1. What is the projected Compound Annual Growth Rate (CAGR) of the Eyeglass Lenses?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Eyeglass Lenses

Eyeglass LensesEyeglass Lenses by Type (Glass, Resin, Others), by Application (Vision Correction, Beautiful, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

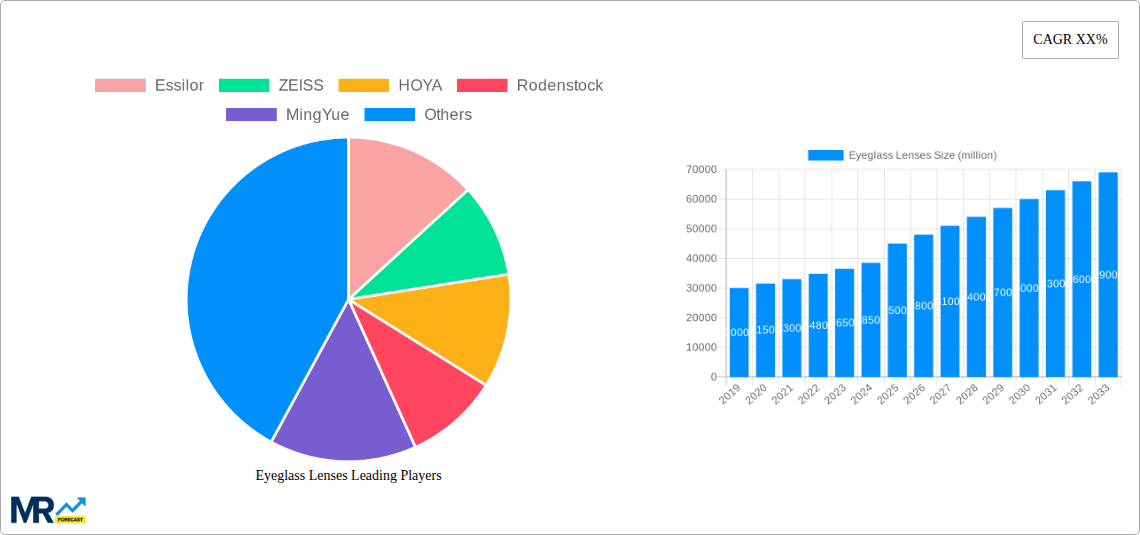

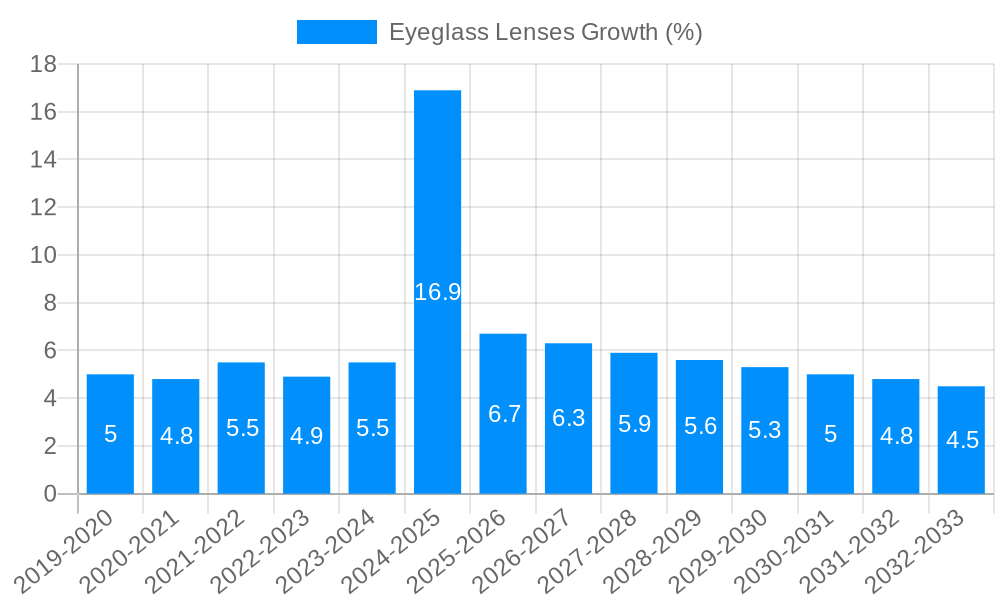

The global eyeglass lenses market is poised for robust expansion, projected to reach a significant market size of approximately $45,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This growth is primarily fueled by an aging global population experiencing increased prevalence of age-related vision impairments such as cataracts and presbyopia. Furthermore, a rising awareness and demand for enhanced visual comfort and protection, including blue light filtering and UV protection, are significant market drivers. The growing trend of cosmetic eyewear, where lenses are chosen for aesthetic appeal and visual enhancement beyond mere correction, also contributes to market dynamism. Technological advancements in lens materials, such as thinner, lighter, and more scratch-resistant options, alongside innovative coatings, are continuously improving product offerings and consumer satisfaction, further propelling market growth.

