1. What is the projected Compound Annual Growth Rate (CAGR) of the Financial Asset Broking Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Financial Asset Broking Services

Financial Asset Broking ServicesFinancial Asset Broking Services by Type (/> Securities Brokerage, Capital-Raising Services, Mortgage Broking, Mergers & Acquisitions Services, Others), by Application (/> Financial Institutions, Individuals, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

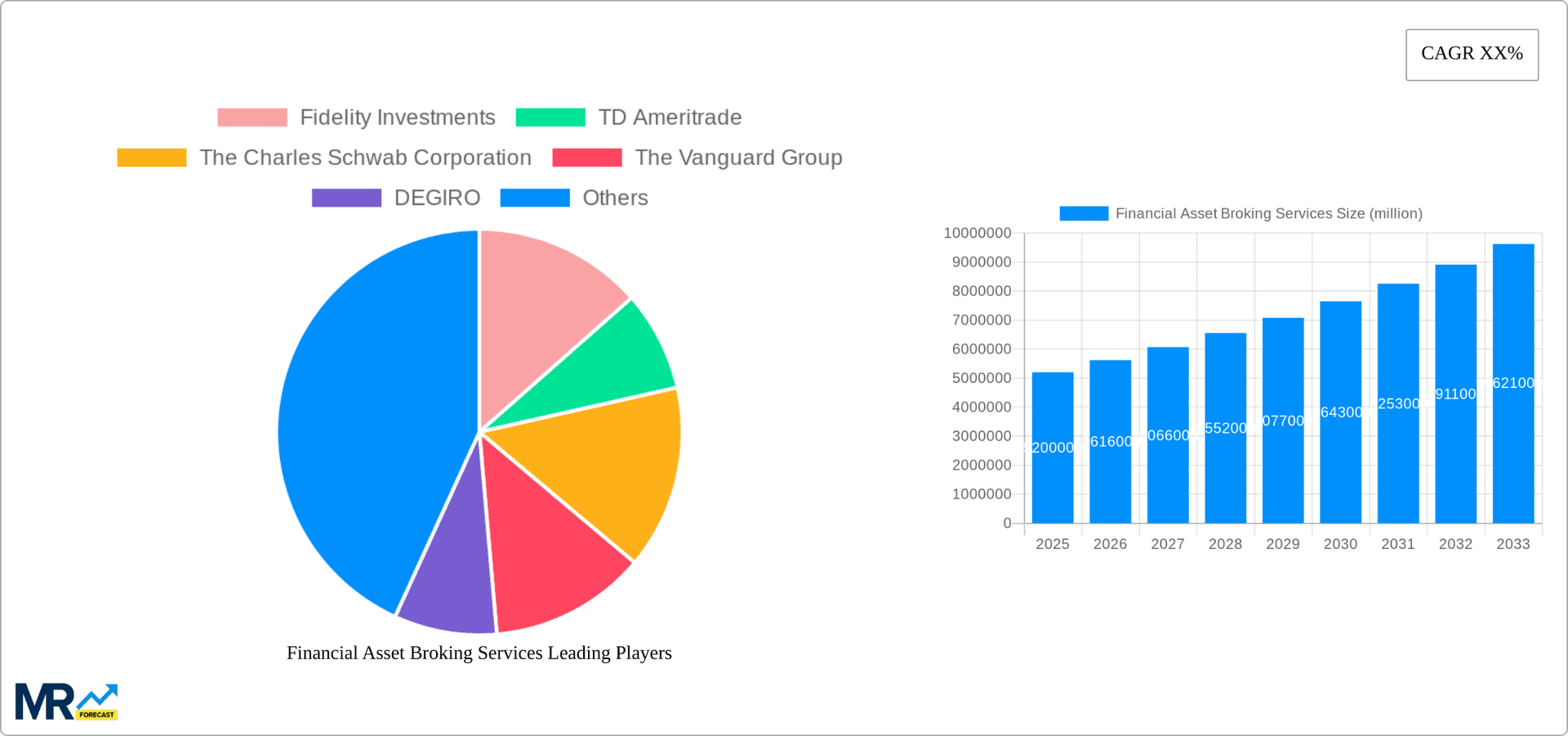

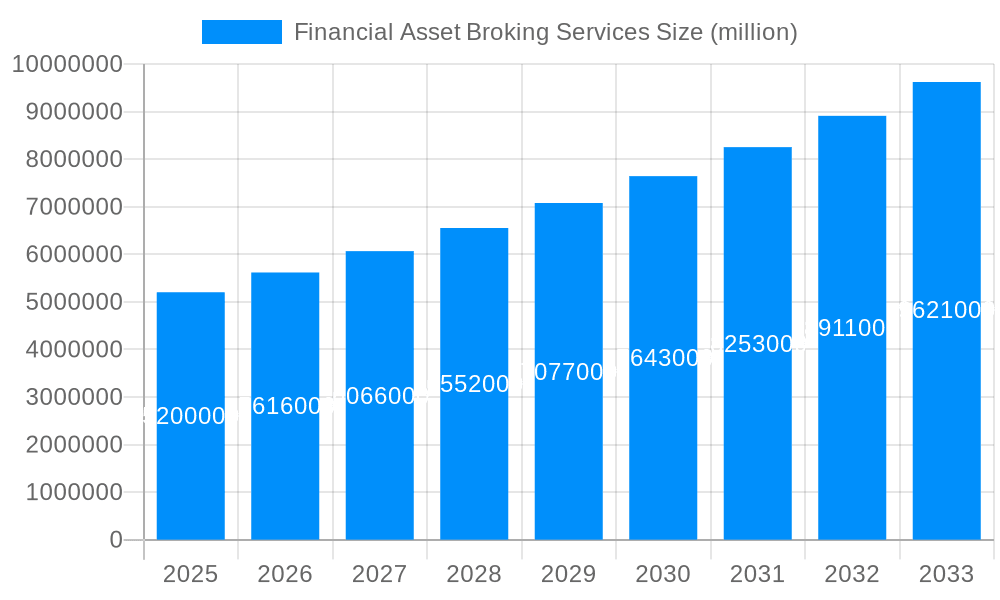

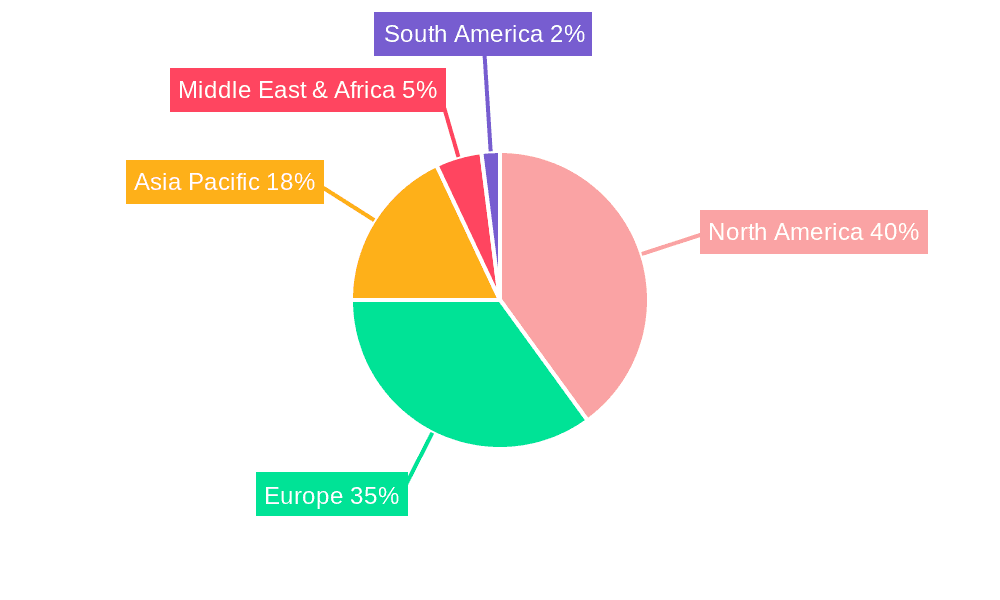

The global financial asset broking services market is experiencing robust growth, driven by increasing retail investor participation, technological advancements, and the expansion of online trading platforms. The market, encompassing securities brokerage, capital-raising services, mortgage broking, mergers & acquisitions services, and others, caters to a diverse clientele including financial institutions and individual investors. While precise market size figures for 2025 are unavailable, a reasonable estimation based on industry reports and observed growth trends in previous years suggests a market value exceeding $5 trillion. A Compound Annual Growth Rate (CAGR) of 8% is projected for the forecast period (2025-2033), indicating significant expansion potential. Key market drivers include the rising adoption of mobile trading apps, increased financial literacy, and the growing popularity of investment products like ETFs and robo-advisors. However, regulatory changes and increasing competition, especially