1. What is the projected Compound Annual Growth Rate (CAGR) of the Engine for Construction Machinery?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Engine for Construction Machinery

Engine for Construction MachineryEngine for Construction Machinery by Type (Below 100kW, 100-300kW, 300-500kW, Above 500kW), by Application (Excavation Machinery, Earth-moving Machinery, Lifting Machinery, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

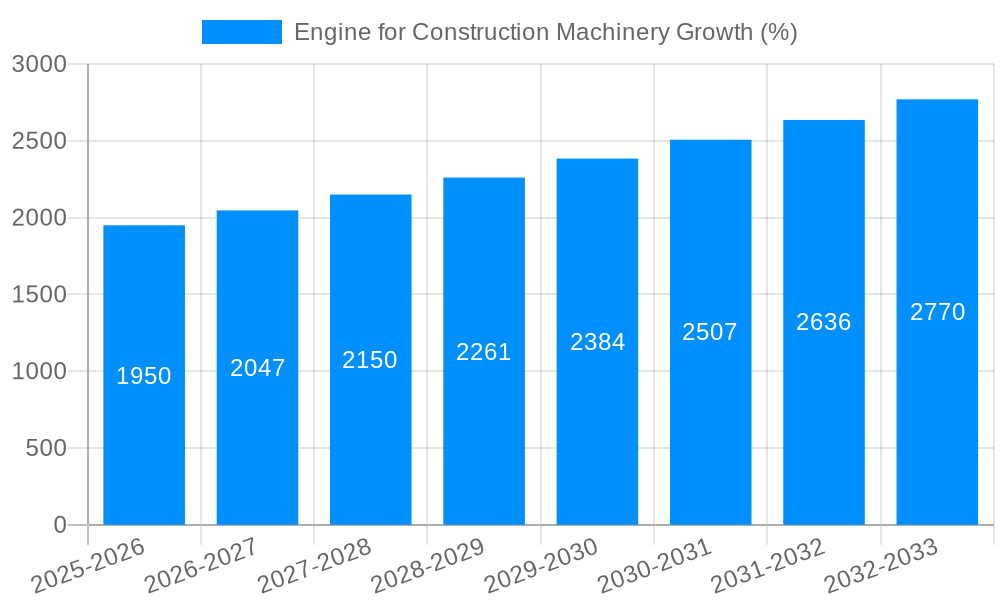

The global market for engines designed for construction machinery is poised for robust expansion, driven by increasing infrastructure development projects worldwide and the subsequent demand for advanced, efficient construction equipment. The market is estimated to be valued at approximately $35,000 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of around 5.5% throughout the forecast period of 2025-2033. This significant growth is primarily fueled by the ongoing urbanization initiatives in emerging economies, the need to upgrade aging infrastructure in developed regions, and the adoption of modern construction techniques that necessitate powerful and reliable machinery. Technological advancements, including the development of more fuel-efficient engines, emission-compliant powertrains, and the integration of smart technologies for performance monitoring, are also playing a crucial role in shaping market dynamics. The increasing emphasis on sustainability and stricter environmental regulations are pushing manufacturers towards producing cleaner and more environmentally friendly engine solutions, which in turn, creates opportunities for innovation and market penetration.

