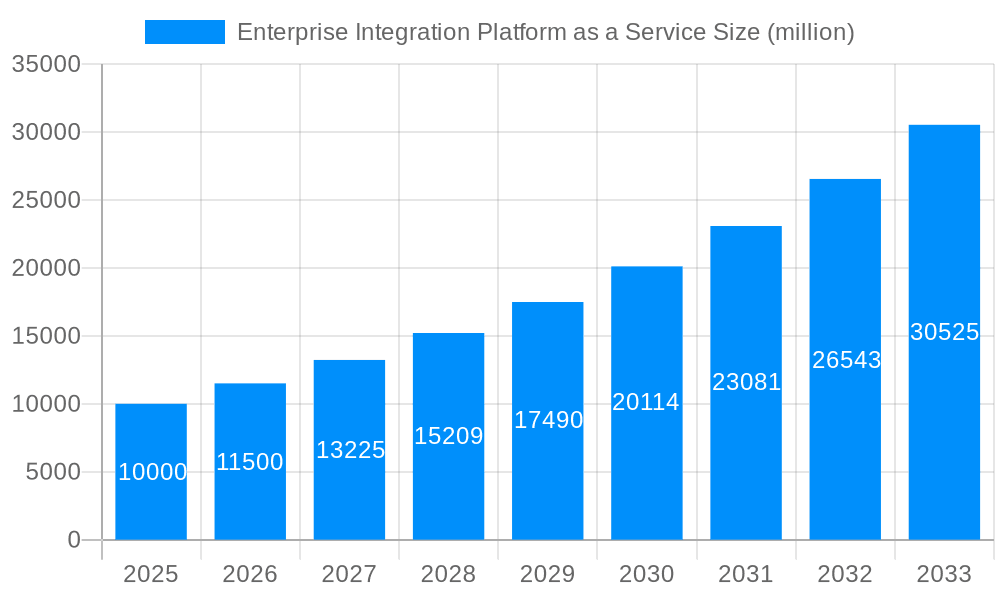

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise Integration Platform as a Service?

The projected CAGR is approximately 35.23%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Enterprise Integration Platform as a Service

Enterprise Integration Platform as a ServiceEnterprise Integration Platform as a Service by Application (SME (Small and Medium Enterprises), Large Enterprise), by Type (Monthly Subscription, Annual Subscription), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Enterprise Integration Platform as a Service (iPaaS) market is experiencing substantial growth, propelled by the widespread adoption of cloud-based applications and the critical need for seamless data integration across diverse organizational systems. Key drivers include the proliferation of hybrid and multi-cloud environments necessitating advanced integration solutions, the escalating volume and variety of business data requiring efficient management, and a clear shift towards agile, subscription-based models over traditional on-premise software. Both Small and Medium-sized Enterprises (SMEs) and large enterprises are rapidly embracing iPaaS for its scalability, cost-effectiveness, and ability to streamline complex processes and boost operational efficiency. Market segmentation includes deployment types (monthly vs. annual subscriptions) and organizational size, with annual subscriptions demonstrating higher average revenue per user (ARPU). Leading vendors are spearheading innovation through ongoing product development and strategic alliances, fostering a competitive and dynamic market landscape. Despite initial implementation considerations and integration complexities, the enduring benefits of improved operational efficiency, reduced IT infrastructure expenditure, and enhanced data visibility are fueling widespread market adoption.

