1. What is the projected Compound Annual Growth Rate (CAGR) of the Environmental Water Testing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Environmental Water Testing

Environmental Water TestingEnvironmental Water Testing by Type (Handheld, Portable, Benchtop), by Application (Environmental, Home & Drinking Water Suppliers, Bottled Water Suppliers, Waste Water Treatment Organizations, Clinical, Hospitals, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

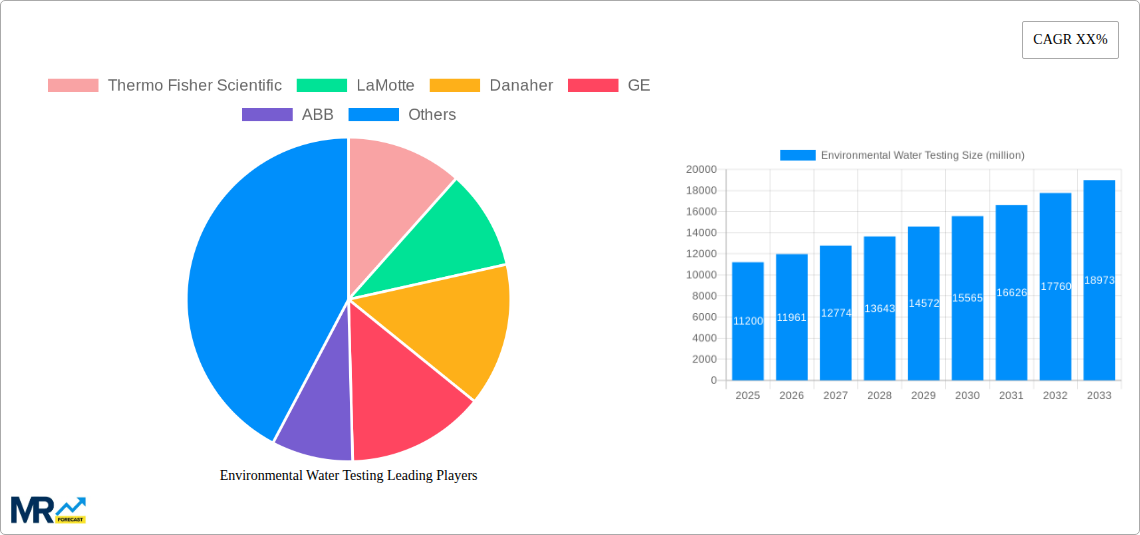

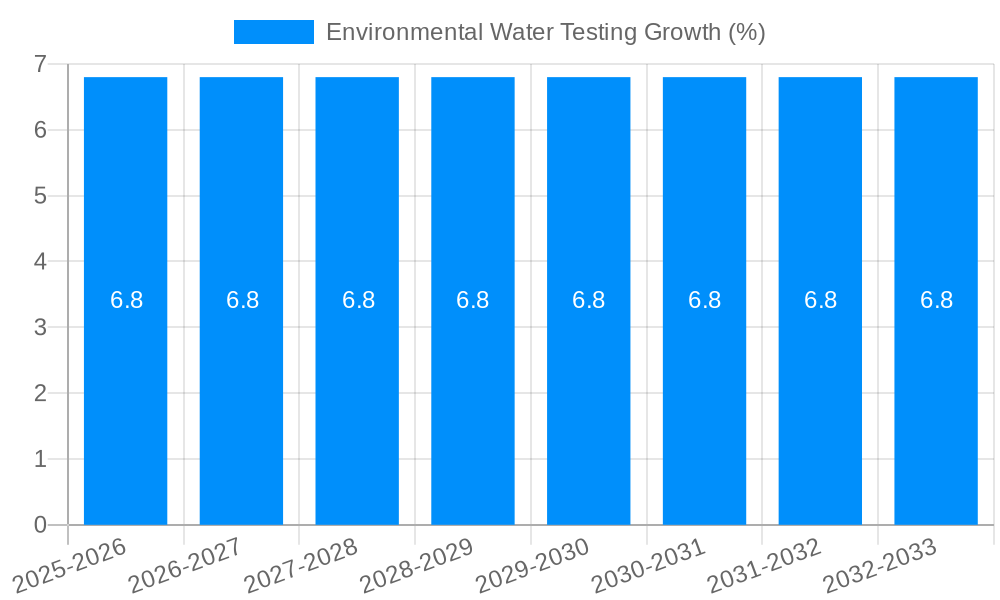

The global Environmental Water Testing market is poised for significant expansion, projected to reach approximately $11,200 million by 2025. This robust growth is fueled by an increasing awareness of water quality's impact on public health and ecosystems, coupled with stringent government regulations mandating regular water monitoring. The market is expected to witness a Compound Annual Growth Rate (CAGR) of around 6.8% during the forecast period of 2025-2033, indicating a sustained upward trajectory. Key drivers include the rising incidence of waterborne diseases, the growing industrialization leading to increased wastewater discharge, and the expanding need for safe drinking water across both developed and developing nations. Technological advancements in portable and handheld testing devices are further democratizing access to water quality analysis, making it more efficient and cost-effective for various stakeholders, from environmental agencies to individual households. The "Others" application segment, encompassing diverse industrial and research purposes, is anticipated to contribute substantially to market growth, reflecting the pervasive need for accurate water analysis across a multitude of sectors.

