1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethernet Network Transformer?

The projected CAGR is approximately 15.89%.

Ethernet Network Transformer

Ethernet Network TransformerEthernet Network Transformer by Type (Transformers for Gigabit Ethernet, Transformers for 10 Gigabit Ethernet, Others, World Ethernet Network Transformer Production ), by Application (Industrial Automation, Communication Equipment, Automotive Manufacturing, Consumer Electronics, Others, World Ethernet Network Transformer Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

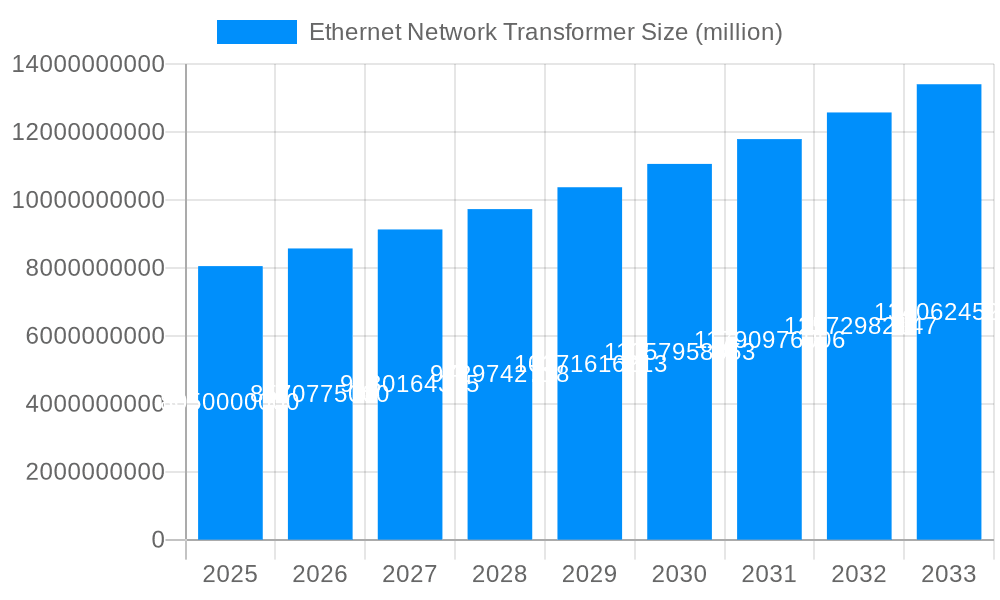

The global Ethernet Network Transformer market is poised for significant expansion, projected to reach USD 8.05 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.47% during the forecast period of 2025-2033. This substantial growth is primarily fueled by the escalating demand for high-speed networking solutions across a multitude of industries. The relentless advancement in communication technologies, necessitating faster data transfer rates, directly translates into a greater need for efficient Ethernet network transformers. Key drivers include the widespread adoption of Industrial Automation, where reliable and high-performance network infrastructure is paramount for seamless operation and increased productivity. Furthermore, the burgeoning communication equipment sector, encompassing everything from advanced routers and switches to sophisticated networking interfaces, represents a substantial consumption avenue. The increasing integration of Ethernet in automotive manufacturing for advanced driver-assistance systems (ADAS) and in-car infotainment also contributes significantly to market expansion.

