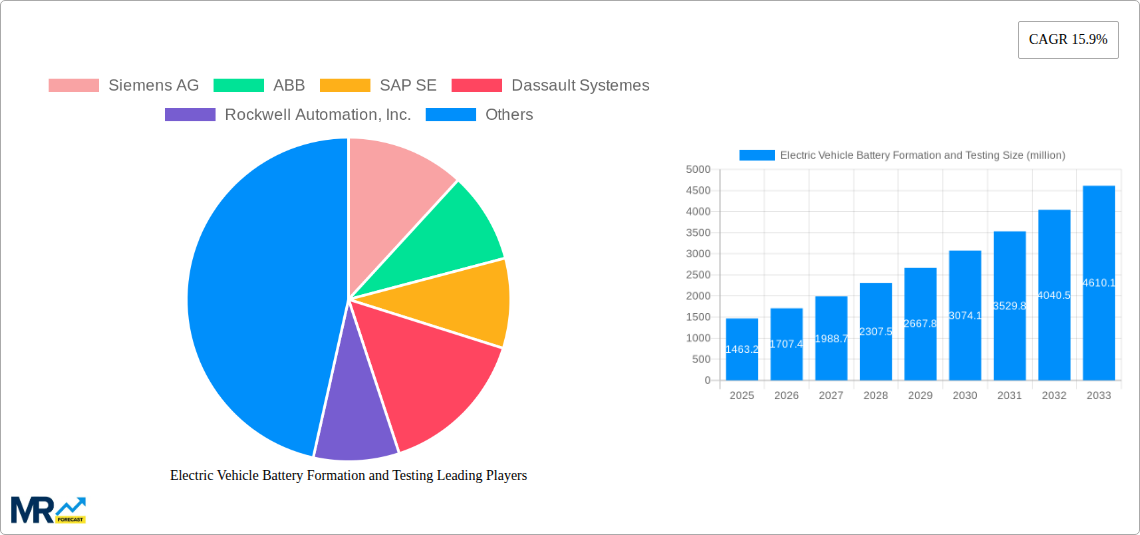

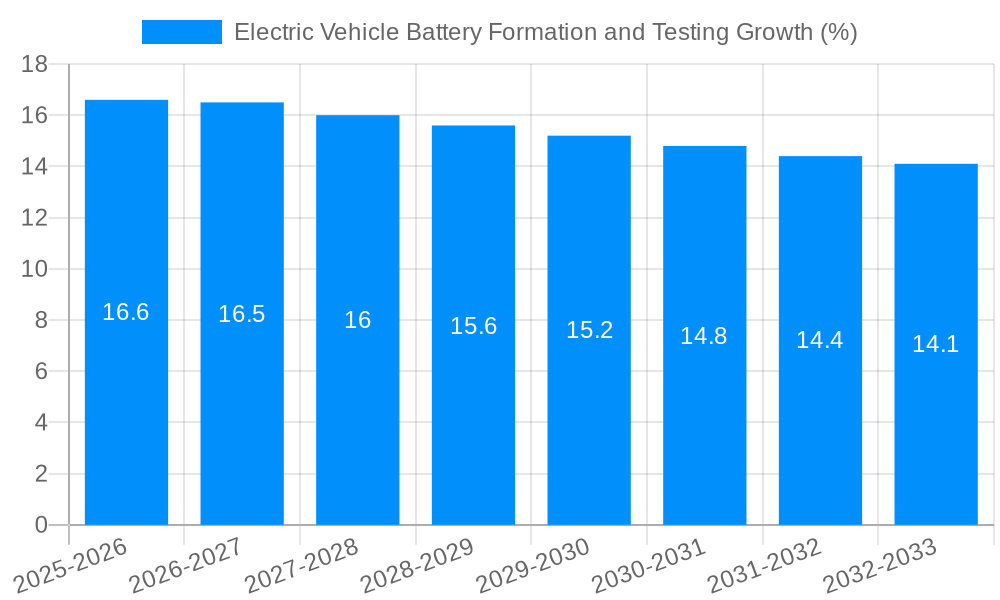

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Battery Formation and Testing?

