1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethyl Phenyl Acetate?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ethyl Phenyl Acetate

Ethyl Phenyl AcetateEthyl Phenyl Acetate by Type (0.98, 0.99, Others, World Ethyl Phenyl Acetate Production ), by Application (Scientific Research, Fragrance, Others, World Ethyl Phenyl Acetate Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

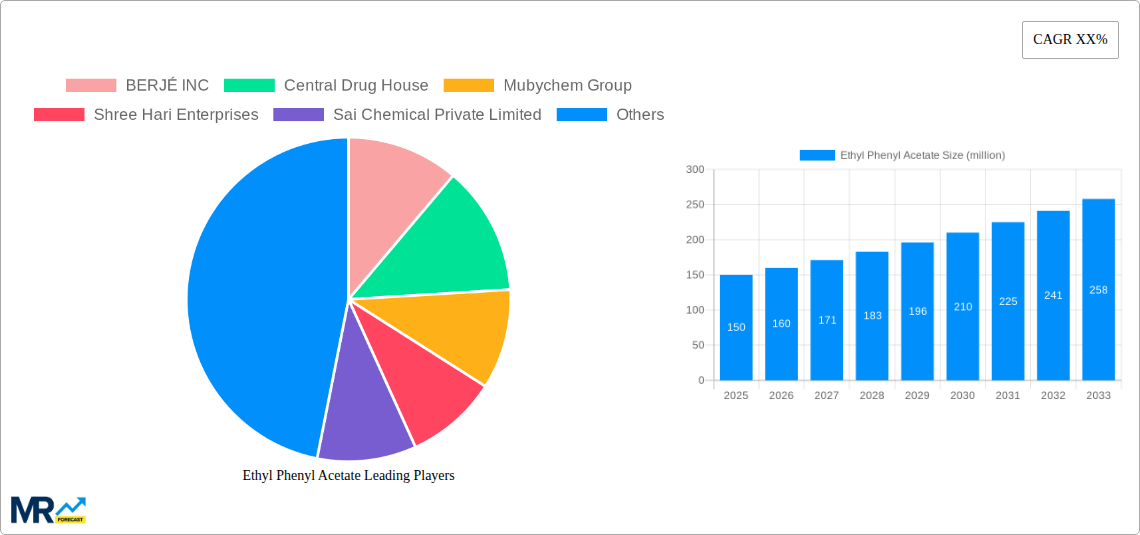

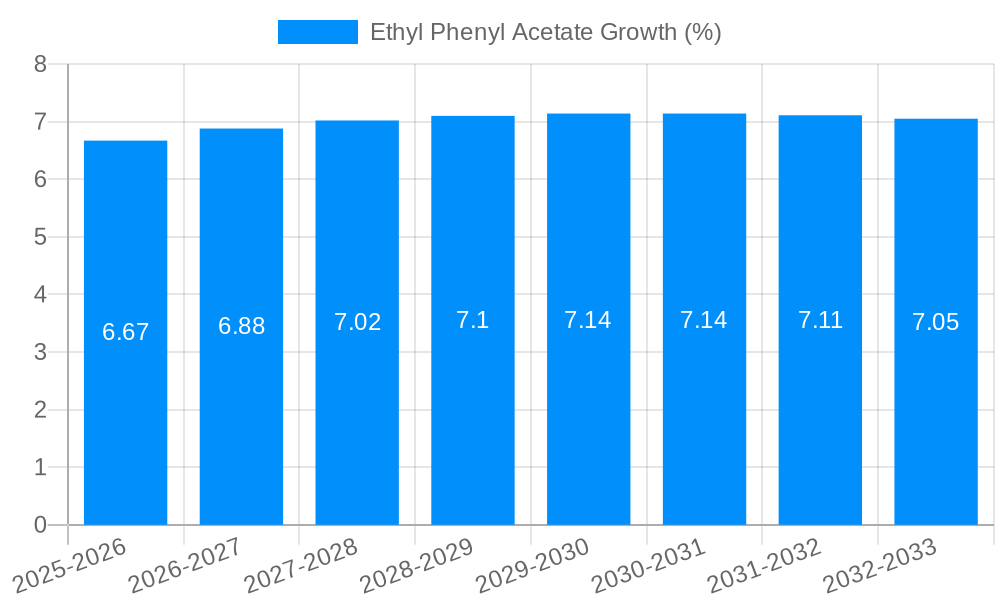

The global Ethyl Phenyl Acetate market is poised for robust expansion, projected to reach an estimated market size of approximately USD 150 million in 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of around 6.5% between 2025 and 2033, signaling a healthy and sustained upward trajectory. The primary drivers fueling this market are the increasing demand from the fragrance industry, where Ethyl Phenyl Acetate is valued for its characteristic floral and fruity notes, contributing to a wide array of perfumes and cosmetic products. Furthermore, its application in scientific research, particularly in organic synthesis and as a flavor compound, adds to its market significance. The market is segmented by type, with "Others" likely representing a substantial portion alongside specific undisclosed types, and by application, with Fragrance and Scientific Research being key growth areas.