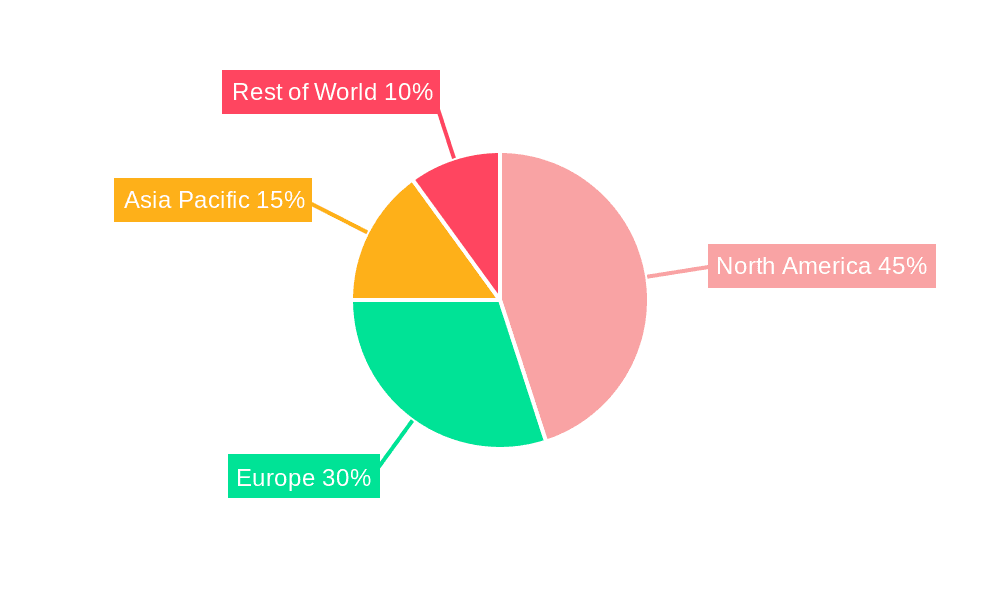

The Enterprise Integration Platform as a Service (iPaaS) market is projected for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 35.23%. With an estimated market size of $17.55 billion in the base year 2025, the market is anticipated to reach approximately $30 Billion by 2033. Geographically, North America and Europe currently dominate market presence, while the Asia-Pacific region presents considerable growth potential. The market is characterized by intense competition, yet offers substantial opportunities for both established vendors and emerging startups. The integration of automation, artificial intelligence (AI), and machine learning (ML) within iPaaS solutions is a significant trend that will continue to drive market innovation, delivering more intelligent and efficient integration capabilities.

The Enterprise Integration Platform as a Service (iPaaS) market is experiencing explosive growth, projected to reach USD 75 billion by 2033, a significant leap from its valuation in 2025. This robust expansion is fueled by several key factors. Firstly, the increasing adoption of cloud-based technologies across diverse industries is driving the demand for seamless integration of applications and data residing in disparate systems. Businesses are realizing the immense benefits of connecting their cloud applications, on-premise systems, and legacy infrastructure for improved operational efficiency and data-driven decision making. Secondly, the surge in data volume and the need for real-time data processing are pushing organizations towards iPaaS solutions. These platforms offer robust capabilities to manage and process vast amounts of data from various sources, enabling faster insights and improved business agility. The rise of APIs and microservices architecture also significantly contributes to iPaaS adoption. Organizations are embracing these modern architectural patterns to build modular and flexible applications, and iPaaS solutions become crucial for connecting these microservices efficiently. The shift towards a digital-first business model, accelerated by the pandemic, has further amplified the demand for iPaaS. Businesses are relying on these solutions to optimize their digital operations, improve customer experience, and drive innovation across their value chains. Finally, the increasing availability of pre-built connectors and easy-to-use interfaces lowers the entry barrier for smaller enterprises, enabling broader market penetration. The overall trend demonstrates a consistent upward trajectory for the iPaaS market, driven by the need for greater efficiency, agility, and connectivity in the modern business landscape.

Several key factors are accelerating the adoption of Enterprise Integration Platform as a Service (iPaaS) solutions. The shift towards cloud computing is a primary driver, with organizations migrating applications and data to the cloud at an unprecedented pace. iPaaS platforms provide the necessary integration capabilities to connect cloud-based applications and services seamlessly, regardless of their location or vendor. Furthermore, the growing complexity of IT landscapes is another significant factor. Businesses are grappling with a myriad of applications, databases, and legacy systems, often spread across different departments and locations. iPaaS simplifies this complexity by providing a centralized platform for managing and integrating these disparate systems. The demand for real-time data integration is also propelling the market's growth. Businesses need access to real-time data from various sources to support timely decision-making and respond quickly to changing market conditions. iPaaS platforms deliver the speed and agility required for real-time integration, providing organizations with a competitive edge. Lastly, the increasing focus on digital transformation and business process automation is further fueling the adoption of iPaaS. Organizations are leveraging these platforms to streamline their operations, improve efficiency, and create more agile and responsive processes across their business functions. These factors collectively contribute to a robust and sustainable growth trajectory for the iPaaS market.