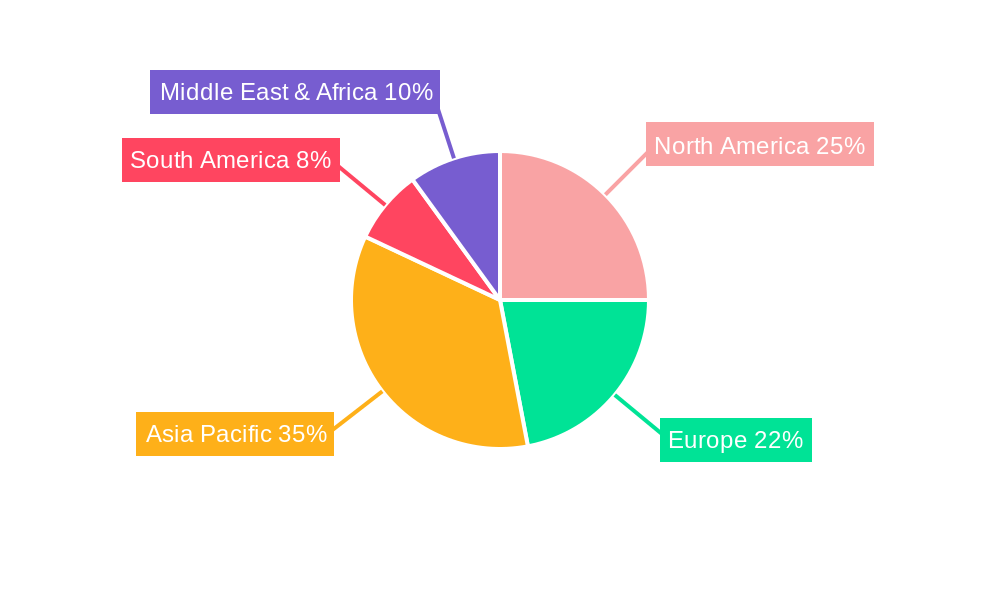

The market is segmented by engine type and application, with a notable concentration in the 100-300kW and 300-500kW power categories, catering to the most common construction machinery like excavators and earth-moving equipment. Asia Pacific, particularly China and India, is expected to lead the market growth due to massive ongoing construction activities and government investments in infrastructure. North America and Europe, while mature markets, will continue to contribute significantly through technological advancements and the replacement of older fleets with more efficient models. Key players such as Cummins, MAN Engines, FPT Industrial, DEUTZ, and Weichai are actively investing in research and development to offer innovative solutions, including hybrid and electric powertrains, to meet evolving industry demands and environmental standards. Despite the positive outlook, factors such as fluctuating raw material costs for engine manufacturing and the potential slowdown in certain construction sectors due to economic uncertainties could pose challenges to sustained high growth.

This report offers an in-depth analysis of the global Engine for Construction Machinery market, providing crucial insights for stakeholders and strategic decision-makers. The study encompasses a comprehensive historical review from 2019 to 2024, with a detailed examination of the market in the base year of 2025 and a forward-looking forecast extending to 2033. The analysis delves into key market dynamics, including evolving trends, driving forces, prevailing challenges, dominant market segments, and the strategic landscape of leading manufacturers.

The Engine for Construction Machinery market is undergoing a significant transformation driven by a confluence of technological advancements, regulatory pressures, and shifting industry demands. A key insight is the escalating demand for electrification and hybrid powertrains, particularly in regions with stringent emission standards. While internal combustion engines (ICE) continue to hold a substantial market share, their dominance is gradually eroding as manufacturers invest heavily in research and development for alternative propulsion systems. The report highlights the growing preference for fuel-efficient and low-emission engines, which is directly impacting product development and R&D strategies. The increasing emphasis on digitalization and smart technologies within construction machinery is also influencing engine design, with a focus on integrated telematics, predictive maintenance capabilities, and remote monitoring features. This trend is not only enhancing operational efficiency but also contributing to a better understanding of engine performance and lifecycle management. Furthermore, the market is witnessing a paradigm shift towards modular and versatile engine platforms, allowing for greater adaptability across different machinery types and power requirements. This approach minimizes manufacturing costs and accelerates time-to-market for new models. The integration of advanced materials and innovative manufacturing techniques is also playing a pivotal role in enhancing engine durability, reducing weight, and improving overall performance. The report underscores the growing importance of aftermarket services and support, as the longevity and reliability of engines are paramount in the demanding construction environment. As the industry embraces sustainability, there is a palpable trend towards the adoption of biofuels and alternative fuels, though their widespread adoption is still in its nascent stages and dependent on infrastructure development and cost-effectiveness. The market is also characterized by a growing consolidation among players and strategic partnerships aimed at leveraging expertise and expanding market reach. The influence of global economic factors, infrastructure development projects, and evolving construction practices will continue to shape the trajectory of this dynamic market throughout the forecast period.

The global Engine for Construction Machinery market is experiencing robust growth, propelled by several compelling factors. Foremost among these is the unprecedented surge in global infrastructure development. Governments worldwide are channeling substantial investments into upgrading existing infrastructure and building new projects, ranging from transportation networks and energy facilities to urban development and housing. This directly translates into an increased demand for a diverse range of construction machinery, consequently driving the need for reliable and powerful engines. Furthermore, the continuous technological innovation in construction machinery is a significant propellant. As manufacturers strive to enhance productivity, efficiency, and operator comfort, they are demanding more advanced and specialized engines. This includes engines that offer higher power density, improved fuel economy, reduced emissions, and integrated smart technologies for better performance monitoring and diagnostics. The growing emphasis on sustainability and environmental regulations is also acting as a powerful catalyst. Increasingly stringent emission standards, such as Euro V and Tier 4, are compelling manufacturers to develop cleaner and more fuel-efficient engines, pushing the adoption of technologies like selective catalytic reduction (SCR) and diesel particulate filters (DPF). This also fuels the demand for research into alternative powertrains, including electric and hybrid options, which are gaining traction in specific applications. The increasing adoption of automation and digitalization in construction indirectly fuels engine demand as modern, digitally integrated machinery requires sophisticated engine management systems. Finally, the need for machinery replacement and upgrades as older equipment reaches its end-of-life, coupled with the expansion of construction activities in emerging economies, provides a sustained demand for new engines.

