1. What is the projected Compound Annual Growth Rate (CAGR) of the EV Battery Test System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

EV Battery Test System

EV Battery Test SystemEV Battery Test System by Type (Unit Test, Module Test, Pack Test), by Application (Passenger Car, Commercial Car, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

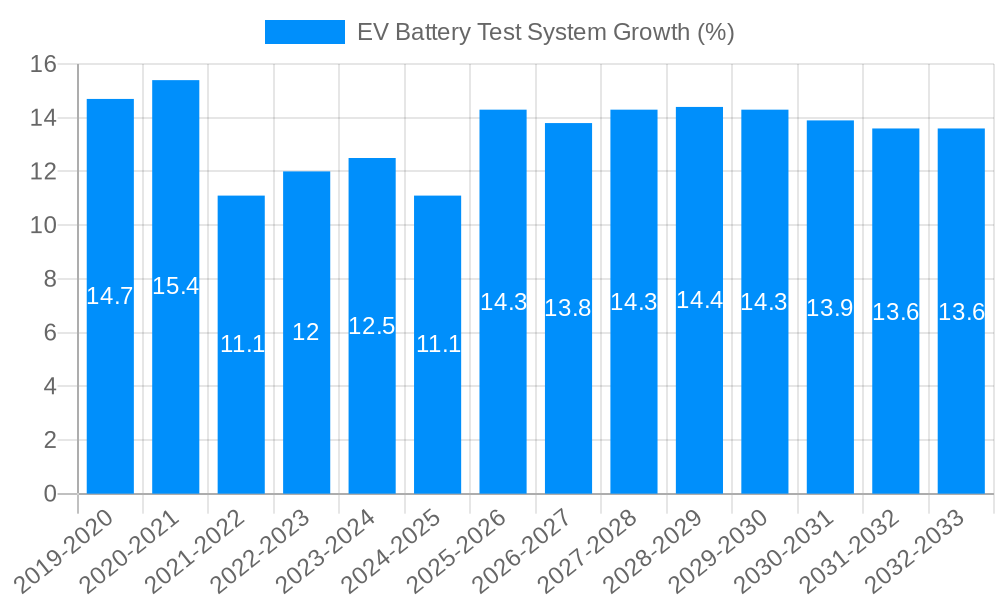

The global EV battery test system market is poised for significant expansion, projected to reach approximately USD 3,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 15% anticipated to propel it through 2033. This surge is primarily driven by the escalating adoption of electric vehicles worldwide, necessitating rigorous and sophisticated testing protocols to ensure battery performance, safety, and longevity. Key market drivers include stringent government regulations promoting EV adoption and mandating battery safety standards, alongside a growing consumer demand for reliable and high-performing electric vehicles. The continuous innovation in battery technology, including advancements in lithium-ion chemistries and the development of solid-state batteries, also fuels the need for adaptable and cutting-edge testing solutions. The market segments include Unit Test, Module Test, and Pack Test, with applications spanning passenger cars, commercial vehicles, and other specialized electric mobility solutions. The increasing complexity and energy density of EV batteries demand advanced testing capabilities, creating opportunities for manufacturers of sophisticated test equipment.