from fintech disruptors, pose considerable challenges to traditional brokerage firms. The market is segmented geographically, with North America and Europe currently holding the largest market shares, although significant growth is anticipated in Asia-Pacific regions like India and China driven by increasing disposable incomes and burgeoning middle classes. The competitive landscape is dominated by established players like Fidelity Investments, Schwab, and Vanguard, but newer entrants are rapidly gaining traction through innovative offerings and cost-effective solutions.

The expansion of the financial asset broking services market is further fueled by the increasing demand for sophisticated investment strategies and wealth management solutions. This demand is creating opportunities for specialized services like mergers and acquisitions advisory and capital-raising for small and medium-sized enterprises (SMEs). While regulatory scrutiny remains a concern, the overall market outlook is positive. The integration of artificial intelligence and machine learning is expected to transform the industry, creating more personalized investment experiences and enhancing efficiency. Moreover, the continued globalization of financial markets and cross-border investments are contributing to the overall growth and expansion of the broking services market. Strategic partnerships and mergers and acquisitions are expected to shape the competitive landscape in the coming years as firms strive to increase their market share and offer a broader range of services.

The global financial asset broking services market exhibited robust growth throughout the historical period (2019-2024), driven by several converging factors. The increasing adoption of online trading platforms, coupled with a rise in retail investor participation fueled by factors such as zero-commission trading and readily available financial information, significantly boosted market expansion. This surge was particularly evident in the securities brokerage segment, which accounted for the largest share of the market. The estimated market value in 2025 sits at approximately $XXX million. However, the market's trajectory isn't uniformly positive. While growth in online brokerage continues, traditional brokerage models are facing challenges adapting to the rapid technological shift. Furthermore, regulatory changes and increased competition are impacting profitability across the board. The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace compared to the historical period, reaching an estimated $YYY million by 2033. This moderation reflects a more mature market, increased regulatory scrutiny, and ongoing consolidation amongst key players. The rise of robo-advisors and algorithmic trading is also reshaping the landscape, demanding innovative strategies from established brokerage firms to maintain their market share. Geographic variations are also notable, with developed economies experiencing slower growth compared to emerging markets experiencing rapid expansion in online brokerage. This report provides a detailed analysis of these trends, providing valuable insights for stakeholders seeking to navigate this dynamic market.