Despite the significant growth potential, several challenges hinder the widespread adoption of iPaaS solutions. Security concerns remain a major obstacle, with organizations hesitant to entrust sensitive data to cloud-based platforms. Addressing these security concerns through robust security measures and compliance certifications is crucial for building trust and overcoming this barrier. Data integration complexity can also pose a significant challenge, particularly for organizations with highly complex and diverse IT landscapes. Integrating legacy systems and dealing with inconsistent data formats require considerable expertise and effort, potentially leading to project delays and cost overruns. The lack of skilled personnel capable of designing, implementing, and maintaining iPaaS solutions is another major hurdle. Organizations need to invest in training and development programs to build internal expertise or rely on external consultants, leading to higher implementation costs. Furthermore, vendor lock-in is a concern for many organizations, as migrating from one iPaaS platform to another can be a complex and expensive process. Selecting a vendor that offers open standards and interoperability is vital to avoid this pitfall. Finally, cost considerations can be a barrier to entry, particularly for smaller organizations with limited budgets. The upfront investment in software licenses, implementation services, and ongoing maintenance can be substantial. Addressing these challenges requires a multi-pronged approach, involving the development of robust security measures, improved integration tools, skilled workforce development, and a focus on vendor interoperability.

The North American market is projected to dominate the Enterprise Integration Platform as a Service market throughout the forecast period (2025-2033), driven by the high adoption rate of cloud technologies and the presence of major technology players in the region. Within North America, the US alone is estimated to contribute USD 40 billion to the overall market value by 2033. Europe follows as a significant regional market, showcasing considerable growth potential. However, the large enterprise segment will drive the majority of revenue, owing to their substantial IT infrastructure and complex integration needs. This segment is estimated to account for over 60% of the overall market value by 2033, surpassing USD 45 billion.

Large Enterprise Segment Dominance: Large enterprises typically have more complex IT infrastructure and require more sophisticated integration solutions. This segment represents a larger revenue pool, with yearly subscription contracts further contributing to consistent revenue streams. Their higher budget allocation for IT investments allows them to easily adopt and integrate advanced iPaaS features, facilitating significant returns on investment. The need for seamless connectivity between their varied applications, both on-premise and cloud-based, makes iPaaS a critical component of their digital transformation strategies. Their investment in maintaining established infrastructure and integrating new solutions drives a consistent market demand.

Annual Subscription Model's Influence: The annual subscription model is gaining traction as it offers businesses greater cost predictability and long-term stability. While monthly subscriptions offer flexibility, annual contracts guarantee higher recurring revenue for iPaaS providers, enabling sustained market growth and consistent investment in R&D. Annual contracts provide vendors with a more stable revenue stream and allows for better long-term planning and investment in product development and customer support, ultimately leading to a more mature and reliable iPaaS market.

The iPaaS market's expansion is further fueled by increasing government initiatives promoting digital transformation, fostering a favorable environment for technology adoption. Additionally, the growing emphasis on data security and compliance drives the demand for robust iPaaS solutions that comply with industry standards and regulations, ensuring data protection and compliance. The rising adoption of APIs and microservices architecture, coupled with the increasing availability of pre-built connectors, simplifies the integration process, making iPaaS more accessible to smaller businesses and accelerating market growth.

This report provides a comprehensive overview of the Enterprise Integration Platform as a Service market, offering detailed insights into market trends, growth drivers, challenges, and key players. It includes a detailed analysis of various market segments, including application (SME, Large Enterprise), subscription type (monthly, annual), and geographical regions. The report also presents market forecasts for the period 2025-2033, enabling businesses to make informed decisions about their iPaaS investments and strategies. The in-depth analysis and detailed projections make this report an invaluable resource for stakeholders across the iPaaS ecosystem.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 35.23% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 35.23%.

