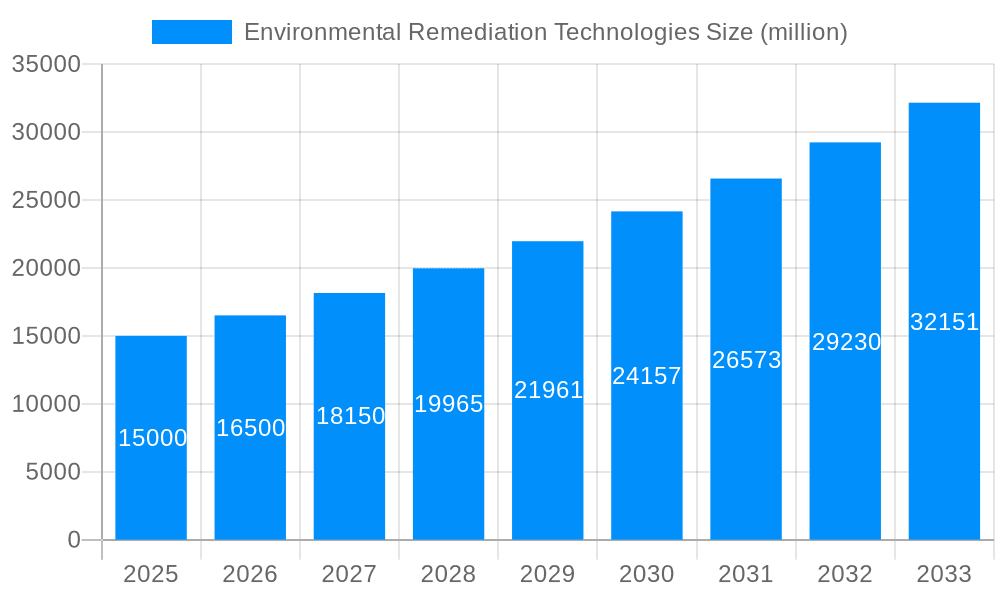

1. What is the projected Compound Annual Growth Rate (CAGR) of the Environmental Remediation Technologies?

The projected CAGR is approximately 6.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Environmental Remediation Technologies

Environmental Remediation TechnologiesEnvironmental Remediation Technologies by Type (Water Pollution, Soil Pollution, Air Pollution, Water Remediation, Soil Remediation, Sediment Remediation, Other), by Application (Oil and Gas Industry Applications, Mining and Forestry Applications, Manufacturing Industry Applications, Land Development Applications, Chemical Production/Processing Applications), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global environmental remediation technologies market is poised for significant expansion, driven by escalating industrialization, stringent environmental mandates, and heightened pollution awareness. The market is projected to reach $49,252.5 million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.9% from the base year 2025. Growth is propelled by substantial infrastructure and industrial development investments in emerging economies, particularly in the Asia-Pacific and Middle East & Africa regions, characterized by rapid urbanization and industrial growth. Innovations in bioremediation and phytoremediation are offering cost-effective, sustainable alternatives, further fueling market expansion. Key market segments include water pollution remediation, driven by the global water scarcity crisis, and soil remediation, essential for agricultural and land development needs. The Oil and Gas, Mining, and Manufacturing sectors represent major application areas.