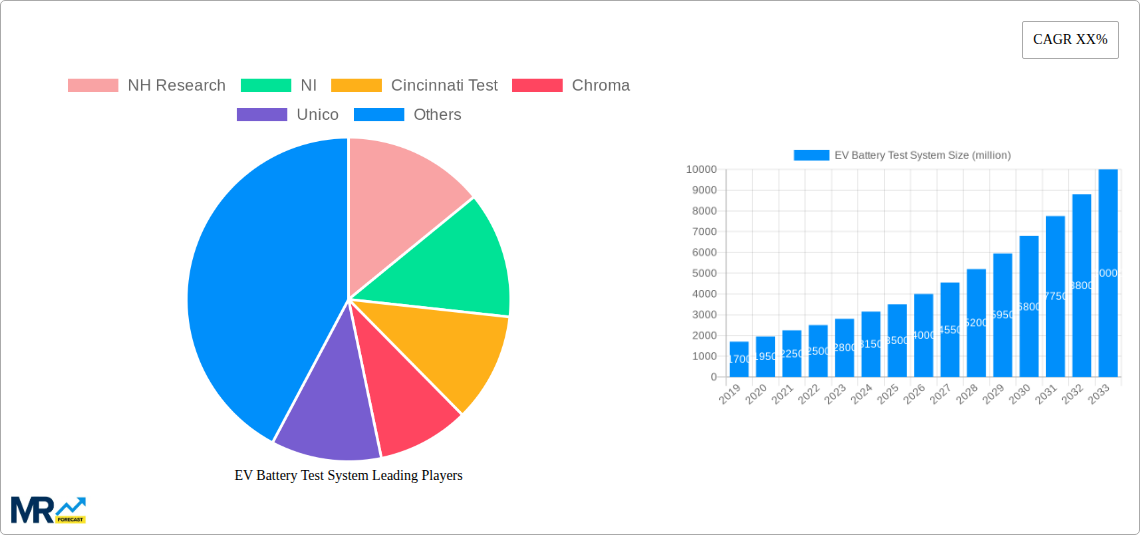

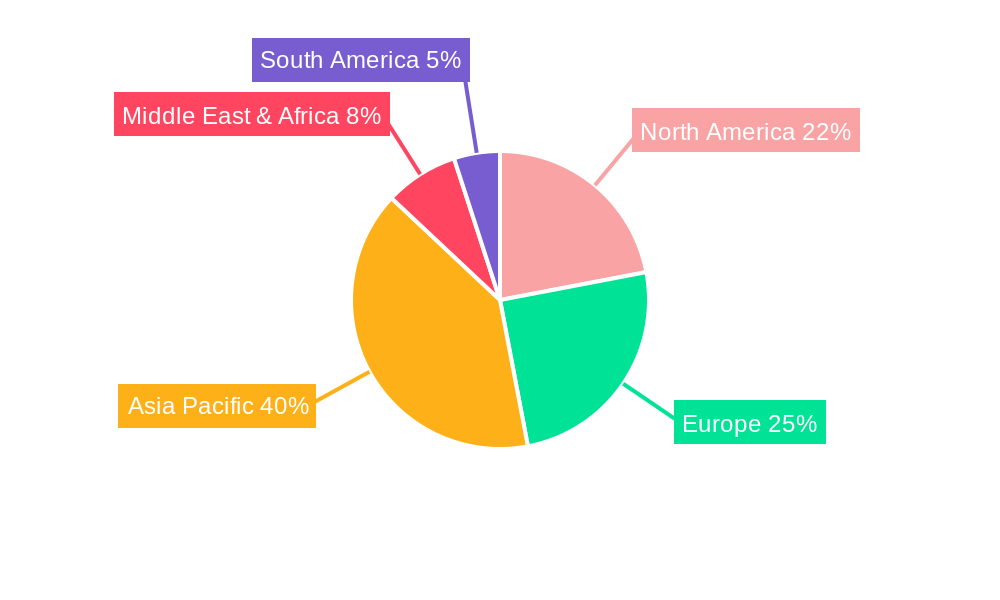

The competitive landscape is characterized by a mix of established players and emerging innovators, all vying to capture market share through technological advancements and strategic partnerships. Companies such as NH Research, NI, Chroma, Keysight, and AVL are at the forefront, offering a comprehensive range of test solutions. Emerging trends include the integration of AI and machine learning for predictive maintenance and enhanced testing efficiency, as well as a growing emphasis on eco-friendly and sustainable testing practices. However, the market also faces certain restraints, such as the high initial investment cost for advanced testing equipment and the need for skilled personnel to operate and maintain these sophisticated systems. Geographically, Asia Pacific, led by China, is expected to dominate the market due to its position as the largest EV manufacturing hub. North America and Europe are also significant contributors, driven by strong government support and rapid EV adoption rates. The ongoing evolution of battery management systems (BMS) and the development of faster charging technologies will continue to shape the requirements and innovation trajectory of the EV battery test system market in the coming years.

This report offers a comprehensive analysis of the global EV Battery Test System market, projecting a significant upward trajectory over the Study Period (2019-2033). With a Base Year of 2025 and an Estimated Year also in 2025, the market is poised for substantial expansion. The Forecast Period (2025-2033) anticipates dynamic growth, building upon the momentum of the Historical Period (2019-2024). We project the market size to reach $X.X million by 2025, with further expansion expected as EV adoption accelerates globally. This growth is driven by a confluence of factors, including stringent safety regulations, the increasing complexity of battery technologies, and the relentless pursuit of higher energy density and faster charging capabilities. The automotive industry's commitment to electrification necessitates robust and sophisticated testing solutions to ensure the reliability, performance, and longevity of EV batteries. As the industry navigates this transformative phase, the demand for advanced EV battery test systems is set to surge, creating significant opportunities for stakeholders. The insights within this report will illuminate the key trends, drivers, challenges, and the competitive landscape, providing invaluable intelligence for strategic decision-making in this rapidly evolving sector.

