1. What is the projected Compound Annual Growth Rate (CAGR) of the Fiberglass Interior Doors?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fiberglass Interior Doors

Fiberglass Interior DoorsFiberglass Interior Doors by Type (Swing Doors, Sliding Doors), by Application (Commercial, Residential), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

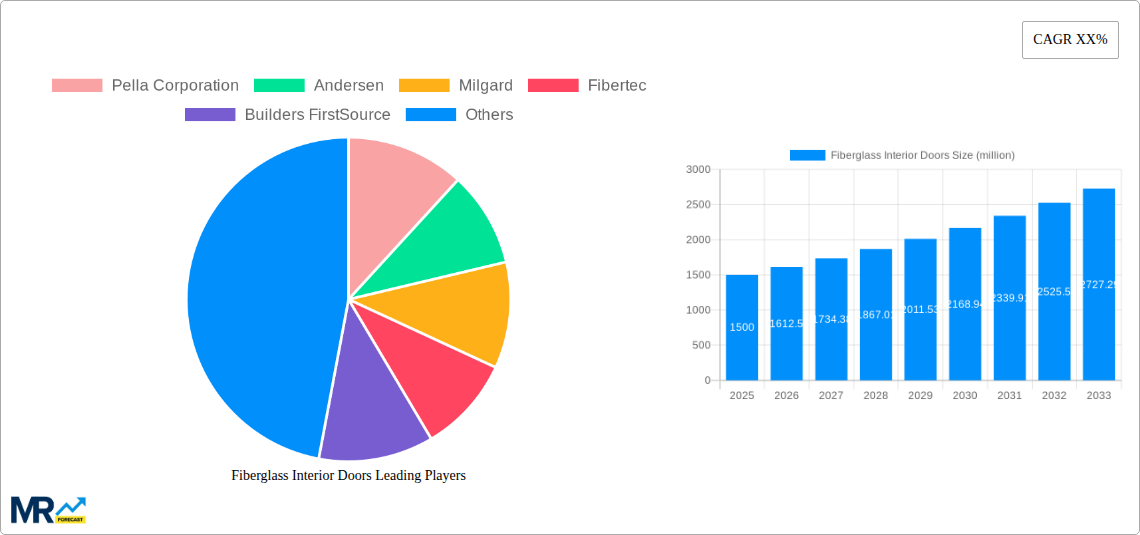

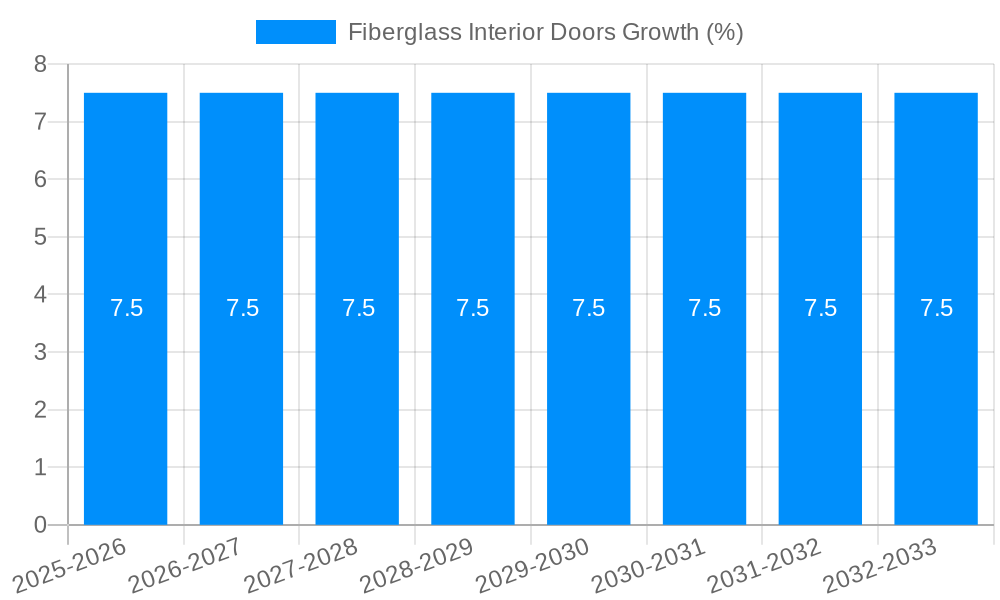

The fiberglass interior door market is experiencing robust growth, driven by increasing demand for durable, energy-efficient, and aesthetically pleasing interior doors. This market, estimated at $500 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6% from 2025 to 2033, reaching approximately $800 million by 2033. Several factors contribute to this growth. Consumers are increasingly prioritizing energy efficiency in their homes, leading to higher adoption of fiberglass doors known for their superior insulation properties compared to traditional wood doors. Furthermore, the rising preference for low-maintenance and aesthetically versatile options fuels demand. Fiberglass doors offer a wide range of styles and finishes, mimicking the look of wood or other materials while requiring minimal upkeep. The market is segmented by door type (single, double, French), style (flush, panel, raised panel), and price point. Key players like Pella Corporation, Andersen, and Marvin are driving innovation through the introduction of technologically advanced doors with enhanced features, such as soundproofing and smart home integration. However, higher initial costs compared to traditional wood doors present a restraint. Nevertheless, the long-term cost savings in maintenance and energy efficiency are gradually overcoming this barrier.

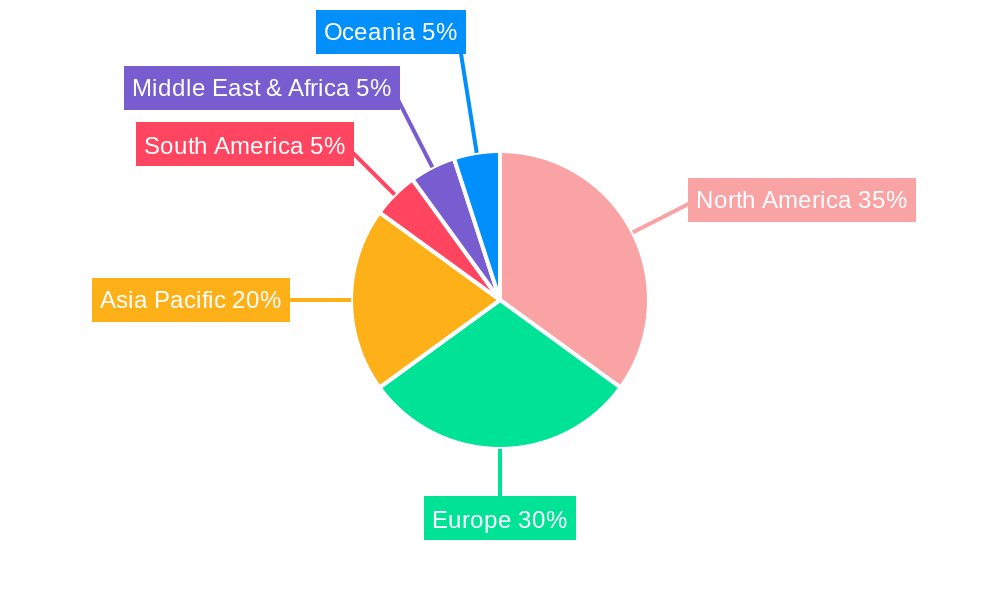

The competitive landscape is characterized by a mix of established manufacturers and smaller regional players. Major companies are focused on expanding their product portfolios to meet the diverse needs of consumers, while smaller companies are targeting niche markets with specialized designs or price points. Regional variations exist, with North America currently dominating the market due to higher disposable incomes and a larger housing