1. What is the projected Compound Annual Growth Rate (CAGR) of the Feminine Hygiene Products?

The projected CAGR is approximately 6.98%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Feminine Hygiene Products

Feminine Hygiene ProductsFeminine Hygiene Products by Type (Sanitary Napkins, Tampons, Pantyliners, Menstrual Cups, Feminine Hygiene Wash, Other), by Application (Online Stores, Retail Outlets, Specialty Stores, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

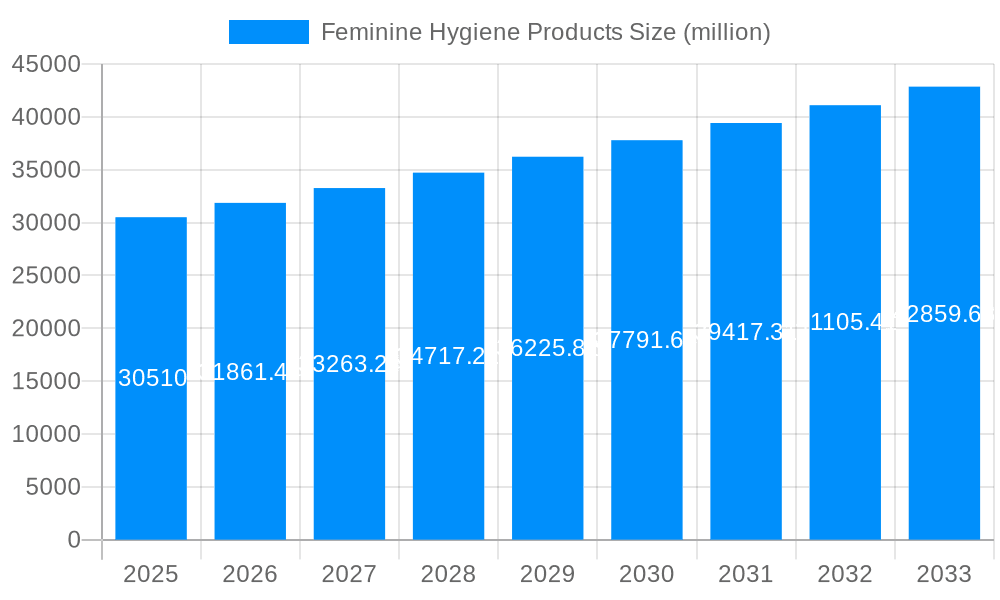

The global feminine hygiene products market, valued at $30.51 billion in 2025, is projected to experience steady growth, driven by increasing awareness of hygiene and menstrual health, particularly in developing economies. A compound annual growth rate (CAGR) of 4.4% from 2025 to 2033 indicates a significant market expansion, reaching an estimated value exceeding $45 billion by 2033. Key drivers include rising disposable incomes, increased female participation in the workforce, and the growing adoption of modern and convenient feminine hygiene products. Market trends show a shift towards eco-friendly and sustainable options, premium products offering enhanced comfort and functionality, and the rise of subscription models for convenient product delivery. While competitive pressures from numerous established and emerging players exist, the market’s growth is largely unconstrained, presenting significant opportunities for innovation and market penetration. The segment encompassing sanitary napkins and tampons remains dominant, though the market is seeing increasing adoption of menstrual cups and period underwear, indicating a growing preference for reusable and sustainable alternatives. Major players like Procter & Gamble, Unicharm, and Kimberly-Clark hold significant market share, but smaller companies are also innovating and attracting customers with specialized products and sustainable practices.

This growth is expected to be fueled by several factors. Firstly, rising disposable incomes, especially in emerging markets, allow more women to access a wider range of feminine hygiene products. Secondly, increased female participation in the workforce is driving demand for convenient and discreet products. Thirdly, a growing awareness of menstrual health and hygiene is encouraging women to adopt better hygiene practices and use higher-quality products. Finally, the continued innovation in product design and materials leads to improved comfort, absorbency, and overall user experience. However, challenges remain, including potential price sensitivity in certain regions and overcoming cultural barriers to the adoption of newer product categories like menstrual cups and sustainable options. Effective marketing and product education play crucial roles in navigating these challenges and driving further market growth.

