1. What is the projected Compound Annual Growth Rate (CAGR) of the Film Forming Starch?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Film Forming Starch

Film Forming StarchFilm Forming Starch by Type (Native Starch, Modified Starch, World Film Forming Starch Production ), by Application (Food and Beverage, Pharmaceutical, Others, World Film Forming Starch Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

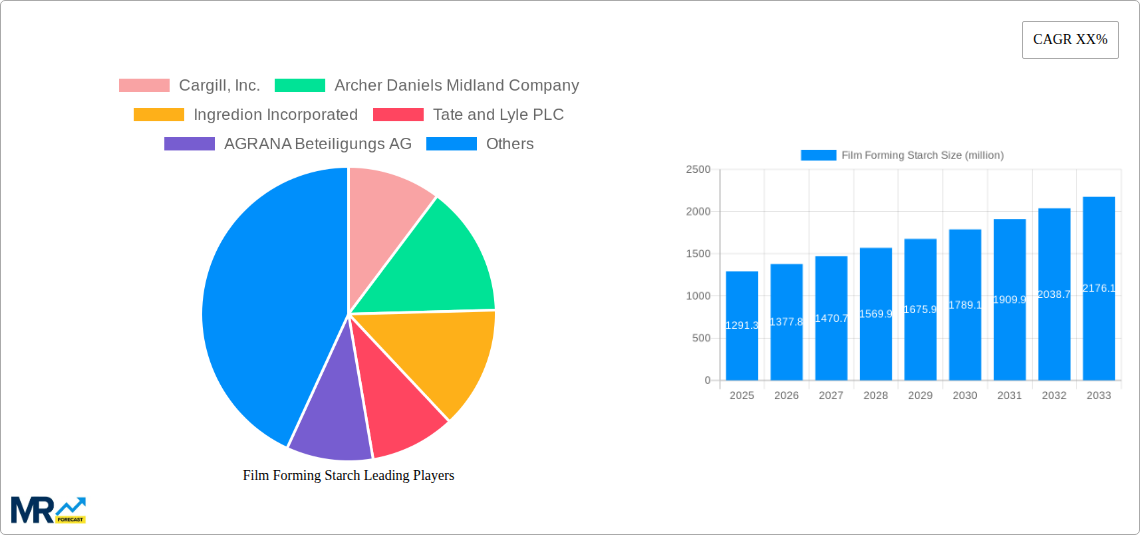

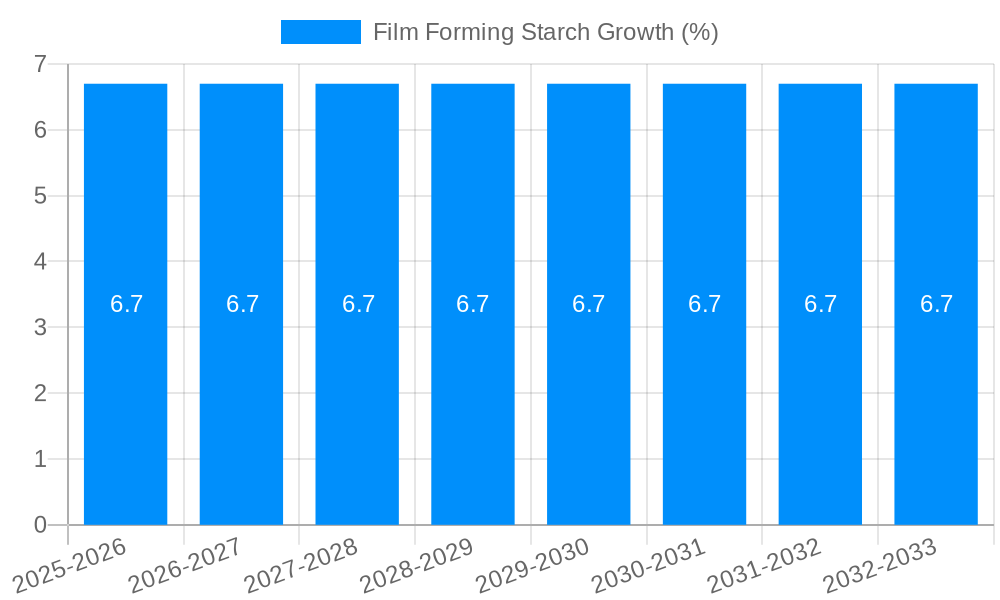

The global Film Forming Starch market is poised for substantial growth, projected to reach approximately $1291.3 million by 2025. This expansion is driven by a confluence of factors, including the increasing demand from the food and beverage sector for ingredients that enhance texture, stability, and shelf-life of processed foods, as well as a growing reliance on advanced pharmaceutical formulations requiring precise film-forming properties for drug delivery systems. The market is characterized by a healthy Compound Annual Growth Rate (CAGR) of around 6.5%, suggesting a robust and sustained upward trajectory throughout the forecast period of 2025-2033. Native starches and modified starches are the primary segments, with modified starches likely to witness higher growth due to their tailored functionalities. The "Others" application segment, encompassing industries like paper, textiles, and biodegradable packaging, is also emerging as a significant contributor to market expansion.

