1. What is the projected Compound Annual Growth Rate (CAGR) of the Etching Electron Gas?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Etching Electron Gas

Etching Electron GasEtching Electron Gas by Application (Solar Energy, Flat Panel Display, LED, Other), by Type (Hexafluoroethane, Carbon Tetrafluoride, Trifluoromethane, Octafluorocyclobutane, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

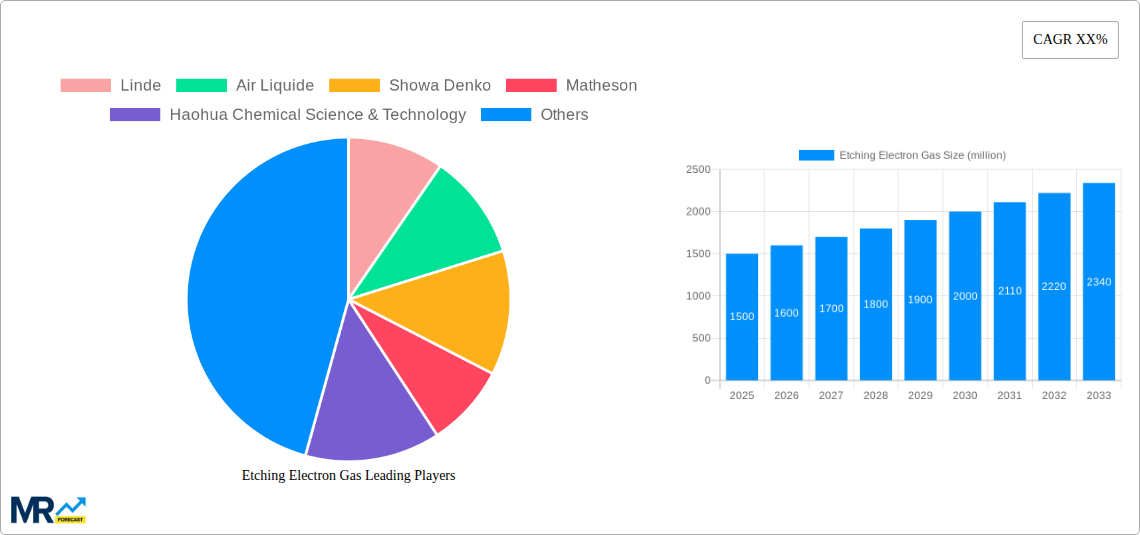

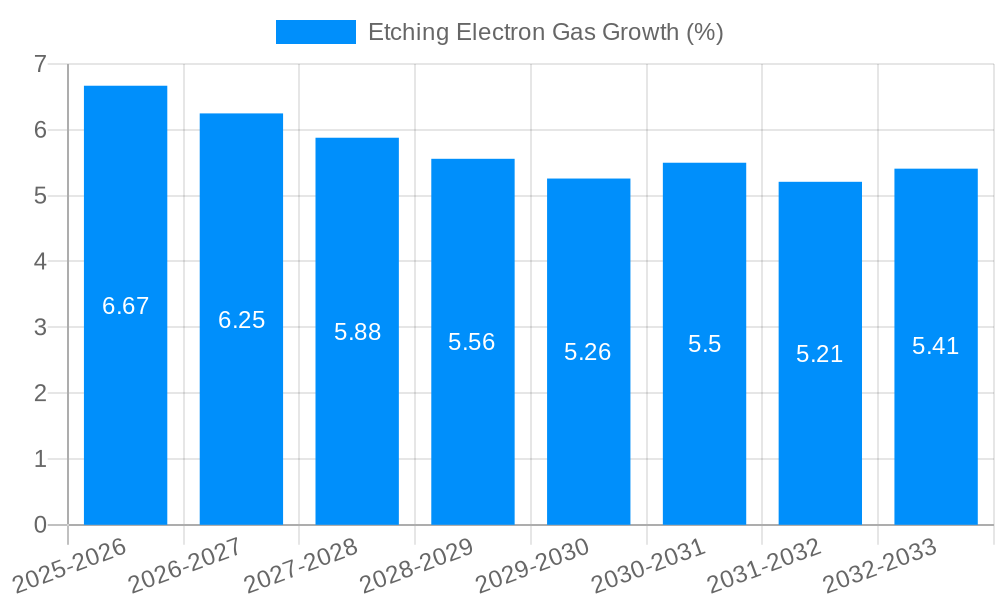

The global Etching Electron Gas market is poised for significant expansion, projected to reach a substantial market size of approximately \$1,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This robust growth is primarily fueled by the insatiable demand from the semiconductor industry for advanced etching processes in the manufacturing of microchips and integrated circuits. The escalating adoption of advanced technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and 5G connectivity necessitates increasingly complex and miniaturized semiconductor components, directly driving the consumption of high-purity etching gases. Key applications like Solar Energy are also contributing to this surge, as efficient solar panel manufacturing relies on precise etching techniques for enhanced performance and durability. Furthermore, the burgeoning growth in the Flat Panel Display market and the widespread adoption of energy-efficient LED lighting solutions are adding substantial momentum to the etching electron gas market.

The market's trajectory is further shaped by several evolving trends. The increasing focus on developing next-generation semiconductor devices, such as those with smaller node sizes and advanced packaging, requires highly specialized and purer etching gases. Innovations in plasma etching technology are also leading to the development of new gas mixtures and formulations to achieve superior etching selectivity and control. While the market exhibits strong growth potential, certain restraints need to be considered. The stringent regulatory landscape surrounding the production and handling of these specialty gases, particularly concerning environmental impact and safety, can pose challenges. Moreover, the high cost associated with the purification and transportation of these high-purity gases can impact overall market economics. Key players are actively investing in research and development to overcome these challenges, focusing on sustainable production methods and exploring new applications to solidify their market positions.

The global Etching Electron Gas market is poised for substantial growth, with projections indicating a significant expansion in market value over the Study Period (2019-2033). Driven by the insatiable demand for advanced semiconductor manufacturing, crucial for powering the digital revolution, these specialty gases are witnessing an upward trajectory. The Base Year (2025), serving as a pivotal reference point, highlights the current market landscape, which is expected to see a remarkable surge towards the Estimated Year (2025) and beyond, throughout the Forecast Period (2025-2033). The Historical Period (2019-2024) has laid the groundwork, showcasing a consistent rise in consumption fueled by technological advancements. The market is characterized by an increasing emphasis on high-purity gases, essential for achieving finer feature sizes and enhanced performance in integrated circuits. Innovations in etching technologies, alongside the relentless pursuit of miniaturization in electronic components, are primary drivers.

