1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethylene Carbonate Solvents?

The projected CAGR is approximately 6.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ethylene Carbonate Solvents

Ethylene Carbonate SolventsEthylene Carbonate Solvents by Application (Lithium Battery Electrolytes, Capacitor Electrolytes, Resist Strip Solvents, Others, World Ethylene Carbonate Solvents Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

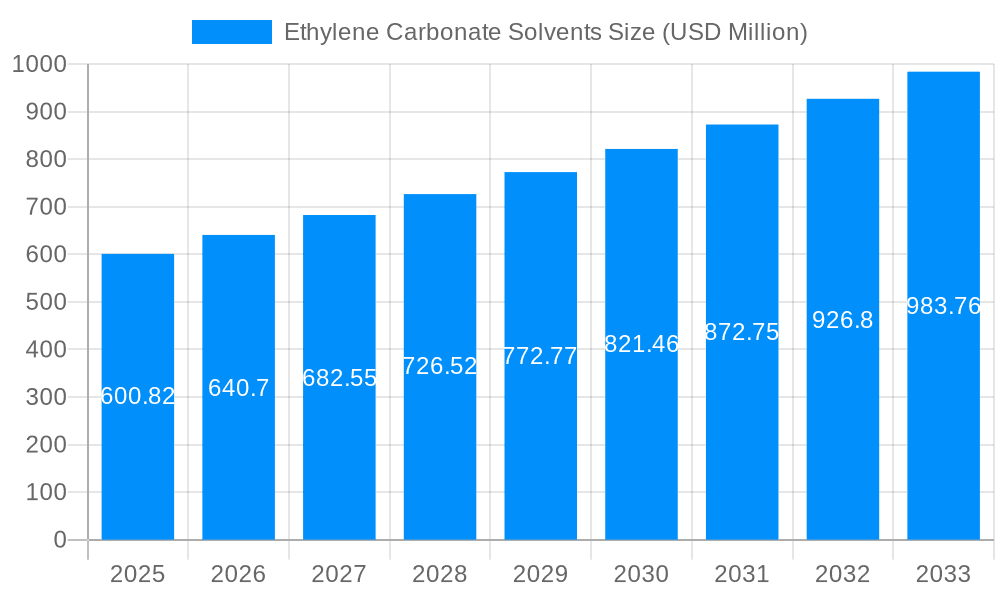

The global Ethylene Carbonate Solvents market is poised for substantial growth, projected to reach an estimated 600.82 million USD by 2025. This expansion is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.6%, indicating a steady and sustained upward trajectory for the market throughout the forecast period of 2025-2033. A primary driver for this impressive growth is the burgeoning demand from the lithium-ion battery sector, which heavily relies on ethylene carbonate as a crucial electrolyte component. As the world accelerates its transition towards electric vehicles (EVs) and renewable energy storage solutions, the consumption of lithium-ion batteries is set to skyrocket, directly translating into increased demand for high-purity ethylene carbonate solvents. Furthermore, the expanding use of ethylene carbonate in capacitor electrolytes, alongside its applications as a resist strip solvent and in other niche chemical processes, further solidifies its market importance and contributes to its upward growth trajectory.