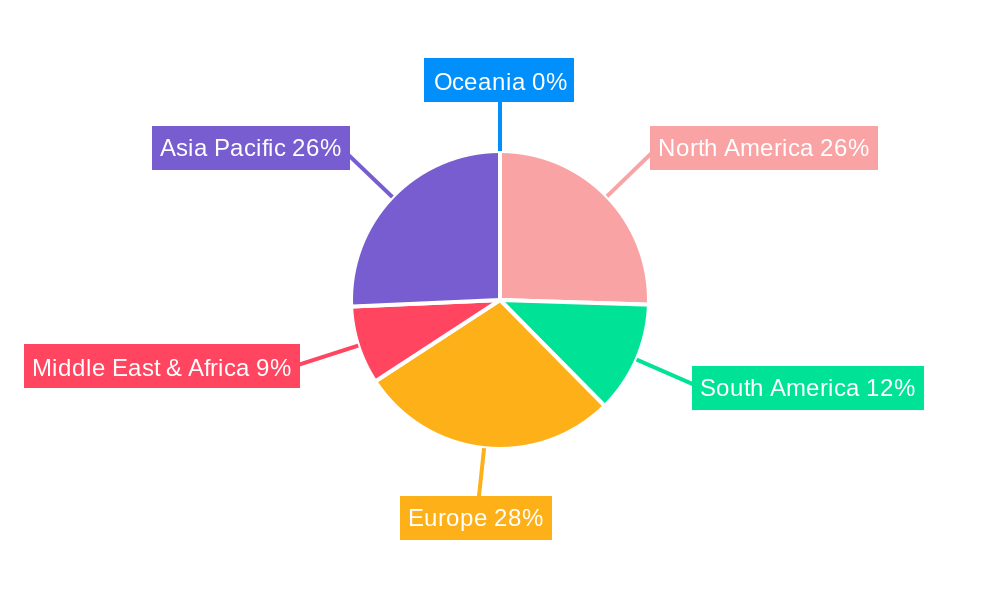

The competitive landscape is dominated by key players such as Cargill, Inc., Archer Daniels Midland Company, Ingredion Incorporated, and Tate and Lyle PLC, who are actively investing in research and development to innovate new starch-based solutions and expand their production capacities. Geographically, Asia Pacific, led by China and India, is expected to be the fastest-growing region due to its burgeoning food processing industry and increasing adoption of advanced materials in pharmaceuticals. North America and Europe, while mature markets, will continue to contribute significantly owing to established industries and a strong emphasis on product innovation. Restraints such as the volatility of raw material prices and the development of alternative ingredients are present, but the inherent versatility and cost-effectiveness of film-forming starches are expected to largely mitigate these challenges, ensuring continued market vitality.

Here's a unique report description on Film Forming Starch, incorporating your specified elements:

This comprehensive report offers an in-depth analysis of the global Film Forming Starch market, providing critical insights for stakeholders navigating this dynamic sector. The study spans a significant period, from the Historical Period (2019-2024) through the Base Year (2025) and extending to the Forecast Period (2025-2033), with particular emphasis on the Estimated Year (2025). We project the World Film Forming Starch Production to reach an impressive $X million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of Y% during the forecast period. The report meticulously dissects market trends, identifies key growth drivers and restraints, and pinpoints dominant regions and segments. Furthermore, it highlights significant industry developments and profiles leading market players, offering a holistic view of the Film Forming Starch landscape. This report is designed to equip businesses with the strategic intelligence necessary to capitalize on emerging opportunities and mitigate potential risks within this burgeoning market.

The global Film Forming Starch market is experiencing a significant upward trajectory, driven by a confluence of evolving consumer preferences and expanding industrial applications. A key trend observed is the increasing demand for bio-based and sustainable alternatives to synthetic film formers. Consumers, increasingly aware of environmental impact, are actively seeking products derived from renewable resources, positioning film forming starches as a highly attractive option. This shift is particularly evident in the food and beverage sector, where manufacturers are exploring starch-based films for edible coatings, packaging solutions, and ingredient encapsulation, aiming to reduce plastic waste and enhance product shelf-life. In the pharmaceutical realm, the development of biodegradable and biocompatible drug delivery systems is fueling the adoption of specialized film forming starches, promising targeted and controlled release mechanisms. Moreover, technological advancements in starch modification are yielding novel starch derivatives with enhanced film-forming properties, such as improved barrier capabilities against moisture and oxygen, superior flexibility, and better thermal stability. These innovations are opening doors to new applications in textiles, adhesives, and even personal care products. The World Film Forming Starch Production is projected to witness substantial growth, with significant advancements anticipated in areas like nano-encapsulation and active packaging technologies. The market is also seeing a rising interest in functionalized starches, incorporating specific properties like antimicrobial or antioxidant activity, further broadening their appeal across diverse industries. The integration of smart packaging solutions, where film forming starches play a crucial role in embedding indicators or sensors, is another emergent trend that promises to reshape market dynamics. The increasing focus on circular economy principles also bodes well for film forming starches, given their inherent biodegradability and compostability. The Estimated Year (2025) is expected to be a pivotal point, with a noticeable acceleration in the adoption of these advanced starch-based solutions across various end-use industries. The global market is poised to witness robust expansion, driven by innovation and a growing commitment to sustainable materials.

