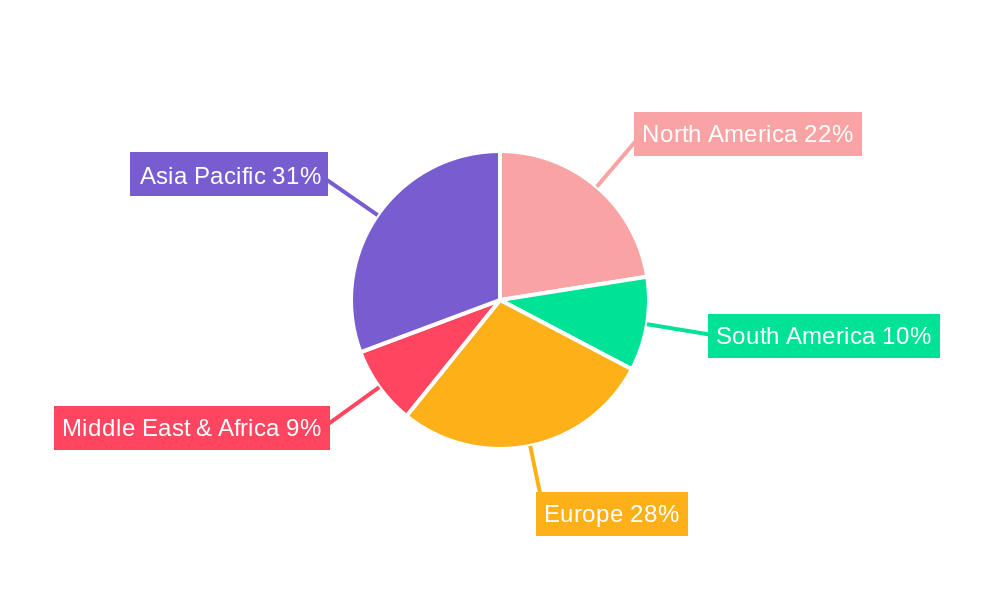

Geographically, Asia Pacific, led by China and India, is anticipated to be a dominant region due to rapid urbanization, significant infrastructure development, and a growing awareness of fire safety standards. Europe and North America, with established regulatory frameworks and a mature construction market, will also represent substantial market shares. Key market players are actively investing in research and development to enhance product performance and explore innovative fire-retardant technologies. This includes the development of MDF with superior fire resistance properties and improved sustainability. While the market benefits from strong demand drivers, potential challenges such as the cost of advanced fire-retardant additives and the availability of raw materials could influence price fluctuations and production capacities. However, the overarching emphasis on fire safety is expected to propel the market forward, creating opportunities for both established and emerging manufacturers.

The Fire Proof Medium Density Fiberboard (FPMDF) market is poised for substantial expansion, driven by an increasing global emphasis on fire safety regulations and a growing demand for enhanced material performance in construction and interior design. Over the study period of 2019-2033, with a base year of 2025 and an estimated year of 2025, the market is projected to witness a CAGR of over 5.5% during the forecast period of 2025-2033. The historical period of 2019-2024 laid the groundwork for this surge, characterized by initial adoption and increasing awareness. A significant insight is the growing penetration of FPMDF in applications traditionally dominated by standard MDF, as building codes become more stringent and homeowners and businesses prioritize safety. The market is projected to reach over USD 1,500 million in value by 2033, a significant leap from its estimated value in 2025, indicating robust growth.