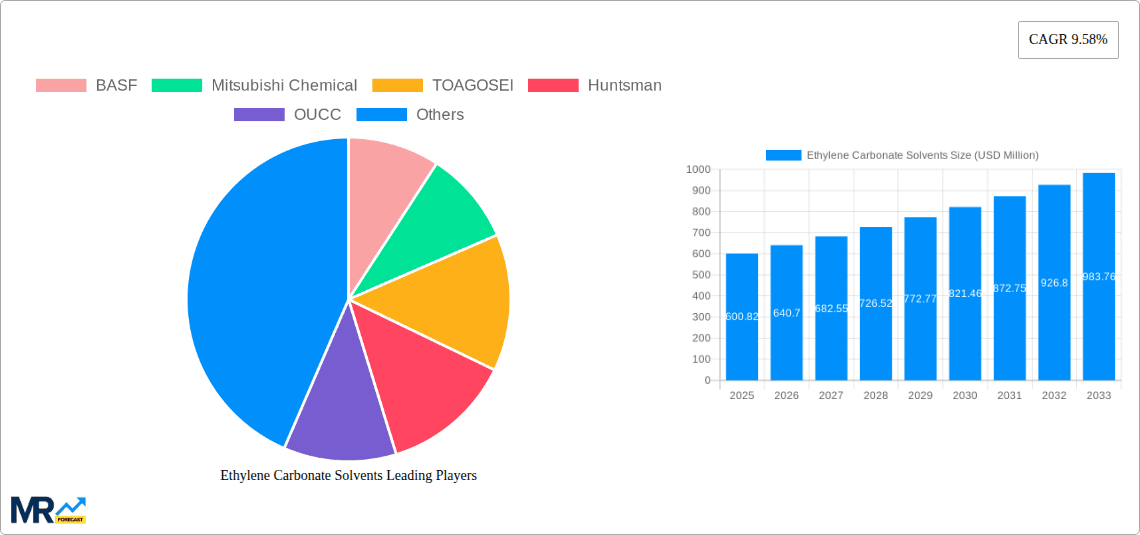

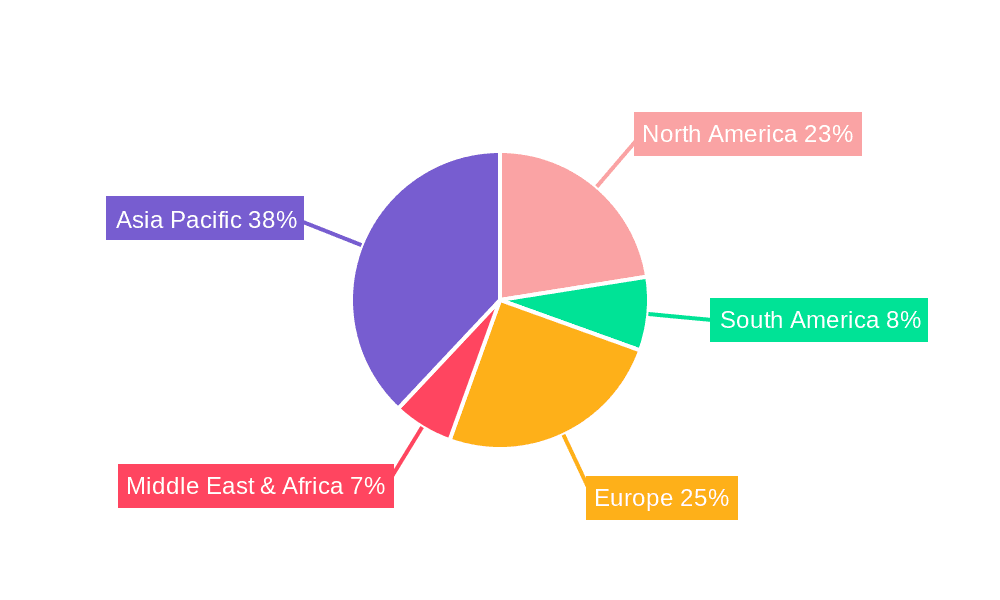

The market landscape is characterized by a dynamic interplay of growth drivers and evolving trends. Beyond the dominant lithium-ion battery application, advancements in capacitor technology and an increasing focus on eco-friendly solvent alternatives are expected to create new avenues for market expansion. The robust CAGR suggests that the market is moving beyond its nascent stages and entering a period of significant commercialization and widespread adoption. While the market is largely driven by its core applications, the competitive landscape features a mix of established global players such as BASF and Mitsubishi Chemical, alongside regional specialists like Shandong Shida Shenghua and Zhongke Hongye, indicating a healthy competitive environment. Geographical segmentation reveals Asia Pacific, particularly China, as a dominant force, driven by its substantial manufacturing capabilities in both chemicals and electronics. North America and Europe are also significant markets, propelled by strong adoption rates of EVs and advancements in energy storage. Restraints, though not explicitly detailed, are likely to revolve around raw material price volatility, stringent environmental regulations in certain regions, and the potential development of alternative solvent chemistries, all of which will influence the market's growth dynamics.