The global EV battery test system market is undergoing a transformative evolution, driven by the relentless pace of electric vehicle adoption and the increasingly sophisticated nature of battery technologies. A key trend is the growing demand for high-voltage and high-power testing capabilities. As battery chemistries evolve towards higher energy densities and faster charging protocols become standard, test systems must be equipped to handle escalating voltage and current levels, often exceeding 1000V and hundreds of amperes. This necessitates advanced power electronics and sophisticated safety mechanisms within the test setups. Furthermore, there is a pronounced shift towards integrated and automated testing solutions. Manufacturers are seeking systems that can perform a multitude of tests – from basic electrical characterization to complex cycle life and abuse testing – within a single platform, minimizing manual intervention and reducing testing times. The integration of advanced software for data acquisition, analysis, and reporting is also crucial, enabling rapid insights into battery performance and potential failure modes. Artificial intelligence (AI) and machine learning (ML) are increasingly being incorporated to optimize testing protocols, predict battery degradation, and enhance the accuracy of performance assessments. This allows for more targeted and efficient testing, reducing overall development cycles. The burgeoning need for virtual testing and digital twins is another significant trend, allowing for simulations and analysis before physical prototypes are even built, thus accelerating R&D and reducing costs. Lastly, the focus on sustainability and recyclability is influencing test system design, with an increasing emphasis on testing battery materials and components for their environmental impact and end-of-life potential. The market is also witnessing a rise in specialized testing for emerging battery chemistries, such as solid-state batteries, which present unique challenges and require novel testing methodologies. The emphasis on safety, particularly in the context of thermal runaway prevention and crashworthiness, continues to drive the development of advanced abuse testing capabilities.

The exponential growth of the electric vehicle market stands as the primary catalyst for the burgeoning EV battery test system industry. Governments worldwide are implementing stringent regulations and offering substantial incentives to accelerate the transition away from internal combustion engine vehicles, thereby directly boosting EV production and, consequently, the demand for reliable battery testing. The continuous pursuit of enhanced battery performance – including increased energy density for longer driving ranges, faster charging times for consumer convenience, and improved lifespan for reduced ownership costs – fuels the need for sophisticated and precise testing methodologies. As battery technologies become more complex, with the introduction of novel materials and advanced cell architectures, the requirement for specialized test systems capable of accurately evaluating these innovations becomes paramount. Furthermore, the escalating emphasis on battery safety, driven by high-profile incidents and consumer concerns, compels manufacturers to rigorously test batteries under various stress conditions to prevent thermal runaway and ensure overall system integrity. The evolution of battery management systems (BMS) also plays a crucial role, as accurate testing is essential to validate the algorithms and functionalities of these critical components that monitor and control battery operations. The global supply chain for EV batteries, encompassing raw material sourcing, cell manufacturing, and module/pack assembly, necessitates a robust testing infrastructure at each stage to ensure quality control and standardization. This multifaceted interplay of technological advancement, regulatory push, and market demand is collectively propelling the EV battery test system market forward at an unprecedented pace.

Despite the robust growth potential, the EV battery test system market faces several significant challenges and restraints that could impede its full realization. The high cost of advanced testing equipment is a primary barrier, especially for smaller manufacturers or those in emerging markets. Sophisticated systems capable of handling high voltages, currents, and complex testing protocols represent a substantial capital investment, limiting accessibility for some players. Standardization across different battery chemistries and testing protocols remains an ongoing challenge. The rapid pace of battery technology development often outstrips the establishment of universal testing standards, leading to fragmentation and complexity in ensuring interoperability and comparability of results. The increasing complexity of battery designs and integration into vehicle architectures requires highly adaptable and versatile testing systems, which can be difficult and expensive to develop and maintain. The need for highly skilled personnel to operate, calibrate, and interpret results from advanced test systems is another constraint. A shortage of qualified engineers and technicians can hinder the efficient deployment and utilization of these technologies. The long cycle times for some types of battery testing, particularly for cycle life and aging studies, can slow down product development and validation processes, impacting time-to-market for new EV models. Furthermore, cybersecurity concerns related to data acquisition, storage, and network connectivity of test systems are becoming increasingly important, requiring robust security measures to protect sensitive intellectual property and operational data. Finally, ensuring the safety of test personnel and equipment when dealing with high-energy battery systems, especially during abuse testing, demands rigorous safety protocols and infrastructure, adding to the overall operational complexity and cost.