Navigating the market landscape presents both opportunities and challenges. Emerging trends indicate a growing preference for natural and sustainably sourced ingredients, which could influence production methods and raw material sourcing for Ethyl Phenyl Acetate. The increasing disposable income in developing economies, especially within the Asia Pacific region, is expected to boost consumer spending on products utilizing this ester, thereby driving market demand. However, potential restraints such as fluctuating raw material prices, stringent regulatory compliances in certain regions regarding chemical production and usage, and the availability of substitute compounds could temper the growth rate. Key players like BERJÉ INC, Central Drug House, and Mubychem Group are actively participating, influencing market dynamics through innovation and strategic partnerships to capitalize on the growing demand and overcome potential market hurdles.

This report provides an in-depth analysis of the global Ethyl Phenyl Acetate market, offering a comprehensive overview from historical trends to future projections. The study spans the period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, followed by a detailed forecast for the period of 2025-2033. The historical period of 2019-2024 has been meticulously reviewed to establish a strong foundation for understanding market dynamics. This report delves into the intricate details of production volumes, application segments, and technological advancements, providing actionable insights for stakeholders.

The global Ethyl Phenyl Acetate market is poised for significant evolution, marked by a projected World Ethyl Phenyl Acetate Production of 150 million units in the base year of 2025, with estimates indicating a steady increase to 180 million units by the end of the forecast period in 2033. This growth trajectory is underpinned by robust demand across key application segments, particularly in the Fragrance sector, which is expected to account for approximately 60% of the total market volume by 2033. The Scientific Research segment, while smaller, is also anticipated to witness consistent growth, driven by ongoing advancements in chemical synthesis and material science. Within the Type segment, the 0.99 purity grade is anticipated to dominate the market, capturing an estimated 70% share by 2033, owing to its superior performance characteristics in demanding applications. The 0.98 purity grade will continue to hold a significant, albeit smaller, market share, catering to specific industrial needs where cost-effectiveness is a primary consideration. The "Others" category within the Type segment, encompassing specialized grades and formulations, is expected to experience moderate growth, fueled by niche applications and customized product development.

The fragrance industry's insatiable appetite for compounds that can evoke specific olfactory experiences is a primary driver for Ethyl Phenyl Acetate. Its characteristic sweet, floral, and slightly rosy aroma makes it an indispensable ingredient in a wide array of perfumes, colognes, and household products such as air fresheners and detergents. As consumer preferences for sophisticated and long-lasting fragrances continue to evolve, the demand for high-quality Ethyl Phenyl Acetate is expected to remain strong. Furthermore, the increasing disposable income in emerging economies is contributing to a rise in per capita spending on personal care and home fragrance products, thereby bolstering the market for aroma chemicals like Ethyl Phenyl Acetate. The scientific research community also relies on Ethyl Phenyl Acetate for its utility as a solvent, a building block in organic synthesis, and as a reference standard in analytical chemistry. Research and development activities in pharmaceuticals, agrochemicals, and polymer science often involve the use of this versatile ester, contributing to a steady, albeit smaller, demand stream. Technological advancements in production processes, focusing on improving yield, purity, and sustainability, are also shaping market trends, allowing manufacturers to meet the stringent quality requirements of various end-use industries.

The Ethyl Phenyl Acetate market is experiencing a surge in demand fueled by several key driving forces. Foremost among these is the ever-expanding global Fragrance industry, which continues to be the primary consumer of Ethyl Phenyl Acetate. The compound's unique aroma profile, characterized by its sweet, floral, and slightly fruity notes, makes it a highly sought-after ingredient in the formulation of perfumes, colognes, soaps, detergents, and a broad spectrum of household and personal care products. As global populations grow and disposable incomes rise, particularly in emerging economies, the demand for scented products is projected to increase significantly, directly translating into higher consumption of Ethyl Phenyl Acetate.