market. However, emerging markets in Asia and Europe are expected to exhibit significant growth in the coming years due to increasing urbanization and rising construction activities. The overall market outlook remains optimistic, with continued growth expected as consumer preferences shift towards high-performance and visually appealing interior door solutions.

The fiberglass interior door market, valued at several million units in 2025, exhibits robust growth potential throughout the forecast period (2025-2033). Analysis of the historical period (2019-2024) reveals a steady increase in demand, driven primarily by the escalating preference for durable, low-maintenance, and aesthetically pleasing interior doors. Consumers are increasingly seeking alternatives to traditional wood doors, recognizing the advantages of fiberglass in terms of longevity, resistance to warping, chipping, and scratching, and its superior ability to withstand daily wear and tear. This trend is particularly pronounced in new construction projects and home renovations, where builders and homeowners alike appreciate the long-term cost savings associated with fiberglass doors. The market also demonstrates a growing preference for customization and design flexibility, with manufacturers offering a wide array of styles, finishes, and options to cater to diverse tastes and architectural preferences. The rise of online retailers and improved accessibility have further fueled market expansion, allowing consumers to easily compare prices and explore various options. While wood remains a significant competitor, the superior performance characteristics and increasingly competitive pricing of fiberglass doors position them for continued market share growth. The increasing adoption of smart home technology is also starting to influence the market, with integrated features like smart locks and automated door controls becoming increasingly attractive. This convergence of factors suggests a bright outlook for the fiberglass interior door market, with substantial growth anticipated in the coming years. The current million-unit market size is projected to expand considerably by 2033, fueled by continuing advancements in material science, design innovation, and evolving consumer preferences.