The projected CAGR is approximately 15.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electric Vehicle Battery Formation and Testing

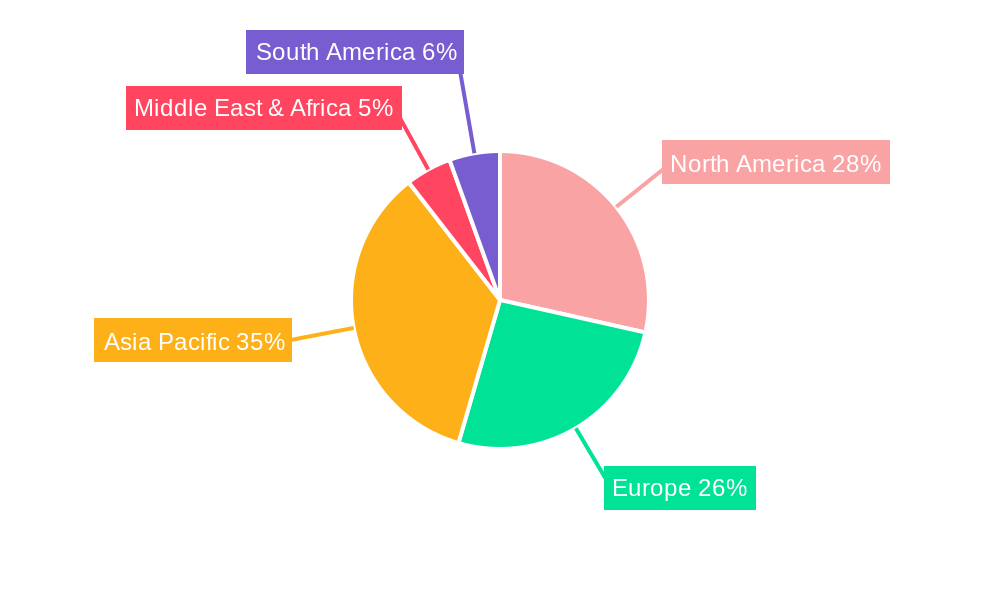

Electric Vehicle Battery Formation and TestingElectric Vehicle Battery Formation and Testing by Type (Mechanical Tests, Thermal Tests, Electrical Tests, Others), by Application (Passenger Car, Commercial Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Electric Vehicle (EV) Battery Formation and Testing market is poised for substantial growth, projected to reach \$1463.2 million by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 15.9% through 2033. This robust expansion is primarily fueled by the accelerating global adoption of electric vehicles, spurred by government initiatives, environmental concerns, and advancements in battery technology. The increasing demand for reliable and high-performance EV batteries necessitates sophisticated formation and testing processes to ensure safety, longevity, and optimal performance. Key drivers include the burgeoning passenger car segment, which accounts for a significant portion of EV sales, and the growing commercial vehicle sector's transition towards electrification. The market is segmented into Mechanical, Thermal, and Electrical Tests, with Electrical tests playing a critical role in validating battery functionality and safety.

Further insights reveal that the market's trajectory is shaped by a dynamic interplay of technological innovation and evolving industry standards. Trends such as the integration of artificial intelligence (AI) and machine learning (ML) in testing protocols, the development of advanced battery management systems (BMS), and the increasing focus on battery recycling and second-life applications are setting new benchmarks. While the market is characterized by intense competition and a growing number of specialized players, including industry giants like Siemens AG, ABB, and SAP SE, as well as prominent testing service providers like TUV SUD and Element Materials Technology, certain restraints may emerge. These could include the high initial investment required for sophisticated testing infrastructure and the continuous need for skilled personnel to operate and interpret complex data. Nevertheless, the overarching demand for safer, more efficient, and sustainable EV battery solutions will continue to propel this market forward.

Here's a unique report description on Electric Vehicle Battery Formation and Testing, incorporating your specified elements:

The global electric vehicle (EV) battery formation and testing market is experiencing an unprecedented surge, driven by the accelerating adoption of electric mobility across passenger cars, commercial vehicles, and increasingly, industrial applications. This report delves into the critical trends shaping this dynamic landscape between 2019-2033, with a robust Base Year analysis in 2025 and an Estimated Year projection for 2025, followed by a comprehensive Forecast Period of 2025-2033, building upon Historical Period data from 2019-2024. The sheer volume of batteries being manufactured necessitates highly efficient and accurate formation and testing processes. Market insights reveal that the demand for advanced testing solutions, capable of ensuring battery safety, longevity, and optimal performance, is paramount. Innovations in automated testing platforms and data analytics are transforming production lines, allowing manufacturers to achieve higher throughput while maintaining stringent quality control. The escalating battery energy densities and chemistries, from traditional lithium-ion to emerging solid-state technologies, present unique formation challenges that are being met with sophisticated electrochemical profiling and advanced diagnostics. Furthermore, the increasing focus on battery lifecycle management and second-life applications is driving the need for comprehensive testing protocols that can assess degradation and remaining useful life. The market is also witnessing a significant push towards standardization of testing procedures, fostering interoperability and enabling faster R&D cycles. The integration of artificial intelligence (AI) and machine learning (ML) in the testing process is revolutionizing anomaly detection and predictive maintenance, minimizing costly recalls and enhancing consumer confidence. The projected market valuation, expected to reach well over 500 million units in sales of testing equipment and services by 2033, underscores the immense opportunities and the strategic importance of this sector. The evolving regulatory landscape, with stricter safety and performance mandates, further reinforces the demand for cutting-edge formation and testing solutions, pushing companies to invest heavily in research and development.

