1. What is the projected Compound Annual Growth Rate (CAGR) of the EV Fast DC Charging Equipment?

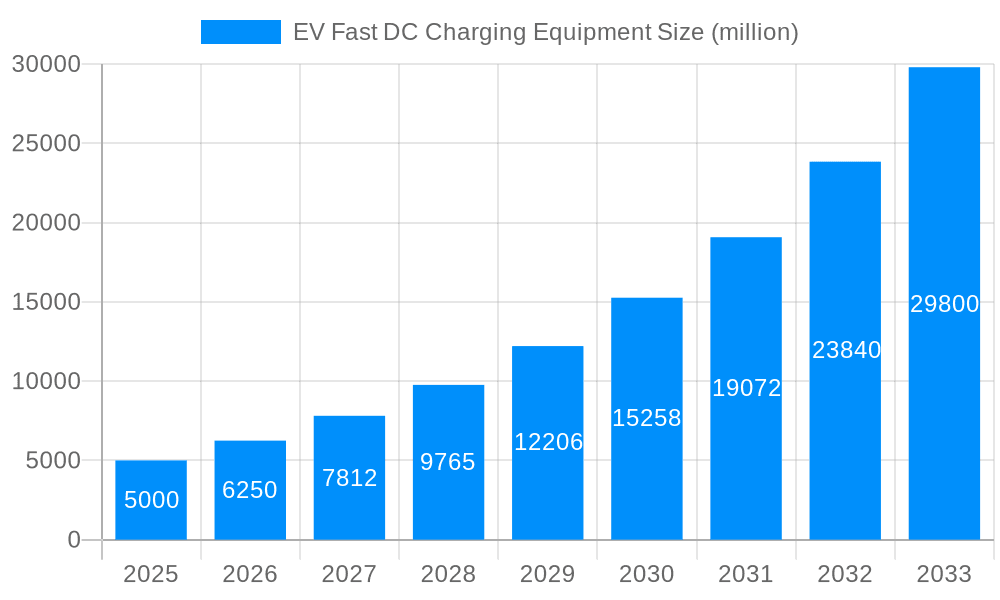

The projected CAGR is approximately 15.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

EV Fast DC Charging Equipment

EV Fast DC Charging EquipmentEV Fast DC Charging Equipment by Type (Level 1, Level 2), by Application (Residential, Public), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

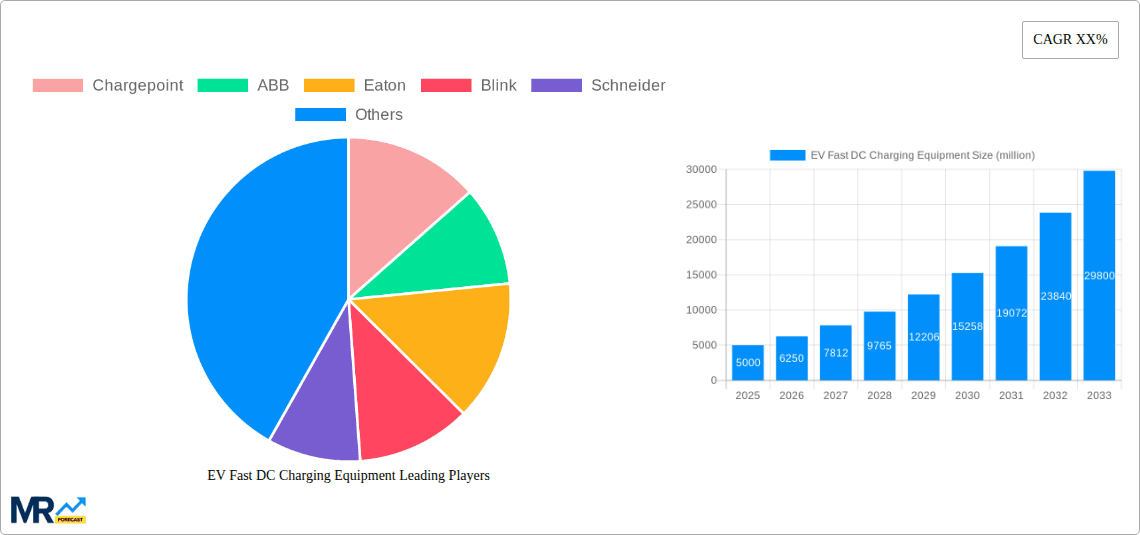

The global Electric Vehicle (EV) DC fast charging equipment market is poised for significant expansion, propelled by the rapid surge in EV adoption and favorable government initiatives for sustainable transport. The market, valued at $28.47 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.1%, reaching an estimated value by 2033. Key growth drivers include substantial investments in charging infrastructure, aimed at alleviating range anxiety for EV consumers. Technological innovations enhancing charging speed, efficiency, and reducing charging times are also critical. The increasing demand for public charging solutions in urban centers and along key transit routes presents considerable market opportunities. Robust competition among leading companies such as ChargePoint, ABB, and Eaton, alongside new entrants, is stimulating innovation and improving accessibility.