Several potent forces are converging to propel the growth of the global Film Forming Starch market. Foremost among these is the burgeoning consumer demand for natural and sustainable ingredients. As environmental consciousness intensifies, industries are actively seeking alternatives to petroleum-based synthetics. Film forming starches, derived from renewable plant sources like corn, potato, and tapioca, perfectly align with this trend, offering a biodegradable and eco-friendly solution. This eco-conscious shift is a significant driver across numerous applications, from food packaging aiming to reduce plastic footprints to pharmaceutical formulations prioritizing biocompatibility. Secondly, the remarkable versatility of film forming starches is a crucial catalyst. Through various modification techniques, starches can be tailored to exhibit a wide array of functional properties, including specific barrier characteristics against moisture and gases, enhanced solubility, improved flexibility, and superior adhesive qualities. This adaptability allows them to serve diverse needs in sectors like food and beverage for coatings and encapsulations, pharmaceuticals for drug delivery systems, and even in industrial applications for binders and coatings. The increasing global population and the subsequent rise in demand for processed foods and packaged goods further contribute to the market's expansion. As the food industry endeavors to extend shelf life and improve product presentation, the demand for effective film forming solutions, often provided by starches, continues to climb. The pharmaceutical industry's relentless pursuit of innovative drug delivery methods, seeking more efficient and patient-friendly administration, also presents a substantial avenue for growth. The continuous research and development efforts focused on creating novel starch derivatives with superior performance characteristics are also a significant propellant, promising to unlock even more advanced applications in the near future.

Despite the promising growth trajectory, the Film Forming Starch market encounters certain hurdles that could temper its expansion. A primary challenge lies in the inherent limitations of native starches in certain demanding applications. While modified starches offer enhanced functionalities, their performance might still fall short of synthetic counterparts in scenarios requiring extreme heat resistance, exceptional water barrier properties, or very high mechanical strength. This necessitates ongoing research and development to bridge these performance gaps and expand the applicability of starch-based films. Another significant restraint is the fluctuating prices of raw materials, particularly agricultural commodities like corn and potato. Global supply chain disruptions, adverse weather conditions, and changing agricultural policies can lead to price volatility, impacting the cost-effectiveness of film forming starches and potentially influencing manufacturer adoption decisions. Furthermore, the processing of starch into functional film-forming ingredients can be energy-intensive and may involve the use of chemicals, raising concerns about the overall environmental footprint and cost-efficiency compared to established synthetic alternatives. Consumer perception and awareness also play a role; while the trend towards natural products is growing, educating consumers about the benefits and efficacy of starch-based films versus traditional materials remains an ongoing endeavor. Regulatory hurdles and the need for extensive testing and certification for new starch-based applications, especially in sensitive sectors like pharmaceuticals and food contact materials, can also slow down market penetration and introduce additional costs for manufacturers. The competitive landscape, with established players in synthetic film formers, also poses a challenge, requiring film forming starches to consistently demonstrate superior cost-performance ratios and unique advantages to gain market share.

The global Film Forming Starch market is characterized by a dynamic interplay between key regions and segments, each contributing to its overall expansion.

Dominant Regions & Countries:

Dominant Segments:

The interplay between these regions and segments paints a clear picture of market leadership. North America and Europe, driven by sustainability mandates and consumer demand, are setting the pace for modified starch applications in the food and beverage sector. However, the Asia Pacific region's rapid industrial growth and expanding consumer base are poised to significantly influence future market dynamics, especially in the realm of modified starches for a diverse range of applications. The continuous innovation within the Modified Starch segment, coupled with the ever-present demand from the Food and Beverage industry, ensures their continued dominance in the global Film Forming Starch market for the foreseeable future.

The Film Forming Starch industry is propelled by several key growth catalysts. The escalating global demand for sustainable and bio-based materials, driven by environmental concerns and regulatory pressures, is a paramount driver. Consumers and industries are actively seeking alternatives to petroleum-based plastics, and film forming starches, being renewable and biodegradable, fit this demand perfectly. Furthermore, ongoing advancements in starch modification technologies are continuously enhancing the performance and expanding the application range of these starches, making them more competitive against synthetic alternatives. The growth of the food and beverage industry, with its increasing need for advanced packaging solutions to extend shelf life and improve product appeal, also significantly fuels demand. In parallel, the pharmaceutical sector's pursuit of innovative and patient-friendly drug delivery systems presents a substantial opportunity for specialized film forming starches.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cargill, Inc., Archer Daniels Midland Company, Ingredion Incorporated, Tate and Lyle PLC, AGRANA Beteiligungs AG, Suzhou Cemo New Material Technology Co., Ltd., Primient, Roquette, .

The market segments include Type, Application.

The market size is estimated to be USD 1291.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Film Forming Starch," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Film Forming Starch, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.