The demand for FPMDF is further augmented by advancements in fire retardant technologies, which are making these boards more cost-effective and environmentally friendly. Innovations in additives and manufacturing processes are yielding FPMDF with superior fire resistance characteristics without compromising on other key properties like workability, aesthetic appeal, and structural integrity. This dual benefit is crucial for its widespread adoption across various sectors. Furthermore, the increasing urbanization and the subsequent rise in construction activities, particularly in developing economies, are creating a fertile ground for FPMDF. As cities grow denser, the need for fire-safe building materials becomes paramount, making FPMDF a critical component in modern architectural designs. The Furniture Industry, a major consumer, is increasingly opting for FPMDF to meet fire safety standards, especially for products intended for public spaces and commercial establishments. Similarly, the Building Materials segment, encompassing everything from wall panels to structural components, is seeing a significant uptake as developers prioritize safety and compliance. Interior Decoration also benefits immensely, as designers seek materials that offer both aesthetic appeal and crucial fire protection for homes and commercial spaces. The shift towards sustainable building practices also inadvertently favors FPMDF, as its enhanced durability and safety contribute to a longer lifecycle and reduced replacement needs, aligning with broader environmental objectives. The market's trajectory is not merely about compliance but about proactive safety integration, reflecting a maturing global consciousness towards mitigating fire-related risks.

The Fire Proof Medium Density Fiberboard (FPMDF) market is experiencing a powerful upward momentum driven by a confluence of critical factors that are reshaping material choices across industries. Foremost among these is the escalating stringency of fire safety regulations globally. As governments and international bodies prioritize public safety, building codes and product standards are being rigorously updated to mandate the use of fire-resistant materials in an increasing array of applications. This legislative push directly translates into a heightened demand for FPMDF, as manufacturers and builders alike seek to comply with these evolving requirements. The Furniture Industry, for instance, is a significant beneficiary, with regulations increasingly dictating fire-retardant properties for products used in public buildings, schools, and healthcare facilities. Beyond mere compliance, there is a growing proactive recognition of the intrinsic value of enhanced fire safety by end-users. Businesses and homeowners are increasingly willing to invest in FPMDF not just to meet legal obligations but to safeguard lives, property, and business continuity in the event of a fire. This heightened awareness, fueled by high-profile fire incidents and public awareness campaigns, creates a strong pull for FPMDF as a superior alternative to conventional materials. Furthermore, technological advancements in the production of FPMDF are playing a pivotal role. Innovations in fire retardant additives and manufacturing techniques are not only improving the fire resistance of these boards but also enhancing their overall performance characteristics, such as durability, aesthetic finish, and ease of installation, making them more competitive and attractive across diverse applications.

Despite the robust growth trajectory of the Fire Proof Medium Density Fiberboard (FPMDF) market, several challenges and restraints could temper its full potential. A primary concern revolves around the cost differential compared to standard Medium Density Fiberboard (MDF). The inclusion of specialized fire retardant additives and potentially more complex manufacturing processes can lead to a higher unit cost for FPMDF. This price premium, while justifiable in terms of enhanced safety, can be a significant barrier in cost-sensitive markets or for applications where fire safety is not a strictly mandated requirement. For instance, in the “Others” segment of applications, where the urgency for fireproofing might be less pronounced, the additional cost could deter adoption. Furthermore, the availability and efficacy of certain fire retardant chemicals can be subject to environmental regulations and concerns. While innovation is constantly seeking greener alternatives, the lifecycle impact and potential toxicity of some additives can lead to scrutiny and, in some cases, limitations on their use. This necessitates ongoing research and development to ensure FPMDF remains an environmentally responsible choice. Another potential restraint lies in the consumer and industry perception and knowledge base. While awareness of fire safety is growing, a comprehensive understanding of the specific benefits and performance of FPMDF might not be universally prevalent. Misconceptions or a lack of clear technical information could hinder its adoption in niche applications or regions where educational outreach is limited. Lastly, the supply chain dynamics for specialized FPMDF can also present challenges. Ensuring a consistent and reliable supply of these specialized boards, especially in large volumes for major construction projects, requires robust manufacturing capabilities and efficient distribution networks, which might not be uniformly developed across all geographical markets.

The global Fire Proof Medium Density Fiberboard (FPMDF) market is characterized by a dynamic interplay of regional strengths and segment-specific demand. Based on projected growth and regulatory landscapes, Asia-Pacific is anticipated to emerge as a dominant region, driven by rapid urbanization, extensive infrastructure development, and increasingly stringent fire safety mandates. Countries like China, India, and Southeast Asian nations are experiencing a construction boom, creating a substantial demand for building materials that adhere to higher safety standards. The sheer scale of construction projects, from residential complexes to commercial hubs and public utilities, necessitates a widespread adoption of FPMDF. The Furniture Industry in this region, which is a major global manufacturing base, is also increasingly incorporating FPMDF to meet international quality and safety benchmarks.

