1. What is the projected Compound Annual Growth Rate (CAGR) of the Estrous Detector for Cattle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Estrous Detector for Cattle

Estrous Detector for CattleEstrous Detector for Cattle by Type (Ear Tag, Tail Tag, Collar, Portable Detector, Others, World Estrous Detector for Cattle Production ), by Application (Small Frams, Large Farms, World Estrous Detector for Cattle Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

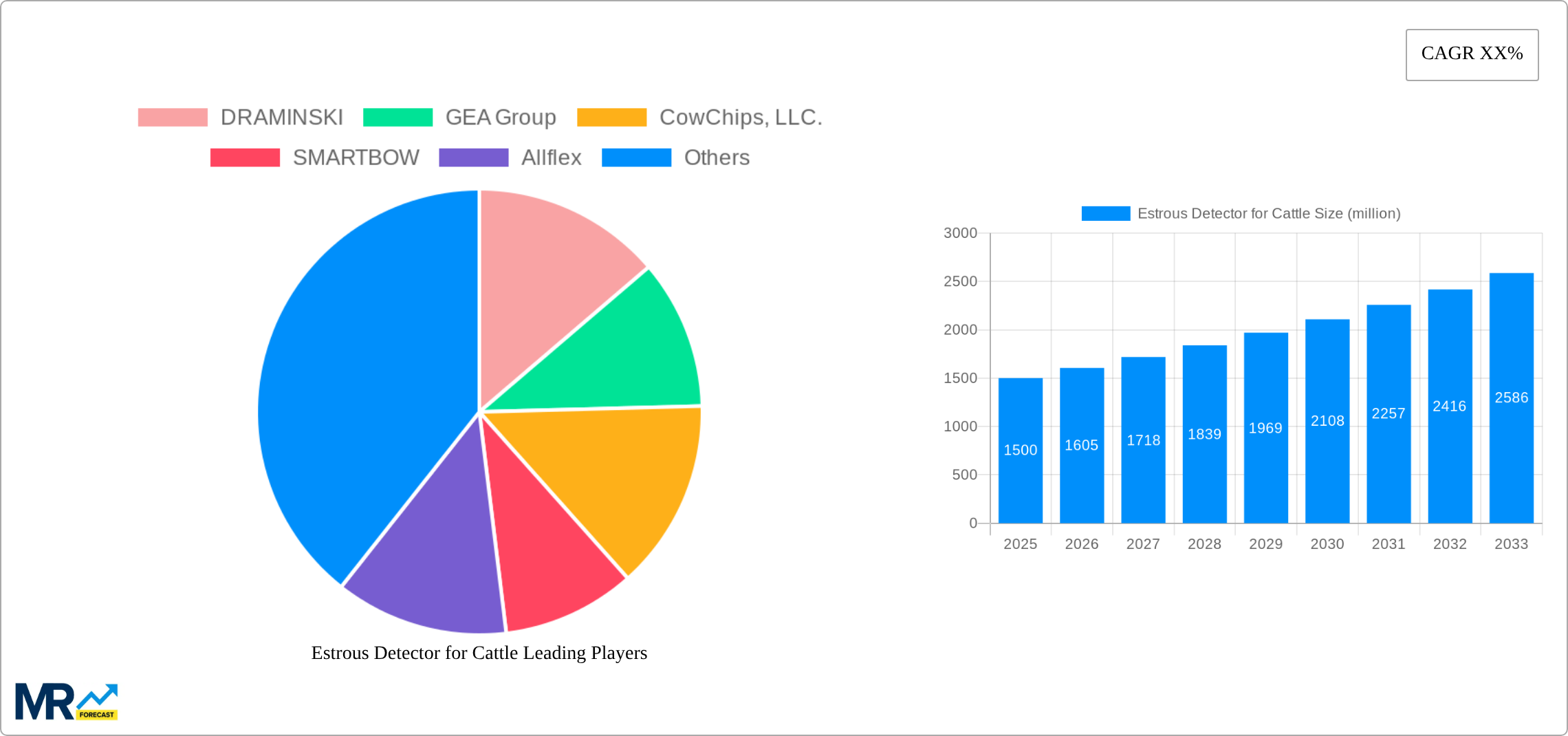

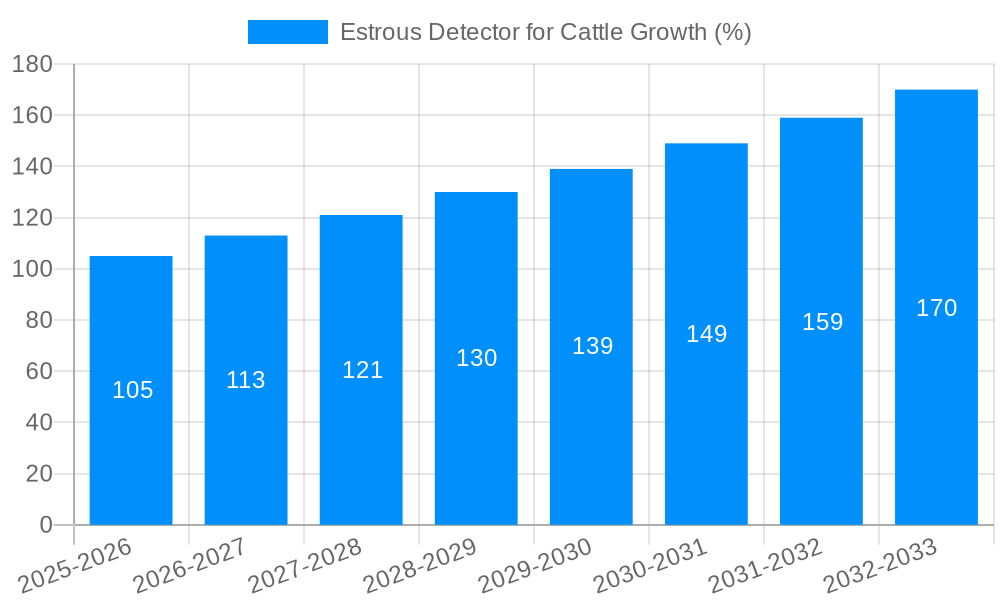

The global market for estrous detectors for cattle is experiencing robust growth, driven by increasing demand for improved reproductive efficiency in dairy and beef cattle farming. Technological advancements, such as the development of more accurate and user-friendly devices, including activity monitors, pedometers, and ultrasound systems, are contributing significantly to market expansion. Furthermore, the rising adoption of precision livestock farming (PLF) practices and the growing awareness among farmers regarding the economic benefits of optimized breeding cycles are key factors fueling market growth. The market is segmented based on technology type (e.g., activity monitors, visual observation aids, electronic devices), animal type (dairy cattle, beef cattle), and region. Leading companies like Draminski, GEA Group, CowChips, LLC, SMARTBOW, and Allflex are actively involved in innovation and market penetration, offering a range of solutions to meet diverse farming needs. While initial investment costs can present a barrier for some farmers, the long-term return on investment through improved herd fertility and reduced labor costs significantly outweighs this limitation. The forecast period from 2025 to 2033 anticipates continued market expansion, with a compounded annual growth rate (CAGR) potentially reaching 7-9%, driven by sustained technological improvements and the continued adoption of PLF globally.

