1. What is the projected Compound Annual Growth Rate (CAGR) of the Feminine Period Care Products?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Feminine Period Care Products

Feminine Period Care ProductsFeminine Period Care Products by Type (Daily Use, Night Use), by Application (Supermarket, Convenience Store, Online Sales, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

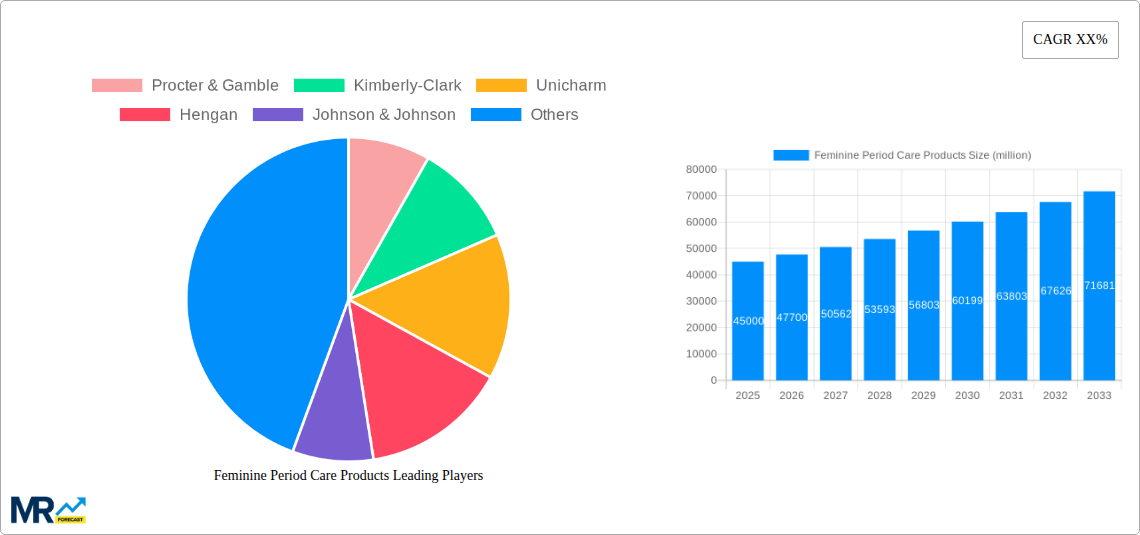

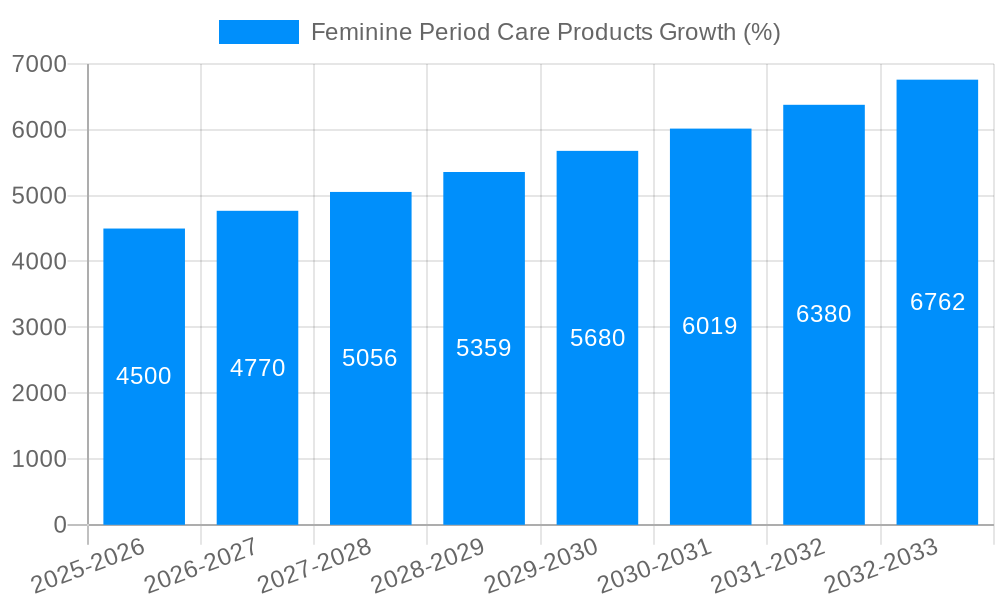

The global Feminine Period Care Products market is poised for significant expansion, projected to reach approximately $45,000 million by the end of 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6%. This growth trajectory is largely propelled by increasing awareness surrounding menstrual hygiene, the rising disposable incomes in emerging economies, and a growing demand for innovative and sustainable period care solutions. Key drivers include the persistent need for essential hygiene products, coupled with an evolving consumer preference for premium and specialized offerings like organic pads, tampons, and menstrual cups. The market is also benefiting from proactive government initiatives promoting menstrual health education and improved access to affordable products, further stimulating market penetration and adoption. Technological advancements are also playing a crucial role, leading to the development of more comfortable, discreet, and eco-friendly products that cater to diverse consumer needs.

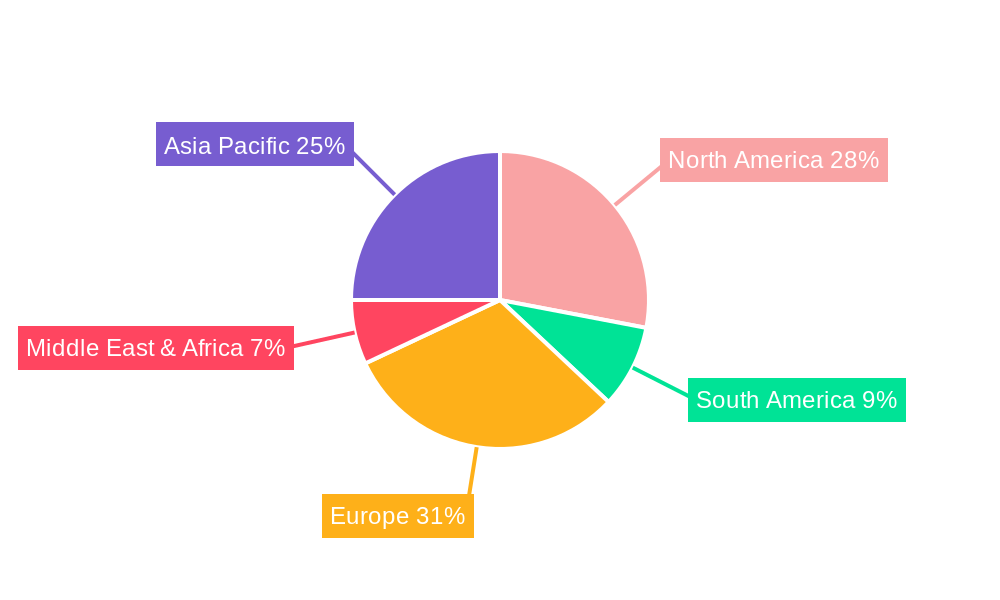

The market landscape for feminine period care products is characterized by a dynamic interplay of established global players and emerging regional brands, all vying for market share. While traditional products like sanitary pads and tampons continue to dominate sales, newer entrants are capitalizing on trends such as reusable menstrual products, period-tracking apps, and subscription box services, indicating a shift towards a more holistic approach to menstrual wellness. However, certain restraints, such as the stigma associated with menstruation in some cultures and the upfront cost of reusable alternatives for certain consumer segments, present ongoing challenges. Geographically, the Asia Pacific region is expected to witness the fastest growth due to its large population, increasing urbanization, and rising health consciousness. North America and Europe remain mature yet significant markets, driven by high consumer spending and a strong emphasis on product quality and innovation.

This comprehensive report offers an in-depth analysis of the global Feminine Period Care Products market, providing crucial insights and actionable intelligence for stakeholders. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, the report delves into the historical trends (2019-2024) and future trajectory of this dynamic industry. We leverage extensive market data, including unit sales figures in the millions, to paint a detailed picture of market segmentation by product type (Daily Use, Night Use) and application channels (Supermarket, Convenience Store, Online Sales, Others). Furthermore, the report meticulously examines significant industry developments and spotlights the leading companies shaping this evolving landscape.

