1. What is the projected Compound Annual Growth Rate (CAGR) of the Fertilizer Anti-Caking Additives?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fertilizer Anti-Caking Additives

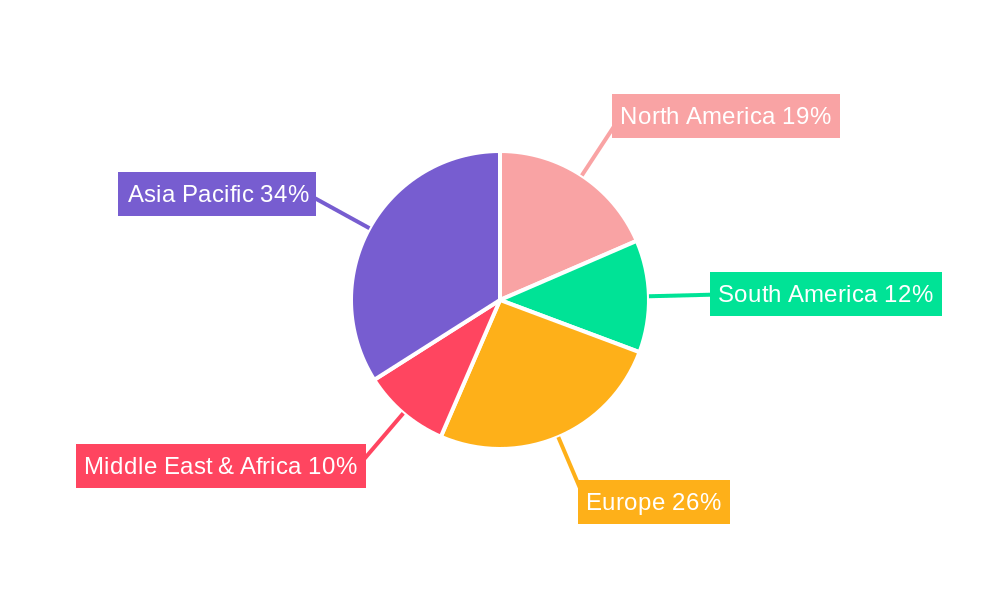

Fertilizer Anti-Caking AdditivesFertilizer Anti-Caking Additives by Application (Microbial Fertilizer, Chemical Fertilizer, World Fertilizer Anti-Caking Additives Production ), by Type (Powder, Paste, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