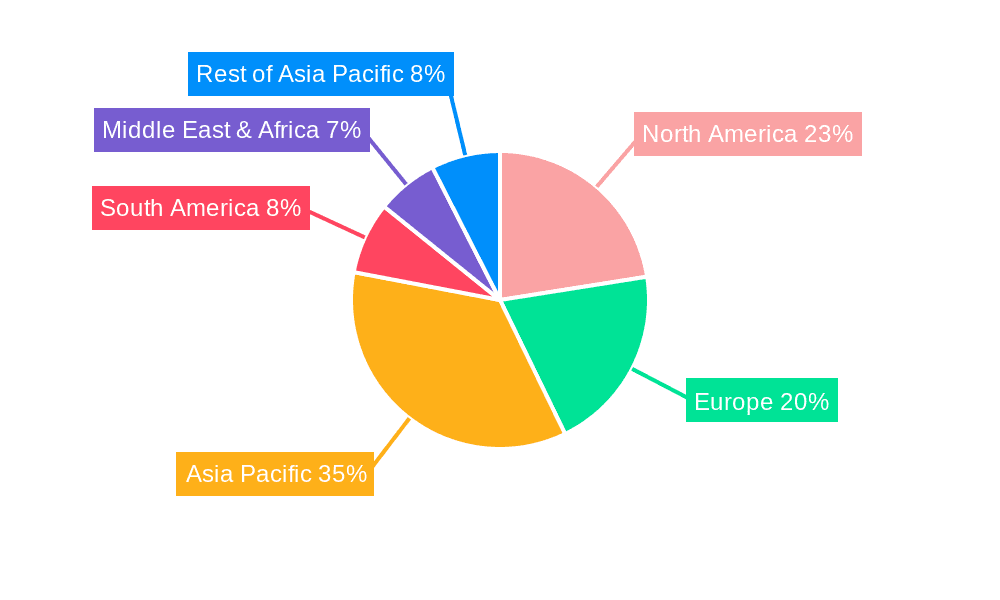

The market's trajectory is further shaped by evolving trends such as the increasing miniaturization of electronic components, enabling smaller and more power-efficient Ethernet network transformers. The growing preference for Gigabit Ethernet and the emerging demand for 10 Gigabit Ethernet solutions are critical segments driving innovation and market penetration. However, certain restraints might influence the pace of growth, including the intense competition among established players and the continuous technological evolution that can lead to rapid obsolescence of older transformer designs. Despite these challenges, the overarching trend towards increased connectivity and the digitalization of industries worldwide underscores a promising future for the Ethernet Network Transformer market. Regional analysis indicates Asia Pacific, particularly China and India, is expected to lead in market size and growth due to its manufacturing prowess and rapid industrialization, followed by North America and Europe, driven by their advanced technological infrastructure and adoption rates in industrial and automotive sectors.

Here's a report description for Ethernet Network Transformers, incorporating your specific requirements:

This report offers an in-depth examination of the global Ethernet Network Transformer market, providing crucial insights for stakeholders across the industry. The study encompasses a comprehensive analysis from the historical period of 2019-2024, focusing on the base and estimated year of 2025, and extending through a robust forecast period of 2025-2033. We delve into the market's intricate dynamics, projected to reach figures in the billions of US dollars by the end of the forecast period.

The Ethernet Network Transformer market is currently experiencing a paradigm shift driven by the relentless pursuit of higher speeds and greater reliability in data communication. XXX, a leading market intelligence firm, highlights that the demand for Transformers for Gigabit Ethernet remains robust, forming the bedrock of numerous enterprise and consumer applications. However, the most significant growth trajectory is undeniably observed in Transformers for 10 Gigabit Ethernet, fueled by the exponential increase in data traffic across cloud computing, high-performance computing, and advanced telecommunications infrastructure. The proliferation of 5G networks and the burgeoning Internet of Things (IoT) ecosystem are further accelerating this trend, necessitating transformers capable of handling immense data throughput with minimal signal degradation.

Beyond these specialized segments, the "Others" category, encompassing niche applications and emerging technologies, is also demonstrating considerable potential. This includes advancements in Power over Ethernet (PoE) transformers, crucial for delivering both data and power to devices, thereby simplifying network deployments and reducing infrastructure costs in sectors like industrial automation and smart buildings. The market is also witnessing a growing emphasis on miniaturization and integration, with manufacturers striving to develop smaller, more efficient transformers that occupy less board space and consume less power. This trend is particularly pertinent in the automotive sector, where the increasing complexity of in-vehicle networking systems demands compact and high-performance solutions. Furthermore, the report meticulously analyzes the World Ethernet Network Transformer Production landscape, identifying key manufacturing hubs and shifts in production capacities, which are vital for understanding supply chain dynamics and potential disruptions. Emerging markets are steadily gaining traction in terms of production, diversifying the global manufacturing footprint and potentially leading to more competitive pricing. The integration of advanced materials and manufacturing techniques is also a significant trend, aimed at improving thermal performance, electromagnetic interference (EMI) shielding, and overall product longevity, thereby contributing to a more sustainable and efficient network infrastructure. The increasing adoption of Ethernet in critical infrastructure, such as smart grids and industrial control systems, is also driving demand for highly reliable and robust transformer solutions that can withstand harsh environmental conditions and ensure uninterrupted operation.