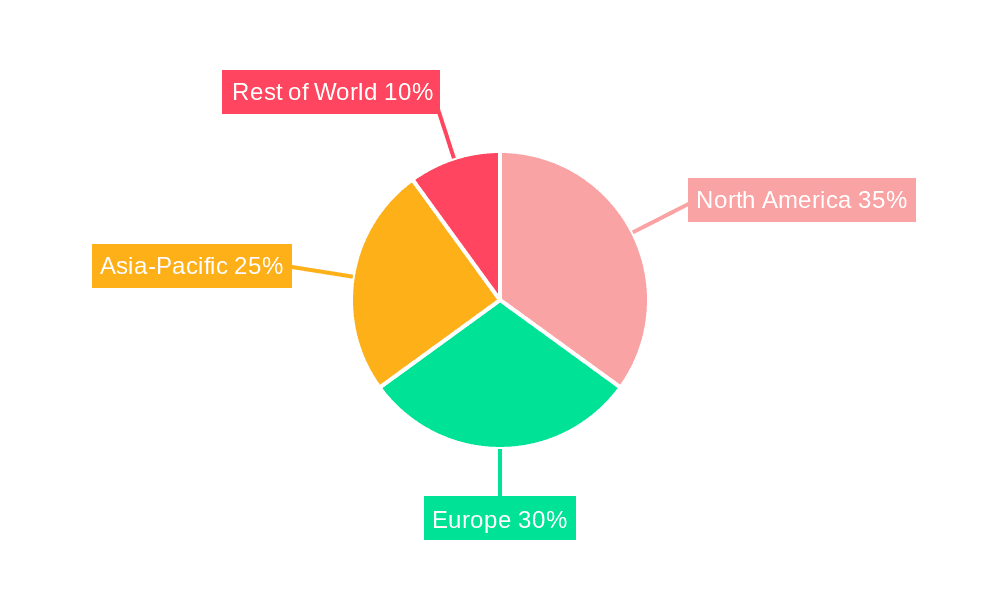

Market restraints include the high upfront costs of remediation projects, potential technological limitations in addressing complex pollutants, and protracted remediation timelines. Inconsistent regional regulatory frameworks also present adoption challenges. Nevertheless, the long-term outlook remains robust, supported by global government prioritization of environmental protection, increased R&D investment, and stricter environmental standard enforcement. The rising demand for sustainable solutions and ongoing technological advancements are expected to sustain market growth. While North America and Europe currently lead market share, the Asia-Pacific region is anticipated to exhibit the fastest growth due to accelerated industrialization and infrastructure investments.

The global environmental remediation technologies market is experiencing robust growth, projected to reach several billion USD by 2033. The historical period (2019-2024) witnessed a steady increase driven by stringent environmental regulations, heightened awareness of pollution's impact, and the rising demand for sustainable solutions across diverse industries. The estimated market value in 2025 is projected at X billion USD, indicating significant growth from the base year. The forecast period (2025-2033) anticipates continued expansion, fuelled by technological advancements, increasing government investments in remediation projects, and a growing focus on brownfield redevelopment. Specific segments like soil remediation and water remediation technologies are experiencing particularly strong demand due to the escalating issues of contaminated land and water bodies globally. The Oil and Gas industry, along with Manufacturing and Land Development sectors are major application areas driving market growth, accounting for a substantial share of the overall revenue. Furthermore, innovations in bioremediation, phytoremediation, and advanced oxidation processes are transforming the remediation landscape, offering more efficient and cost-effective solutions. This trend towards environmentally friendly and sustainable remediation methods is expected to propel the market’s growth trajectory during the forecast period. The market is witnessing a shift towards integrated remediation approaches, combining various technologies to address complex contamination scenarios more effectively. This holistic approach enhances efficiency and reduces overall remediation costs, appealing to both public and private sector clients.

Several factors are contributing to the rapid expansion of the environmental remediation technologies market. Stringent environmental regulations and policies worldwide are creating a compelling need for effective remediation solutions. Governments are imposing stricter penalties for environmental violations, incentivizing businesses to invest in remediation projects. The increasing awareness among consumers and stakeholders about the detrimental effects of pollution is another significant driver. This heightened awareness is pushing industries to adopt responsible environmental practices and invest in remediation technologies to mitigate their environmental footprint. Furthermore, the growing focus on brownfield redevelopment is creating substantial opportunities for remediation companies. Brownfield sites, often contaminated industrial or commercial areas, require extensive remediation before they can be reused, creating significant demand for remediation services and technologies. Technological advancements, leading to the development of more efficient and cost-effective remediation techniques, are also contributing to market growth. These advancements make remediation more feasible and economically viable for a wider range of applications. Finally, the rising investments in research and development by both public and private entities are furthering technological advancements and fueling market growth.

Despite the significant growth potential, the environmental remediation technologies market faces several challenges. High upfront capital costs associated with remediation projects can be a major deterrent for many businesses, particularly smaller companies. The complexity of remediation projects, particularly those involving multiple contaminants and diverse geological conditions, can increase project timelines and costs. Technological limitations exist in addressing certain types of contamination, especially complex and persistent pollutants. The need for skilled professionals in project management, engineering, and environmental science creates a workforce challenge. A shortage of qualified personnel can limit the capacity of the industry to meet the rising demand for remediation services. Furthermore, regulatory uncertainties and varying environmental regulations across different jurisdictions can complicate project planning and implementation. The lack of standardized remediation protocols and guidelines adds to these challenges, potentially leading to inconsistencies in remediation effectiveness and costs. Finally, the difficulty in assessing the long-term effectiveness of remediation efforts can pose a risk for both clients and contractors.

The North American and European regions are anticipated to dominate the environmental remediation technologies market during the forecast period due to stringent environmental regulations, significant industrial activity, and a high concentration of remediation companies. Within these regions, specific segments show significant promise:

Soil Remediation: This segment is expected to witness substantial growth driven by increasing land development projects, rising awareness of soil contamination's health impacts, and the increasing need to restore contaminated industrial sites. The remediation of sites contaminated with heavy metals, hydrocarbons, and other persistent pollutants is a key driver. The demand for innovative soil remediation technologies such as bioremediation and thermal desorption is expected to surge.

Water Remediation: Growing concerns over water pollution from industrial discharge, agricultural runoff, and other sources are fueling the demand for effective water remediation solutions. Technologies like advanced oxidation processes, membrane filtration, and bioremediation are gaining traction due to their efficiency in treating contaminated water sources. This segment is predicted to hold a substantial market share throughout the forecast period.

Oil and Gas Industry Applications: The oil and gas industry generates significant amounts of contaminated soil and water, requiring substantial remediation efforts. This segment's growth is closely tied to the expansion of oil and gas exploration and production activities globally. The demand for technologies specifically designed to remediate hydrocarbon contamination will continue to be a strong growth driver.