The global feminine hygiene products market is experiencing significant transformation, driven by evolving consumer preferences and technological advancements. Over the historical period (2019-2024), the market witnessed steady growth, primarily fueled by rising awareness of hygiene and increasing disposable incomes, particularly in developing economies. The estimated market size in 2025 is projected to be in the hundreds of millions of units, indicating a substantial market presence. This growth is expected to continue throughout the forecast period (2025-2033), albeit at a potentially moderated pace due to factors discussed later. Key trends include a rising demand for organic and eco-friendly products, reflecting a growing concern for environmental sustainability and personal health. Consumers are increasingly seeking products with natural ingredients, biodegradable materials, and sustainable packaging. Furthermore, the market is witnessing a surge in popularity of menstrual cups and reusable pads, driven by the desire for cost-effective and environmentally conscious alternatives to disposable products. Innovation in product design and functionality is also a key trend, with companies introducing products with improved comfort, absorbency, and leak protection. The shift towards digital marketing and e-commerce channels is another significant trend, with online sales of feminine hygiene products experiencing substantial growth. This allows for greater consumer reach and targeted marketing campaigns. Finally, a growing emphasis on menstrual health education and awareness initiatives is positively impacting market growth by encouraging wider adoption of hygiene products and appropriate practices.

Several key factors are driving the growth of the feminine hygiene products market. Firstly, the rising female population globally contributes significantly to market expansion. Increased disposable incomes, especially in emerging markets, allow more women access to a wider range of higher-quality products. Enhanced awareness regarding menstrual hygiene and its importance to overall health is another critical driver. Public health campaigns and educational initiatives are playing a vital role in promoting the adoption of sanitary products. Technological advancements in product development have led to the creation of more comfortable, effective, and discreet products, catering to a broader consumer base. The development of eco-friendly and sustainable options is also attracting a significant segment of environmentally conscious consumers. Finally, the increasing availability of products through diverse distribution channels, including online platforms and retail stores, has broadened market accessibility and consumer choice, further stimulating market growth. The rising preference for convenience and the increasing adoption of e-commerce platforms have fueled the demand for readily available products, significantly impacting market dynamics.

Despite the positive growth trajectory, several challenges and restraints hinder the market's expansion. The foremost is the prevalence of high pricing for certain products, particularly premium organic and sustainable options, which can restrict accessibility for lower-income consumers. Concerns regarding the environmental impact of disposable products are leading to increased scrutiny and regulatory pressures, potentially leading to increased production costs. Fluctuations in raw material prices can impact the overall profitability of manufacturers. The presence of counterfeit and substandard products in the market presents a significant challenge, impacting consumer trust and safety. Cultural and religious beliefs in some regions may influence the acceptance and use of modern feminine hygiene products, restricting market penetration. Finally, competitive pressures among established and emerging brands necessitates constant innovation and product differentiation to maintain market share, further impacting profitability and influencing market strategy.