Several powerful forces are collectively propelling the growth of the Ethernet Network Transformer market. The relentless demand for faster data transfer speeds across all sectors, from consumer electronics to industrial automation, is the primary catalyst. As applications become more data-intensive, requiring real-time processing and seamless connectivity, the need for high-performance transformers capable of supporting Gigabit and 10 Gigabit Ethernet becomes paramount. The widespread adoption of cloud computing and the exponential growth of data centers worldwide are major drivers, as these facilities rely heavily on robust and high-speed Ethernet connectivity for their operations. Furthermore, the advent and rapid expansion of 5G telecommunications networks are creating a ripple effect, demanding a significant upgrade in network infrastructure, including the transformers used within base stations, switches, and routers.

The burgeoning Internet of Things (IoT) is another significant growth engine. The sheer volume of connected devices, each requiring reliable network access, is creating an unprecedented demand for Ethernet connectivity solutions. This extends to smart homes, smart cities, and industrial IoT (IIoT) applications, where Ethernet transformers are integral to enabling data exchange between sensors, actuators, and control systems. The automotive industry's increasing reliance on in-vehicle Ethernet for advanced driver-assistance systems (ADAS), infotainment, and autonomous driving technologies is also a substantial contributor. As vehicles become more connected and sophisticated, the demand for high-speed, reliable Ethernet transformers within their complex electronic architectures is set to surge. Government initiatives promoting digitalization and the development of smart infrastructure in various countries are also indirectly fueling market expansion by encouraging the adoption of advanced networking technologies.

Despite the robust growth prospects, the Ethernet Network Transformer market is not without its challenges and restraints. One of the primary hurdles is the increasing complexity and cost associated with developing and manufacturing transformers that meet the stringent performance requirements of ultra-high-speed Ethernet standards, particularly for 10 Gigabit Ethernet and beyond. The miniaturization trend, while desirable for device manufacturers, often necessitates intricate designs and advanced materials, leading to higher production costs. Furthermore, the fluctuating prices of raw materials, such as copper and specialized magnetic alloys, can impact profit margins for transformer manufacturers.

The rapid pace of technological evolution presents another significant challenge. As new Ethernet standards emerge and existing ones are refined, transformer manufacturers must continuously invest in research and development to keep pace. This can lead to shorter product lifecycles and the risk of obsolescence if innovation is not sufficiently agile. The global supply chain, already subject to disruptions from geopolitical events and natural disasters, can also impact the availability and cost of essential components and finished products. Moreover, the increasing demand for energy efficiency in electronic devices places pressure on transformer designers to develop solutions with lower power loss, which can be technically challenging to achieve without compromising performance. Stringent regulatory requirements and environmental standards regarding material usage and manufacturing processes can also add to compliance costs and complexity for manufacturers. The intense competition within the market, with numerous established and emerging players, also exerts downward pressure on pricing, further challenging profitability for some segments.

The Ethernet Network Transformer market is characterized by dynamic regional dominance and segment leadership, with Asia Pacific poised to be the most influential region in terms of both production and consumption by the end of the forecast period. This dominance is largely driven by its established manufacturing prowess in electronic components, coupled with burgeoning domestic demand from a rapidly growing digital economy. Countries like China, South Korea, Taiwan, and Japan are at the forefront of this expansion, acting as global manufacturing hubs for a wide array of electronic devices that incorporate Ethernet connectivity. The sheer scale of manufacturing for consumer electronics, communication equipment, and increasingly, automotive components within this region underpins its leadership.

Within the Asia Pacific, the Communication Equipment segment is expected to be a significant driver, given the region's pivotal role in the global telecommunications industry. The aggressive rollout of 5G infrastructure, coupled with the ongoing demand for routers, switches, and other networking devices for both enterprise and residential use, fuels a substantial requirement for Ethernet transformers. Furthermore, the rapid adoption of smart devices and the expansion of data centers across the region are contributing to the sustained growth of this segment.

In terms of specific transformer types, Transformers for Gigabit Ethernet will continue to represent a substantial market share due to its widespread application in a myriad of devices. However, the forecast period anticipates a particularly rapid acceleration in the growth of Transformers for 10 Gigabit Ethernet. This surge is directly linked to the increasing adoption of high-speed networking in enterprise environments, cloud infrastructure, and advanced communication systems within the Asia Pacific. As businesses and data centers strive for greater bandwidth and lower latency, the demand for these higher-performance transformers will escalate significantly.