Several key factors are propelling the growth of the fiberglass interior doors market. The inherent durability and low-maintenance nature of fiberglass are significant drivers, appealing to both homeowners and commercial builders seeking long-term cost savings and reduced upkeep. Unlike wood doors, fiberglass resists warping, cracking, and scratching, ensuring a longer lifespan and maintaining aesthetic appeal for years. The increasing popularity of energy-efficient homes is another important factor; fiberglass doors offer superior insulation compared to traditional materials, contributing to energy savings and reduced utility bills. Furthermore, the aesthetic versatility of fiberglass allows for a wide range of styles, finishes, and designs to complement various interior aesthetics. Manufacturers are constantly innovating, offering options that mimic the look of wood, metal, or other materials, catering to diverse design preferences. Finally, the growing awareness of the environmental impact of construction materials is subtly pushing the market. While fiberglass production itself has an environmental footprint, its long lifespan and reduced need for replacements contribute to a more sustainable building practice compared to more frequently replaced wood doors. These combined factors contribute to the strong and sustained growth of the fiberglass interior doors market.

Despite the significant growth potential, the fiberglass interior door market faces some challenges. The initial cost of fiberglass doors is often higher compared to traditional wooden doors, potentially posing a barrier for budget-conscious consumers. This higher upfront cost can be a significant deterrent, particularly in price-sensitive segments of the market. Another challenge lies in the perception of fiberglass doors as less aesthetically appealing than high-quality wood doors, although advancements in manufacturing and design are gradually overcoming this perception. The market also faces competition from other alternative door materials, such as composite and solid core doors, which offer similar benefits at potentially lower prices in certain configurations. Furthermore, the transportation and handling of fiberglass doors can present logistical challenges due to their weight and fragility. Finally, the availability of skilled installers experienced in working with fiberglass doors can sometimes be a constraint, impacting overall market penetration and customer satisfaction. Addressing these challenges through effective marketing, product innovation, and improved supply chain management will be crucial for sustained market growth.

The North American market, specifically the United States, is expected to dominate the fiberglass interior door market throughout the forecast period. This dominance is attributed to several factors:

High Construction Activity: The US consistently experiences high levels of new residential and commercial construction, creating substantial demand for building materials, including interior doors.

High Disposable Incomes: A significant portion of the US population enjoys relatively high disposable incomes, allowing for greater spending on premium home improvement products like fiberglass doors.

Strong Preference for Energy Efficiency: Rising energy costs and a growing environmental awareness contribute to increased preference for energy-efficient building materials, which benefits fiberglass doors due to their superior insulation properties.

Established Supply Chains: The US has well-established supply chains for fiberglass production and door manufacturing, ensuring sufficient access to raw materials and timely production of the final products.

Significant Presence of Major Players: Leading manufacturers in the sector, including Pella Corporation, Andersen, and Milgard, are headquartered or have significant operations in North America, further contributing to the regional market dominance.

Beyond geography, the new construction segment is poised for the most substantial growth. New construction projects typically incorporate higher-end materials, and the long-term benefits of fiberglass—durability and reduced maintenance—make it particularly attractive for builders. Homeowners in new constructions are generally less sensitive to higher upfront costs, and the emphasis on overall build quality makes fiberglass doors a popular choice. This contrasts with the renovation market where existing door frames might require additional work or adaptation with fiberglass units. The commercial sector also shows notable growth potential, driven by the increasing demand for low-maintenance and durable doors in office buildings, hotels, and other commercial properties. This segment is also motivated by the long-term cost-effectiveness of fiberglass.

Technological advancements in fiberglass manufacturing are leading to lighter, stronger, and more aesthetically versatile products. Improved insulation properties and designs mimicking the look and feel of higher-cost materials are creating higher consumer appeal. Simultaneously, increasing awareness of the long-term cost benefits associated with durability and low maintenance, coupled with a focus on sustainable building practices, fuels this growth.

This report provides a comprehensive analysis of the fiberglass interior doors market, encompassing historical data, current market trends, and future projections. It offers valuable insights into market drivers, challenges, key players, and regional dynamics. The report's detailed segmentation, including geographic location and industry segments, allows for a nuanced understanding of this evolving sector. This information is crucial for strategic decision-making by manufacturers, investors, and stakeholders within the construction and home improvement industries.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Pella Corporation, Andersen, Milgard, Fibertec, Builders FirstSource, Cascadia Windows & Doors, Marvin, Silex Fiberglass Windows and Doors, Inline Fiberglass Ltd, Kohltech, Westeck Windows and Doors, Lux Windows and Glass, Lorendo, Atlantic Windows, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fiberglass Interior Doors," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fiberglass Interior Doors, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.