1. What is the projected Compound Annual Growth Rate (CAGR) of the Etching Solution?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Etching Solution

Etching SolutionEtching Solution by Type (Acid Copper Chloride, Basic Copper Chloride, Ferric Chloride, Ammonium Persulfate, Sulfuric Acid, Hydrogen Peroxide), by Application (Aviation, Mechanical, Chemical Industry, Semiconductor), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

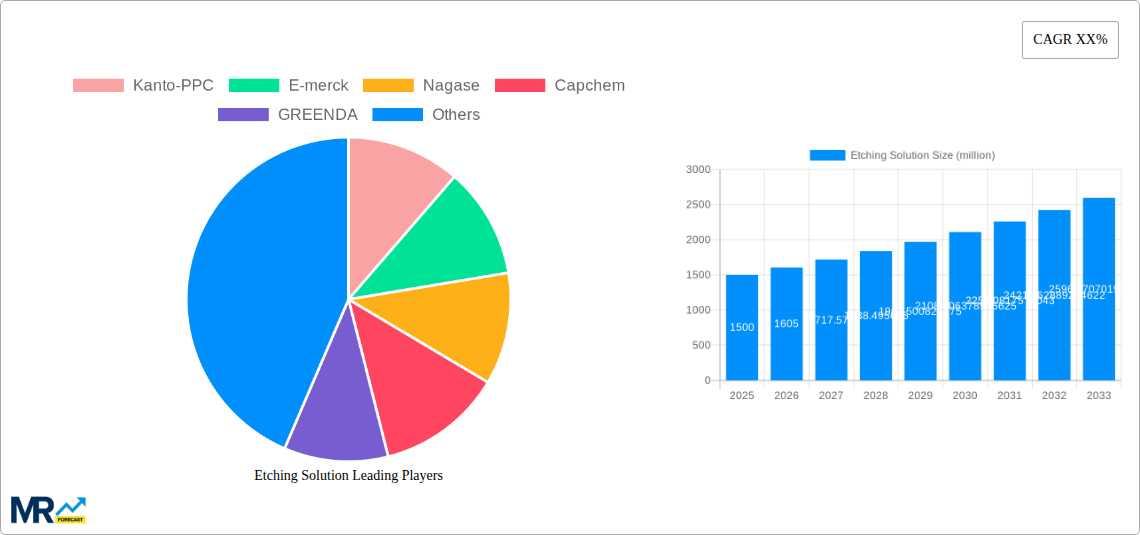

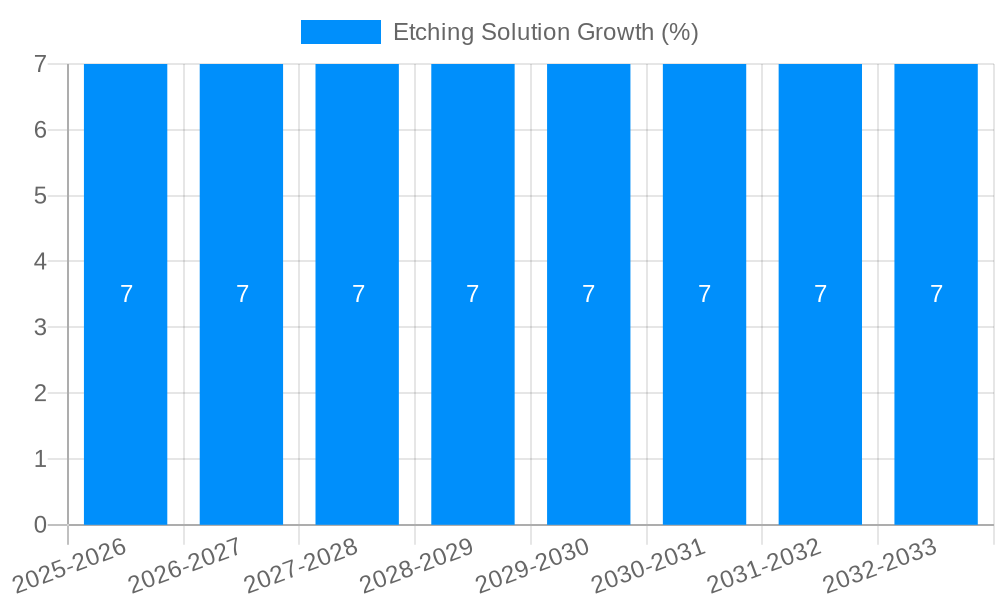

The global Etching Solution market is poised for substantial growth, projected to reach an estimated market size of $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% anticipated from 2025 to 2033. This expansion is primarily fueled by the escalating demand for advanced electronics, particularly in the semiconductor industry, where precision etching is crucial for manufacturing intricate microchips. The aviation and mechanical sectors also contribute significantly to market growth, driven by the need for high-performance materials and sophisticated surface treatments. The increasing adoption of sophisticated manufacturing processes across various industries, coupled with ongoing research and development in etching technologies, is expected to further propel market expansion.

