1. What is the projected Compound Annual Growth Rate (CAGR) of the Erbium Sulfate?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Erbium Sulfate

Erbium SulfateErbium Sulfate by Type (Purity 99%, Purity 99.9%, Purity 99.99%, Purity 99.999%), by Application (Glass, Ceramics, Chemical Industry, Laboratory, Industrial Application, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

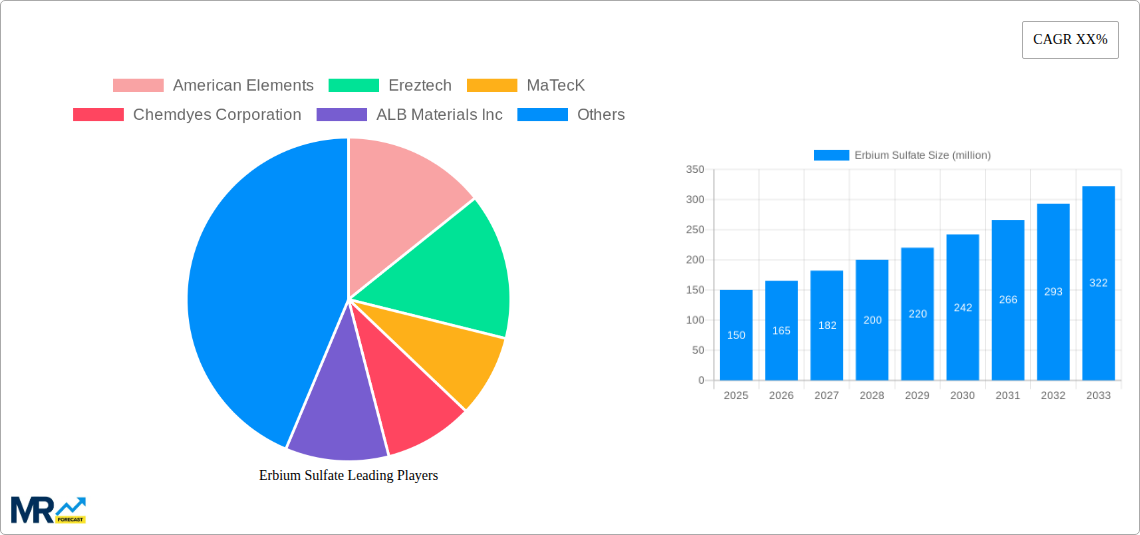

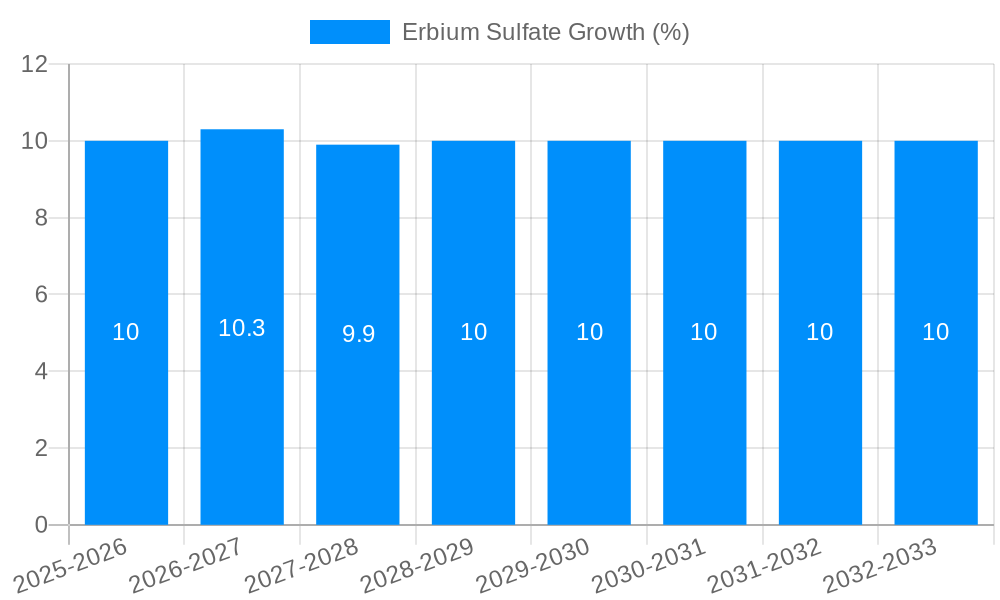

The Erbium Sulfate market is poised for significant growth, projected to reach a substantial market size of approximately $XXX million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This expansion is primarily fueled by the increasing demand across various high-growth sectors, notably in the chemical industry, where erbium sulfate serves as a crucial component in specialized synthesis and as a catalyst. The glass and ceramics industries are also significant contributors, leveraging erbium sulfate for its unique optical properties, such as its pink coloration and light-filtering capabilities, finding applications in decorative glass, specialized lenses, and laser components. Furthermore, the escalating use of advanced materials in research and development, particularly within laboratories and industrial applications, is creating sustained demand for high-purity grades of erbium sulfate. The market's trajectory is further bolstered by ongoing technological advancements and the development of novel applications for rare earth compounds.

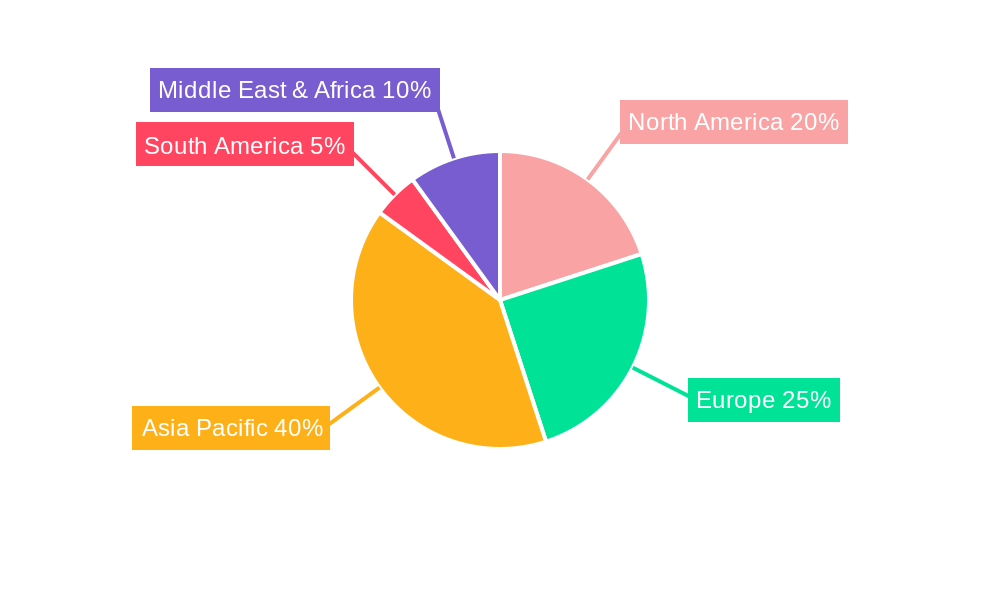