Here's a unique report description for Ethylene Carbonate Solvents, incorporating your specified elements:

The global Ethylene Carbonate (EC) solvents market is poised for robust expansion, driven by an insatiable demand for advanced energy storage solutions and the increasing sophistication of electronic component manufacturing. During the study period of 2019-2033, with a base and estimated year of 2025, the market will witness significant evolution. The historical period (2019-2024) laid the groundwork, characterized by steady growth fueled by early adoption in lithium-ion batteries and capacitors. As we move into the forecast period (2025-2033), the market is expected to surge. A key market insight is the escalating dominance of the Lithium Battery Electrolytes application segment. This surge is directly attributable to the exponential growth in electric vehicles (EVs) and portable electronics, where high-performance battery electrolytes are paramount. The demand for safer, longer-lasting, and faster-charging batteries has placed EC at the forefront, owing to its exceptional solvency, high dielectric constant, and low melting point, which are crucial for efficient ion transport. Beyond batteries, the capacitor electrolytes segment also presents a compelling growth trajectory, albeit at a more measured pace. As electronic devices become more compact and power-hungry, the need for efficient energy buffering in capacitors is rising, with EC playing a vital role in ensuring their performance and longevity. Furthermore, the Resist Strip Solvents application, though smaller in market share, is exhibiting consistent demand, particularly from the semiconductor and printed circuit board (PCB) industries, where precise and effective stripping of photoresists is critical for intricate circuit fabrication. The "Others" segment, encompassing various niche applications, is also anticipated to contribute to the overall market growth, reflecting the versatility of EC as a solvent in diverse industrial processes. The intricate interplay of technological advancements in battery chemistry, the miniaturization of electronics, and the ongoing pursuit of more sustainable manufacturing processes are collectively shaping the future landscape of the EC solvents market, projecting a future where its significance will only amplify. The market size, projected to be in the hundreds of millions in the base year 2025, is expected to reach billions by the end of the forecast period, underscoring the immense potential and transformative impact of this critical chemical compound. The increasing global emphasis on renewable energy storage, from grid-scale batteries to personal devices, solidifies EC's position as an indispensable component in numerous high-growth industries.

The ethylene carbonate solvents market is experiencing an unprecedented upswing, propelled by a confluence of powerful driving forces. The most significant catalyst is the unyielding global momentum towards electrification, primarily driven by the burgeoning electric vehicle (EV) industry. As governments worldwide implement stringent emissions regulations and consumers embrace sustainable transportation, the demand for high-performance lithium-ion batteries has skyrocketed. Ethylene carbonate, with its exceptional properties as a co-solvent in battery electrolytes, is indispensable for achieving the desired energy density, cycle life, and safety standards. Its ability to form a stable solid electrolyte interphase (SEI) layer on the anode is crucial for battery longevity and performance. Beyond EVs, the exponential growth in portable electronics, including smartphones, laptops, and wearable devices, further amplifies the need for advanced battery technologies, where EC plays a pivotal role. Furthermore, the increasing adoption of renewable energy sources like solar and wind power necessitates robust energy storage solutions, thereby boosting the demand for large-scale battery systems. This surge in energy storage applications directly translates into a heightened requirement for ethylene carbonate. The expanding electronics industry, encompassing the manufacturing of semiconductors, printed circuit boards (PCBs), and advanced displays, also contributes significantly. Ethylene carbonate's utility as a high-purity solvent for resist stripping in photolithography processes is critical for the fabrication of increasingly complex and miniaturized electronic components. Its effectiveness in dissolving photoresist materials without damaging sensitive substrates ensures high yields and superior product quality. The continuous innovation in capacitor technology, particularly in applications requiring high power density and rapid charge/discharge capabilities, also favors the use of EC in electrolytic capacitors. These intertwined factors create a powerful demand dynamic, ensuring sustained and substantial growth for the ethylene carbonate solvents market.

