1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Cigarette and Tobacco Vapor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electronic Cigarette and Tobacco Vapor

Electronic Cigarette and Tobacco VaporElectronic Cigarette and Tobacco Vapor by Type (Electronic Cigarette, Tobacco Vapor), by Application (Online Distribution Channel, Retail Distribution Channel, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

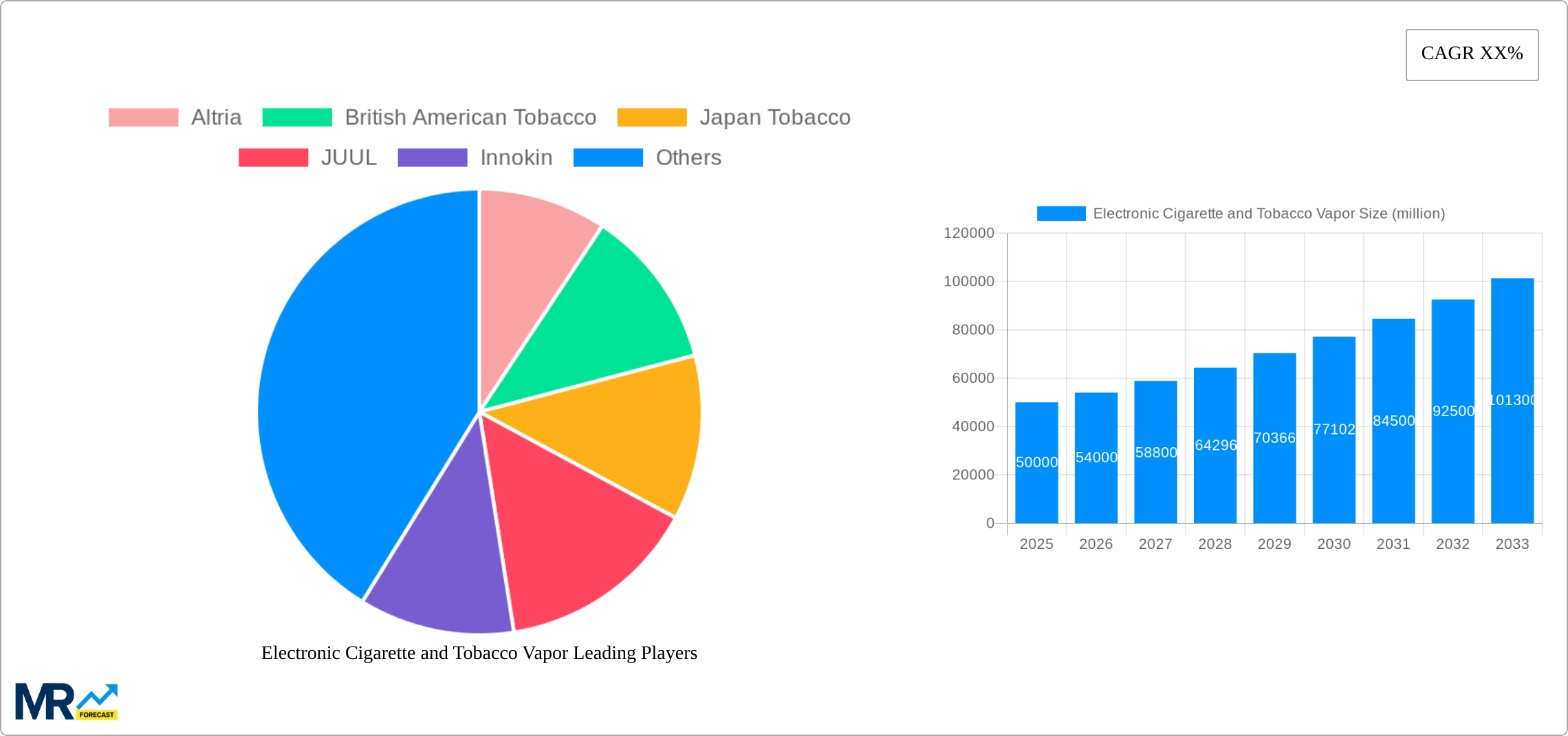

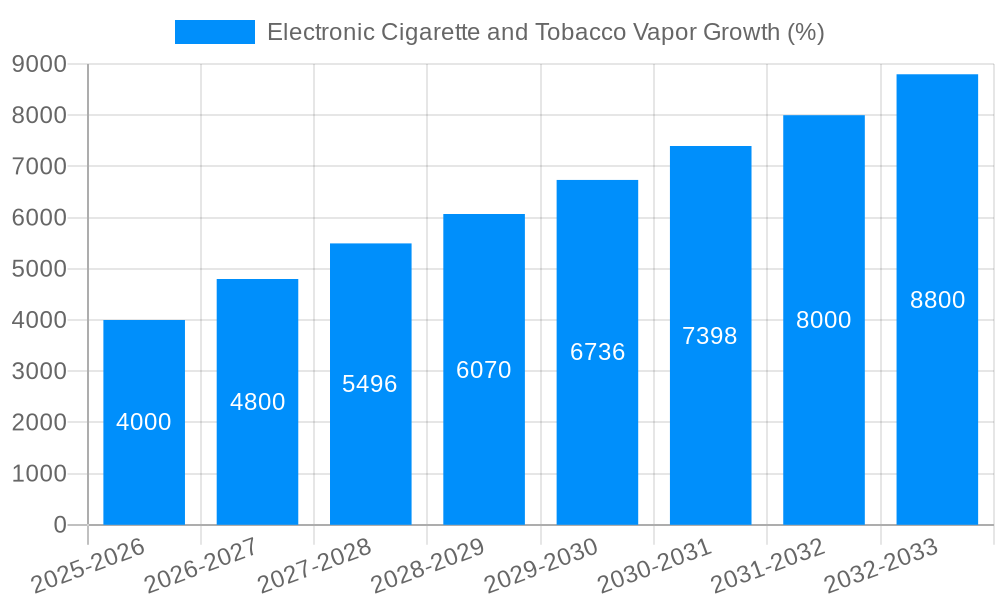

The global electronic cigarette and tobacco vapor market is experiencing robust growth, driven by increasing awareness of smoking cessation alternatives and a shift towards vaping among younger demographics. While precise figures for market size and CAGR are unavailable, industry analyses suggest a substantial market value (let's conservatively estimate a 2025 market size of $50 billion) with a compound annual growth rate (CAGR) fluctuating between 8% and 12% over the forecast period (2025-2033). This growth is fueled by several key drivers: the rising prevalence of smoking-related illnesses globally, increasing government regulations aimed at curbing traditional cigarette use, and the continuous innovation in vaping technology resulting in more appealing and safer alternatives. The market is segmented by product type (electronic cigarettes and tobacco vapor) and distribution channel (online and retail). Online channels are experiencing significant growth due to convenience and accessibility. Major players in the market include Altria, British American Tobacco, Japan Tobacco, JUUL, Innokin, Nicopure Labs, and Philip Morris, who are actively engaged in product diversification, market expansion, and strategic acquisitions to consolidate their positions. Geographical expansion is also a significant trend, with North America and Europe currently dominating the market. However, rapidly growing economies in Asia-Pacific are expected to contribute significantly to overall market expansion during the forecast period. Regulatory challenges concerning vaping products' safety and marketing remain a key restraint, posing a significant hurdle for market growth in certain regions.

The market's future trajectory is likely to be shaped by several evolving trends. The development and adoption of newer vaping technologies, such as heated tobacco products, offer opportunities for market expansion. Increased regulatory scrutiny is pushing manufacturers to develop innovative vaping solutions with reduced health risks. Furthermore, the emerging preference for customized vaping experiences is likely to drive personalized product offerings. The market also shows potential for growth through innovative product development and strategic partnerships, especially in emerging markets. The long-term sustainability of this market will depend on balancing economic growth with responsible regulation to mitigate health concerns while accommodating consumer demand for alternative nicotine consumption methods.

