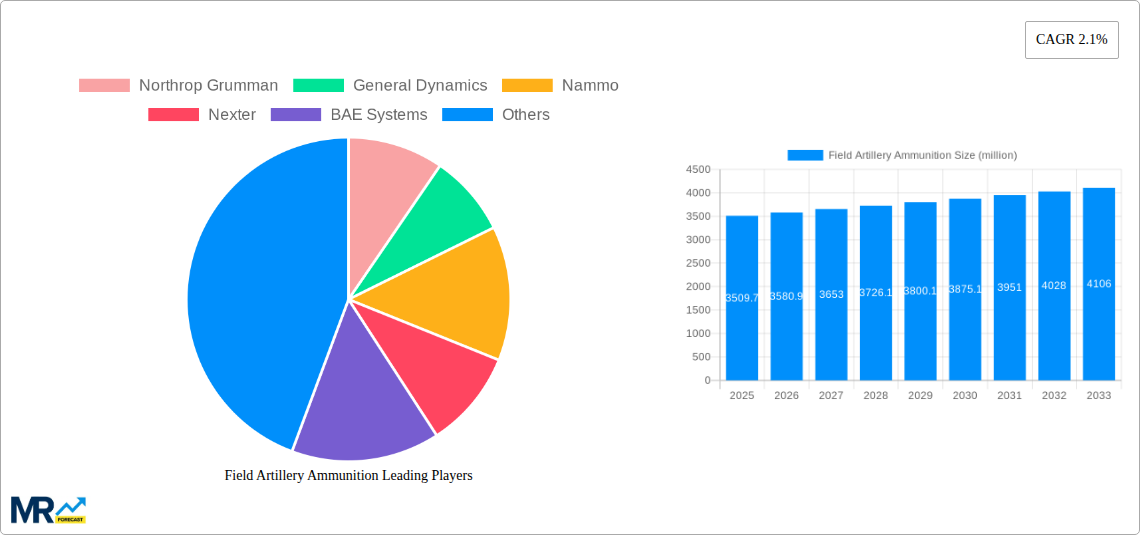

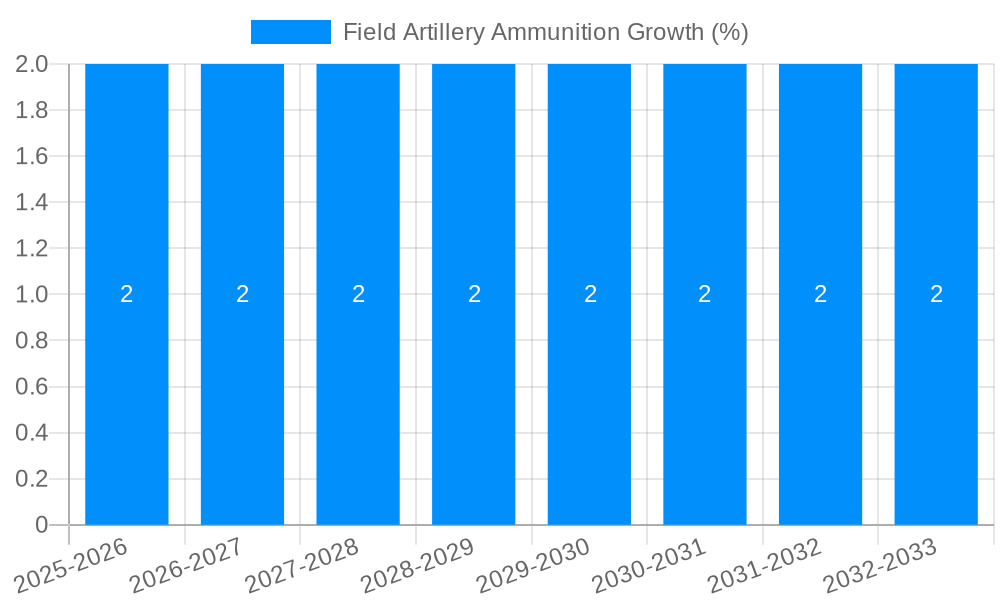

1. What is the projected Compound Annual Growth Rate (CAGR) of the Field Artillery Ammunition?

The projected CAGR is approximately 2.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Field Artillery Ammunition