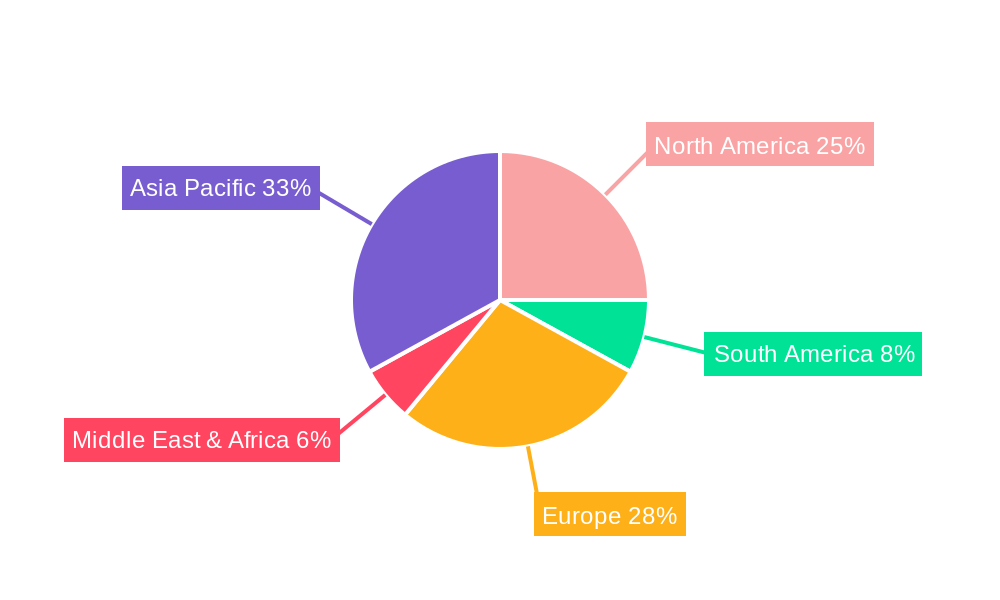

The market is segmented into key types, with Glass and Resin lenses holding substantial shares, catering to diverse consumer preferences and optical needs. The "Resin" segment, in particular, is expected to witness accelerated growth due to its lightweight, durable, and versatile properties, making it ideal for a wide range of eyeglass frames and prescription needs. In terms of application, "Vision Correction" remains the dominant segment, driven by the unabated need for refractive error correction. However, the "Beautiful" segment, encompassing cosmetic and lifestyle-enhancing lenses, is emerging as a significant growth area, reflecting shifting consumer priorities. Geographically, Asia Pacific, led by China and India, is expected to be a major growth engine, driven by a large population base, increasing disposable incomes, and rising healthcare expenditure. North America and Europe, with their established healthcare infrastructure and high consumer spending on vision care, will continue to be significant markets.

The global eyeglass lenses market, projected to be valued at over 250 million units by 2025 and experiencing a robust growth trajectory leading up to 2033, is undergoing a dynamic transformation driven by a confluence of technological advancements, evolving consumer preferences, and an increasing awareness of eye health. The study period, spanning from 2019 to 2033, with a base and estimated year of 2025, encapsulates both historical performance and future projections, revealing significant shifts in market dynamics. Resin lenses, particularly high-index materials, continue to dominate the market share, propelled by their lightweight, impact-resistant, and aesthetically pleasing characteristics, offering a comfortable and durable alternative to traditional glass. The application segment for vision correction remains paramount, accounting for the largest portion of the market as the global prevalence of refractive errors continues to rise. However, a burgeoning segment is emerging within the "Beautiful" application, encompassing cosmetic lenses and specialized lenses designed for fashion and lifestyle purposes, indicating a growing consumer desire to blend visual correction with personal style. Furthermore, the "Others" application category is witnessing innovation in areas such as protective eyewear and specialized occupational lenses, catering to niche demands. Industry developments are characterized by a relentless pursuit of thinner, lighter, and more advanced lens materials, alongside the integration of smart technologies for enhanced visual performance and protection. The forecast period (2025-2033) is expected to witness continued innovation in coatings, such as anti-reflective, blue light filtering, and self-cleaning technologies, further enhancing user experience and lens functionality. The market is also being influenced by an aging global population, which naturally leads to an increased demand for corrective lenses, while a growing youth demographic embracing digital lifestyles also contributes to the demand for vision correction and eye protection solutions.