Manufacturing Industry Applications: Manufacturing facilities often generate hazardous waste and contaminate surrounding environments. The manufacturing sector's commitment to environmental sustainability is creating a high demand for effective remediation solutions to clean up legacy contamination and minimize future environmental impact.

In summary, the combination of stringent regulations, increased environmental awareness, and the growing number of contaminated sites, specifically in North America and Europe, positions soil and water remediation within the oil and gas and manufacturing sectors as key drivers for market dominance throughout the forecast period (2025-2033).

The environmental remediation technologies industry is experiencing significant growth fueled by increasing governmental regulations, rising environmental awareness, and technological advancements. Stringent environmental policies and liabilities associated with pollution are compelling businesses and government entities to invest in remediation projects. Furthermore, the development of innovative and cost-effective remediation technologies, such as bioremediation and phytoremediation, is making remediation more accessible and efficient, accelerating market expansion.

This report provides a detailed analysis of the environmental remediation technologies market, covering key trends, drivers, challenges, and growth opportunities. It offers insights into various segments, including water pollution, soil pollution, air pollution, and different application areas. The report also profiles leading companies in the industry, providing valuable information for stakeholders seeking to understand and participate in this rapidly evolving market. The comprehensive coverage aims to equip readers with the knowledge needed to make informed business decisions and navigate the dynamic landscape of environmental remediation technologies.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.9%.

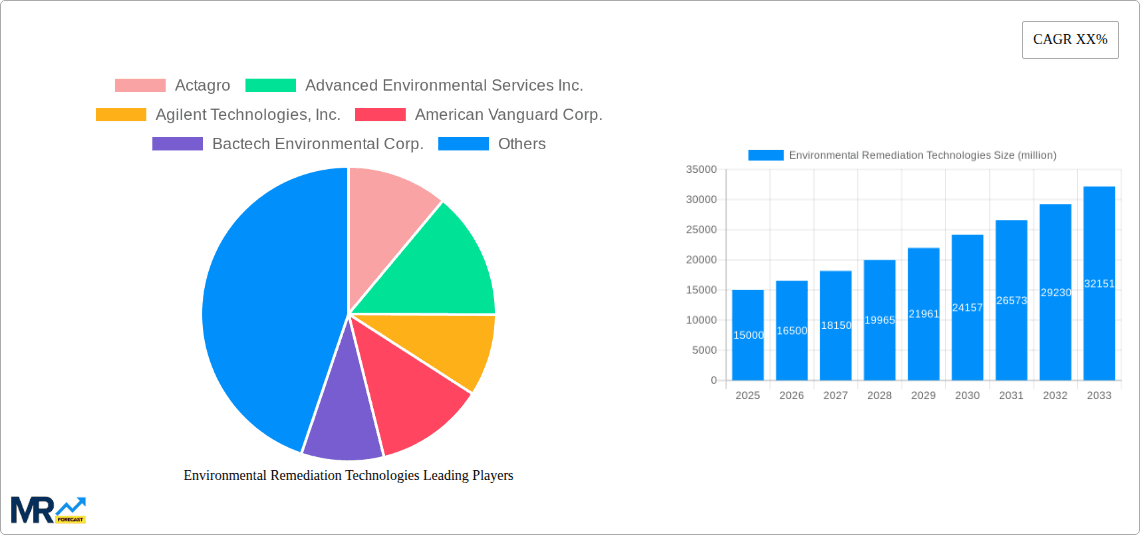

Key companies in the market include Actagro, Advanced Environmental Services Inc., Agilent Technologies, Inc., American Vanguard Corp., Bactech Environmental Corp., Bioline Agrosciences Ltd., Bristol Environmental Remediation Services Llc, Camson Bio Technologies Ltd., CBF China Bio-Fertilizers Ag, Certis Usa Llc, Ch2M Hill, Civil & Environmental Consultants, Clean Harbors Inc., Creative Water Technology Ltd., Cypher Environmental Ltd., Ecometales Ltd., Econ Industries Services Gmbh, Ecs Design Inc., EHS Associates, Geo Forward Inc., Gingko Bioworks, Groundwater Treatment & Technology Llc, Highway Environmental Response Solutions, Innovative Engineering Solutions Inc., International Rehabilitation And Soil Stabilization Services, Keramida Environmental, Inc., Koppert Biological Systems Bv, EnviroWaste Services Group Inc., Ferro Canada Inc., Metro Environmental Services Llc, Nuverra Environmental Solutions Inc., BRK Ambiental Participações S.A., Partner Engineering and Science Inc., Powercem Technologies B.V., Remedial Construction Services Lp, Romer Labs Inc., Triumvirate Environmental Inc., Water & Environmental Technologies, .

The market segments include Type, Application.

The market size is estimated to be USD 49252.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Environmental Remediation Technologies," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Environmental Remediation Technologies, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.