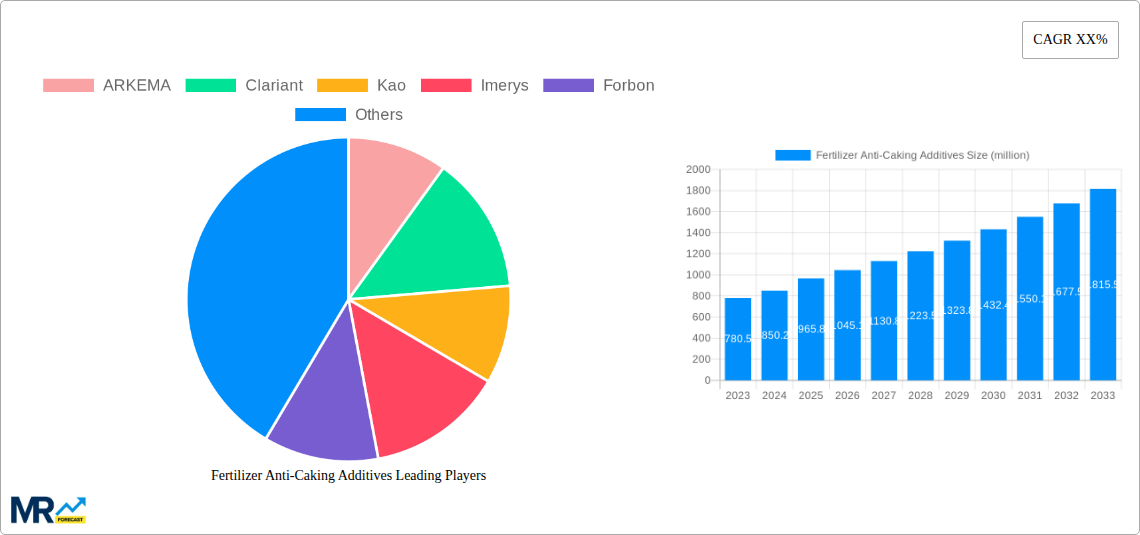

The global Fertilizer Anti-Caking Additives market is poised for significant expansion, projected to reach an estimated market size of USD 965.8 million. This growth is driven by the increasing demand for enhanced fertilizer efficiency and improved handling characteristics. As agricultural practices worldwide focus on optimizing crop yields and minimizing waste, the role of anti-caking additives becomes paramount. These additives prevent the clumping of fertilizers, ensuring uniform application and optimal nutrient delivery to crops. The rising global population necessitates a corresponding increase in food production, directly fueling the demand for effective fertilizers and, consequently, the anti-caking additives that preserve their quality and usability. Furthermore, the evolving landscape of fertilizer types, including the growing adoption of microbial fertilizers alongside traditional chemical fertilizers, presents both opportunities and challenges for additive manufacturers. The need to maintain the integrity and performance of diverse fertilizer formulations will be a key growth catalyst.

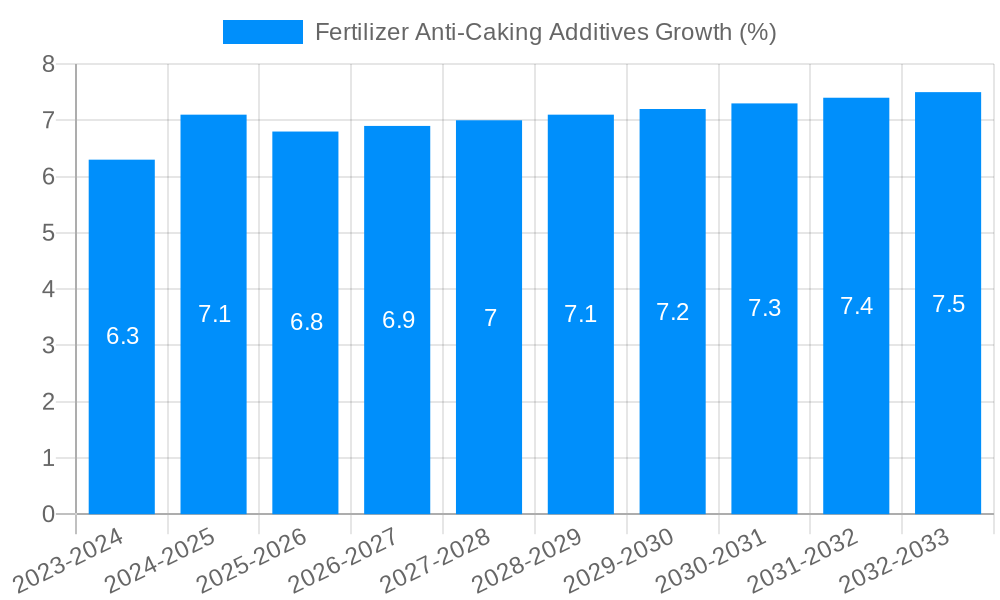

The market's trajectory is also shaped by a dynamic interplay of trends and restraints. Key drivers include advancements in additive technology offering superior anti-caking performance and eco-friendly solutions, alongside the growing emphasis on sustainable agriculture. The expansion of the agricultural sector in emerging economies, particularly in Asia Pacific and South America, is creating substantial demand. However, challenges such as fluctuating raw material prices and stringent environmental regulations can pose restraints. The market is segmented into applications like microbial fertilizers and chemical fertilizers, with Powder and Paste types dominating. Leading companies such as ARKEMA, Clariant, and Kao are actively innovating and expanding their global footprint, catering to the diverse needs across regions like China, India, the United States, and Europe. The forecast period is expected to witness a sustained Compound Annual Growth Rate (CAGR) of approximately 6.8%, underscoring the market's robust potential.