The market dynamics for Erbium Sulfate are influenced by a combination of driving forces and potential restraints. Key drivers include the burgeoning electronics sector and the growing need for advanced optical materials. The increasing global investment in renewable energy technologies, which often utilize rare earth elements, also presents a positive outlook. However, the market faces certain restraints, including the inherent volatility in rare earth element pricing, complex extraction and refining processes, and growing environmental concerns associated with mining and processing. Despite these challenges, the continuous innovation in purification techniques, leading to higher purity grades such as 99.99% and 99.999%, is opening up new, niche applications and ensuring a robust demand. Geographically, Asia Pacific, particularly China, is expected to dominate the market due to its significant rare earth reserves and advanced manufacturing capabilities. North America and Europe are also key regions, driven by strong R&D activities and specialized industrial applications.

This comprehensive report delves into the intricate landscape of the Erbium Sulfate market, offering a granular analysis across its multifaceted dimensions. The study meticulously charts the trajectory of Erbium Sulfate from its historical roots in the 2019-2024 period through to its projected future in the 2025-2033 forecast period, with a sharp focus on the Base Year of 2025. We provide an in-depth examination of key market drivers, emergent trends, and potential impediments, leveraging data points often measured in the millions. The report also highlights dominant market segments and geographical regions, providing actionable insights for stakeholders across the value chain.