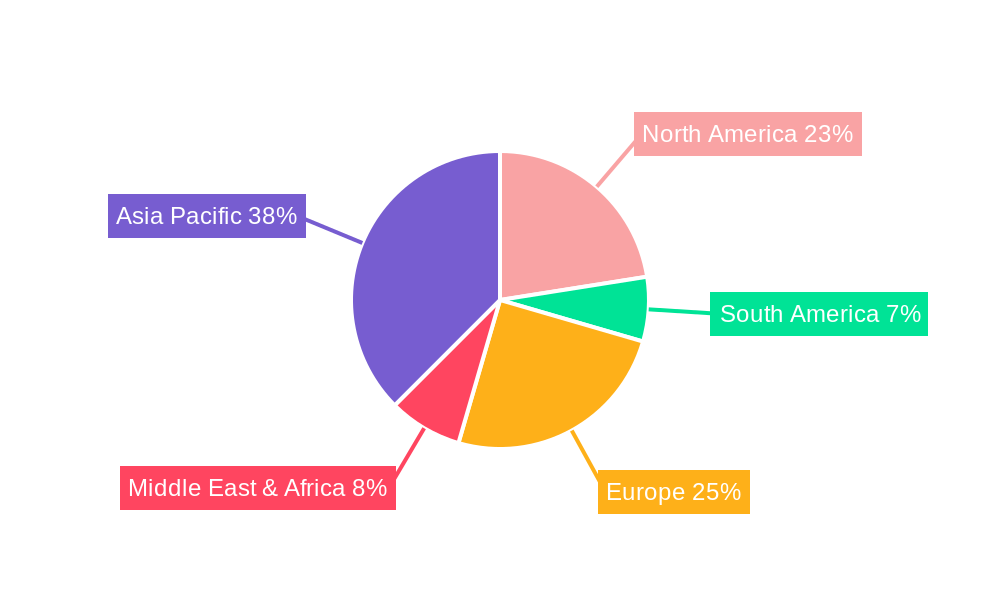

The market is segmented into key types including Acid Copper Chloride, Basic Copper Chloride, Ferric Chloride, Ammonium Persulfate, Sulfuric Acid, and Hydrogen Peroxide, each catering to specific industrial requirements. Ferric Chloride and Sulfuric Acid are anticipated to dominate the market due to their widespread applications in electronics and industrial cleaning. Geographically, the Asia Pacific region, led by China and Japan, is expected to emerge as the largest market due to its prominent role in global electronics manufacturing and a strong presence of key players. North America and Europe are also significant markets, driven by technological advancements and a well-established industrial base. Despite strong growth drivers, challenges such as stringent environmental regulations concerning the disposal of etching waste and the high initial investment for advanced etching equipment may pose moderate restraints to market growth.

This report provides an in-depth analysis of the global etching solution market, encompassing a comprehensive study of market trends, driving forces, challenges, regional dynamics, key players, and significant developments. The analysis spans the Study Period of 2019-2033, with the Base Year set at 2025 and the Estimated Year also 2025. The Forecast Period extends from 2025-2033, building upon the Historical Period of 2019-2024. The report offers invaluable insights for stakeholders seeking to understand and capitalize on the evolving landscape of etching solutions.

The global etching solution market is poised for robust growth, driven by an increasing demand for miniaturization and enhanced performance across various end-use industries. Our analysis indicates a projected market size exceeding USD 5,000 million by 2025, with an anticipated expansion to over USD 7,500 million by 2033. This growth trajectory is underpinned by several key trends. The semiconductor industry continues to be a primary driver, with the relentless pursuit of smaller, more powerful, and energy-efficient microchips necessitating advanced etching processes. This includes the development and adoption of sophisticated wet and dry etching techniques, requiring highly specialized and pure etching solutions. The increasing complexity of integrated circuits, particularly in areas like advanced packaging and 3D NAND flash memory, further fuels the demand for precise and controlled etching.

