1. What is the projected Compound Annual Growth Rate (CAGR) of the Fiber Optic Cable Blowing Machines?

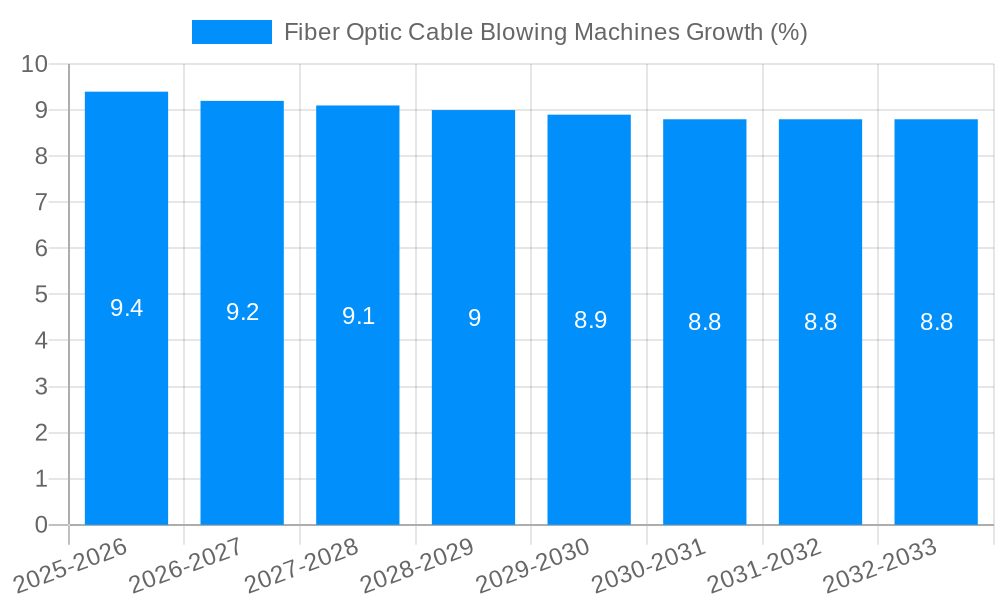

The projected CAGR is approximately 9.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fiber Optic Cable Blowing Machines

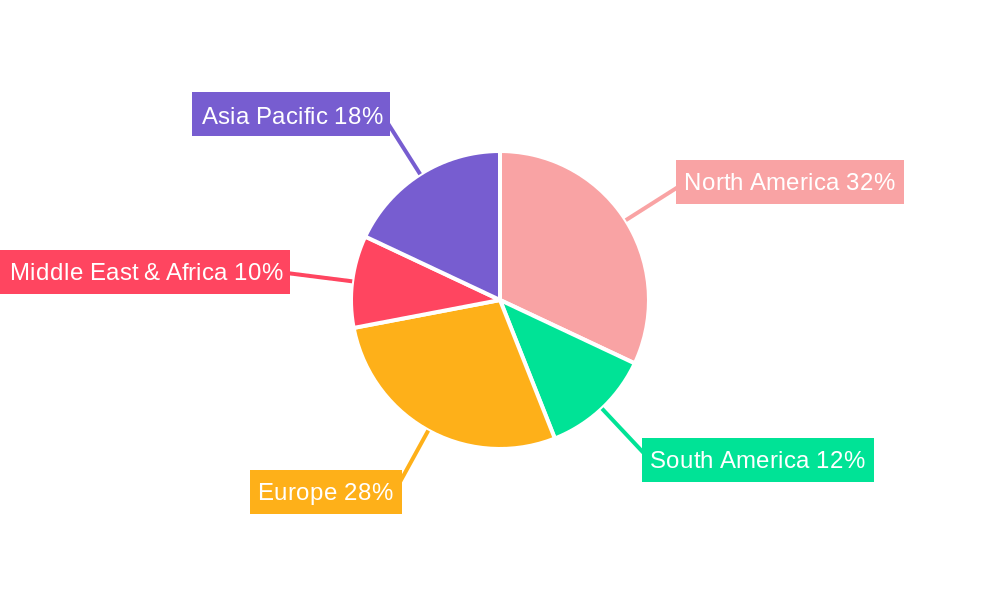

Fiber Optic Cable Blowing MachinesFiber Optic Cable Blowing Machines by Type (Hydraulically Powered, Pneumatically Powered, Others), by Application (OSP Fiber Deployment, Telecommunication, Wide Area Networks, CATV, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