The global Erbium Sulfate market is exhibiting a nuanced yet promising growth trajectory, driven by the increasing demand from specialized industrial applications and advancements in material science. Throughout the study period of 2019-2033, particularly observed from the historical period of 2019-2024 and projected into the estimated year of 2025, we've witnessed a consistent upward trend, albeit with fluctuations influenced by supply chain dynamics and raw material availability. A significant trend is the growing preference for higher purity grades, such as Purity 99.99% and Purity 99.999%, as technological innovation demands increasingly sophisticated materials. This shift is not merely about meeting specifications but about enabling next-generation functionalities in sectors like advanced optics and specialized ceramics. The market's resilience is further bolstered by its essential role in niche yet critical applications within the Chemical Industry and Laboratory settings, where precise formulations are paramount. The integration of Erbium Sulfate into advanced glass formulations for specific optical properties, particularly for telecommunications and laser technologies, continues to be a cornerstone of its market value. The millions of units consumed in these sectors underscore its strategic importance. Furthermore, the report anticipates an acceleration in market penetration driven by emerging technologies that are just beginning to explore the unique properties of Erbium Sulfate. The development of novel catalysts and advanced functional materials is expected to unlock new avenues for growth, adding further millions to the overall market valuation. The evolving regulatory landscape concerning rare earth elements, while presenting some challenges, is also spurring innovation in recycling and sustainable sourcing, thereby contributing to a more stable and predictable market environment for Erbium Sulfate. The interplay between these factors suggests a robust future, characterized by technological integration and sustained demand from a diverse set of industries, all contributing to market expansion measured in the millions.

The expansion of the Erbium Sulfate market is primarily propelled by the insatiable demand for high-performance materials in rapidly advancing technological sectors. The proliferation of fiber optic communication networks, a critical global infrastructure, relies heavily on Erbium-Doped Fiber Amplifiers (EDFAs), which utilize Erbium Sulfate as a key precursor. The continuous expansion of the internet, the surge in data traffic, and the ongoing deployment of 5G technology are directly translating into an increased need for more sophisticated optical components, thereby fueling the demand for high-purity Erbium Sulfate, particularly Purity 99.99% and Purity 99.999%. Beyond telecommunications, the burgeoning field of laser technology for applications ranging from medical surgery to industrial manufacturing and scientific research is another significant driver. The unique luminescent properties of Erbium ions make Erbium Sulfate an indispensable ingredient in the creation of specialized laser crystals and phosphors, contributing to market growth in the millions. Furthermore, the growing interest in advanced ceramics with unique optical and thermal properties for aerospace and defense applications is also creating new market opportunities. The inclusion of Erbium Sulfate in these ceramic matrices can impart desirable characteristics, opening up new frontiers for material innovation and consumption measured in the millions. The consistent growth in the Laboratory sector, driven by research and development activities across various scientific disciplines, also adds to the steady demand for Erbium Sulfate, as it serves as a crucial reagent and reference standard. The underlying technological progress in these diverse fields, coupled with increasing investments in research and development, creates a powerful synergistic effect that propels the Erbium Sulfate market forward.

Despite the promising growth outlook, the Erbium Sulfate market is not without its inherent challenges and restraints that could potentially impede its full potential. A significant concern revolves around the geopolitical implications and supply chain vulnerabilities associated with rare earth elements, including Erbium. The concentration of mining and refining operations in a few key countries can lead to price volatility and supply disruptions, directly impacting the availability and cost of Erbium Sulfate. Fluctuations in the prices of raw Erbium ore, driven by geopolitical tensions or changes in export policies, can create uncertainty for manufacturers and end-users, potentially slowing down market expansion. Environmental regulations surrounding the extraction and processing of rare earth minerals also pose a significant restraint. The mining and refining processes can be environmentally intensive, leading to stricter regulatory oversight and increased compliance costs for producers. This can, in turn, affect the overall cost of production and potentially limit the adoption of Erbium Sulfate in certain price-sensitive applications, even if the demand exists in the millions. The development of alternative materials or technologies that can substitute for Erbium Sulfate in specific applications, though currently limited, remains a potential long-term restraint. As research and development in material science continue to advance, innovative solutions that offer comparable or superior performance at a lower cost could emerge, posing a competitive threat. The relatively high cost of high-purity Erbium Sulfate, especially Purity 99.999%, can also be a limiting factor for widespread adoption in less demanding applications, restricting its market penetration to sectors where its unique properties are indispensable and can justify the premium price, even when considering volumes in the millions. Lastly, the complex processing requirements and specialized expertise needed for handling and producing high-quality Erbium Sulfate can create barriers to entry for new players, limiting competition and potentially influencing market dynamics.

The global Erbium Sulfate market is poised for significant growth, with certain regions and segments expected to play a dominant role. Geographically, North America and Asia Pacific are anticipated to lead the market in terms of both consumption and production throughout the forecast period (2025-2033).