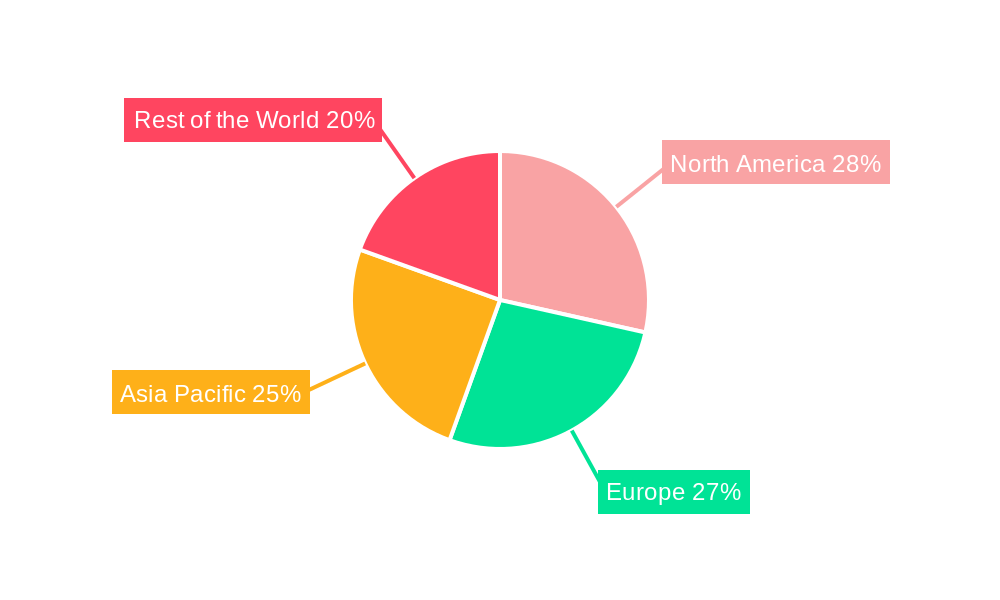

The market's expansion is also shaped by emerging trends such as the integration of IoT and AI in water quality monitoring systems, enabling real-time data analysis and predictive capabilities. This shift towards smart water management is crucial for addressing the challenges posed by climate change and increasing water scarcity. However, certain restraints, such as the high initial cost of advanced analytical instruments and the limited availability of skilled personnel in some regions, may temper the growth rate. Despite these challenges, the increasing demand from environmental protection agencies, home and drinking water suppliers, and wastewater treatment organizations underscores the critical role of environmental water testing in safeguarding public health and preserving natural resources. The Asia Pacific region, driven by rapid industrialization and growing environmental concerns in countries like China and India, is expected to emerge as a key growth engine, alongside established markets in North America and Europe.

This comprehensive report delves into the dynamic global market for Environmental Water Testing, offering a detailed analysis of trends, drivers, challenges, and opportunities. With a study period spanning from 2019 to 2033, the report utilizes 2025 as its base and estimated year, with a focused forecast period of 2025-2033, building upon a robust historical analysis of 2019-2024. The market is projected to experience significant growth, with projections indicating a market size valued in the high tens of millions for the base year and expected to surpass hundreds of millions by the end of the forecast period.

The Environmental Water Testing market is experiencing a transformative period, characterized by a heightened global awareness of water quality and its profound impact on public health and ecosystem stability. A key market insight is the increasing adoption of advanced analytical technologies. For instance, the demand for high-throughput screening solutions, capable of detecting trace contaminants at parts per million (ppm) levels, is soaring. This surge is fueled by stringent regulatory frameworks and a proactive approach by various stakeholders, from governmental bodies to private industries. The advent of IoT-enabled sensors and real-time monitoring systems is another significant trend. These devices allow for continuous data collection, providing immediate alerts on water quality anomalies and enabling rapid response mechanisms. This technological integration is projected to drive substantial market growth, with early adoption rates already demonstrating a significant upward trajectory. Furthermore, the market is witnessing a shift towards portable and handheld testing devices. These solutions offer unparalleled convenience and flexibility, enabling field-based testing with minimal infrastructure requirements. The portability trend is particularly benefiting applications in remote areas and emergency response scenarios. The cost-effectiveness and ease of use of these devices are making them increasingly accessible to a broader user base, including home users and smaller environmental consultancies. The demand for testing kits for a wider range of parameters, including emerging contaminants like microplastics and per- and polyfluoroalkyl substances (PFAs), is also on the rise. Laboratories and industries are investing heavily in solutions that can provide comprehensive analysis of these newly identified threats, ensuring compliance with evolving environmental standards. The market is also shaped by the growing demand for sustainable testing solutions, with a focus on reducing reagent consumption and minimizing waste generation. Companies are investing in the development of greener testing methodologies and the use of biodegradable materials in testing kits. This commitment to sustainability is not only driven by environmental concerns but also by the potential for cost savings in the long run. The overall market outlook is overwhelmingly positive, with a consistent upward trend in revenue and adoption rates across various segments. The increasing emphasis on water security and resource management will continue to propel the demand for reliable and accurate environmental water testing solutions throughout the forecast period.