Field Artillery AmmunitionField Artillery Ammunition by Type (60mm, 81mm, 120mm, Other), by Application (High-Explosive (HE), Smoke, Illumination, Training Rounds), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Field Artillery Ammunition market is projected to reach USD 3509.7 million by 2025, demonstrating a steady Compound Annual Growth Rate (CAGR) of 2.1% through 2033. This growth is underpinned by the sustained geopolitical tensions and the ongoing modernization efforts of defense forces worldwide. Key applications driving demand include High-Explosive (HE) rounds, vital for direct engagement and area denial, alongside increasing interest in specialized munitions such as smoke rounds for obscuration and illumination rounds for enhanced battlefield visibility. The market is segmented by caliber, with 155mm, 81mm, and 120mm dominating the landscape, reflecting their widespread adoption in modern artillery systems. Training rounds also represent a significant segment, crucial for maintaining operational readiness and skill proficiency among artillery crews. The strategic importance of maintaining robust artillery capabilities in the face of evolving threats ensures a consistent demand for these essential munitions.

The competitive landscape is characterized by the presence of major global defense contractors and specialized ammunition manufacturers, including Northrop Grumman, General Dynamics, and Rheinmetall, among others. These companies are actively involved in research and development to introduce advanced ammunition types, such as precision-guided munitions, which offer enhanced accuracy and reduced collateral damage, thereby increasing their market competitiveness. Emerging defense industries in regions like Asia Pacific and Eastern Europe are also contributing to market expansion through increased procurement and domestic production capabilities. While the market exhibits stable growth, potential restraints could include stringent regulatory frameworks governing the production and export of munitions, as well as the high cost associated with developing and manufacturing advanced artillery rounds. Nevertheless, the persistent need for effective artillery firepower in modern warfare positions the Field Artillery Ammunition market for continued, albeit moderate, expansion.

This report provides a comprehensive analysis of the global Field Artillery Ammunition market, examining trends, driving forces, challenges, and future projections. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages historical data from 2019-2024 to offer robust market insights. We analyze the market across various segments including caliber types (60mm, 81mm, 120mm, and Other), applications (High-Explosive (HE), Smoke, Illumination, Training Rounds), and significant industry developments. The report also highlights key players and their contributions to the evolving landscape of field artillery ammunition.

XXX The global field artillery ammunition market is experiencing a dynamic evolution driven by a confluence of geopolitical shifts, technological advancements, and evolving defense strategies. Throughout the historical period (2019-2024), the market witnessed a steady demand, largely influenced by ongoing regional conflicts and sustained military modernization programs. However, the estimated year of 2025 marks a significant inflection point, with projections indicating accelerated growth in the forecast period (2025-2033). This anticipated surge is underpinned by an increasing emphasis on precision-guided munitions (PGMs) and smart artillery systems. These advanced ammunitions offer enhanced accuracy, reduced collateral damage, and greater operational effectiveness, making them a prime focus for defense procurement across major nations. The demand for conventional High-Explosive (HE) rounds remains robust, serving as the bedrock of artillery operations. However, the market is increasingly diversifying to include specialized ammunitions such as advanced smoke rounds for obscurant capabilities and illumination rounds for night operations, reflecting the need for versatile battlefield support. Furthermore, training rounds continue to play a crucial role in maintaining troop proficiency and are expected to see consistent demand. The proliferation of advanced manufacturing techniques and the pursuit of cost-effective solutions are also shaping the market, with companies actively investing in R&D to develop next-generation ammunition that can meet the evolving demands of modern warfare. The market is expected to see a significant shift towards modular designs and multi-purpose munitions, offering greater flexibility and reducing logistical burdens. The increasing adoption of digital battlefield integration also necessitates ammunition that can communicate and coordinate with other battlefield assets, further driving innovation. This integrated approach to artillery systems, with ammunition at its core, is poised to redefine the strategic landscape of indirect fire capabilities.