The burgeoning demand for consumer electronics, sophisticated automotive systems, and the ever-expanding Internet of Things (IoT) ecosystem directly translates into a higher requirement for etching electron gases. Furthermore, the rapid evolution of 5G technology and the increasing deployment of Artificial Intelligence (AI) necessitate more complex and power-efficient semiconductor chips, thereby escalating the need for these specialized gases. The development of advanced display technologies, including high-resolution flat-panel displays and energy-efficient LEDs, also significantly contributes to market expansion. Looking ahead, the industry is focusing on sustainable etching processes and the development of novel gas compositions to meet the stringent environmental regulations and evolving manufacturing requirements. The market is projected to reach multi-million dollar valuations, with a Compound Annual Growth Rate (CAGR) reflecting the robust nature of the underlying demand drivers. For instance, the Type: Hexafluoroethane segment, along with Type: Carbon Tetrafluoride, are expected to be key contributors to this growth, owing to their established utility in various etching processes. The interplay between technological innovation in semiconductor fabrication and the consistent demand from end-user industries will continue to shape the Etching Electron Gas market for years to come, with projected market values easily exceeding the hundreds of million units in the coming years.

The global Etching Electron Gas market is being propelled by a confluence of powerful technological and economic drivers. At its core, the relentless miniaturization of semiconductor devices, a fundamental tenet of Moore's Law, is a primary impetus. As manufacturers strive for smaller, faster, and more power-efficient chips, the precision and control offered by etching electron gases become indispensable. The increasing complexity of integrated circuits, with billions of transistors packed onto a single chip, demands highly specialized and pure gases to achieve the intricate patterns required. The proliferation of consumer electronics, including smartphones, tablets, and wearable devices, continues to fuel demand. Furthermore, the automotive industry's rapid electrification and the integration of advanced driver-assistance systems (ADAS) require sophisticated semiconductor components, thereby boosting the consumption of etching gases. The expansion of the IoT ecosystem, connecting billions of devices across various sectors, creates a sustained demand for microprocessors and sensors. The ongoing rollout of 5G networks necessitates the production of advanced radio-frequency (RF) chips, which rely heavily on precise etching processes. The growing adoption of cloud computing and data centers also drives the demand for high-performance servers, further stimulating the semiconductor industry. The market is also influenced by government initiatives promoting domestic semiconductor manufacturing and investments in advanced research and development, aiming to secure supply chains and foster technological innovation. The projected market size, measured in millions of units, underscores the substantial economic impact of these driving forces.