Beyond semiconductors, the aviation sector is witnessing a surge in the utilization of etching solutions for the manufacturing of lightweight and high-strength components. Advanced materials and intricate designs in aircraft manufacturing rely on etching for precise material removal, contributing to fuel efficiency and performance enhancement. Similarly, the mechanical industry is leveraging etching for the production of intricate parts, molds, and tools where high precision and surface finish are paramount. The chemical industry, a foundational user, continues to demand etching solutions for diverse applications ranging from catalysis to the preparation of specialized materials. Emerging applications in areas like printed electronics and microfluidics are also contributing to market expansion, showcasing the versatility of etching technologies.

Furthermore, there is a discernible shift towards environmentally friendly and safer etching solutions. Regulatory pressures and a growing industry focus on sustainability are prompting manufacturers to develop and adopt formulations with reduced toxicity and waste generation. This includes exploring alternatives to traditional hazardous chemicals and optimizing existing processes for greater efficiency and reduced environmental impact. The market is also witnessing a trend towards customized etching solutions tailored to specific substrate materials and process requirements, reflecting the increasing complexity and diversity of modern manufacturing needs. The ongoing research and development in novel etching chemistries and processes, coupled with the increasing adoption of automation and advanced process control, are expected to shape the future of the etching solution market, ensuring its continued expansion and evolution.

Several potent driving forces are collectively propelling the growth of the etching solution market. Foremost among these is the insatiable demand from the semiconductor industry. The relentless advancement in semiconductor technology, characterized by Moore's Law and the drive for ever-smaller transistors and more complex integrated circuits, directly translates to a higher requirement for precise and efficient etching processes. This includes the etching of intricate patterns on silicon wafers for microprocessors, memory chips, and other critical electronic components. The burgeoning Internet of Things (IoT) ecosystem, coupled with the exponential growth of artificial intelligence (AI) and machine learning applications, further amplifies the need for advanced semiconductor manufacturing capabilities, thus boosting the demand for high-purity and specialized etching solutions.

The expansion of the aviation industry is another significant catalyst. Modern aircraft are increasingly incorporating advanced materials and complex designs to achieve better fuel efficiency, reduce weight, and enhance performance. Etching solutions play a crucial role in the precision manufacturing of intricate aircraft components, such as turbine blades, structural elements, and micro-electromechanical systems (MEMS), where exact material removal is critical. The stringent quality and performance requirements in aviation necessitate reliable and repeatable etching processes, driving innovation in etching solution formulations and delivery systems.

Moreover, the mechanical industry’s continuous pursuit of precision engineering and miniaturization in various applications, including automotive, medical devices, and industrial machinery, is creating a sustained demand for etching solutions. The ability to create highly detailed and precise features on metal and other substrates for components like molds, dies, and intricate parts is a testament to the evolving role of etching. Finally, a growing emphasis on sustainable manufacturing practices is indirectly fueling innovation. The need for etching solutions that are less toxic, more environmentally friendly, and generate less waste is spurring research and development into novel chemistries and processes, thereby expanding the market's potential.

Despite the robust growth prospects, the etching solution market is not without its challenges and restraints. A significant hurdle is the increasing stringency of environmental regulations. Many traditional etching solutions utilize hazardous chemicals that pose risks to human health and the environment. Compliance with evolving and stricter regulations regarding chemical handling, disposal, and emissions necessitates substantial investment in research and development for safer alternatives, process optimization, and waste treatment technologies. This can lead to increased production costs and potentially slower adoption rates for certain established etching chemistries.

The high cost of raw materials and the complexity of manufacturing specialized etching solutions also present a significant restraint. The purity requirements for etching solutions, particularly for the semiconductor industry, are exceptionally high. Sourcing and processing these high-purity raw materials can be expensive, directly impacting the overall cost of the final product. Furthermore, the specialized equipment and expertise required for the precise formulation and quality control of these solutions add to the manufacturing overhead.

Another challenge is the technological complexity and the need for continuous innovation. As end-use industries, especially semiconductors, push the boundaries of miniaturization and complexity, etching solution manufacturers must continuously innovate to develop solutions that can meet these evolving demands. This includes developing solutions with higher selectivity, etch rates, and uniformity, as well as ensuring compatibility with new substrate materials and advanced fabrication processes. The capital investment required for such R&D can be substantial.

Finally, supply chain disruptions and geopolitical factors can also pose a threat to market stability. The global nature of the etching solution supply chain, with raw material sourcing and manufacturing often spread across different regions, makes it vulnerable to trade disputes, natural disasters, and logistical challenges. These factors can lead to price volatility and potential shortages, impacting the smooth operation of end-use industries.