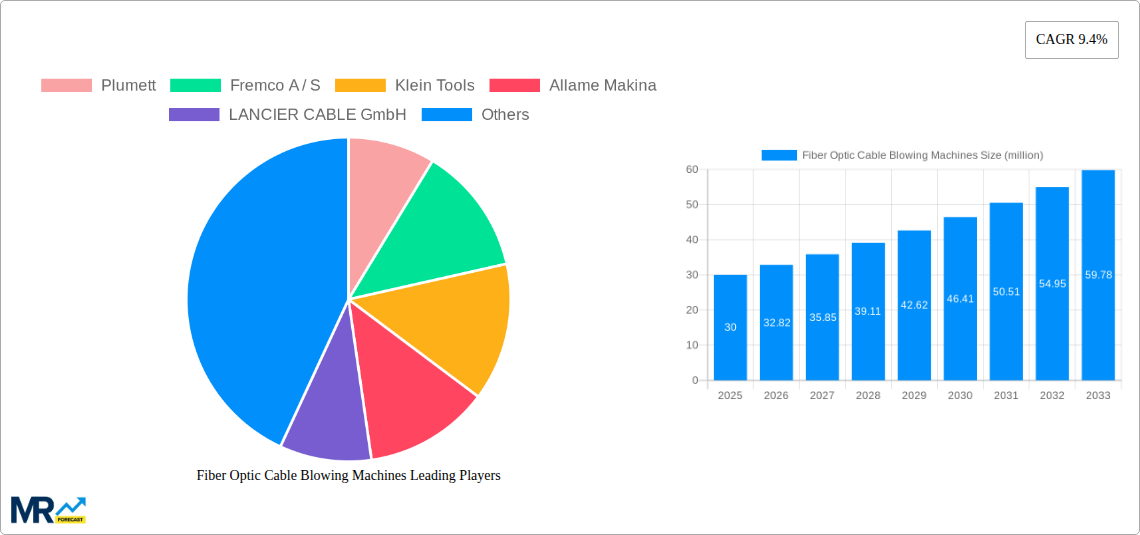

The global market for Fiber Optic Cable Blowing Machines is poised for significant expansion, projected to reach an estimated market size of $30 million by 2025. This growth is propelled by a robust Compound Annual Growth Rate (CAGR) of 9.4%, indicating a dynamic and expanding industry. The primary drivers fueling this ascent are the ever-increasing demand for high-speed internet and data transmission, a direct consequence of the accelerating digital transformation across all sectors. Furthermore, the continuous expansion of telecommunication networks, especially in developing regions, and the widespread adoption of Fiber to the x (FTTx) deployments, including Fiber to the Home (FTTH), are creating substantial opportunities. The development of Wide Area Networks (WANs) and the ongoing upgrades to CATV infrastructure also contribute to the sustained demand for these specialized machines. As the world becomes more interconnected, the need for efficient and scalable fiber optic deployment solutions, which cable blowing machines provide, will only intensify.

The market is characterized by several key trends, including advancements in machine technology towards more automated and user-friendly designs, enhanced power efficiency, and improved precision for intricate deployments. The increasing focus on reducing installation time and labor costs is a significant trend, making blowing techniques increasingly attractive over traditional methods. While the market demonstrates strong growth, certain restraints could influence its trajectory. High initial investment costs for advanced blowing machines might pose a barrier for smaller players or less developed regions. Moreover, the availability of skilled labor to operate and maintain these sophisticated machines could present a challenge in certain markets. However, the overwhelming benefits in terms of speed, cost-effectiveness, and minimal disruption to existing infrastructure are expected to outweigh these restraints, ensuring continued market growth and innovation in the fiber optic cable blowing machine sector.

