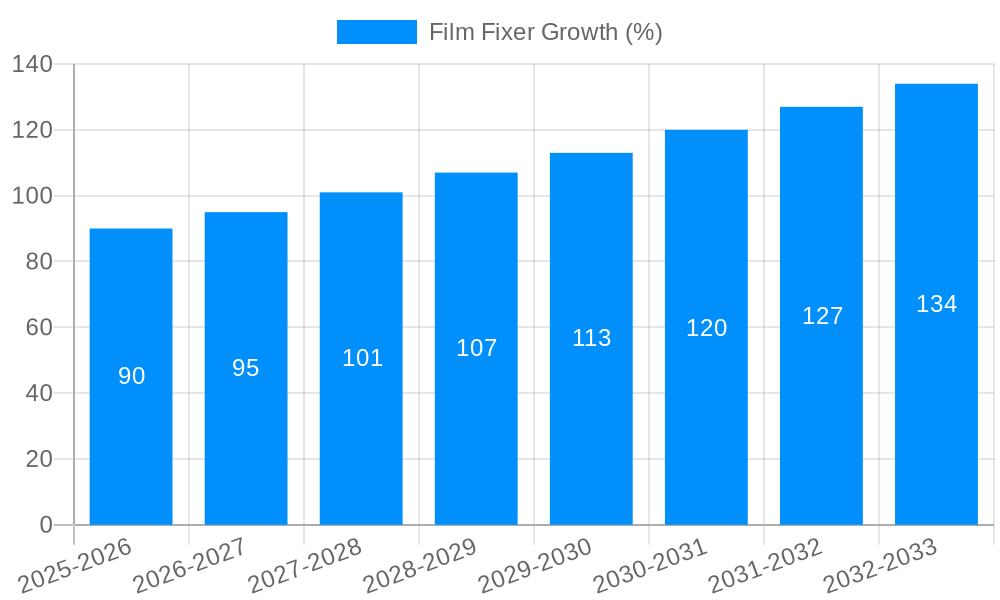

1. What is the projected Compound Annual Growth Rate (CAGR) of the Film Fixer?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Film Fixer

Film FixerFilm Fixer by Type (Black and White Film Fixer, Color Film Fixer, X-ray Film Fixer), by Application (Domestic, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global film fixer market, encompassing black and white, color, and X-ray film fixers, is experiencing moderate growth, driven by the continued niche demand from professional photographers, film enthusiasts, and medical imaging facilities. While digital photography dominates the broader imaging landscape, a dedicated segment of consumers and professionals remain committed to traditional film photography, fueling consistent, albeit modest, demand for film fixers. The market's growth is further influenced by factors such as the increasing popularity of analog photography as a creative pursuit and the archival needs of historical photographic collections. However, the market faces constraints from the ongoing dominance of digital technology, the high cost of film processing compared to digital alternatives, and the limited availability of film processing labs in many regions. Segmentation by type reveals that color film fixers hold the largest market share, followed by black and white and then x-ray film fixers. The application segment is largely split between domestic and commercial use, with commercial applications (primarily labs and specialized imaging centers) accounting for a significant portion of the overall demand.