The eyeglass lenses market is witnessing a significant shift towards advanced materials and sophisticated functionalities, driven by evolving consumer demands and technological breakthroughs. Within the "Type" segment, resin lenses, particularly those made from high-index materials, have outpaced traditional glass lenses due to their inherent advantages of being lighter, thinner, and more impact-resistant. This trend is expected to continue, with a projected market share exceeding 300 million units in the coming years, as manufacturers invest heavily in research and development to produce even more advanced and comfortable lens materials. The "Application" segment for vision correction, which historically has been the bedrock of the market, is now being complemented by a rapid expansion in the "Beautiful" and "Others" categories. The "Beautiful" segment, encompassing fashion-oriented lenses and those with aesthetic enhancements, is projected to grow substantially, driven by a younger demographic and an increasing desire for personalized eyewear that doubles as a fashion statement. This surge is estimated to contribute over 100 million units to the overall market volume in the forecast period. Simultaneously, the "Others" application, including specialized lenses for sports, occupational safety, and therapeutic purposes, is also gaining traction. Advancements in lens coatings, such as anti-glare, UV protection, and blue-light filtering, are becoming standard features, enhancing visual comfort and eye health, thereby driving demand for premium products. The increasing incidence of digital eye strain and a heightened awareness of the long-term effects of blue light exposure are fueling the adoption of specialized lenses, further diversifying the market's application landscape. The study period (2019-2033) highlights a sustained upward trend, with the base year of 2025 acting as a pivotal point for forecasting substantial growth. The estimated market size in 2025 is projected to be well over 280 million units, indicating a strong foundation for continued expansion.

Several key factors are acting as powerful engines driving the growth of the global eyeglass lenses market. The most significant among these is the increasing global prevalence of refractive errors. Factors such as prolonged screen time, changing lifestyles, and an aging population are contributing to a higher incidence of myopia, hyperopia, and astigmatism, thereby augmenting the demand for corrective eyeglass lenses. This underlying demographic shift alone is projected to drive the demand for vision correction lenses by several tens of millions of units annually. Concurrently, a growing emphasis on eye health and wellness is empowering consumers to proactively manage their vision. This includes a greater understanding of the harmful effects of UV radiation and blue light, leading to a surge in demand for lenses with advanced protective coatings and features. The market is witnessing a significant rise in the adoption of blue-light filtering lenses, with projections suggesting a market penetration of over 40% of all prescription lenses within the forecast period. Furthermore, technological advancements and innovation in lens materials and manufacturing processes are continuously enhancing the performance and aesthetic appeal of eyeglass lenses. The development of thinner, lighter, and more durable materials, coupled with sophisticated coatings, is making eyewear more comfortable and functional, thereby appealing to a wider consumer base. The introduction of personalized lens designs, catering to individual visual needs and lifestyles, is also a significant growth driver.

Despite the robust growth trajectory, the eyeglass lenses market faces certain challenges and restraints that could impede its full potential. A primary concern is the increasing prevalence of counterfeit and unbranded lenses, particularly in emerging markets. These products often compromise on quality and safety, posing risks to consumer eye health and undermining the sales of legitimate manufacturers. The market for counterfeit lenses is estimated to represent a loss of billions of dollars annually to legitimate players. Another significant challenge is the high cost associated with advanced lens technologies and coatings. While these features offer superior performance, their premium pricing can be a barrier for price-sensitive consumers, particularly in developing economies. This affordability constraint could limit the penetration of high-end lenses, potentially slowing down the overall market growth by a few percentage points. Furthermore, fierce competition among manufacturers leads to price wars and reduced profit margins, especially for basic lens types. This intense competition necessitates continuous investment in research and development to maintain a competitive edge, which can strain the financial resources of smaller players. The reliance on specific raw materials and potential supply chain disruptions can also pose a risk, impacting production volumes and cost structures. For instance, fluctuations in the price of polycarbonate or other specialized polymers can directly affect the cost of resin lenses, which constitute a substantial portion of the market. Lastly, limited awareness and accessibility to eye care services in certain regions can restrict the adoption of corrective lenses, thereby limiting market expansion.

The global eyeglass lenses market is characterized by regional disparities and segment dominance, with the Asia Pacific region poised to be the largest and fastest-growing market throughout the study period (2019-2033). This dominance is attributed to several intertwined factors.

Burgeoning Population and Increasing Disposable Income: Asia Pacific is home to over half of the world's population, and a rapidly growing middle class with increasing disposable income. This demographic shift directly translates into a larger addressable market for vision correction products. The region is expected to contribute over 200 million units to the global market volume by 2033.