Despite the overwhelmingly positive growth trajectory, the ethylene carbonate solvents market is not without its share of challenges and restraints. One of the primary concerns revolves around the price volatility of raw materials. The production of ethylene carbonate is intrinsically linked to the availability and pricing of ethylene oxide and carbon dioxide. Fluctuations in crude oil prices, geopolitical events impacting petrochemical supply chains, and the availability of feedstock can lead to significant swings in the cost of ethylene carbonate, impacting profitability for manufacturers and potentially influencing adoption rates for end-users. This price instability can make long-term contract negotiations more complex and potentially lead to a search for cost-effective alternatives, even if those alternatives offer slightly compromised performance. Another significant challenge lies in the environmental regulations and sustainability pressures. While ethylene carbonate itself is considered relatively benign compared to some other organic solvents, its production processes can involve hazardous chemicals and energy-intensive steps. Increasing global scrutiny on chemical manufacturing's environmental footprint, including emissions control, waste management, and the push for greener production methods, can lead to higher compliance costs for manufacturers. Furthermore, the development and scaling up of more sustainable alternatives, although currently not matching EC's performance in critical applications, could pose a future competitive threat if breakthroughs occur. Supply chain disruptions, exacerbated by global events such as pandemics or trade disputes, can also pose a significant restraint. Ensuring a consistent and reliable supply of high-purity ethylene carbonate to meet the ever-growing demand from battery manufacturers and the electronics sector is critical. Any interruption in this supply chain can lead to production delays and increased costs for end-users. Finally, technological obsolescence and the emergence of alternative technologies in end-use applications present a longer-term restraint. While EC is currently dominant in lithium-ion battery electrolytes, ongoing research into solid-state batteries or other advanced battery chemistries could, in the distant future, reduce the reliance on liquid electrolytes and, consequently, on ethylene carbonate.

The global ethylene carbonate solvents market is characterized by distinct regional dominance and segment leadership. The Asia-Pacific region, particularly China, is unequivocally positioned to dominate the market in both production and consumption. This dominance stems from several interwoven factors.

While the Asia-Pacific region dominates, other regions also play crucial roles. North America, with its significant automotive industry and growing EV adoption, and Europe, with its strong emphasis on sustainability and its own burgeoning EV market, represent important consumption centers. However, their production capabilities are generally less extensive than those of Asia.

Among the application segments, Lithium Battery Electrolytes will indisputably dominate the market share and drive growth. The rapid acceleration of the electric vehicle revolution is the primary engine behind this segment's supremacy.

The Capacitor Electrolytes segment, while significant, will trail behind Lithium Battery Electrolytes in terms of market share and growth rate. However, it will still experience steady expansion due to the increasing sophistication and power demands of modern electronic devices. The Resist Strip Solvents segment will maintain a stable, albeit smaller, market share, driven by the continuous need for precision in the semiconductor and PCB manufacturing industries. The Others segment will represent a collection of niche applications that collectively contribute to the market's diversification.

Several key factors are acting as potent growth catalysts for the ethylene carbonate solvents industry. Foremost among these is the relentless global push towards electric mobility, which is driving unprecedented demand for high-performance lithium-ion batteries. The increasing adoption of renewable energy sources also necessitates large-scale energy storage solutions, further amplifying the need for advanced battery technologies that utilize ethylene carbonate. Furthermore, continuous innovation in electronic devices, leading to miniaturization and increased power requirements, fuels the demand for efficient capacitor electrolytes. The growing emphasis on sustainable manufacturing practices and the development of more efficient production processes for ethylene carbonate itself also contribute to its market expansion by making it a more attractive and cost-effective option for end-users.

This comprehensive report delves deep into the intricate dynamics of the global ethylene carbonate solvents market. It provides an in-depth analysis of market trends, exploring the drivers and restraints shaping its trajectory from 2019 to 2033, with a detailed examination of the base and estimated year of 2025. The report offers granular insights into key regions and countries, highlighting their dominance in production and consumption, and dissects the market by application segments, with a particular focus on the burgeoning Lithium Battery Electrolytes sector and its implications for the broader market. Furthermore, it identifies the leading players and significant developments within the industry, offering a forward-looking perspective on growth catalysts and future opportunities. This report is an indispensable resource for stakeholders seeking a holistic understanding of the ethylene carbonate solvents market's current landscape and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.6%.

Key companies in the market include BASF, Mitsubishi Chemical, TOAGOSEI, Huntsman, OUCC, Lixing Chemical, Zhongke Hongye, Haike, Shandong Shida Shenghua, Kong Lung, Hengyang New Energy, OXIRAN.

The market segments include Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Ethylene Carbonate Solvents," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ethylene Carbonate Solvents, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.