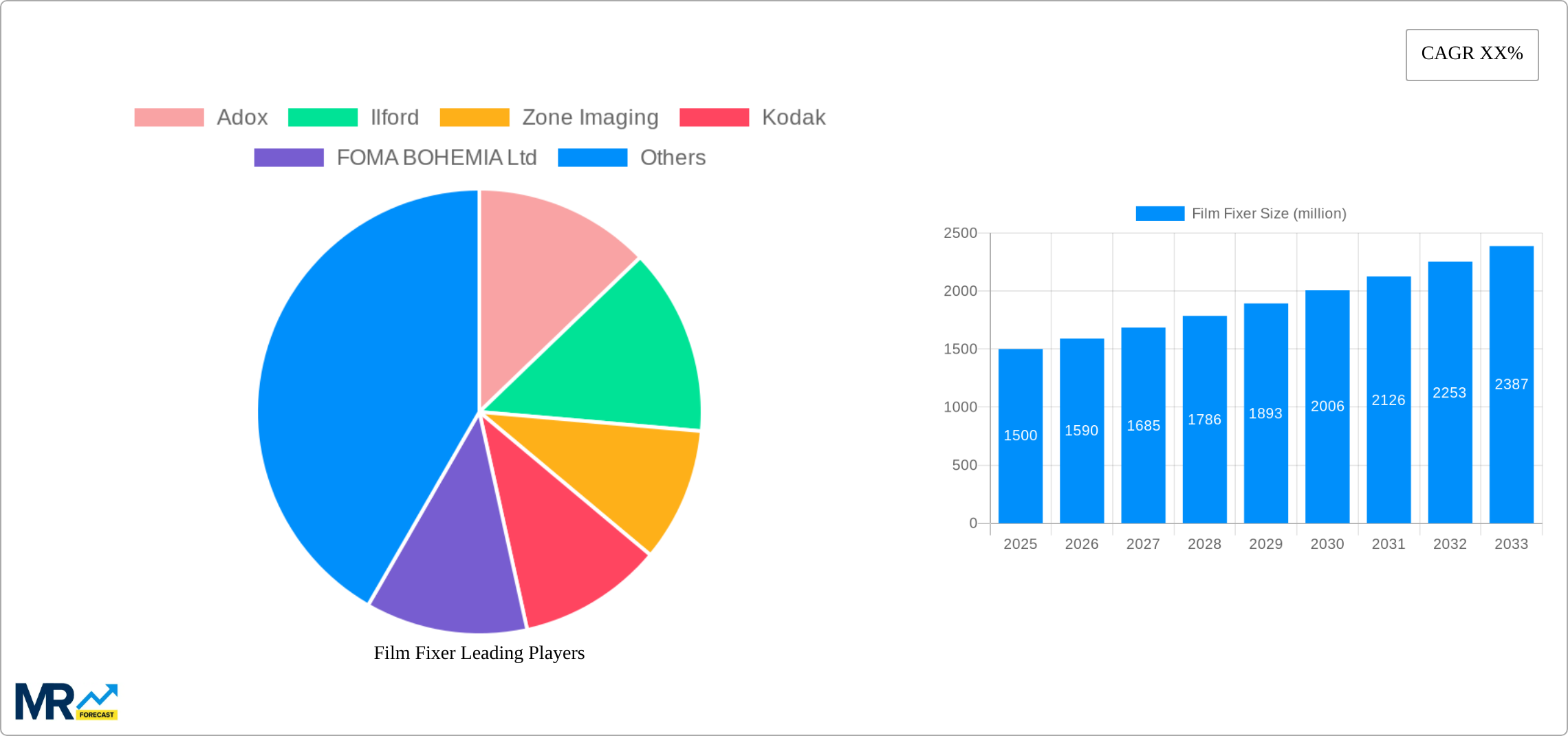

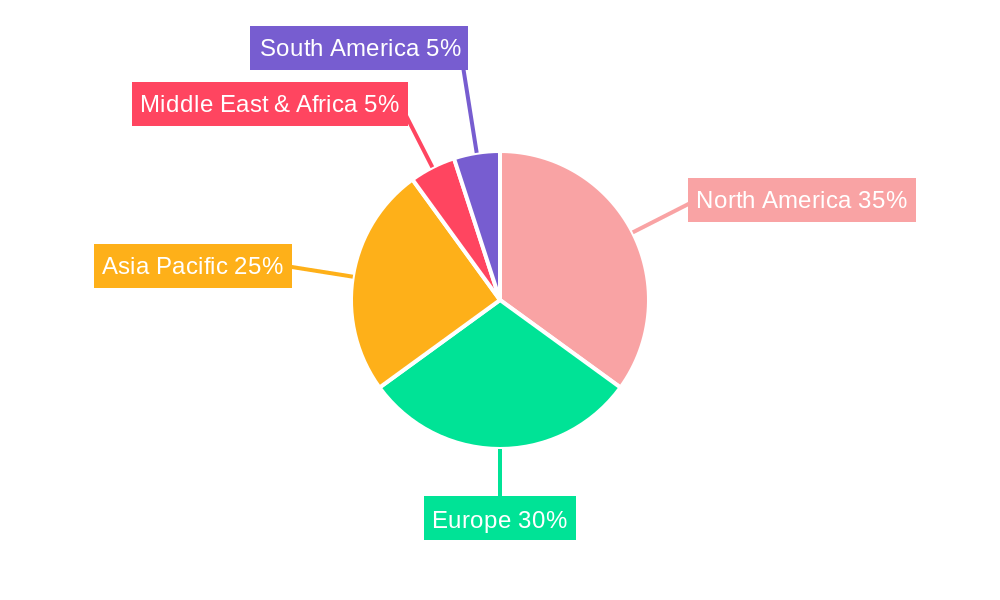

Geographic distribution reveals North America and Europe as the leading regions in film fixer consumption, reflecting established markets for traditional photography and advanced medical imaging. Asia-Pacific shows potential for future growth, driven by increasing disposable income and a rising interest in analog photography amongst younger generations. Competition among key players like Adox, Ilford, Kodak, and others is primarily focused on product quality, specialized formulations catering to specific film types, and ensuring reliable supply chains. Future market projections indicate continued growth, albeit at a moderate pace, primarily driven by the resilience of the analog photography community and the enduring need for specialized film fixers in niche medical and industrial applications. The market is unlikely to experience explosive growth, but rather a stable progression sustained by its core user base and the appeal of traditional photographic methods.