Despite the positive growth trajectory, the Engine for Construction Machinery market is not without its hurdles. A significant challenge is the increasingly stringent emission regulations across various regions. Manufacturers face mounting pressure to comply with evolving standards, which necessitates substantial investments in research and development to create cleaner and more efficient engine technologies. This can lead to higher production costs and potentially impact the affordability of machinery. Another considerable restraint is the volatility in raw material prices, particularly for metals like steel, aluminum, and rare earth elements used in engine manufacturing. Fluctuations in these prices can impact profitability and create uncertainty in production planning. The growing interest and development in alternative powertrains, particularly electric and hybrid systems, while a future opportunity, also presents a challenge for traditional ICE manufacturers. The transition requires significant capital investment in new technologies and manufacturing capabilities, and the widespread adoption is dependent on factors like charging infrastructure availability and battery technology advancements. Furthermore, the global economic uncertainties and geopolitical tensions can disrupt supply chains, impact construction project timelines, and consequently dampen demand for construction machinery and their engines. The skilled labor shortage within the manufacturing sector, particularly for specialized engine technicians and engineers, can also pose a challenge to efficient production and innovation. Finally, the high initial cost of advanced and eco-friendly engines can be a deterrent for some end-users, especially in price-sensitive markets or for smaller construction firms, thus slowing down their adoption rate.

The global Engine for Construction Machinery market is projected to witness significant dominance from both specific geographical regions and particular product segments, driven by distinct economic and developmental factors. Asia Pacific, particularly China, is expected to emerge as a dominant region due to its massive ongoing infrastructure development projects and a burgeoning construction industry. The sheer scale of urbanization, coupled with government initiatives to boost domestic manufacturing, fuels a substantial demand for construction machinery and, consequently, their engines. Countries like India and Southeast Asian nations also contribute significantly to this regional dominance through their own infrastructure expansion plans.

Within the segmentation by Type, the 100-300kW power range is anticipated to command a substantial market share. This segment caters to a wide array of commonly used construction equipment, including mid-sized excavators, loaders, and dozers, which are essential for a broad spectrum of construction activities. The versatility and widespread applicability of machinery in this power category make it a consistent driver of engine demand.

In terms of application, Excavation Machinery is poised to be a key segment driving market growth. Excavators are indispensable tools in almost every construction project, from large-scale civil engineering works and mining operations to smaller urban developments and utility installations. The continuous innovation in excavator technology, leading to more powerful and efficient models, directly translates into a higher demand for robust and advanced engines within this application.

The dominance of these segments is further reinforced by several contributing factors:

Therefore, the synergy between the robust infrastructure development in Asia Pacific, the widespread utility of machinery in the 100-300kW power range, and the indispensable role of excavators in construction activities positions these segments and regions for significant market dominance.

The Engine for Construction Machinery industry is experiencing several significant growth catalysts. The accelerated pace of global infrastructure development, driven by government initiatives and population growth, is a primary driver. Increased urbanization and the need for modern transportation networks, utilities, and housing projects directly translate into higher demand for construction equipment and their engines. Furthermore, technological advancements leading to enhanced efficiency and reduced emissions are creating new market opportunities. The development of more fuel-efficient engines and the gradual integration of hybrid and electric powertrains cater to evolving environmental regulations and customer preferences. The growing adoption of smart technologies and telematics in construction machinery allows for better engine performance monitoring, predictive maintenance, and optimized fuel consumption, further boosting the value proposition of modern engines. Finally, emerging economies opening up new construction frontiers provide a sustained demand for a wide array of construction equipment.

This report offers a holistic and granular examination of the global Engine for Construction Machinery market from 2019 to 2033. It meticulously dissects market trends, identifying the pivotal shift towards electrification and digitalization. The report delves into the principal driving forces, such as global infrastructure development and technological innovation, while also acknowledging the significant challenges posed by evolving emission regulations and raw material price volatility. Detailed regional analysis highlights the anticipated dominance of Asia Pacific, driven by robust infrastructure projects. Furthermore, the report strategically identifies key product segments and applications, such as the 100-300kW power range and Excavation Machinery, expected to lead market growth. It provides an exhaustive list of leading players and outlines significant past and future developments, offering a comprehensive understanding of the market's trajectory and future potential. This detailed coverage empowers stakeholders with actionable insights for strategic planning and investment decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cummins, MAN Engines, FPT Industrial, DEUTZ, Yanmar, Kubota, Hitachi, Honda, Volvo Group, Perkins Engines, DEEC, Weichai, Dongfeng Chaoyang Diesel, Yuchai, Deere, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Engine for Construction Machinery," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Engine for Construction Machinery, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.