The global Feminine Period Care Products market is experiencing a profound transformation, driven by a confluence of evolving consumer preferences, technological advancements, and a growing emphasis on sustainability and health. The XXX segment, encompassing a wide array of innovative products designed for everyday comfort and discretion, has witnessed remarkable growth. Consumers are increasingly seeking out thinner, more absorbent, and aesthetically pleasing period care solutions that integrate seamlessly into their daily routines. This trend is amplified by a greater awareness surrounding menstrual hygiene and well-being. The rise of direct-to-consumer (DTC) models and subscription services has also democratized access, allowing brands to connect directly with consumers and offer personalized experiences. Furthermore, the demand for eco-friendly and sustainable options is no longer a niche concern but a significant market driver. Consumers are actively seeking out biodegradable, reusable, and ethically sourced period care products, pushing manufacturers to invest in greener materials and production processes. This shift is not only about environmental consciousness but also about a desire for products free from potentially harmful chemicals and synthetic materials. The market is also seeing a surge in product diversification, moving beyond traditional pads and tampons to include menstrual cups, period underwear, and innovative absorption technologies that offer enhanced comfort and leak protection. The influence of social media and open discussions about menstruation have played a pivotal role in destigmatizing periods, encouraging a more proactive approach to menstrual health management and driving demand for a wider range of specialized products. This cultural shift is fostering an environment where consumers are more willing to explore and invest in premium and specialized period care solutions that cater to their individual needs and values. The market is poised for continued expansion as these underlying trends continue to gain momentum, creating opportunities for both established players and new entrants.

Several potent forces are driving the robust growth of the Feminine Period Care Products market. A fundamental driver is the continuously expanding global female population, particularly within reproductive age groups, which inherently translates to a consistent and growing demand for menstrual hygiene products. Beyond sheer numbers, there's a discernible upward trend in disposable income across many emerging economies. This economic uplift empowers more individuals to access and afford a wider spectrum of period care products, including premium and innovative options that were previously considered inaccessible. Simultaneously, a significant surge in consumer awareness regarding menstrual health and hygiene is a powerful propellant. Educational initiatives, advocacy campaigns, and the increasing openness of societal discourse surrounding menstruation have demystified the topic, encouraging proactive and informed purchasing decisions. Consumers are no longer solely focused on basic absorbency but are actively seeking products that offer superior comfort, skin-friendliness, and an enhanced user experience. This growing demand for well-being extends to a heightened concern about the ingredients used in period care products. There's a pronounced shift towards natural, organic, and chemical-free options, pushing manufacturers to innovate with sustainable and health-conscious materials. The burgeoning e-commerce landscape has also been a game-changer, vastly improving accessibility and convenience. Online platforms offer a discreet and readily available avenue for consumers to explore and purchase a diverse range of products, breaking down geographical barriers and catering to the convenience-driven modern consumer.

Despite its promising growth trajectory, the Feminine Period Care Products market is not without its hurdles. A significant challenge stems from the persistent societal stigma surrounding menstruation in certain regions. This deeply ingrained cultural barrier can hinder open conversations, limit product awareness, and consequently, restrain market penetration, particularly for newer or less conventional products. Furthermore, the price sensitivity of a substantial consumer base, especially in price-conscious markets, presents a continuous restraint. While demand for premium and sustainable products is growing, a significant portion of the market still prioritizes affordability, making it challenging for manufacturers to balance innovation with accessible pricing. The highly competitive nature of the market is another formidable challenge. With numerous established global players and an increasing number of new entrants, brands face intense pressure to differentiate themselves through product innovation, marketing strategies, and pricing. This intense competition can lead to price wars and impact profit margins. Regulatory hurdles, although often necessary for consumer safety, can also pose challenges. Navigating diverse and sometimes stringent regulations across different countries for product safety, labeling, and ingredient disclosure requires significant investment and time. Finally, the availability and cost of raw materials, especially for eco-friendly and specialized materials, can fluctuate, impacting production costs and overall market pricing, thereby posing a potential restraint on sustained growth.