Several powerful forces are propelling the growth of the Environmental Water Testing market. Paramount among these is the increasing global concern over water scarcity and the imperative for effective water resource management. As populations grow and climate change impacts water availability, ensuring the quality of existing water resources becomes critically important for agriculture, industry, and human consumption. Governments worldwide are responding with more stringent regulations governing water quality standards for various applications, from drinking water to industrial discharge. This regulatory push directly translates into a higher demand for accurate and reliable water testing solutions. Furthermore, the growing awareness of the health implications associated with contaminated water is a significant driver. Diseases linked to waterborne pathogens and chemical pollutants have prompted increased investment in water quality monitoring by both public health organizations and private consumers. The rise of industrial activities, including manufacturing, mining, and energy production, also contributes significantly. These sectors often generate wastewater that requires rigorous testing to comply with environmental discharge permits and minimize their ecological footprint. The burgeoning bottled water industry and the demand for safe home and drinking water also play a crucial role, creating a consistent need for quality assurance through water testing. Emerging contaminants, such as pharmaceuticals, personal care products, and microplastics, are becoming increasingly recognized as environmental threats, necessitating the development and deployment of advanced testing methodologies. This evolving threat landscape is opening new avenues for market expansion and innovation within the environmental water testing sector.

Despite the robust growth trajectory, the Environmental Water Testing market faces several significant challenges and restraints. One primary challenge is the high cost associated with advanced analytical instrumentation and consumables. While the market is moving towards more sophisticated testing, the initial investment and ongoing operational expenses can be prohibitive for smaller organizations or those operating in resource-constrained regions. This cost barrier can limit widespread adoption, particularly in developing economies. Another significant restraint is the lack of standardized testing protocols across different regions and applications. Variations in regulatory requirements and analytical methods can create complexity for manufacturers and users, hindering market harmonization and potentially leading to inconsistent results. The availability of skilled personnel trained in operating complex water testing equipment and interpreting data also presents a challenge. A shortage of qualified technicians and scientists can impede the efficient utilization of advanced technologies and slow down the overall market expansion. Furthermore, the evolving nature of contaminants and the detection of new emerging pollutants require continuous innovation and adaptation of testing methods. Staying ahead of these evolving threats demands substantial research and development investment, which can be a significant hurdle for some market players. The logistical complexities of sample collection, preservation, and transportation, especially from remote or challenging environments, can also impact the accuracy and timeliness of test results. Finally, the economic downturns and budget constraints experienced by governments and industries can lead to reduced spending on environmental monitoring programs, acting as a temporary but impactful restraint on market growth.

The Environmental Water Testing market is poised for significant dominance by specific regions and segments, driven by a confluence of regulatory emphasis, industrial activity, and technological adoption.

Key Dominating Segments:

Application: Wastewater Treatment Organizations:

Type: Portable and Handheld Devices:

Key Dominating Region/Country:

North America (United States and Canada):

Europe:

The interplay of these dominating segments and regions, driven by regulatory pressures, technological advancements, and growing environmental consciousness, will shape the landscape of the Environmental Water Testing market for the foreseeable future.

The Environmental Water Testing industry is experiencing substantial growth fueled by several key catalysts. Increasingly stringent governmental regulations worldwide, mandating higher standards for drinking water and wastewater discharge, are a primary growth engine. The growing global awareness of waterborne diseases and the long-term health impacts of contaminated water is driving demand from both public and private sectors. Furthermore, the rising tide of industrialization and agricultural activities, particularly in developing economies, generates more wastewater that requires meticulous testing to comply with environmental standards. The continuous innovation in analytical technologies, leading to more accurate, sensitive, and portable testing solutions, is also a significant catalyst, making water quality monitoring more accessible and efficient.

This report provides a comprehensive overview of the Environmental Water Testing market, offering in-depth analysis and actionable insights for stakeholders. It meticulously examines market size, growth drivers, key trends, and the competitive landscape, with a detailed forecast from 2025 to 2033. The report dissects the market by product type (handheld, portable, benchtop), application (environmental, home & drinking water suppliers, bottled water suppliers, wastewater treatment organizations, clinical, hospitals, others), and regional segmentation. It highlights the critical role of leading companies and their contributions to market evolution. Furthermore, the report delves into the impact of technological advancements and regulatory changes, providing a holistic understanding of the market's dynamics and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Thermo Fisher Scientific, LaMotte, Danaher, GE, ABB, bioMerieux, Neogen, Merck, Idexx Laboratories, Qiagen, ETR Labs, Sensafe, Eurofins, Suburban Testing Labs, WagTek Solutions, PerkinElmer, Camlab, HACH, Lovibond, Aqualytic, ThomasNet, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Environmental Water Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Environmental Water Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.