Several key factors are propelling the growth of financial asset broking services. The democratization of finance, spurred by the proliferation of online brokerage platforms offering commission-free or low-commission trading, has significantly broadened market access. This has resulted in a substantial increase in retail investor participation, particularly among younger demographics who are more comfortable engaging with digital financial tools. Technological advancements, including the development of sophisticated trading algorithms and artificial intelligence-driven investment advisory services (robo-advisors), are enhancing efficiency and improving the user experience, attracting a wider range of investors. Furthermore, the growing sophistication of financial products and the increasing complexity of investment strategies are driving demand for specialized brokerage services. This is particularly true for high-net-worth individuals and institutional investors who require bespoke solutions for managing their portfolios. The increasing prevalence of mobile trading apps has also streamlined access and increased convenience, further contributing to the market's expansion. Finally, the continued growth of the global economy and increasing disposable incomes across various regions represent a solid foundation for future growth in this sector.

Despite the positive trends, the financial asset broking services industry faces several significant challenges. Intense competition, particularly from low-cost online brokers and the emergence of disruptive fintech companies, is putting pressure on margins and forcing established players to innovate aggressively. Regulatory scrutiny and evolving compliance requirements increase operational costs and complicate business operations. Cybersecurity threats represent a growing concern, as brokers handle sensitive client data and financial transactions. The increasing complexity of financial regulations, especially in areas like anti-money laundering (AML) and know-your-customer (KYC), necessitates significant investments in compliance infrastructure. Furthermore, economic downturns and market volatility can severely impact investor sentiment and trading volumes, negatively impacting brokerage revenues. Finally, the challenge of attracting and retaining talent with specialized knowledge in financial markets and technology remains a crucial obstacle for many firms seeking to maintain a competitive edge.

Securities Brokerage: This segment consistently dominates the market due to its widespread accessibility and diverse range of investment products offered. The ease of online trading, coupled with the increasing number of retail investors, fuels its growth. The projected growth within this segment is expected to surpass other segments during the forecast period, propelled by ongoing technological innovation and the expansion of financial literacy.

Individuals: Individual investors comprise the largest user base for financial asset broking services. The democratization of finance through online platforms has empowered individuals to manage their investments directly, contributing to the significant growth of this segment. This segment's growth will be sustained by increasing financial inclusion and the growing popularity of digital investment platforms.

North America & Europe: These regions maintain a significant market share due to their established financial markets, high levels of technological adoption, and a strong presence of major brokerage firms. However, the growth rate in these regions may be slower compared to emerging markets due to market maturity.

Asia-Pacific (specifically India and China): These rapidly developing economies show remarkable potential. The expanding middle class, increasing internet penetration, and rising disposable incomes are driving a surge in retail investor participation. The significant growth of online brokerage platforms and increased financial literacy in these regions contribute to their dominant market position in terms of growth rate within the forecast period.

In summary, while North America and Europe maintain a substantial market share, the fastest growth is projected to emanate from the Asia-Pacific region, specifically India and China, within both the securities brokerage segment and the individual investor application segment. The combination of a growing middle class, increased internet accessibility, and the burgeoning popularity of digital investment platforms are key drivers for this exceptional growth potential.

The financial asset broking services industry is experiencing significant growth propelled by several key catalysts. The increasing accessibility of online trading platforms and the rise of robo-advisors are lowering the barrier to entry for new investors. Simultaneously, advancements in technology such as AI-driven investment strategies and algorithmic trading are enhancing the efficiency and effectiveness of investment management. The broadening appeal of fractional share investing further empowers individual investors with limited capital, fostering market growth.

This report provides a comprehensive overview of the financial asset broking services market, offering detailed analysis of market trends, drivers, challenges, key players, and future growth projections. It serves as a valuable resource for investors, businesses, and policymakers seeking to understand and navigate this dynamic and evolving sector. The report combines quantitative data with qualitative insights, providing a holistic perspective on the current and future state of the financial asset broking services industry. This in-depth analysis is backed by rigorous research and data analysis from reliable sources, ensuring accurate and relevant information for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Fidelity Investments, TD Ameritrade, The Charles Schwab Corporation, The Vanguard Group, DEGIRO, Interactive Brokers, Zerodha Broking, Revolut, E-Trade Financial Corporation.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Financial Asset Broking Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Financial Asset Broking Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.