The Semiconductor segment is unequivocally the dominant force shaping the global etching solution market, with its influence extending across key regions and countries. This segment is projected to account for the largest market share, exceeding 65% by 2025, and is expected to maintain its lead throughout the forecast period. The intrinsic need for precise and controlled material removal in the fabrication of integrated circuits (ICs) is the fundamental reason behind this dominance. The relentless drive for smaller feature sizes, higher transistor densities, and increasingly complex 3D architectures in chips for smartphones, data centers, AI accelerators, and advanced computing platforms directly translates into a sustained and escalating demand for a wide array of etching solutions.

Within the semiconductor segment, specific types of etching solutions are critical. Acid Copper Chloride and Ferric Chloride have historically been significant, particularly for copper interconnect etching in advanced nodes. However, the market is witnessing a growing demand for more specialized and purer formulations. Hydrogen Peroxide based solutions are gaining traction due to their milder etching properties and environmental benefits, especially in front-end-of-line (FEOL) processes. The continuous innovation in chip design necessitates the development of new etching chemistries that can handle novel materials like high-k dielectrics, metal gates, and advanced interconnect materials, further solidifying the semiconductor's leading position.

Geographically, Asia Pacific, particularly East Asia, is the undisputed leader in both the consumption and production of etching solutions, primarily driven by its dominant position in semiconductor manufacturing. Countries like South Korea, Taiwan, and China are home to the world's largest foundries and integrated device manufacturers (IDMs). These nations invest heavily in advanced semiconductor fabrication facilities, consequently creating a massive demand for high-volume, high-purity etching solutions. The presence of major semiconductor players like Samsung, TSMC, and SK Hynix fuels this demand.

Asia Pacific:

North America:

Europe:

The Semiconductor segment's dominance is further amplified by the ancillary industries that support it, such as printed circuit board (PCB) manufacturing, which also utilizes various etching solutions like Ferric Chloride and Ammonium Persulfate. While the Aviation, Mechanical, and Chemical Industry segments represent substantial markets in their own right, their overall consumption volume and growth rate, at least in the near to medium term, are outpaced by the relentless demand from the semiconductor sector. The continuous technological evolution and the strategic importance of semiconductor independence in major economies will ensure the semiconductor segment, and by extension the regions heavily invested in it, will continue to lead the etching solution market for the foreseeable future.

The etching solution industry is fueled by several key growth catalysts. The ongoing miniaturization and increasing complexity of electronic devices, particularly in the semiconductor industry, remain a primary driver. The demand for smaller, more powerful, and energy-efficient microchips necessitates advanced and precise etching techniques, thus boosting the consumption of specialized etching solutions. Furthermore, the expansion of emerging technologies like 5G, artificial intelligence, and the Internet of Things (IoT) are creating new avenues for chip development and, consequently, for etching solutions. The growing adoption of etching in the aviation industry for lightweight and high-performance components, along with its increasing application in the mechanical industry for precision manufacturing, are also significant growth contributors. Finally, the ongoing research and development into more sustainable and environmentally friendly etching chemistries are opening up new market opportunities and driving innovation.

The global etching solution market is characterized by the presence of several prominent players who are at the forefront of innovation and market supply. These companies are instrumental in driving technological advancements and meeting the diverse needs of end-use industries. The leading companies in this sector include:

The etching solution sector has witnessed significant advancements and strategic moves over the past few years, shaping its current landscape and future trajectory. These developments highlight the industry's dynamic nature and its continuous pursuit of innovation and market expansion.

This comprehensive report delves deep into the intricate workings of the global etching solution market, providing stakeholders with an unparalleled understanding of its dynamics. The report meticulously analyzes market trends, forecasts, and key growth drivers. It offers a detailed examination of the leading companies and their strategic initiatives, alongside a thorough breakdown of regional market shares and competitive landscapes. Furthermore, the report scrutinizes the impact of technological advancements, regulatory shifts, and evolving end-user demands on the market. With a focus on the Study Period of 2019-2033, and detailed analysis for the Base Year of 2025, this report is an indispensable resource for strategic decision-making, investment planning, and gaining a competitive edge in the dynamic etching solution industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kanto-PPC, E-merck, Nagase, Capchem, GREENDA, Sun Surface, KANTO, DONGJIN, BASF, TOK, Suzhou Ruihong Electronic Chemical Co., LTD., AUFIRST Chemicals, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Etching Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Etching Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.