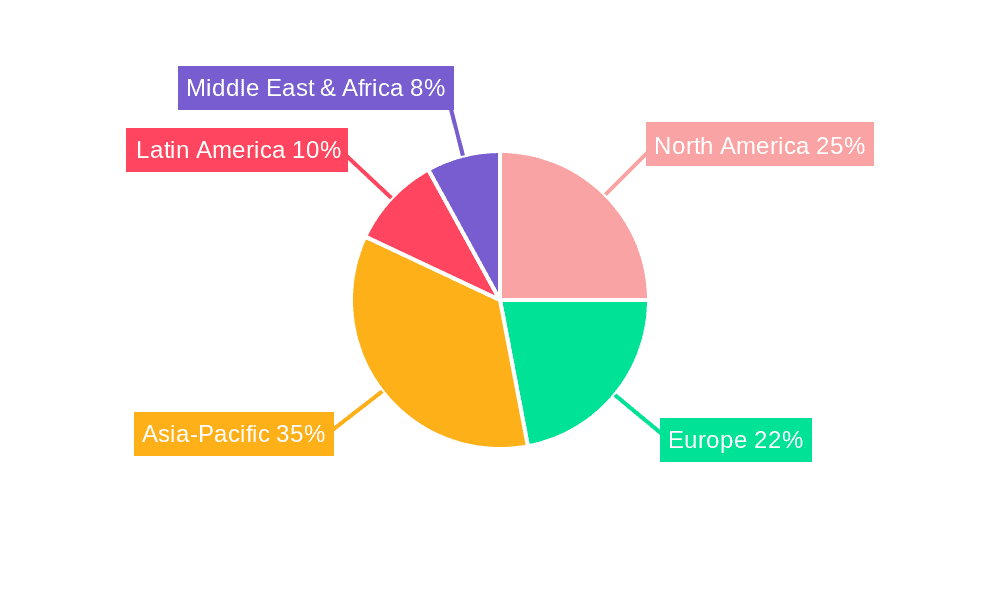

North America and Western Europe: These regions are expected to maintain a significant market share due to high per capita consumption and established distribution networks. The high awareness of menstrual hygiene and the prevalence of advanced healthcare infrastructure contribute to this dominance. The high disposable income levels in these regions also contribute to the purchase of premium and specialty products, creating diverse market segments.

Asia-Pacific: This region is experiencing rapid growth, fueled by increasing female population, rising disposable incomes, and expanding awareness of menstrual hygiene. The large and diverse population provides a massive potential market, driving the need for localized product development.

Emerging Markets (Africa, Latin America): These markets are poised for substantial growth, driven by rising awareness and increasing disposable incomes. However, challenges related to infrastructure, distribution, and affordability remain significant hurdles.

Segments: The sanitary napkins segment is currently dominating the market due to its wide acceptance and extensive availability. However, the reusable pads and menstrual cup segments are experiencing significant growth, driven by eco-conscious consumer preferences. The premium segment, offering innovative products with superior features, is also seeing robust growth.

The paragraph above explains that North America and Western Europe are leading markets due to factors like high per capita consumption and established infrastructure. The Asia-Pacific region demonstrates rapid growth due to its large population and increasing disposable incomes, while emerging markets are identified as areas with immense potential but facing challenges in terms of access and affordability. Different product segments are analyzed, highlighting the dominance of sanitary napkins while acknowledging the rising popularity of more sustainable alternatives.

The feminine hygiene products industry's growth is fueled by a confluence of factors, including rising awareness of hygiene and health, escalating disposable incomes in developing nations, and the continuous development of technologically advanced and sustainable products that meet evolving consumer preferences. These factors, coupled with effective marketing campaigns and strategic distribution networks, are pivotal in driving market expansion and stimulating demand for a broader range of hygiene solutions.

This report provides a comprehensive analysis of the feminine hygiene products market, covering market size, trends, drivers, challenges, leading players, and future growth prospects. The report offers detailed insights into various segments, including sanitary napkins, tampons, menstrual cups, and reusable pads, and provides regional breakdowns to facilitate a thorough understanding of the market landscape. The study employs a robust methodology, encompassing extensive data collection and analysis, to provide reliable and actionable information for stakeholders across the industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.98% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.98%.

Key companies in the market include Procter & Gamble, Unicharm, Johnson & Johnson, Kimberly-Clark, Svenska Cellulosa Aktiebolaget, Edgewell Personal Care, Bella, Bodywise (UK), Cora, Corman, First Quality Enterprises, Fujian Hengan Group, Lil-Lets, Masmi, Moxie, Ontex, Pee Buddy, Kao, The Honest Company, Seventh Generation, Vivanion, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Feminine Hygiene Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Feminine Hygiene Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.