This comprehensive report delves into the dynamic Fertilizer Anti-Caking Additives Market, offering an in-depth analysis of its trends, drivers, challenges, and future outlook. Spanning the Study Period: 2019-2033, with a specific focus on the Base Year: 2025, the report provides critical insights for stakeholders across the agricultural and chemical industries. The Estimated Year: 2025 forms the cornerstone for projections, with the Forecast Period: 2025-2033 detailing expected market trajectory. A thorough examination of the Historical Period: 2019-2024 establishes a robust foundation for understanding past performance and identifying emerging patterns. The global market for fertilizer anti-caking additives is projected to reach approximately $1,300 million in 2025, with an anticipated growth to over $1,800 million by 2033, reflecting a healthy Compound Annual Growth Rate (CAGR). This growth is driven by the increasing demand for efficient and stable fertilizer products, crucial for global food security.

The fertilizer anti-caking additives market is witnessing a transformative period, characterized by an increasing demand for high-performance solutions that enhance fertilizer quality and shelf-life. XXX highlights several key market insights that are shaping this landscape. A significant trend is the rising adoption of specialized anti-caking agents tailored for different fertilizer types and application methods. With the global fertilizer anti-caking additives production valued at an estimated $1,300 million in 2025, the market is experiencing robust growth. The historical data from 2019-2024 shows a steady upward trajectory, with the market size expanding from approximately $950 million in 2019 to $1,150 million in 2024. This growth is largely attributed to the increasing recognition of the economic and operational benefits of preventing caking in fertilizers. Caked fertilizers lead to difficulties in handling, application inefficiencies, and potential nutrient loss, all of which directly impact agricultural productivity and profitability.

The market is segmented by Type, with the Powder additive segment holding a substantial market share, estimated at over 60% of the total market value in 2025. This dominance is due to its ease of application and cost-effectiveness. The Paste segment, while smaller, is experiencing significant growth, driven by its enhanced binding properties and suitability for specific fertilizer formulations. The Other type segment, encompassing advanced and specialized formulations, is also on an upward trajectory, catering to niche applications and emerging fertilizer technologies.

Geographically, Asia-Pacific is emerging as a dominant region, accounting for approximately 35% of the global market share in 2025. This is propelled by the region's vast agricultural sector, a growing population demanding increased food production, and a proactive approach towards adopting modern farming practices that include quality fertilizer management. North America and Europe also represent significant markets, driven by stringent quality control measures and a focus on optimizing fertilizer application efficiency. The report forecasts a CAGR of approximately 4.5% for the global fertilizer anti-caking additives market during the forecast period of 2025-2033. This growth is underpinned by ongoing research and development into more sustainable and environmentally friendly anti-caking solutions. The increasing emphasis on precision agriculture and the need for uniform fertilizer application further fuel the demand for effective anti-caking additives.

The fertilizer anti-caking additives market is experiencing robust expansion, fueled by several interconnected driving forces. Foremost among these is the escalating global demand for food, driven by a burgeoning world population projected to exceed 9 billion by 2030. This necessitates enhanced agricultural productivity, making efficient fertilizer utilization paramount. Anti-caking additives play a crucial role in ensuring that fertilizers remain free-flowing and easily spreadable, thereby maximizing nutrient delivery to crops and minimizing wastage. The market size for fertilizer anti-caking additives, which stood at approximately $1,150 million in 2024, is projected to reach $1,300 million by 2025, underscoring the increasing importance of these additives.