Despite this positive outlook, challenges persist. The substantial initial capital expenditure required for the installation and upkeep of DC fast charging stations can impede market entry for smaller enterprises and slow adoption in certain geographies. A dependable and robust power grid infrastructure is essential to meet the escalating demand from fast charging. Furthermore, ongoing interoperability challenges across various charging standards may affect user experience. Overcoming these obstacles is vital for sustained market growth and the widespread integration of EV DC fast charging solutions. Future market segmentation is expected to feature specialized charging solutions catering to diverse EV models and use cases.

The global EV fast DC charging equipment market is experiencing explosive growth, driven by the accelerating adoption of electric vehicles (EVs) worldwide. The market, valued at several million units in 2024, is projected to witness a significant expansion during the forecast period (2025-2033). This surge is fueled by several interconnected factors, including increasing government initiatives promoting EV adoption (through subsidies, tax breaks, and stricter emission regulations), growing consumer awareness of environmental concerns and the benefits of EVs, and continuous advancements in battery technology leading to increased driving ranges and faster charging times. The historical period (2019-2024) showcased substantial growth, setting the stage for even more impressive expansion in the coming years. While the base year (2025) provides a crucial benchmark, the estimated year (2025) values confirm this upward trajectory. Key market insights reveal a shift towards higher-power charging solutions, with significant investments in ultra-fast charging infrastructure capable of adding hundreds of kilometers of range in minutes. This trend is further driven by the rising demand for convenient and quick charging experiences, mirroring the refueling convenience offered by traditional gasoline vehicles. The market is characterized by intense competition among established players and emerging startups, leading to continuous innovation in charging technology, network expansion, and service offerings. This competition ultimately benefits consumers, offering diverse choices in terms of price, technology, and accessibility. The evolution of charging standards is another critical trend, with various standards vying for dominance, influencing the design and compatibility of charging equipment. Finally, the integration of smart charging technologies, enabling optimized energy management and grid integration, is gaining traction, contributing to the overall market expansion. The study period (2019-2033) provides a comprehensive overview of this dynamic market landscape, showcasing the intricate interplay of technological advancements, regulatory frameworks, and consumer behavior.

Several key factors are accelerating the growth of the EV fast DC charging equipment market. Firstly, the global push towards decarbonization and reducing greenhouse gas emissions is creating a favorable environment for electric vehicle adoption. Governments worldwide are implementing policies to incentivize EV ownership and the deployment of charging infrastructure, including substantial financial subsidies and tax breaks for both consumers and charging station operators. Secondly, technological advancements are continuously improving battery technology, leading to extended EV ranges and faster charging times, thus addressing one of the major concerns associated with EVs – "range anxiety." This improvement reduces the time spent charging, making EVs more appealing to consumers. Thirdly, rising fuel prices and fluctuating oil markets make EVs a more economically attractive option for many, especially in the long run, further boosting their adoption rate. Simultaneously, the increasing awareness among consumers about environmental sustainability and the reduction of carbon footprint is influencing purchase decisions towards more eco-friendly vehicles. Lastly, the development of robust and reliable charging networks is crucial for wider EV adoption. As the density of fast DC charging stations increases, the convenience factor of EV ownership improves, encouraging more people to switch from traditional vehicles. The synergistic effect of these driving forces contributes to a continuously expanding market for fast DC charging equipment, fueling significant growth in the coming years.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of EV fast DC charging equipment. High initial investment costs associated with installing and maintaining fast DC chargers are a major barrier for both private businesses and public entities. The cost includes not only the equipment itself but also grid upgrades, land acquisition, and ongoing maintenance. Furthermore, the interoperability of different charging standards poses a significant challenge. The lack of standardization across various charging protocols can lead to compatibility issues, hindering seamless charging experiences for EV users. The uneven geographical distribution of charging stations also poses a significant constraint, particularly in rural areas and developing countries. This uneven distribution creates "charging deserts" and limits the practicality of EV ownership for many. Grid infrastructure limitations in some regions struggle to handle the increased energy demand from a rapid proliferation of fast chargers, posing a technical challenge requiring substantial grid upgrades. Finally, the long payback periods associated with the investments in fast DC charging stations can deter private investors, necessitating government support and incentives to stimulate infrastructure development. Addressing these challenges will require a multi-faceted approach involving technological advancements, policy interventions, and private sector investment.