Rising Incidence of Refractive Errors: Factors such as increased screen time among both young and old, urbanization, and changing dietary habits have led to a surge in the prevalence of myopia and other refractive errors across Asian countries like China, India, and Southeast Asian nations. This escalating need for vision correction is a primary driver.

Expanding Healthcare Infrastructure and Awareness: Governments and private entities in many Asia Pacific countries are investing in expanding healthcare infrastructure and promoting eye health awareness. This leads to increased eye check-ups and a higher demand for corrective lenses.

Technological Adoption and Manufacturing Hub: The region is also a significant manufacturing hub for eyeglass lenses, with major players like Essilor, ZEISS, HOYA, and local giants such as MingYue and WanXin having substantial production facilities. This localized manufacturing capability, combined with a growing appetite for advanced lens technologies, fuels market dominance.

Within the Asia Pacific, the Resin segment for Vision Correction application is expected to be the most dominant.

Resin Lenses Dominance: Resin lenses, due to their inherent lightweight, durability, and safety, have become the preferred choice for a majority of consumers seeking vision correction. The affordability and continuous innovation in higher-index resin materials further solidify their market leadership. This segment is projected to account for over 80% of the total market volume in the region.

Vision Correction as the Primary Application: The fundamental need for clear vision remains the paramount driver for eyeglass lens consumption. The sheer number of individuals requiring vision correction in Asia Pacific, coupled with increasing affordability of prescription eyewear, ensures that the "Vision Correction" application segment will continue to be the largest contributor, representing a market size in the hundreds of millions of units annually within the region.

Growth in "Beautiful" and "Others" Applications: While vision correction leads, the "Beautiful" application segment, encompassing cosmetic lenses and fashion eyewear, is experiencing rapid growth, particularly among the younger demographics in countries like South Korea, Japan, and China. The "Others" segment, including specialized lenses for occupational use and sports, is also seeing an upward trend driven by urbanization and increasing participation in recreational activities. These niche segments, though smaller in volume compared to vision correction, offer higher profit margins and represent significant growth opportunities.

The presence of major global players like Essilor and ZEISS alongside strong local manufacturers such as MingYue and WanXin in China, and HOYA with its significant presence, creates a competitive yet expansive market. Rodenstock, Nikon, and Chemilens also contribute to the market's diversity. Conant and HongChen represent key domestic players, further strengthening the regional market dynamics. The continuous introduction of new coatings, materials, and personalized lens designs within the Resin and Vision Correction segments will ensure their continued dominance in the Asia Pacific eyeglass lenses market.

The eyeglass lenses industry is propelled by several key growth catalysts. The escalating global burden of eye conditions, particularly refractive errors like myopia and presbyopia, driven by lifestyle changes and an aging population, creates a consistent and expanding demand for vision correction. Furthermore, increasing consumer awareness about eye health and the detrimental effects of UV and blue light exposure is driving the adoption of protective and specialized lenses. Technological advancements, leading to lighter, thinner, and more durable lens materials and advanced coatings, enhance user comfort and functionality, thereby encouraging upgrades and purchases. The growing emphasis on aesthetics and personalization is also fueling the demand for fashionable and custom-designed lenses, broadening the market beyond purely functional correction.

This comprehensive report provides an in-depth analysis of the global eyeglass lenses market, offering detailed insights into its current state and future trajectory. It meticulously covers the market dynamics from the historical period of 2019-2024, establishing a solid foundation for understanding past trends. With a base year of 2025 and an estimated year also set as 2025, the report offers a precise snapshot of the market's immediate standing. The forecast period of 2025-2033 is thoroughly explored, providing actionable projections and strategic recommendations for stakeholders. The report delves into critical segments, including lens types (Glass, Resin, Others) and applications (Vision Correction, Beautiful, Others), offering a granular understanding of their respective market shares and growth potential. It also meticulously examines the industry's evolution, highlighting key developments and influential players, such as Essilor, ZEISS, HOYA, Rodenstock, MingYue, WanXin, Chemilens, Nikon, Conant, and HongChen. The report further identifies the driving forces behind market growth and the challenges that need to be navigated, ensuring a balanced and realistic perspective. Furthermore, it pinpoints key regions and countries expected to dominate the market, along with the segments that will spearhead this growth, providing a strategic roadmap for market participants.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Essilor, ZEISS, HOYA, Rodenstock, MingYue, WanXin, Chemilens, Nikon, Conant, HongChen, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Eyeglass Lenses," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Eyeglass Lenses, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.