The field artillery ammunition market is being propelled by a potent combination of factors, primarily stemming from heightened geopolitical tensions and the subsequent escalation in defense spending across numerous nations. The persistent threat of regional conflicts and the need for robust deterrence have spurred governments to prioritize the replenishment and modernization of their existing ammunition stockpiles. Furthermore, the ongoing advancements in military technology are creating a significant demand for sophisticated and precise artillery solutions. The development of smart munitions, guided projectiles, and advanced propellants is revolutionizing the effectiveness and efficiency of artillery operations. Nations are increasingly investing in these next-generation ammunitions to gain a tactical advantage, emphasizing precision strikes, reduced collateral damage, and enhanced lethality. The ongoing evolution of warfare, with its emphasis on network-centric operations and multi-domain capabilities, necessitates artillery systems and ammunition that can seamlessly integrate with other battlefield assets. This drive for interoperability and enhanced situational awareness is a key catalyst for innovation and procurement in the ammunition sector. Additionally, the growing recognition of the importance of artillery in both offensive and defensive operations, particularly in providing crucial fire support to ground troops, ensures a sustained demand for a wide range of ammunition types, from standard high-explosive rounds to specialized munitions for various tactical applications.

Despite the positive growth trajectory, the field artillery ammunition market faces several significant challenges and restraints. A primary concern is the substantial cost associated with the research, development, and manufacturing of advanced ammunition. The complexity of modern munition designs, often incorporating sophisticated guidance systems and specialized warheads, translates into higher unit costs, which can strain defense budgets and limit procurement volumes for some nations. Furthermore, the stringent regulatory environment surrounding the production and export of defense matériel can impose delays and create barriers to market entry for new players. Export controls and international arms treaties, while essential for global security, can significantly impact the global reach and accessibility of certain ammunition types. The obsolescence of older ammunition stockpiles also presents a logistical and financial challenge. Nations are faced with the difficult decision of whether to upgrade existing systems or invest in entirely new platforms and ammunition, a process that is often lengthy and expensive. Supply chain vulnerabilities, exacerbated by global events and geopolitical instability, can also disrupt the availability of critical raw materials and components, leading to production delays and price fluctuations. Lastly, the evolving nature of warfare, with an increased focus on asymmetric threats and counter-insurgency operations, sometimes necessitates a recalibration of traditional artillery ammunition requirements, leading to a need for specialized, and thus potentially less mass-produced, solutions.

