1. What is the projected Compound Annual Growth Rate (CAGR) of the EV Battery Swapping Station?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

EV Battery Swapping Station

EV Battery Swapping StationEV Battery Swapping Station by Type (Pay-per-use, Subscription), by Application (Passenger Vehicle, Commercial Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

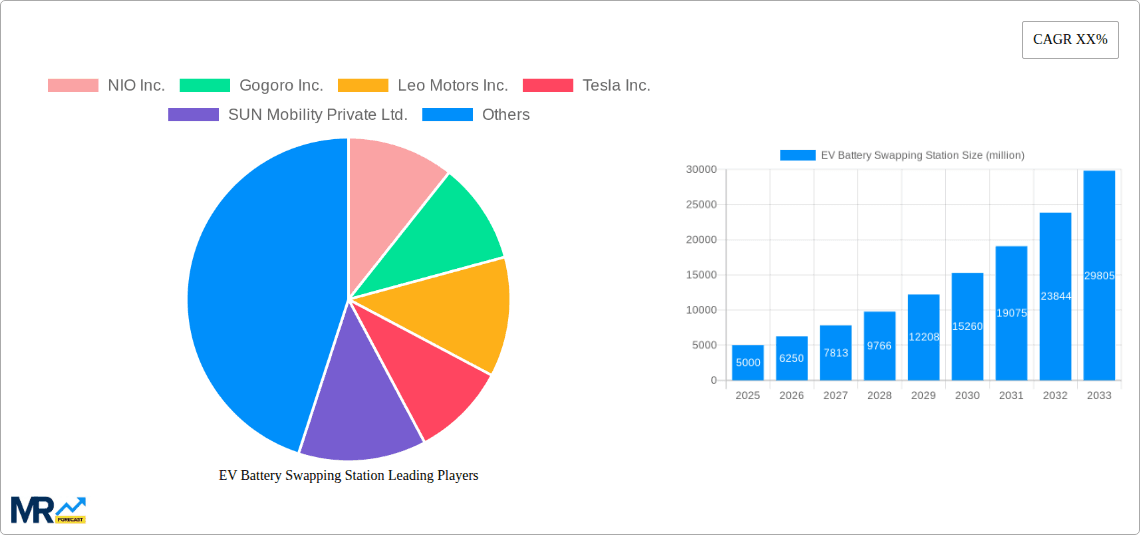

The global electric vehicle (EV) battery swapping station market is experiencing significant growth, driven by increasing EV adoption, limitations of traditional charging infrastructure, and the faster refueling times offered by battery swapping. The market's expansion is fueled by several key trends: the rising demand for efficient and convenient EV charging solutions in densely populated urban areas, government incentives promoting EV adoption and battery swapping infrastructure development, and ongoing technological advancements leading to improved battery designs and swapping station efficiency. The pay-per-use model currently dominates the market, offering flexibility to EV users, while the subscription model is gaining traction, promising predictable costs for frequent users. Passenger vehicles currently comprise the larger segment, but commercial vehicle adoption is expected to grow rapidly, driven by fleet optimization needs and reduced downtime. Major players like NIO, Gogoro, and Tesla are driving innovation and market penetration, while smaller companies are focusing on niche markets and technological advancements. Despite the promising outlook, market growth faces some restraints including high initial investment costs for infrastructure development, standardization challenges across different battery chemistries and EV models, and concerns about battery safety and lifecycle management.

The forecast period (2025-2033) projects continued robust growth, with a substantial increase in the number of swapping stations globally, particularly in regions with high EV penetration rates like Asia Pacific and North America. The market is poised for further fragmentation, with new entrants bringing innovative solutions to improve efficiency, reduce costs, and address the current limitations. Differentiation strategies focusing on fast swap times, robust safety features, and strategic partnerships with EV manufacturers are likely to be critical for success. While challenges remain, the long-term outlook for the EV battery swapping station market is positive, fueled by the global transition to electric mobility and the inherent advantages of this innovative charging technology. We estimate a CAGR (let's assume a conservative 25%) for the forecast period, based on current market dynamics and technological advancements.