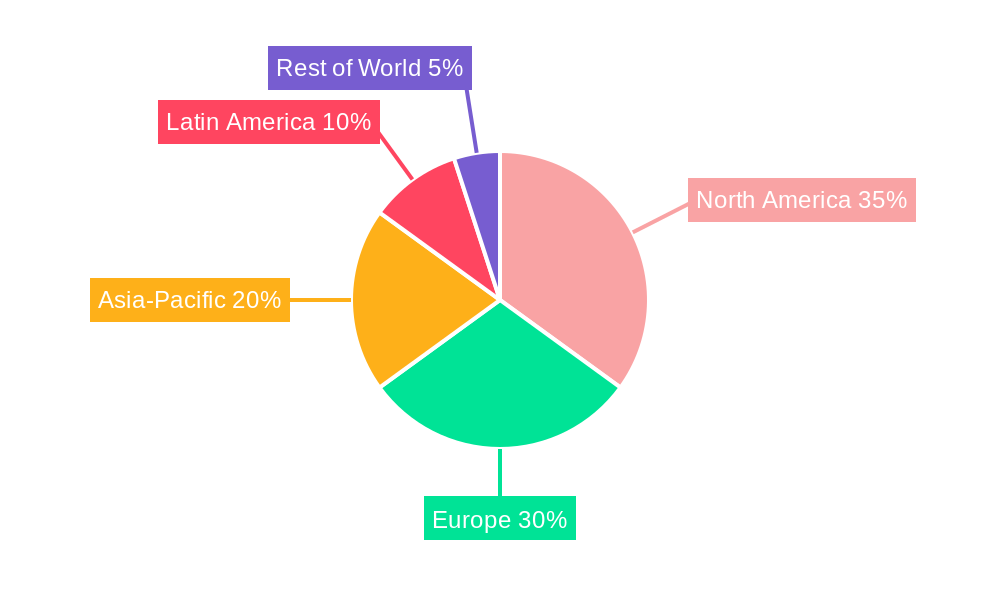

The competitive landscape features a mix of established players and emerging companies, leading to continuous innovation in product design and functionality. Market growth is geographically diverse, with North America and Europe currently holding significant market shares, although developing regions in Asia and Latin America show substantial growth potential. Future market trends suggest a shift towards integrated solutions combining estrous detection with other PLF technologies, such as automated milking systems and feeding management, enhancing farm efficiency and data analysis capabilities. Regulatory changes and increasing awareness of animal welfare standards are also expected to influence the development and adoption of new detection technologies. Overall, the estrous detector market for cattle is poised for substantial growth over the coming years, driven by a convergence of technological advancements, economic incentives, and evolving farming practices.

The global estrous detector for cattle market is experiencing robust growth, projected to reach multi-million unit sales by 2033. The study period from 2019 to 2033 reveals a significant upward trajectory, driven by increasing technological advancements and a growing awareness among farmers regarding the importance of optimized breeding management. The estimated market value for 2025 serves as a crucial benchmark, showcasing the market's maturity and potential for future expansion. The historical period (2019-2024) indicates a steady rise in adoption rates, with farmers increasingly recognizing the economic benefits of improved reproductive efficiency. This trend is expected to continue throughout the forecast period (2025-2033), fueled by factors such as increased farm sizes, the rising demand for high-quality dairy and beef products, and the adoption of precision livestock farming techniques. The market exhibits a diverse range of technologies, including activity monitors, pedometers, and visual observation aids, each catering to different farm sizes and management styles. The competitive landscape is characterized by established players like GEA Group and Allflex alongside innovative startups like CowChips, LLC and SMARTBOW, constantly striving to improve accuracy, ease of use, and data integration capabilities. This constant innovation ensures that the market remains dynamic and responsive to the evolving needs of the agricultural sector, promising sustained growth in the coming years. The base year 2025 provides a strong foundation for projecting future market performance, highlighting the significant impact of technological advancements on market expansion. Overall, the market is poised for continued expansion, driven by factors outlined in subsequent sections.