North America: The region's dominance is largely attributed to its robust technological infrastructure and substantial investments in research and development. The presence of leading telecommunications companies and advanced manufacturing facilities drives a consistent demand for high-purity Erbium Sulfate for applications in optical networking, laser technologies, and specialized glass production. The strong emphasis on innovation and the adoption of cutting-edge technologies in sectors like aerospace and defense further bolster the market in this region. The demand for Purity 99.99% and Purity 99.999% grades, crucial for high-performance applications, is particularly pronounced in North America, translating into substantial market value in the millions. The presence of key players and established supply chains within the region also contributes to its leading position.

Asia Pacific: This region is set to witness the most rapid growth due to its expanding manufacturing base, increasing adoption of advanced technologies, and a growing emphasis on research and development. Countries like China, Japan, and South Korea are significant consumers and producers of Erbium Sulfate. The burgeoning electronics industry, the continuous expansion of fiber optic networks to cater to a vast population, and the growing demand for advanced materials in automotive and industrial applications are key growth drivers. The region's extensive manufacturing capabilities in areas like glass and ceramics also contribute significantly to the demand for Erbium Sulfate. The increasing affordability of Erbium Sulfate in various purity grades, including Purity 99% and Purity 99.9%, is making it accessible for a wider range of industrial applications, further boosting market penetration in the millions. Government initiatives promoting technological advancement and domestic production of critical materials are also instrumental in shaping the market landscape in Asia Pacific.

In terms of dominant segments, Type: Purity 99.99% and Purity 99.999% will exhibit the highest growth rate and command a significant market share.

Purity 99.99% and Purity 99.999%: The escalating demand for high-performance optical components, advanced lasers, and specialized electronic materials directly fuels the demand for these ultra-high purity grades. These applications, including fiber optic amplifiers and advanced scientific instruments, require stringent purity levels to ensure optimal performance and reliability. The technological advancements in telecommunications, medical devices, and scientific research are making these purity grades indispensable. Manufacturers are increasingly investing in refining processes to achieve these higher purity levels, driven by the premium prices they command and the critical nature of the end-use applications. The market value derived from these high-purity segments, measured in the millions, is expected to grow at an accelerated pace compared to lower purity grades.

Application: Glass and Ceramics: While other applications are significant, the Glass and Ceramics segments are expected to continue their strong performance. Erbium Oxide, a precursor often derived from Erbium Sulfate, is widely used to impart pink hues to glass and glazes, a niche but consistent application in decorative and architectural glass. More importantly, the use of Erbium Sulfate in the development of advanced ceramics with unique optical properties for specialized lenses, phosphors, and even solid-state lighting is a rapidly growing area. The ability of Erbium ions to exhibit specific luminescence under excitation makes them valuable in these advanced material applications, contributing to market demand in the millions. The increasing exploration of Erbium-containing ceramics for thermal barrier coatings and other high-temperature applications further solidifies its importance in this sector.

The Erbium Sulfate industry is experiencing significant growth catalysts driven by ongoing technological advancements and expanding application horizons. The relentless evolution of telecommunications, particularly the expansion of fiber optic networks and the advent of 5G, necessitates enhanced optical amplification, a key area where Erbium Sulfate plays a crucial role. Furthermore, the burgeoning demand for high-power lasers in medical, industrial, and scientific sectors, coupled with the increasing use of Erbium in advanced phosphors for displays and lighting, acts as a potent growth catalyst. Investment in research and development aimed at discovering novel applications in areas such as quantum computing and advanced imaging further promises to unlock new market opportunities, injecting millions into the industry.

This comprehensive report offers an in-depth analysis of the Erbium Sulfate market, meticulously dissecting its growth trajectory from 2019-2033. It provides a granular examination of key market drivers, including the burgeoning demand from the telecommunications sector and advancements in laser technology. The report further investigates prevailing trends, such as the increasing preference for high-purity grades, and explores the challenges and restraints that could impact market expansion. Insights into dominant regions and segments, including Purity 99.99% and Application: Glass, are thoroughly elaborated, offering a holistic view of the market landscape. Strategic recommendations and future outlooks are presented, making this report an indispensable resource for stakeholders seeking to navigate and capitalize on opportunities within the global Erbium Sulfate market, estimated in the millions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include American Elements, Ereztech, MaTecK, Chemdyes Corporation, ALB Materials Inc, ProChem, METALL RARE EARTH LIMITED, GFS Chemicals, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Erbium Sulfate," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Erbium Sulfate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.