The global film fixer market, valued at approximately $XXX million in 2025, is experiencing a complex interplay of factors influencing its growth trajectory. While the overall market might appear niche compared to digital imaging, a resurgence of interest in traditional film photography is driving renewed demand, particularly within specific segments. The historical period (2019-2024) saw a period of relative stability, with some decline due to the continued dominance of digital technology. However, the estimated year (2025) shows signs of stabilization and even slight growth, suggesting a potential turning point. This resurgence is fueled by a younger generation discovering the aesthetic appeal and unique character of film photography, alongside a growing community of enthusiasts who appreciate the tangible nature of the process. The forecast period (2025-2033) is projected to show moderate growth, driven primarily by specific applications like specialized commercial photography (e.g., high-end fashion, advertising) and niche markets like art photography and filmmaking. However, this growth is tempered by the ongoing technological advancements in digital imaging and the associated cost-effectiveness of digital workflows. The market's future hinges on maintaining the appeal of film photography and effectively leveraging its inherent artistic and unique qualities to attract and retain customers. Technological advancements in film chemistry, aiming to improve archival stability and ease of use, could also play a crucial role in market expansion. Competition amongst manufacturers is relatively modest but significant, as companies like Kodak and Ilford continue to adapt their offerings to meet the evolving demands of the market. The continued availability of high-quality film fixers is key to sustaining this renewed interest and growth.

Several key factors contribute to the ongoing, albeit moderate, growth of the film fixer market. The rising popularity of analog photography, fueled by a younger demographic discovering its aesthetic appeal, is a primary driver. This renewed interest is particularly evident among artists and photographers seeking a unique creative medium that stands apart from digital alternatives. The increasing demand for high-quality prints in specialized commercial applications, such as fashion photography and advertising, also plays a significant role. These applications often require the unique characteristics that film photography offers, contributing to the demand for film fixers. Further fueling growth is the persistent presence of specific industries reliant on film technology, such as medical imaging (X-ray film fixers) and certain archival processes. While digital alternatives exist, some industries maintain a reliance on film due to reasons of image quality, established workflow, or regulatory requirements. Additionally, the growing interest in artisan crafts and handmade goods contributes to a broader appreciation of traditional processes like film photography, indirectly impacting the demand for associated chemicals like fixers. Collectively, these factors ensure a sustained, though niche, market for film fixers in the coming years.

Despite the renewed interest in film photography, the film fixer market faces several challenges that hinder significant expansion. The dominant presence of digital imaging technologies remains a major constraint. Digital photography's ease of use, cost-effectiveness, and instant feedback loop continue to attract a vast majority of photographers, limiting the overall market size for film. The high cost of film and processing, compared to digital alternatives, also acts as a barrier to entry for many aspiring photographers. The environmental impact of chemical processing is another concern, as film fixers and their disposal present environmental challenges that need careful management. Moreover, the availability of raw materials and the complexities of maintaining consistent product quality in a relatively small market can present operational difficulties for manufacturers. The market is also susceptible to fluctuations in raw material prices, which can impact the cost and availability of fixers. Finally, the ongoing advancements in digital imaging technology continue to offer more efficient and cost-effective solutions, potentially limiting the growth of the film fixer market in the long term.

The global film fixer market demonstrates diverse growth patterns across regions and segments. While precise market share data requires detailed analysis, several key areas are expected to contribute significantly to market growth.

North America and Europe: These regions are expected to remain significant consumers of film fixers due to a relatively strong presence of professional photographers, artists, and specialized industries using film. The established culture of analog photography and the presence of niche communities contribute to sustained demand.

Asia-Pacific (Specific Countries like Japan and South Korea): Certain Asian countries, notably Japan and South Korea, maintain a thriving culture of film photography, with a dedicated community of enthusiasts and professionals, creating significant demand for high-quality film fixers. The continued interest in analog aesthetics contributes to market growth.

Black and White Film Fixer Segment: This segment is likely to exhibit sustained or even increasing demand, due to the artistic appeal and unique aesthetic of black and white photography. The ongoing popularity of this style within photography circles supports this trend.

Commercial Segment: High-end commercial photography and advertising often prefer the aesthetic qualities of film, especially in certain genres, leading to consistent demand for high-quality fixers within this segment.

The dominance of these regions and segments is attributed to a confluence of factors including the established photography cultures, the presence of significant professional photography sectors, and the continued appeal of specific photographic styles that favor film. The accessibility and availability of high-quality film fixers within these areas also contribute to their strong market performance.

Several factors are positioned to accelerate growth within the film fixer industry. Technological innovations leading to more environmentally friendly fixers could lessen environmental concerns and attract a wider customer base. The increased focus on sustainable and ethical practices within the photography industry could also benefit eco-friendly film fixer brands. Effective marketing campaigns highlighting the unique artistic benefits and nostalgic appeal of film photography can attract new users, thereby increasing demand for related products, including fixers. Collaboration between film fixer manufacturers and organizations promoting analog photography could foster community growth and contribute to market expansion.

This report provides a comprehensive analysis of the film fixer market, offering insights into market trends, driving forces, challenges, key players, and significant developments. It covers the historical period (2019-2024), the base year (2025), the estimated year (2025), and projects the market's future trajectory through the forecast period (2025-2033). The report focuses on key segments like Black and White and Color fixers, as well as commercial and domestic applications, offering a granular understanding of market dynamics and future opportunities. This detailed overview helps stakeholders make informed decisions about investments, product development, and market positioning within this evolving niche market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Adox, Ilford, Zone Imaging, Kodak, FOMA BOHEMIA Ltd, Rollei, Fotospeed, Flic Film.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Film Fixer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Film Fixer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.