Several key factors are driving the growth of the estrous detector for cattle market. Firstly, the increasing demand for improved reproductive efficiency in cattle farming is paramount. Accurate estrus detection directly translates to higher conception rates, shorter calving intervals, and ultimately, increased profitability for farmers. Secondly, technological advancements have led to the development of more accurate, reliable, and user-friendly estrous detection tools. Modern systems offer features like automated data logging, remote monitoring capabilities, and seamless integration with farm management software, significantly enhancing efficiency and data analysis. Thirdly, the growing adoption of precision livestock farming (PLF) is accelerating market growth. PLF emphasizes data-driven decision-making, and estrous detectors are an integral component of this approach, providing crucial insights into animal reproductive health. Furthermore, rising consumer awareness regarding food safety and traceability is indirectly boosting the market. Farmers are increasingly under pressure to optimize their operations and improve animal welfare, leading to greater investment in technologies like estrous detectors. Finally, government initiatives promoting technological advancements in agriculture and support for sustainable farming practices are contributing to market expansion, making such technologies more accessible and cost-effective for farmers. These combined factors create a powerful synergy that fuels the continued expansion of the estrous detector market.

Despite the significant growth potential, the estrous detector market faces certain challenges. High initial investment costs can be a barrier for small and medium-sized farms, limiting the market penetration in developing regions. The accuracy of some estrous detection technologies can be affected by factors such as animal behavior, environmental conditions, and user error, leading to inconsistencies in results. Data management and integration can also pose a challenge, especially for farms with diverse and complex systems. The need for skilled labor to operate and interpret data from these systems represents another restraint. In addition, the market is subject to fluctuations in commodity prices, which can influence farmers' investment decisions. Finally, concerns about data security and privacy, particularly with the increasing use of cloud-based data management systems, need to be addressed effectively. Overcoming these challenges through technological innovation, cost reduction strategies, and effective user training programs is crucial for unlocking the full potential of the estrous detector market and expanding its reach globally.

North America: This region is expected to hold a significant market share due to the high adoption of advanced technologies in livestock farming and the presence of large-scale dairy and beef operations. The high awareness amongst farmers about optimizing breeding management and the availability of advanced tools makes this region a key market player.

Europe: Europe shows strong growth, driven by similar factors as North America, coupled with a robust regulatory environment that supports technological advancement in agriculture. The region benefits from a well-established agricultural infrastructure and a high level of technological adoption among farmers.

Asia-Pacific: This region is experiencing rapid growth, driven by increasing dairy and beef consumption, rising farm sizes, and growing government initiatives to support agricultural modernization.

Dairy Cattle Segment: This segment holds a larger market share than the beef cattle segment due to the higher economic value and the greater emphasis on optimizing reproduction in dairy farming. Dairy farms often maintain larger herds and have greater economic incentives to improve breeding efficiency.

Activity Monitors/Pedometers Segment: This segment is rapidly gaining popularity due to their relatively lower cost, ease of use, and improving accuracy. The non-invasive nature of these technologies makes them attractive to farmers.

The paragraph above provides a summary. The dominance of these regions and segments is driven by a combination of factors including: existing infrastructure, government support, consumer demand, and the economic viability of employing such technologies to improve reproductive efficiency and overall farm profitability.

The estrous detector for cattle industry is experiencing significant growth fueled by several key catalysts. Improved accuracy and reliability of detectors, coupled with declining costs, are making them more accessible to a wider range of farmers. The integration of these technologies with broader farm management systems and the availability of comprehensive data analytics provide invaluable insights into herd health and reproductive performance. Government incentives and support for technological advancements in agriculture further accelerate market expansion.

This report provides a comprehensive overview of the estrous detector for cattle market, covering market size, growth drivers, challenges, competitive landscape, and key industry trends. It offers valuable insights for stakeholders, including manufacturers, farmers, investors, and policymakers, enabling informed decision-making and strategic planning within this rapidly evolving sector. The report's detailed analysis encompasses historical data, current market conditions, and future projections, providing a complete picture of the market's dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DRAMINSKI, GEA Group, CowChips, LLC., SMARTBOW, Allflex.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Estrous Detector for Cattle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Estrous Detector for Cattle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.