The Pack Test segment within the EV battery test system market is poised to dominate, driven by the increasing complexity and critical role of battery packs in overall vehicle performance and safety. As battery technologies mature and integration becomes more sophisticated, the testing of complete battery packs – encompassing individual cells, modules, thermal management systems, and the Battery Management System (BMS) – becomes paramount. This holistic approach ensures that the entire pack functions optimally and safely under various operating conditions. The Application segment of Passenger Cars is expected to be the leading contributor to market revenue. The sheer volume of passenger car production globally, coupled with aggressive electrification targets from major automotive manufacturers, directly translates into a massive demand for testing solutions for their battery systems. The rapid expansion of the EV passenger car market in regions like North America, Europe, and Asia-Pacific, particularly China, underpins this dominance.

In terms of regions, Asia-Pacific is expected to emerge as the leading market for EV battery test systems. This dominance is primarily attributed to:

While Asia-Pacific leads, Europe is also a significant and rapidly growing market. Driven by stringent emissions regulations and ambitious decarbonization targets, European automakers are heavily invested in electrifying their fleets. The presence of leading European battery manufacturers and automotive OEMs, such as Volkswagen, BMW, and Stellantis, contributes significantly to the demand for advanced testing systems. The region's focus on battery safety and performance standards also drives the need for high-fidelity testing.

North America, particularly the United States, is experiencing a resurgence in EV manufacturing and adoption. Significant investments from both established automakers and new EV startups are creating a substantial demand for battery test systems. The increasing domestic production of batteries and vehicles further amplifies this need.

Therefore, the dominance of the Pack Test segment and the Passenger Car application within the rapidly expanding Asia-Pacific region, coupled with strong growth in Europe and North America, defines the key market dynamics for EV battery test systems. The scale of production in these regions means that the annual market for EV battery test systems will likely be in the hundreds of millions of dollars, with the pack testing segment alone accounting for a significant portion.

The EV battery test system industry is propelled by several key growth catalysts. The global push towards decarbonization and stringent government regulations mandating EV adoption are creating an unprecedented surge in electric vehicle production, directly increasing the need for battery testing. Furthermore, the relentless pursuit of higher energy density, faster charging capabilities, and extended battery lifespan fuels the demand for advanced testing solutions capable of validating these evolving performance metrics. The continuous innovation in battery chemistries and designs, such as the adoption of silicon anodes and solid-state batteries, necessitates the development of specialized and adaptable testing equipment. Moreover, the growing emphasis on battery safety and reliability, driven by concerns about thermal runaway and longevity, compels manufacturers to invest in rigorous testing protocols.

This report offers a comprehensive examination of the global EV battery test system market, delving into its intricate dynamics from 2019 to 2033. With 2025 serving as both the Base Year and Estimated Year, the study meticulously analyzes the Historical Period (2019-2024) to forecast robust growth throughout the Forecast Period (2025-2033). The market's expansion is underpinned by the escalating demand for advanced testing solutions driven by increasing EV adoption, stringent safety regulations, and the relentless pursuit of enhanced battery performance. The report provides granular insights into market trends, key drivers, emerging challenges, and the competitive landscape, ensuring stakeholders possess the critical intelligence to navigate this dynamic sector. Our analysis encompasses critical market segments, including Unit Test, Module Test, and Pack Test, as well as key applications such as Passenger Car, Commercial Car, and Others. Furthermore, significant industry developments and the strategic positioning of leading players are thoroughly explored. This comprehensive coverage aims to equip industry participants with actionable insights to capitalize on the substantial opportunities within the burgeoning EV battery test system market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include NH Research, NI, Cincinnati Test, Chroma, Unico, Bitrode, Millbrook, TÜV SÜD, JOT Automation, Keysight, A&D Technology, Crystal Instruments, ITECH, Webasto Charging System, SAKOR Technologie, Chen Tech, AVL, Seica, WinAck Battery, Elektro Automatik, Proventia, Neware, Ador Digatron, Digatron, Arbin, Webasto, Maccor, Hioki, Nebula, Blue Key, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "EV Battery Test System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the EV Battery Test System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.