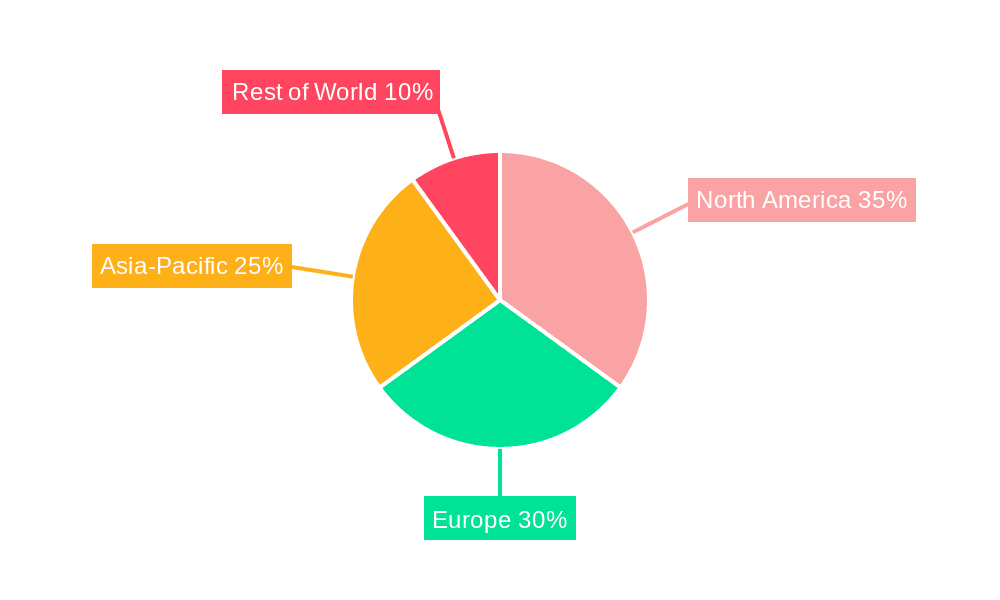

North America (specifically the USA): The US is leading the charge (pun intended!) in EV adoption, driven by significant government incentives, a robust automotive industry, and growing consumer awareness. This translates into a high demand for fast DC charging equipment. The extensive highway system also necessitates a wide network of fast charging stations to support long-distance travel. Moreover, the presence of numerous major players in the EV charging sector in the US further contributes to market dominance.

Europe: Similar to North America, Europe is aggressively pursuing EV adoption with strong government regulations, subsidies, and a commitment to reducing carbon emissions. Several European countries have ambitious targets for EV penetration, driving significant investment in charging infrastructure. The relatively high EV ownership rates in several European countries contribute significantly to the region's dominance in the EV fast DC charging equipment market.

Asia-Pacific (specifically China): China is a significant player due to its massive EV market and ambitious plans for nationwide electrification. The country's large population and expanding middle class create a huge potential market for EVs and consequently, fast DC chargers. The Chinese government's strong support for domestic EV manufacturers and charging infrastructure also plays a crucial role.

High-Power Charging Segment: The segment focusing on high-power (150kW and above) fast DC chargers is experiencing rapid growth due to the increasing demand for significantly reduced charging times. This is a key trend shaping the overall market and contributing to the segment's dominance.

Public Charging Stations Segment: Public charging stations, including those at malls, businesses, and along highways, account for a significant portion of the market. This segment's dominance is fueled by the convenience factor for EV drivers who don't have home charging options. The need for widespread public charging infrastructure to enable mass adoption of EVs makes this segment pivotal.

In summary, the combination of strong government support, significant EV adoption rates, and a focus on high-power charging solutions contributes to North America, Europe, and Asia-Pacific dominating the market, with a special emphasis on high-power public charging stations.

Several factors are accelerating growth in the EV fast DC charging equipment industry. Firstly, continuous technological advancements are making fast DC chargers more efficient, reliable, and cost-effective. Secondly, increasing government investments in building charging infrastructure are creating substantial market opportunities. Thirdly, growing consumer demand for convenient and quick charging solutions is driving the adoption of fast DC chargers. Finally, the expansion of EV fleets within various sectors, such as transportation and logistics, creates a growing demand for fast charging infrastructure. The synergistic effect of these catalysts will propel the market to new heights in the coming years.

This report provides a comprehensive analysis of the EV fast DC charging equipment market, covering market trends, driving forces, challenges, key players, and significant developments. It offers a detailed look at the market's past performance, current status, and future projections, providing valuable insights for industry stakeholders. The report's in-depth analysis of key market segments and geographical regions empowers decision-makers to formulate effective strategies for growth and market penetration. The report also examines the competitive landscape, identifying key players and their respective market shares, contributing to a complete understanding of this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.1%.

Key companies in the market include Chargepoint, ABB, Eaton, Blink, Schneider, Siemens, General Electric, AeroVironment, Panasonic, Chargemaster, Elektromotive, Clipper Creek, .

The market segments include Type, Application.

The market size is estimated to be USD 28.47 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "EV Fast DC Charging Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the EV Fast DC Charging Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.