Furthermore, the growing adoption of advanced farming techniques, including precision agriculture and conservation tillage, places a premium on uniform fertilizer application. Caked fertilizers hinder this uniformity, leading to uneven nutrient distribution and suboptimal crop yields. As such, farmers and fertilizer manufacturers are increasingly investing in anti-caking solutions to guarantee consistent product quality and performance. The economic benefits derived from preventing caking, such as reduced handling costs, minimized product loss, and improved storage stability, further contribute to the market's upward momentum. Manufacturers are also recognizing the value of these additives in extending the shelf-life of their products, which is critical in regions with diverse climatic conditions and lengthy supply chains. The overall market value is expected to climb to over $1,800 million by 2033, indicating sustained growth driven by these fundamental agricultural and economic imperatives.

Despite the promising growth trajectory, the fertilizer anti-caking additives market faces several challenges and restraints that could temper its expansion. One of the primary concerns is the increasing scrutiny and regulation surrounding the environmental impact of chemical additives. As governments and environmental agencies worldwide implement stricter policies regarding chemical usage in agriculture, manufacturers are pressured to develop eco-friendlier alternatives. This necessitates significant investment in research and development, which can be a costly and time-consuming process. The market size, while projected to grow to $1,300 million by 2025, could be impacted if sustainable alternatives are not readily available or cost-competitive.

Another significant restraint is the price volatility of raw materials. The production of many anti-caking additives relies on petrochemical-based inputs, which are subject to fluctuations in global oil prices. These price swings can directly impact the manufacturing costs of additives, leading to increased product prices for end-users and potentially affecting demand, especially in price-sensitive markets. The historical data shows that periods of high oil prices have correlated with increased additive costs, creating uncertainty in market planning.

Moreover, the diverse nature of fertilizers and their manufacturing processes poses a challenge in developing universal anti-caking solutions. Different fertilizer compositions, particle sizes, and production methods require customized additive formulations. This fragmentation can limit economies of scale for additive manufacturers and increase development costs. The ongoing need for specialized solutions, particularly for niche applications like microbial fertilizers, adds complexity to market penetration. The forecast period of 2025-2033 will likely see continued efforts to overcome these formulation challenges and achieve broader applicability, but it remains a significant hurdle.

The Chemical Fertilizer segment is poised to dominate the global Fertilizer Anti-Caking Additives market.

Dominance of Chemical Fertilizers:

Asia-Pacific Leading Region:

The dominance of chemical fertilizers and the Asia-Pacific region is a synergistic relationship. The vast scale of chemical fertilizer production in Asia-Pacific, driven by the need for enhanced agricultural output, directly translates into a substantial demand for anti-caking additives. The preference for powder additives in this region further solidifies the market dynamics.

The fertilizer anti-caking additives industry is propelled by key growth catalysts that ensure sustained expansion. The primary driver is the unyielding global demand for food, necessitating increased agricultural output and, consequently, higher fertilizer consumption. Enhanced fertilizer efficiency through anti-caking agents translates to better crop yields and reduced wastage, a critical factor in achieving food security. Moreover, the growing trend towards precision agriculture and modern farming techniques demands uniform fertilizer application, a feat made possible by free-flowing fertilizer granules, thus directly boosting the demand for effective anti-caking solutions.

This report offers unparalleled comprehensive coverage of the fertilizer anti-caking additives market, providing a holistic view for industry stakeholders. From a detailed analysis of market trends and driving forces to a thorough examination of challenges and restraints, the report equips readers with critical insights for strategic decision-making. It meticulously dissects the market by application segments, including Microbial Fertilizer and Chemical Fertilizer, and by product type, such as Powder, Paste, and Other. The report's robust methodology ensures that all facets of the market are explored, from production volumes to regional dominance, making it an indispensable resource for understanding the current landscape and future trajectory of this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ARKEMA, Clariant, Kao, Imerys, Forbon, Fertibon, Dorf Ketal, PPG, .

The market segments include Application, Type.

The market size is estimated to be USD 965.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fertilizer Anti-Caking Additives," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fertilizer Anti-Caking Additives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.