The global market for fiber optic cable blowing machines is experiencing robust growth, projected to reach USD 850 million by 2033, a significant increase from its USD 350 million valuation in the historical period (2019-2024). This upward trajectory is underpinned by a confluence of factors, primarily the insatiable demand for high-speed internet and expanding telecommunication infrastructure worldwide. The study period, spanning from 2019 to 2033, with a base year of 2025, highlights a consistent expansion in adoption. As of the estimated year 2025, the market is valued at USD 420 million, setting the stage for the dynamic forecast period of 2025-2033. The increasing deployment of fiber-to-the-home (FTTH) and fiber-to-the-building (FTTB) initiatives across both developed and developing economies is a major driver. These projects necessitate efficient and cost-effective methods for laying fiber optic cables, where blowing technology offers a distinct advantage over traditional trenching or plowing methods, particularly in challenging terrains and urban environments. Furthermore, the expansion of 5G networks, the growth of data centers, and the increasing adoption of cloud computing services all contribute to the escalating demand for high-bandwidth connectivity, directly fueling the need for advanced cable blowing equipment. The market is also witnessing technological advancements, with manufacturers focusing on developing more compact, powerful, and user-friendly machines. Innovations in pneumatic systems, hydraulic power management, and intelligent control features are enhancing the efficiency, accuracy, and safety of cable deployment operations. The trend towards automation and remote operation is also gaining traction, offering increased productivity and reduced labor costs for telecommunication companies. Geographically, Asia Pacific is emerging as a dominant region, driven by massive government investments in digital infrastructure and a rapidly growing subscriber base. North America and Europe continue to be significant markets, characterized by ongoing network upgrades and the deployment of new fiber networks. The Middle East and Africa are also presenting lucrative opportunities with their increasing focus on developing digital ecosystems. The competitive landscape is characterized by a mix of established global players and emerging regional manufacturers, all vying for market share through product innovation, strategic partnerships, and aggressive marketing strategies. The overall market sentiment is highly positive, with strong underlying demand and continuous technological evolution ensuring sustained growth in the coming years.

The global fiber optic cable blowing machines market is experiencing a surge in demand, propelled by a multi-faceted set of drivers that are reshaping the telecommunications landscape. Foremost among these is the unprecedented global appetite for high-speed internet connectivity. The proliferation of data-intensive applications, streaming services, online gaming, and the burgeoning Internet of Things (IoT) ecosystem are creating an ever-increasing need for higher bandwidth and lower latency. Fiber optic cable is the undisputed technology of choice to meet these demands, and the blowing method has emerged as a highly efficient and cost-effective means of deploying this crucial infrastructure. This is particularly evident in the widespread implementation of Fiber-to-the-Home (FTTH) and Fiber-to-the-Building (FTTB) initiatives across urban, suburban, and even increasingly rural areas. Governments and telecommunication companies are investing heavily in these projects to bridge the digital divide and enhance digital inclusion. Complementing this is the ongoing expansion of 5G networks. The deployment of 5G requires a dense network of fiber optic backhaul to support the massive data transfer requirements and low latency promises of this next-generation mobile technology. Cable blowing machines play a pivotal role in rapidly and cost-effectively installing the necessary fiber optic cables to build out these 5G infrastructure. Furthermore, the explosive growth of data centers and the increasing reliance on cloud computing services necessitate robust and high-capacity network connections, driving the demand for fiber optic deployment. The efficiency and reduced disruption offered by cable blowing technology make it an attractive solution for connecting these critical data hubs.