The electronic cigarette and tobacco vapor market experienced a period of explosive growth followed by a period of market correction and stabilization during the historical period (2019-2024). Initially fueled by the perception of reduced harm compared to traditional cigarettes and innovative product designs, the market saw unit sales in the hundreds of millions. However, increasing regulatory scrutiny, public health concerns surrounding vaping-related lung illnesses, and shifting consumer preferences have led to a more nuanced market landscape. While the overall market is not experiencing the hyper-growth of its early years, it remains a significant sector with continued sales in the tens of millions of units annually. The estimated year (2025) shows a stabilization, with a projected forecast (2025-2033) indicating modest but consistent growth, driven by evolving product innovations (e.g., heated tobacco products, advanced e-liquid formulations), a focus on harm reduction strategies by some manufacturers, and the ongoing segmentation of the market. The market is increasingly characterized by a shift towards higher-quality, regulated products and a greater emphasis on consumer safety and transparency. The transition is away from the early days' unregulated market dominated by small, independent brands towards a more consolidated landscape where larger multinational players increasingly hold significant market share. This trend is particularly evident in the retail distribution channel, where established tobacco companies leverage their extensive distribution networks. Online distribution, while experiencing some regulatory challenges, continues to be a vital sales channel, particularly for niche products and brands focusing on specific consumer demographics. Overall, the market exhibits a maturing trend, moving away from rapid expansion towards a sustainable and regulated growth trajectory.

Several factors are driving the continued growth of the electronic cigarette and tobacco vapor market, albeit at a more measured pace than previously observed. The persistent desire among smokers to quit or reduce their cigarette consumption remains a key driver. Electronic cigarettes and vapor products are marketed as less harmful alternatives, although this claim remains subject to ongoing scientific debate and regulatory oversight. The continuous innovation in product design and technology plays a crucial role. New devices, e-liquids with diverse flavor profiles, and heated tobacco products offer consumers a wider range of choices, catering to varying preferences and nicotine levels. Furthermore, the aggressive marketing and established distribution networks of major tobacco companies like Altria, British American Tobacco, and Philip Morris are significantly influencing market penetration and brand recognition. These established players bring substantial resources to bear on product development, marketing, and distribution, thereby shaping the market’s trajectory. Finally, the relative affordability of e-cigarettes and vaping products compared to traditional cigarettes is a contributing factor, particularly in certain socioeconomic demographics.

Despite the market’s continued existence, several significant challenges and restraints hinder its growth. Stringent regulations imposed by governments worldwide represent a major hurdle. These regulations often include restrictions on advertising, flavor bans, and limitations on nicotine strength, directly impacting product availability and market expansion. Public health concerns, particularly those linked to vaping-related lung illnesses, have led to negative media coverage and public skepticism, impacting consumer confidence and potentially slowing down adoption rates. The ongoing scientific debate surrounding the long-term health effects of vaping adds to this uncertainty. Furthermore, the rise of counterfeit and unregulated products poses a substantial risk, undermining consumer trust and potentially leading to health hazards. Competition among a large number of brands, both established and emerging, creates a highly fragmented market, leading to price wars and making it difficult for individual companies to gain a dominant market share. Finally, inconsistencies in regulatory frameworks across different countries create challenges for global manufacturers and distributors in achieving seamless market access and maintaining uniform operational standards.