Within this burgeoning market, the Building Materials segment, particularly the Type: >20mm sub-segment, is poised for significant dominance. This emphasis on thicker FPMDF boards is directly linked to their application in structural and semi-structural components within buildings, such as fire-rated wall panels, partitions, and ceiling systems. These applications inherently demand higher fire resistance and structural integrity, making the thicker variants of FPMDF a preferred choice. The Building Materials sector is also benefiting from government initiatives aimed at promoting safer and more sustainable construction practices. For instance, in the Asia-Pacific region, where rapid industrialization has sometimes led to concerns about fire safety, there is a strong push towards adopting advanced materials that can mitigate risks.

The Furniture Industry also plays a crucial role, with a considerable demand for FPMDF in panels for cabinetry, shelving, and furniture components intended for high-traffic areas and public spaces. The Type: 10-20mm FPMDF is particularly relevant here due to its versatility and ease of processing for furniture manufacturing. As consumer awareness regarding product safety increases, manufacturers are proactively integrating FPMDF to enhance the fire performance of their offerings, thereby gaining a competitive edge.

Another segment showing considerable promise is Interior Decoration. As architects and interior designers increasingly focus on creating safe yet aesthetically pleasing environments, FPMDF offers a compelling solution. Its ability to be finished with various veneers, laminates, and paints makes it suitable for decorative wall panels, custom furniture, and built-in fixtures where fire safety is a critical consideration. This segment is expected to witness substantial growth as design trends increasingly converge with safety requirements. The "Others" segment, while more fragmented, can encompass niche applications like fire doors, specialized acoustic panels, and industrial applications where fire resistance is paramount, contributing to the overall market expansion. The interplay between these segments and the overarching regional demand, particularly in economically vibrant and rapidly developing areas, will dictate the landscape of FPMDF market dominance.

The Fire Proof Medium Density Fiberboard (FPMDF) industry is experiencing significant growth catalysts that are propelling its expansion. A primary driver is the increasing global awareness and implementation of stricter fire safety regulations across residential, commercial, and industrial sectors. This regulatory push is compelling industries to adopt materials that offer superior fire resistance, directly benefiting FPMDF. Furthermore, technological advancements in fire retardant additives and manufacturing processes are enhancing the performance and cost-effectiveness of FPMDF, making it a more attractive alternative to traditional materials. The growing trend towards sustainable and safe construction practices also bolsters demand, as FPMDF contributes to a safer built environment and can have a longer lifecycle.

This comprehensive report delves into the intricacies of the Fire Proof Medium Density Fiberboard (FPMDF) market, providing an in-depth analysis of its current state and future trajectory. Covering the study period from 2019 to 2033, with a base year of 2025, the report offers critical insights into market dynamics, including key trends, driving forces, and potential challenges. It meticulously examines the growth catalysts that are fueling the industry's expansion, such as evolving fire safety regulations and technological innovations in fire retardant materials. The report also identifies the leading players in the market and highlights significant developments that are shaping the sector. Furthermore, it presents a detailed segmentation of the market by type and application, alongside an analysis of key regions and countries expected to dominate. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving FPMDF landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.7%.

Key companies in the market include Kronospan M&P Kaindl, Arauco, Duratex SA, Swiss Krono Group, Nelson Pine, MASISA, Sonae Arauco, kastamonu Entegre, Finsa, Yildiz Entegre, Egger, Pfleiderer, Norbord, Georgia-Pacific Wood Products, Swedspan, Dongwha, Yonglin Group, Furen Group, DareGlobal Wood, Quanyou, .

The market segments include Type, Application.

The market size is estimated to be USD 8865.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fire Proof Medium Density Fiberboard," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fire Proof Medium Density Fiberboard, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.