Despite the robust growth trajectory, the Etching Electron Gas market faces several significant challenges and restraints that could temper its expansion. Foremost among these is the increasing stringency of environmental regulations. Many traditional etching gases, particularly fluorinated compounds, are potent greenhouse gases with high global warming potentials. This necessitates significant investment in research and development for more environmentally friendly alternatives or advanced abatement technologies to capture and neutralize these gases. The cost of high-purity gases is another considerable factor. The purification processes required to achieve the ultra-high purity levels demanded by the semiconductor industry are complex and expensive, leading to higher product costs. Fluctuations in the raw material prices, particularly for fluorine-based precursors, can also impact the profitability of etching gas manufacturers. The semiconductor manufacturing industry is highly cyclical, subject to boom-and-bust cycles influenced by global economic conditions and the pace of technological innovation. A slowdown in the electronics market can directly translate into reduced demand for etching gases. Moreover, the concentration of semiconductor manufacturing in specific geographic regions creates supply chain vulnerabilities. Geopolitical tensions, trade disputes, and natural disasters can disrupt the supply of these critical gases, impacting production schedules for semiconductor fabs. The development of alternative etching technologies that reduce or eliminate the reliance on certain gases also poses a long-term challenge. Furthermore, the capital-intensive nature of semiconductor fabrication facilities means that the adoption of new etching gas chemistries can be slow, requiring extensive qualification and validation processes. The hundreds of million units market value is therefore not without its headwinds.