The global EV battery swapping station market is experiencing explosive growth, projected to reach multi-million unit installations by 2033. Driven by increasing electric vehicle (EV) adoption, particularly in densely populated areas and regions with limited charging infrastructure, battery swapping offers a compelling alternative to traditional slow or fast charging. The market's evolution is marked by a shift from nascent technology to a viable solution, attracting significant investments from both established automotive giants and innovative startups. The historical period (2019-2024) saw the emergence of several key players and pilot programs, laying the groundwork for the rapid expansion anticipated during the forecast period (2025-2033). While the pay-per-use model currently dominates, subscription-based services are gaining traction, appealing to users seeking predictable costs. Furthermore, the application is broadening beyond passenger vehicles; the commercial vehicle segment shows tremendous potential, particularly in delivery and logistics, where downtime is a significant cost factor. The estimated market size in 2025 reflects a significant jump from previous years, highlighting the accelerating adoption rate of this innovative technology. The total number of battery swapping stations is expected to grow into the millions within the forecast period, fueled by supportive government policies, technological advancements in battery technology, and the increasing urgency to address climate change. The market is characterized by a diverse range of business models and technological approaches, leading to a dynamic and competitive landscape. Key trends include standardization efforts to ensure interoperability across different EV models and battery types, along with the development of more robust and efficient battery swapping systems.

Several factors are driving the rapid expansion of the EV battery swapping station market. Firstly, the ever-increasing demand for electric vehicles worldwide is a primary catalyst. Governments globally are implementing policies promoting EV adoption, including subsidies, tax incentives, and stricter emission regulations. This creates a favorable environment for alternative charging solutions like battery swapping, especially in regions where conventional charging infrastructure is lacking or inadequate. Secondly, battery swapping addresses a major limitation of EVs: range anxiety. The ability to quickly replace a depleted battery with a fully charged one eliminates long wait times associated with charging, significantly enhancing convenience and practicality. This is particularly crucial for commercial fleets and ride-sharing services where vehicle downtime translates directly into lost revenue. Thirdly, advancements in battery technology are making battery swapping more efficient and cost-effective. Improved battery designs, coupled with automated swapping systems, are reducing swapping times and improving overall system reliability. Finally, the emergence of various business models, including pay-per-use and subscription options, offers flexibility for diverse consumer needs and preferences, further contributing to market expansion.

Despite the significant potential, the EV battery swapping station market faces several challenges. Standardization remains a crucial hurdle. Lack of interoperability between different EV models and battery types hinders widespread adoption and limits the potential for economies of scale. High initial investment costs for setting up swapping stations, including the infrastructure and technology, can deter smaller players and limit market penetration, especially in regions with limited financial resources. Safety concerns related to battery handling and swapping processes are also a critical factor. Ensuring the safety and reliability of the swapping mechanism is paramount to build consumer confidence and prevent accidents. Furthermore, the availability of sufficient battery supply and efficient battery management systems are essential for the smooth operation of swapping stations. Managing the logistical challenges of battery transportation, storage, charging, and maintenance also pose significant operational complexities. Finally, regulatory uncertainties and a lack of clear guidelines in some regions can create ambiguity and hinder investment decisions.

The Asia-Pacific region is poised to dominate the EV battery swapping station market throughout the forecast period (2025-2033). China, in particular, is a key driver, with significant government support and a rapidly expanding EV market. Countries like India are also showing strong potential due to increasing EV adoption and the need for efficient charging solutions.

Focusing on the passenger vehicle segment within the Asia-Pacific region, the dominance is further strengthened by:

The pay-per-use model also holds a significant advantage, given the early stage of the market and the need to attract a broad consumer base. Its simplicity and affordability make it especially attractive to many EV users in the Asia-Pacific region.

Several factors are accelerating growth. Government incentives, particularly subsidies and tax breaks, are actively encouraging both the installation of swapping stations and the purchase of compatible EVs. Technological advancements in battery technology and swapping mechanisms are constantly improving efficiency and reliability, thus boosting consumer confidence. The increasing focus on sustainability and reducing carbon emissions is creating a favorable environment for EV adoption, indirectly boosting the demand for battery swapping as a fast and clean charging solution.

This report provides a comprehensive analysis of the EV battery swapping station market, covering market trends, driving forces, challenges, key players, and future growth prospects. It offers valuable insights for stakeholders across the value chain, including manufacturers, investors, and policymakers. The report's detailed analysis of various market segments, regional dynamics, and competitive landscapes provides a thorough understanding of this rapidly evolving industry, enabling informed decision-making. The report's forecasts, based on robust methodologies and industry data, provide a clear picture of the market's growth trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include NIO Inc., Gogoro Inc., Leo Motors Inc., Tesla Inc., SUN Mobility Private Ltd., BYD Co. Ltd., BattSwap Inc., Kwang Yang Motor Co. Ltd. (KYMCO), Panasonic Corp., Lithion Power Pvt. Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "EV Battery Swapping Station," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the EV Battery Swapping Station, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.