Beyond fragrances, the segment of Scientific Research is also contributing to market growth. Ethyl Phenyl Acetate serves as a valuable reagent and solvent in various chemical synthesis processes, research laboratories, and academic institutions. Its application as a building block for more complex organic molecules, its use as a solvent for specific reactions, and its role as an analytical standard in quality control and research further solidify its importance. The ongoing advancements in chemical sciences, drug discovery, and material development necessitate a consistent supply of high-purity Ethyl Phenyl Acetate, thereby underpinning its demand in this sector. Furthermore, the increasing focus on developing more efficient and sustainable production methods for Ethyl Phenyl Acetate itself, driven by environmental regulations and consumer demand for greener products, is also indirectly propelling the market by ensuring a reliable and cost-effective supply chain. The exploration of new applications for Ethyl Phenyl Acetate in emerging fields of material science and specialty chemicals also holds the potential to unlock new avenues of growth in the coming years.

Despite the robust growth prospects, the Ethyl Phenyl Acetate market is not without its challenges and restraints. One of the primary concerns is the volatility in the prices of raw materials, such as acetic acid and phenylacetaldehyde, which are crucial for the production of Ethyl Phenyl Acetate. Fluctuations in the supply and cost of these feedstocks, often influenced by global commodity markets, geopolitical events, and seasonal factors, can significantly impact the manufacturing costs and profit margins for Ethyl Phenyl Acetate producers. This price volatility can lead to uncertainty in production planning and can also affect the competitiveness of Ethyl Phenyl Acetate in price-sensitive applications.

Another significant restraint is the increasingly stringent regulatory landscape surrounding chemical production and usage. Environmental regulations, particularly concerning emissions, waste disposal, and the use of certain chemicals, can necessitate costly upgrades to manufacturing facilities and production processes. Furthermore, concerns about the potential health effects and environmental impact of chemical substances, even those considered relatively safe, can lead to stricter guidelines and limitations on their use, particularly in consumer-facing products. The need for extensive testing, compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) or similar regulations in different regions, and the potential for product bans or restrictions can deter investment and slow down market expansion. Additionally, the emergence of substitute products or alternative ingredients that offer similar functional properties, or are perceived as more environmentally friendly or cost-effective, poses a competitive threat to Ethyl Phenyl Acetate. While Ethyl Phenyl Acetate has established its niche, continuous innovation in the fragrance and chemical industries means that companies must remain vigilant and adaptable to evolving market demands and technological advancements to maintain their market position.