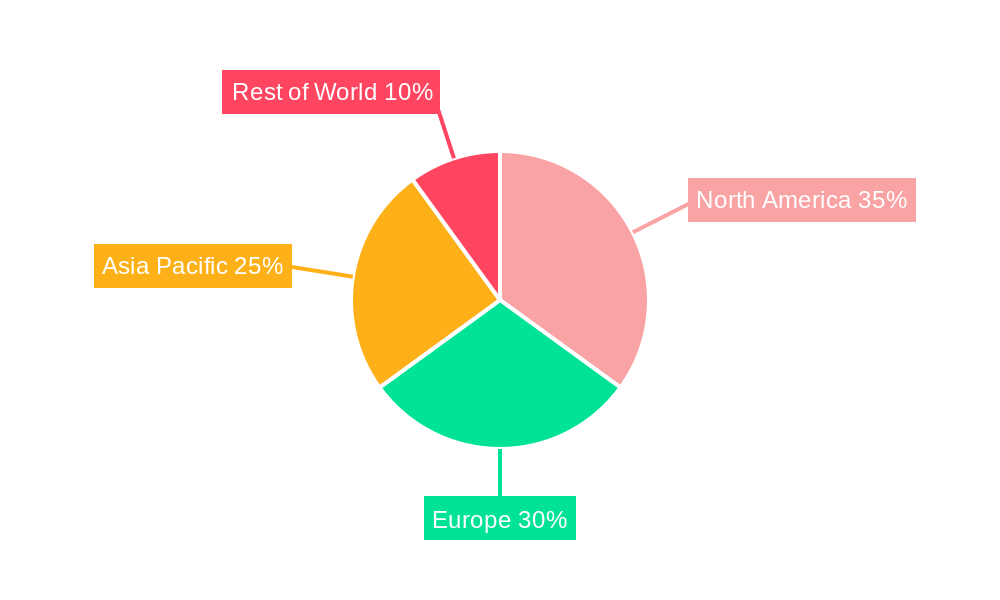

The market is geographically diverse, with significant regional variations in adoption rates, regulatory landscapes, and consumer preferences. However, several key regions and segments demonstrate potential for strong growth during the forecast period (2025-2033).

Retail Distribution Channel: This segment is expected to retain its dominance, largely due to the established distribution networks of major tobacco companies and the convenience it offers to consumers. The sheer volume of sales handled through traditional retail outlets (convenience stores, supermarkets, tobacco shops) significantly outweighs other channels. This dominance is expected to continue, albeit with an increasing presence of online retailers offering a wider product selection and potentially disrupting the established order to a limited extent. The established players will continue to be pivotal in maintaining the dominance of this segment by leveraging existing supply chains and brand loyalty.

North America and Europe: These regions represent mature markets with significant existing consumer bases and robust regulatory frameworks (though differing significantly between countries within both regions). While growth may not be as explosive as in some emerging markets, the sheer size of these markets and the established consumer habits contribute significantly to the overall global sales volume. The higher disposable incomes in these developed markets sustain higher purchase rates. While certain countries within these regions have seen increased restrictions, the overall mature market nature means that they'll remain key players in global sales. The established base of vapers provides continued sales and replacement products for these established regions.

Electronic Cigarettes: While heated tobacco products are gaining traction, electronic cigarettes are expected to remain the largest segment within the type category. This is largely due to the established consumer base, the relative affordability, and the wide variety of available devices and e-liquids. However, the segment will continue to be impacted by regulations impacting flavors and nicotine strengths. The product category itself, however, is predicted to remain a major contributor to the overall market due to its established market dominance.

In summary, while the retail distribution channel is currently dominant, the interplay between regional variations and product type will continue to shape the market's trajectory. The dominance of retail will probably persist, with other channels playing a supporting role. The Electronic Cigarette type, despite regulations, is likely to continue leading in overall sales.

Several factors will act as growth catalysts for the industry during the forecast period. Further product innovation, particularly in areas like reduced-harm technology and improved flavor delivery systems, will attract new consumers and retain existing ones. Continued marketing efforts by major tobacco companies, focusing on harm reduction messaging and diverse product offerings, will increase market penetration. The gradual acceptance and standardization of regulations across different regions will create a more stable and predictable market environment, encouraging investment and innovation. Finally, increasing consumer awareness of the relative risks and benefits of vaping compared to traditional cigarettes, based on evolving scientific understanding, will drive informed consumer choices.

This report provides a comprehensive overview of the electronic cigarette and tobacco vapor market, including detailed analysis of market trends, driving forces, challenges, and key players. It offers valuable insights into the evolving regulatory landscape, consumer preferences, and future growth prospects for the industry. The report includes detailed forecasts for unit sales in the millions, broken down by region, segment, and product type, providing actionable intelligence for stakeholders across the value chain. The study combines qualitative analysis with quantitative data, offering a well-rounded perspective on this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Altria, British American Tobacco, Japan Tobacco, JUUL, Innokin, Nicopure Labs, Philip Morris, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Electronic Cigarette and Tobacco Vapor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electronic Cigarette and Tobacco Vapor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.