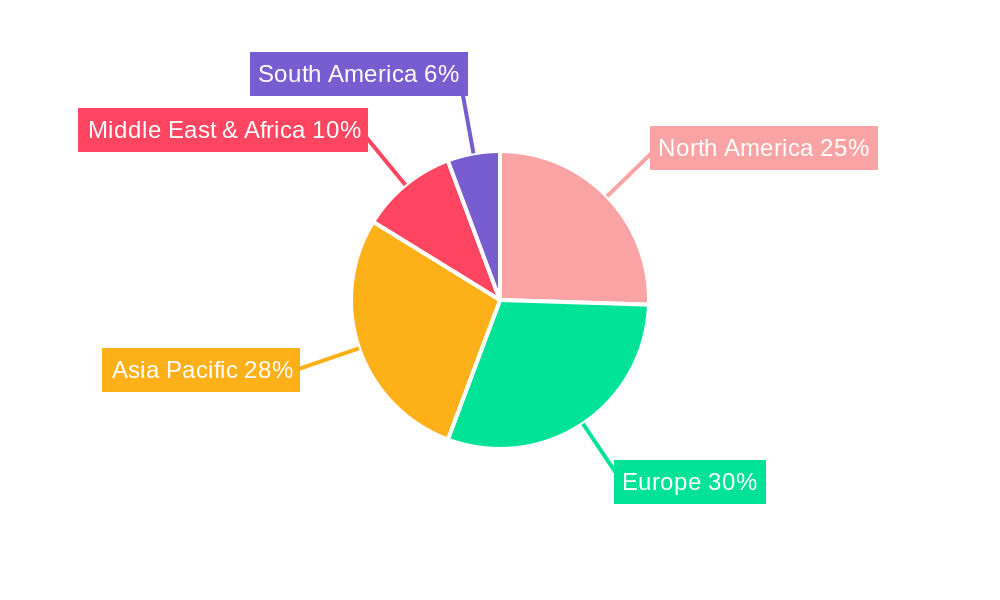

The North America region is poised to dominate the global Field Artillery Ammunition market, driven by significant defense expenditures and a robust technological ecosystem. The United States, in particular, stands as a pivotal player, continuously investing in the modernization of its artillery forces and the development of advanced munitions. This includes a strong emphasis on the High-Explosive (HE) segment, which forms the cornerstone of artillery operations. The U.S. military's extensive training programs and ongoing deployment in various global hotspots necessitate a consistent and substantial supply of HE rounds. Furthermore, the U.S. is at the forefront of developing and procuring smart munitions and precision-guided artillery shells, which fall under the broader HE application but represent a high-value segment.

Within North America, the 155mm caliber (which would fall under the "Other" type category due to the specific listing of 60mm, 81mm, and 120mm) is expected to be a dominant caliber, given its widespread adoption by the U.S. military and its allies. However, the report's specific focus on 60mm, 81mm, and 120mm reveals significant market activity. The 120mm segment is projected for substantial growth, largely driven by its integration into modern main battle tanks and advanced infantry fighting vehicles, offering enhanced firepower and standoff capabilities. The U.S. Army's ongoing modernization efforts, including the development of extended-range 120mm rounds, will further solidify its dominance.

Beyond HE, the Training Rounds segment in North America is also substantial, fueled by the need for continuous soldier training and readiness. The sheer scale of U.S. military exercises and deployments ensures a perpetual demand for cost-effective and realistic training ammunition.

While North America leads, Europe is another significant market, with countries like Germany, France, and the United Kingdom actively upgrading their artillery capabilities. The ongoing conflict in Eastern Europe has amplified the urgency for ammunition procurement, particularly for High-Explosive (HE) rounds and Smoke rounds, which are crucial for defensive operations and battlefield obscurant. The 155mm caliber is also prevalent in Europe, mirroring the trends in North America, though specific focus on 81mm and 120mm mortars and artillery systems by various European armies also drives demand in these segments. Nexter and Rheinmetall, prominent European players, are key contributors to this market.

The Asia-Pacific region, particularly countries like South Korea, India, and China, is also experiencing robust growth. South Korea's Poongsan Corporation is a major player in this region, producing a wide array of artillery ammunitions. China, with its vast military and NORINCO and CSGC as leading manufacturers, represents a significant market for 120mm rounds and various High-Explosive (HE) applications. The increasing defense budgets and modernization drives in countries like India are further contributing to the market's expansion.

The Field Artillery Ammunition industry is experiencing several key growth catalysts. The escalating geopolitical tensions globally are a primary driver, compelling nations to bolster their defense capabilities and replenish ammunition stockpiles. Technological advancements, particularly in the realm of precision-guided munitions (PGMs) and smart artillery, are creating new market opportunities as militaries seek enhanced accuracy and effectiveness. Furthermore, the ongoing modernization of artillery systems across various armed forces, coupled with the development of advanced propellants and multi-purpose rounds, is spurring demand for next-generation ammunition.

This comprehensive report delves into the intricate dynamics of the Field Artillery Ammunition market from 2019 to 2033. It provides granular analysis across key segments such as caliber types (60mm, 81mm, 120mm, Other) and applications (High-Explosive, Smoke, Illumination, Training Rounds). The report meticulously examines the historical performance, current market landscape, and future projections, offering insights into market size, growth rates, and influential factors. Furthermore, it highlights significant industry developments, competitive strategies of leading players, and the impact of technological innovations, providing stakeholders with a complete understanding of this critical defense sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.1%.

Key companies in the market include Northrop Grumman, General Dynamics, Nammo, Nexter, BAE Systems, Poongsan Corporation, Elbit Systems, Day & Zimmermann, Rheinmetall, Rostec, National Presto, NORINCO, CSGC, .

The market segments include Type, Application.

The market size is estimated to be USD 3509.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Field Artillery Ammunition," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Field Artillery Ammunition, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.