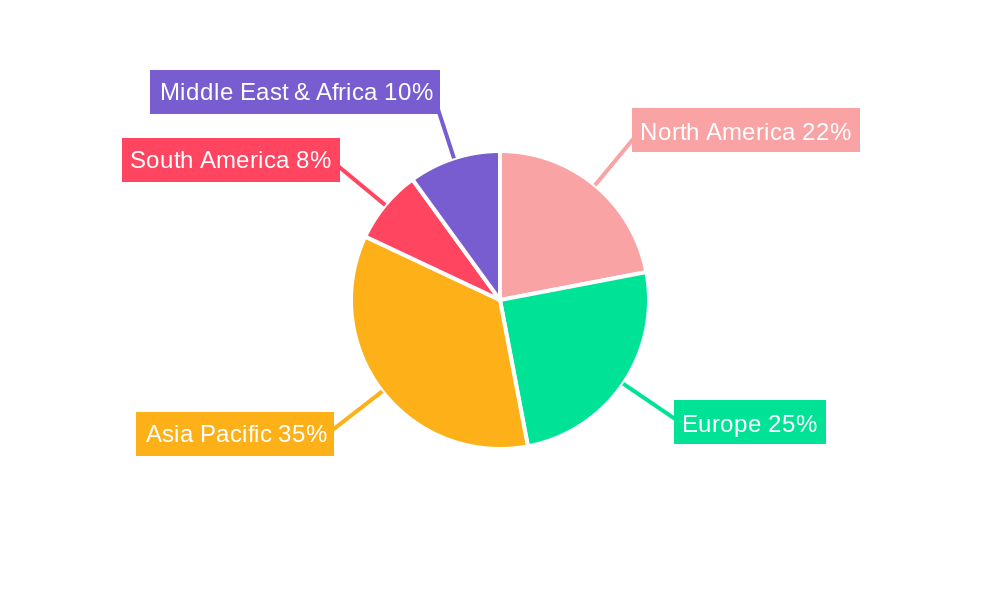

The global Ethyl Phenyl Acetate market is characterized by the dominance of specific regions and segments. The Asia Pacific region is projected to emerge as the leading force, driven by its rapidly expanding industrial base, burgeoning consumer markets, and significant manufacturing capabilities. Within this region, countries like China and India are expected to play a pivotal role. China, with its extensive chemical manufacturing infrastructure and robust demand from its vast domestic market for fragrances and personal care products, is anticipated to be a major producer and consumer of Ethyl Phenyl Acetate. The country's increasing focus on high-value chemical production and its role as a global manufacturing hub further bolster its dominance. India, on the other hand, is witnessing a substantial growth in its fragrance and flavor industry, alongside a growing chemical sector. The increasing disposable incomes and the rising preference for perfumed products among its large population are key drivers for Ethyl Phenyl Acetate consumption in India. The region's cost-effective manufacturing environment and its strategic position in global supply chains are also contributing factors to its market leadership.

In terms of segments, the Fragrance application segment is overwhelmingly anticipated to dominate the Ethyl Phenyl Acetate market. Its characteristic sweet, floral, and rosy aroma makes it an indispensable component in a wide array of perfumery products, including fine fragrances, colognes, body sprays, and deodorants. The ever-growing global demand for scented products, fueled by increasing urbanization, rising disposable incomes, and evolving consumer preferences for personal grooming and ambiance enhancement, directly translates into a sustained and significant demand for Ethyl Phenyl Acetate within this sector. This segment is expected to account for an estimated 65% of the total market volume by the end of the forecast period in 2033.

Furthermore, within the Type segment, the 0.99 purity grade is expected to lead the market. This higher purity grade is often preferred for its superior olfactory performance and consistency in demanding fragrance formulations, where even minute impurities can alter the scent profile. The growing emphasis on premium and sophisticated fragrances by both manufacturers and consumers further supports the demand for the 0.99 grade. While the 0.98 purity grade will continue to hold a significant market share, particularly in more cost-sensitive industrial applications, the higher purity segment is projected to witness more rapid growth due to its association with high-quality end products. The World Ethyl Phenyl Acetate Production itself, as a broad market indicator, is directly influenced by the demand from these dominant regions and applications. The continuous expansion of fragrance manufacturing hubs in Asia Pacific, coupled with the increasing use of 0.99 purity Ethyl Phenyl Acetate in premium products, solidifies the dominance of these factors in shaping the global Ethyl Phenyl Acetate market landscape. The "Others" category in both Type and Application segments, while niche, will also see steady growth as new applications and specialized formulations emerge.

The Ethyl Phenyl Acetate industry is poised for sustained growth, propelled by several key catalysts. A significant growth catalyst is the escalating global demand for sophisticated and long-lasting fragrances across various product categories, from fine perfumes to household items. This surge is driven by increasing consumer spending power, particularly in emerging economies, and a growing appreciation for olfactory experiences. Additionally, ongoing research and development efforts aimed at enhancing the synthesis efficiency and purity of Ethyl Phenyl Acetate are contributing to cost-effectiveness and improved product quality, thereby broadening its application potential. The discovery of novel applications in niche areas beyond traditional fragrance and scientific research also holds promise for future market expansion.

This comprehensive report on Ethyl Phenyl Acetate offers an exhaustive analysis, providing stakeholders with invaluable insights into market dynamics, trends, and future prospects. The report delves deep into the intricate details of World Ethyl Phenyl Acetate Production, examining historical data from 2019-2024 and projecting future volumes up to 2033, with a base year of 2025 and an estimated year of 2025. It meticulously analyzes the diverse Application segments, including the dominant Fragrance sector, the crucial Scientific Research segment, and other niche applications. Furthermore, the report scrutinizes the Type segmentation, highlighting the market share and growth potential of 0.98, 0.99, and "Others" purity grades. Through detailed market intelligence, including key drivers, challenges, regional dominance, and industry developments, this report empowers businesses to make informed strategic decisions, optimize their operations, and capitalize on emerging opportunities within the Ethyl Phenyl Acetate market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BERJÉ INC, Central Drug House, Mubychem Group, Shree Hari Enterprises, Sai Chemical Private Limited, Premier Group Of Industries, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ethyl Phenyl Acetate," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ethyl Phenyl Acetate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.