Despite the overwhelmingly positive growth trajectory, the fiber optic cable blowing machines market faces certain inherent challenges and restraints that could temper its full potential. One significant hurdle is the initial capital investment required for advanced cable blowing equipment. While the long-term operational cost savings can be substantial, the upfront cost of sophisticated hydraulic or pneumatically powered machines, especially those with advanced features, can be a barrier for smaller contractors or companies operating in cost-sensitive markets. This can lead to a reliance on older, less efficient technologies or outsourcing of deployment services. Another key challenge revolves around the technical expertise and training required for operating these machines effectively. Improper setup, incorrect air pressure settings, or inadequate understanding of cable and duct specifications can lead to cable damage, premature failure, or inefficient deployment, resulting in costly repairs and downtime. Ensuring a skilled workforce remains a continuous challenge for the industry. Variability in duct and cable quality can also pose a significant restraint. The success of the blowing technique is highly dependent on the smoothness and integrity of the duct, as well as the structural properties of the fiber optic cable. Substandard duct materials, bends that are too tight, or cables with insufficient tensile strength can lead to increased friction, blockages, and potential damage during the blowing process. This necessitates stringent quality control measures throughout the supply chain. Environmental factors, such as extreme temperatures, high humidity, or the presence of debris in ducts, can also impact the performance and reliability of cable blowing operations, requiring specialized adaptations and potentially increasing operational complexity. Finally, competition from alternative deployment methods such as micro-trenching or aerial deployment, while often more costly or disruptive in certain scenarios, can still present a competitive challenge in specific geographical or application contexts.

The OSP Fiber Deployment segment is poised to be the dominant force in the fiber optic cable blowing machines market throughout the forecast period (2025-2033). This dominance stems from its critical role in extending high-speed internet access beyond urban centers and into previously underserved areas. The ongoing global push to bridge the digital divide and provide equitable access to digital resources directly fuels the demand for efficient outdoor plant (OSP) fiber optic cable installation.

OSP Fiber Deployment Segment: This segment is projected to account for a substantial market share, estimated to reach USD 480 million by 2033. The need to lay fiber optic cables in the ground, under roads, and across various terrains for broadband access, telecommunication backhaul, and smart city initiatives makes this segment the primary driver.

Telecommunication Segment: This segment, closely intertwined with OSP deployment, also represents a substantial and growing market for cable blowing machines. The demand for robust and scalable networks to support voice, data, and video services for millions of subscribers ensures a continuous need for fiber optic infrastructure.

Wide Area Networks (WANs) and CATV Segments: While smaller in comparison to OSP and Telecommunication, these segments contribute to the overall market growth. WANs require high-capacity fiber optic links for inter-city and international connectivity, while the expansion of fiber-based CATV services necessitates efficient fiber deployment in local distribution networks. These segments collectively represent a market value of approximately USD 150 million by 2033.

The Hydraulically Powered type of fiber optic cable blowing machines is expected to hold a significant market share due to their robust power delivery, ability to handle longer duct runs and heavier cables, and suitability for demanding OSP deployment scenarios.

The fiber optic cable blowing machines industry is experiencing a significant growth spurt fueled by several key catalysts. The ever-increasing global demand for data from a burgeoning digital economy is the primary engine, driving the need for higher bandwidth and faster internet speeds. This is directly translating into accelerated fiber optic network deployments, particularly for FTTH and 5G infrastructure. Furthermore, supportive government initiatives and investments in digital transformation and bridging the digital divide are creating a favorable market environment. The inherent advantages of cable blowing technology – its speed, cost-effectiveness, and minimal disruption compared to traditional methods – are also acting as powerful growth catalysts, making it the preferred choice for many deployment projects.

This comprehensive report provides an in-depth analysis of the global fiber optic cable blowing machines market from 2019 to 2033. It offers granular insights into market dynamics, including historical trends, base year valuations (2025), and future projections. The report meticulously details the market segmentation by type (Hydraulically Powered, Pneumatically Powered, Others) and application (OSP Fiber Deployment, Telecommunication, Wide Area Networks, CATV, Others), providing value estimates in the millions. Furthermore, it explores the driving forces behind market growth, identifies key challenges and restraints, and highlights the dominant regions and segments shaping the industry landscape. Leading players are identified, along with their significant market developments, offering a complete picture of the competitive environment. This report is an indispensable resource for stakeholders seeking to understand the current and future trajectory of the fiber optic cable blowing machines sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.4%.

Key companies in the market include Plumett, Fremco A / S, Klein Tools, Allame Makina, LANCIER CABLE GmbH, Condux International, Asian Contec, Prayaag Technologies, Genius Engineers, KOSMAK MACHINES, General Machine Products, Mal-Met, .

The market segments include Type, Application.

The market size is estimated to be USD 30 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fiber Optic Cable Blowing Machines," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fiber Optic Cable Blowing Machines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.