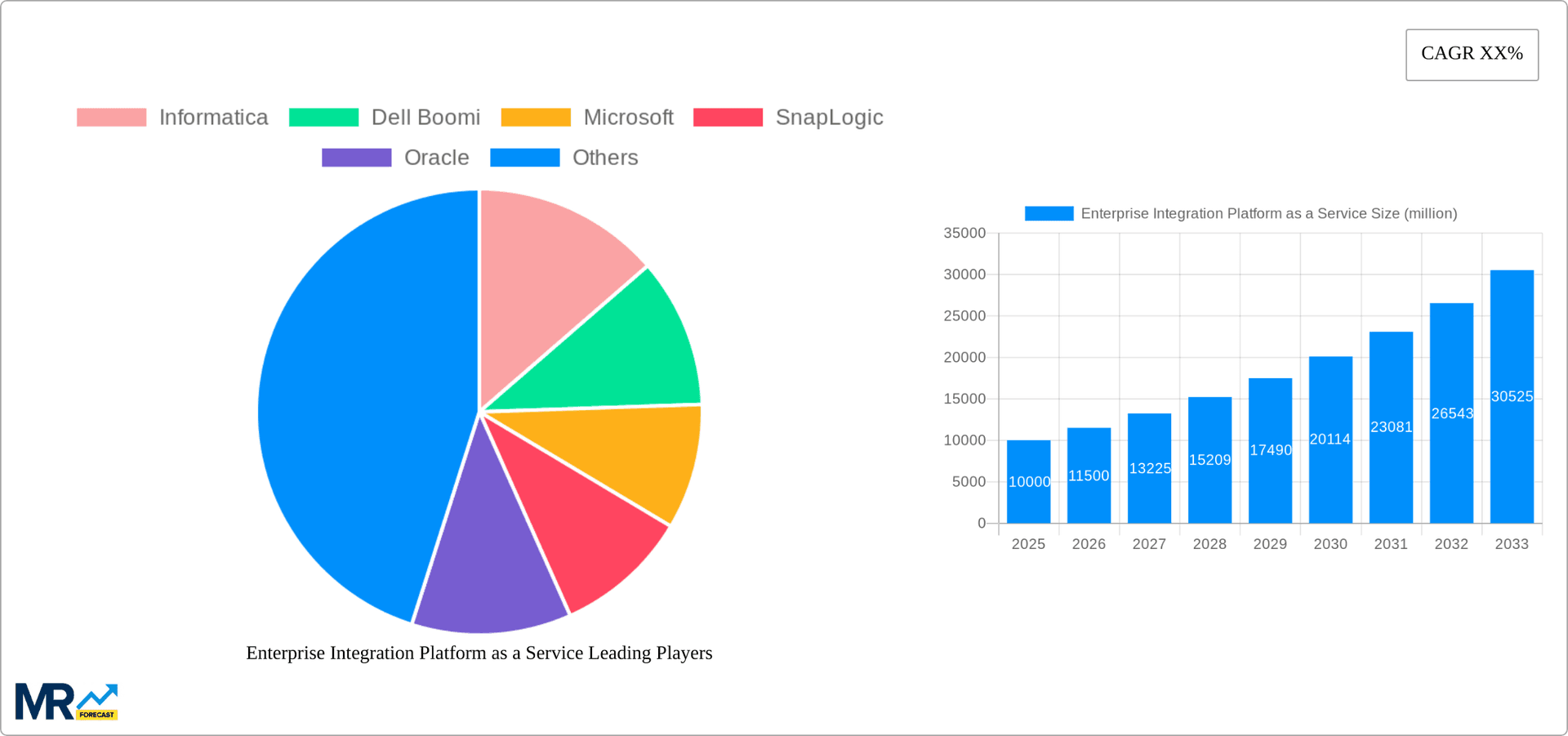

Key companies in the market include Informatica, Dell Boomi, Microsoft, SnapLogic, Oracle, Mulesoft, Jitterbit, Okta (Azuqua), Celigo, SAP, TIBCO Software, Justransform, IBM, WSO2, Moskitos, Software AG (Built.io), Talend, Amazon Web Services (AWS), Perspectium Corporation, Stamplay, .

The market segments include Application, Type.

The market size is estimated to be USD 17.55 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Enterprise Integration Platform as a Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Enterprise Integration Platform as a Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.