Dominant Segments:

Daily Use Type: The Daily Use segment is poised for significant dominance in the global Feminine Period Care Products market. This dominance is underpinned by the fundamental and continuous need for menstrual hygiene solutions throughout a woman's reproductive life. Unlike specialized products that might cater to specific needs like overnight protection, daily use products, encompassing liners, ultra-thin pads, and tampons designed for everyday wear, represent a consistent and high-volume purchase category. The increasing focus on comfort, discretion, and a desire to feel fresh throughout the day fuels the demand for these products. As women increasingly participate in professional, social, and physical activities, the need for reliable and discreet daily protection becomes paramount. This segment benefits from high brand loyalty and consistent repurchase rates, establishing a stable foundation for market leadership. The proliferation of ultra-thin, highly absorbent, and odor-neutralizing technologies further enhances the appeal and utility of daily use products, making them the go-to choice for a vast majority of menstruating individuals.

Online Sales Application: The Online Sales application segment is rapidly emerging as a dominant force and is projected to witness the most substantial growth in the Feminine Period Care Products market. The inherent privacy associated with purchasing feminine hygiene products makes online platforms an ideal channel. Consumers, especially younger generations, are increasingly comfortable browsing and purchasing these items discreetly from the comfort of their homes. The convenience of doorstep delivery, coupled with the ability to compare a wider array of brands, products, and price points, significantly contributes to the online segment's dominance. Furthermore, the rise of subscription services, where consumers can schedule regular deliveries of their preferred products, further solidifies the online channel's stronghold. This model not only ensures a continuous supply but also often offers cost savings, making it an attractive option. E-commerce platforms are also adept at showcasing new and innovative products, providing detailed product information, and leveraging digital marketing to reach a broader audience, thus accelerating the adoption of novel menstrual care solutions.

Key Region/Country:

The Asia Pacific region is expected to be a pivotal growth engine and a dominant force in the global Feminine Period Care Products market. This dominance is driven by a combination of factors, including a vast and growing female population, particularly in countries like China and India, which represent significant end-user bases. Furthermore, a rapidly expanding middle class across the region is leading to increased disposable incomes, enabling a greater proportion of the population to access and afford a wider range of menstrual hygiene products. The increasing awareness surrounding menstrual health and hygiene, fueled by government initiatives, non-governmental organizations, and growing media influence, is also playing a crucial role in driving demand. As societal taboos surrounding menstruation gradually diminish in many Asia Pacific countries, consumers are becoming more open to exploring and adopting a diverse range of products, including premium and innovative solutions. The significant presence of key manufacturers like Unicharm and Hengan within this region, coupled with strategic investments in expanding production capabilities and distribution networks, further reinforces its dominance. The adoption of e-commerce platforms for purchasing these products is also accelerating in Asia Pacific, providing an accessible and convenient avenue for consumers to procure their essential needs, thus contributing to the region's overall market leadership.

Several key growth catalysts are propelling the Feminine Period Care Products industry forward. The escalating global awareness and destigmatization surrounding menstruation are fundamental drivers, encouraging open discussions and increasing demand for effective solutions. Furthermore, a growing consumer preference for sustainable and eco-friendly products is spurring innovation in biodegradable materials and reusable options. Advancements in material science are leading to thinner, more absorbent, and comfortable products, enhancing user experience and driving upgrades. The expanding e-commerce landscape offers unparalleled accessibility and convenience, breaking down geographical barriers and catering to modern lifestyles. Finally, rising disposable incomes in emerging economies are empowering a larger segment of the population to access and afford a broader range of period care options.

This report offers a holistic view of the Feminine Period Care Products market, meticulously detailing market dynamics, key trends, and future projections. It provides invaluable data on market size and segmentation by product type and application, supported by unit sales figures in the millions. The analysis extends to identifying key regions and countries poised for dominance, along with dominant market segments like Daily Use products and Online Sales channels. Furthermore, the report highlights the critical growth catalysts and identifies the leading global players, offering a comprehensive understanding of the competitive landscape. Significant industry developments and future trends are also comprehensively covered, making this report an indispensable resource for strategic decision-making, market entry, and competitive analysis within the evolving Feminine Period Care Products sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Procter & Gamble, Kimberly-Clark, Unicharm, Hengan, Johnson & Johnson, Essity, Kingdom Healthcare, Kao Corporation, Jieling, Edgewell Personal Care Company, Elleair, KleanNara, Ontex International, Corman SpA, Bjbest, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Feminine Period Care Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Feminine Period Care Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.