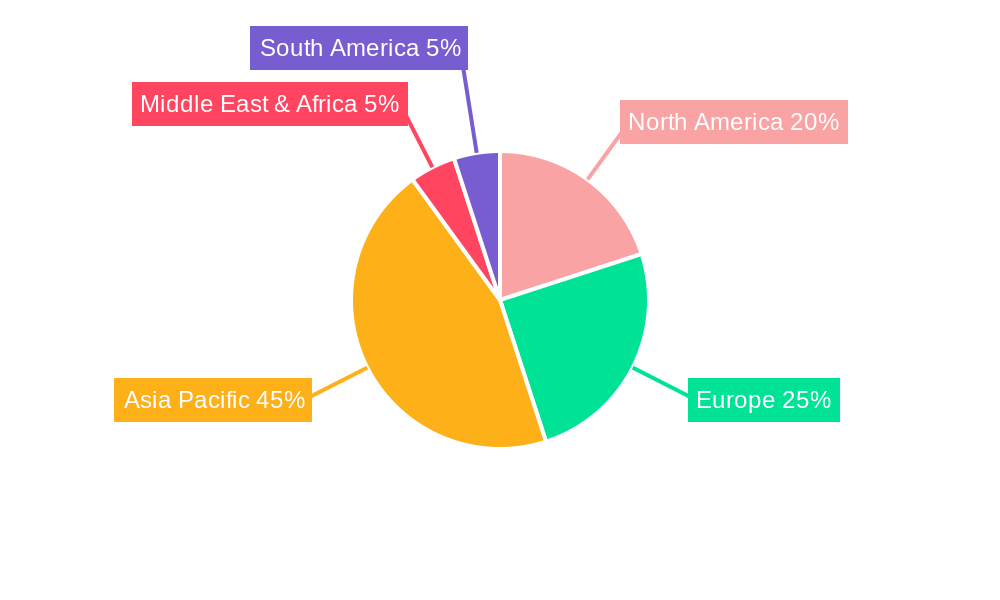

The Etching Electron Gas market is characterized by significant regional dominance and strong performance in specific application and type segments. Geographically, Asia-Pacific, particularly East Asia, is the undisputed leader and is projected to maintain its stronghold throughout the Forecast Period (2025-2033). This dominance is primarily attributed to the presence of the world's largest semiconductor manufacturing hubs in countries like Taiwan, South Korea, and China. These regions are home to leading semiconductor foundries and integrated device manufacturers (IDMs) that consume vast quantities of etching electron gases for the production of advanced microchips. The rapid growth of the electronics manufacturing sector in China, coupled with substantial government investments in developing its domestic semiconductor industry, further solidifies Asia-Pacific's leading position. Countries like Japan also play a crucial role with their advanced materials and equipment suppliers catering to the semiconductor industry.

Within this dominant region, the Type: Hexafluoroethane (C2F6) segment is expected to witness substantial growth and potentially lead the market. Hexafluoroethane is a widely used etching gas in the fabrication of silicon-based integrated circuits, particularly for plasma etching of dielectrics. Its effectiveness in achieving fine feature sizes and its compatibility with various plasma chemistries make it a preferred choice for advanced semiconductor nodes. Another significant segment contributing to market growth is Type: Carbon Tetrafluoride (CF4). This gas is extensively used in etching silicon, silicon dioxide, and silicon nitride in the manufacturing of semiconductors and flat-panel displays. Its versatility and established track record in high-volume manufacturing ensure its continued demand.

In terms of applications, the Flat Panel Display segment is a key driver of the etching electron gas market. The ever-increasing demand for high-resolution smartphones, televisions, and monitors fuels the production of advanced displays, which rely heavily on precise etching processes. The intricate patterns required for thin-film transistors (TFTs) used in LCD and OLED displays are achieved using specialized etching gases. The LED application segment also contributes significantly, with the growing adoption of LED lighting and displays across various industries, including automotive, signage, and general illumination, requiring specialized semiconductor manufacturing processes. While Solar Energy applications are growing, their current contribution to etching gas consumption is relatively smaller compared to displays and LEDs. However, advancements in photovoltaic cell manufacturing could lead to increased demand in the future. The overall market is projected to reach values well into the hundreds of million units, with Asia-Pacific, driven by the Flat Panel Display and LED segments, and the Hexafluoroethane and Carbon Tetrafluoride types, leading the charge.

The Etching Electron Gas industry's growth is catalyzed by several key factors. The relentless demand for smaller, more powerful, and energy-efficient electronic devices, driven by consumer electronics, automotive advancements, and the IoT, is a primary catalyst. The ongoing 5G rollout and the proliferation of AI applications necessitate the production of cutting-edge semiconductors, boosting the need for high-purity etching gases. Furthermore, investments in advanced display technologies like OLED and micro-LED, alongside the expansion of the solar energy sector, create new avenues for growth. Government initiatives to bolster domestic semiconductor manufacturing capabilities in various regions also act as significant catalysts, encouraging localized demand and production.

This report offers a comprehensive analysis of the Etching Electron Gas market, providing in-depth insights and future projections. It covers the market dynamics across the Study Period (2019-2033), with a detailed examination of the Base Year (2025) and the Forecast Period (2025-2033). The report delves into the key market trends, driving forces such as technological advancements in electronics and the expansion of 5G, and the challenges including stringent environmental regulations and supply chain complexities. It highlights dominant regions like Asia-Pacific and key segments such as Flat Panel Display applications and Hexafluoroethane as the primary type, projecting their significant contribution to the market's multi-million dollar valuation. Furthermore, the report identifies major growth catalysts and lists leading players, alongside significant developments and innovations within the sector. The comprehensive nature of this report makes it an invaluable resource for stakeholders seeking to understand and navigate the evolving Etching Electron Gas landscape, with projected market values easily exceeding the hundreds of million units.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Linde, Air Liquide, Showa Denko, Matheson, Haohua Chemical Science & Technology, Solvay, SIAD, Concorde Speciality Gases, Shandong Ruihua Fluoride Industry, Fujian Yongjing Technology, Versum Materials, Air Products & Chemicals, Concorde Speciality Gases, Fujian Shaowu Yongfei Chemical, Huate Gas, Dalian Special Gases, Feiyuan Group, Jinhong Gas, PERIC Special Gases, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Etching Electron Gas," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Etching Electron Gas, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.