Beyond Asia Pacific, North America is anticipated to maintain a strong position, driven by innovation in the communication equipment and automotive manufacturing sectors. The United States, in particular, is a hub for technological advancements in AI, cloud computing, and autonomous driving, which necessitate sophisticated Ethernet networking solutions. The increasing focus on upgrading existing infrastructure and the deployment of next-generation technologies will ensure continued demand for Ethernet transformers in this region.

The Automotive Manufacturing segment is also identified as a key growth area globally, and its impact on regional market dynamics will be profound. As vehicles become more integrated with advanced electronic systems, the demand for specialized Ethernet transformers designed for the automotive environment – characterized by stringent reliability and temperature tolerance requirements – will rise considerably. The increasing production of electric vehicles (EVs) and the development of connected car technologies further bolster this trend.

The Ethernet Network Transformer industry is experiencing robust growth fueled by several key catalysts. The relentless demand for higher data speeds and bandwidth across all sectors is paramount, driven by the proliferation of cloud computing, 5G networks, and the Internet of Things (IoT). The increasing complexity of modern electronic devices and the need for reliable signal integrity further necessitate advanced transformer solutions. Investments in infrastructure upgrades by telecommunications companies and enterprises seeking to enhance their network capabilities are also significant growth drivers.

This comprehensive report delves into the intricate dynamics of the global Ethernet Network Transformer market, offering detailed insights into market size, trends, and future projections. The study encompasses historical data from 2019-2024 and forecasts through 2033, with a specific focus on the base and estimated year of 2025. It meticulously analyzes key market drivers such as the accelerating adoption of 5G, the burgeoning IoT ecosystem, and the increasing demand for high-speed data communication in cloud computing and enterprise networks. Furthermore, the report scrutinizes the challenges faced by the industry, including technological complexities and supply chain volatilities. It identifies dominant regions and segments, with a particular emphasis on the Asia Pacific and the growing importance of 10 Gigabit Ethernet. Key players, significant developments, and industry outlook are all thoroughly covered, providing stakeholders with a holistic understanding of this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.89% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.89%.

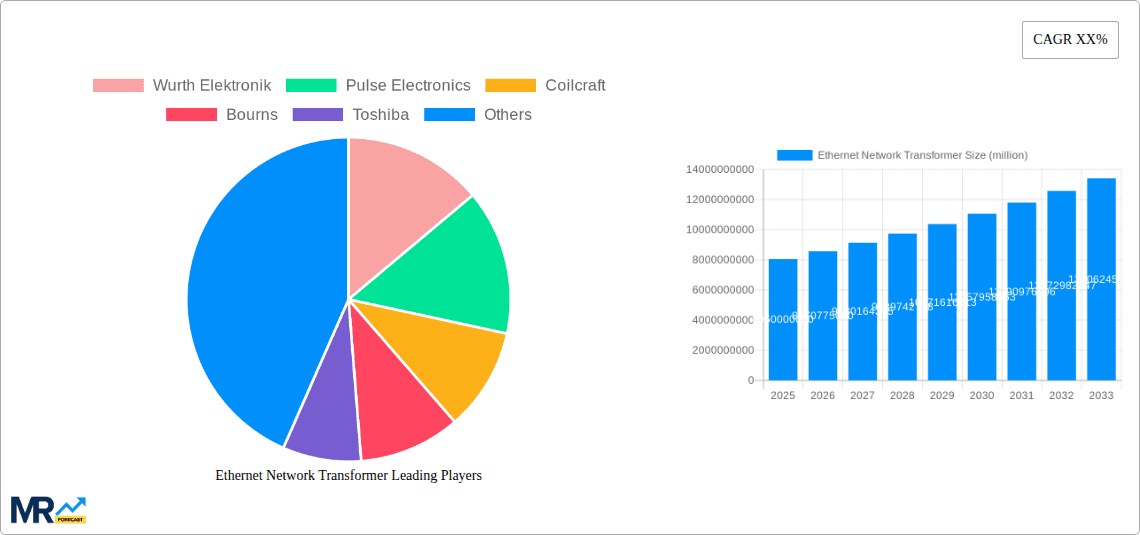

Key companies in the market include Wurth Elektronik, Pulse Electronics, Coilcraft, Bourns, Toshiba, Vishay.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Ethernet Network Transformer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ethernet Network Transformer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.