The exponential growth of the electric vehicle market is the undeniable primary driver for the EV battery formation and testing sector. As governments worldwide implement ambitious targets for EV adoption and emissions reduction, the demand for batteries has surged beyond initial projections. This surge translates directly into a need for mass production of high-quality batteries, making formation and testing indispensable steps in the manufacturing process. Advanced battery chemistries and designs, while offering improved energy density and charging speeds, introduce complexities that necessitate sophisticated formation techniques to unlock their full potential and ensure stability. Simultaneously, the increasing emphasis on battery safety and reliability, driven by high-profile incidents and consumer concerns, has elevated the importance of rigorous testing throughout the entire battery lifecycle. This includes not only initial formation but also performance validation and end-of-life assessments. Furthermore, the drive towards cost reduction in EV manufacturing puts pressure on battery producers to optimize their formation and testing processes for efficiency and speed. Technological advancements in testing equipment, such as high-speed cyclers, impedance spectroscopy, and non-destructive evaluation methods, are enabling faster and more accurate assessments, contributing to higher production yields and lower manufacturing costs. The growing maturity of the EV market is also leading to greater scrutiny from regulatory bodies and standardization organizations, pushing for more stringent and harmonized testing protocols.

Despite the robust growth, the EV battery formation and testing sector faces several significant challenges. One of the foremost is the rapid evolution of battery technology. New materials, cell designs, and manufacturing processes emerge continuously, requiring constant adaptation and reinvestment in testing equipment and methodologies. Keeping pace with these advancements, especially the transition to next-generation chemistries like solid-state batteries, demands considerable R&D efforts and can lead to obsolescence of existing infrastructure. The sheer scale of battery production, projected to reach hundreds of million units annually, presents a logistical and financial hurdle. Establishing and maintaining high-capacity formation and testing facilities requires substantial capital investment. Furthermore, the complexity of modern battery systems, with intricate thermal management and battery management systems (BMS), adds layers of difficulty to testing protocols. Ensuring the reliability and repeatability of formation processes across diverse manufacturing sites and battery suppliers is another challenge. Data management and analysis also pose significant hurdles, as the vast amounts of data generated during formation and testing require sophisticated systems for processing, interpretation, and actionable insights, particularly for predictive maintenance and quality control. Supply chain disruptions, affecting the availability of specialized components and raw materials for testing equipment, can also impede market growth.

Regions and Countries:

Asia-Pacific: This region, particularly China, is poised for dominance in the EV battery formation and testing market due to its established leadership in EV manufacturing and battery production. China's massive domestic EV market, coupled with its role as a global supplier of batteries, fuels an insatiable demand for advanced formation and testing solutions. The presence of major battery manufacturers and a robust automotive supply chain further solidifies its position. Countries like South Korea and Japan, with their pioneering battery technologies and strong automotive sectors, also contribute significantly to the region's market share. The extensive industrial infrastructure and government support for the EV ecosystem in these nations create a fertile ground for market expansion, projected to account for over 70% of the global market by 2033.

Europe: With ambitious decarbonization goals and substantial government incentives for EV adoption, Europe is a rapidly growing market for battery formation and testing. Germany, France, and the UK are at the forefront, driven by their established automotive industries and significant investments in battery gigafactories. The emphasis on localized battery production and supply chain resilience further bolsters this region's importance.

North America: The US, in particular, is experiencing a strong resurgence in EV manufacturing and battery production, spurred by government policies and increasing consumer demand. Investments in gigafactories and R&D are driving the need for sophisticated formation and testing capabilities.

Segments:

Electrical Tests: Within the "Type" segment, Electrical Tests are projected to dominate the EV battery formation and testing market, accounting for a significant portion of the projected hundreds of millions in revenue. This dominance stems from the fundamental need to assess battery performance characteristics like capacity, impedance, cycle life, and charge/discharge efficiency. These tests are crucial for verifying that batteries meet stringent performance specifications and ensuring their longevity and reliability. Advanced electrical testing techniques, including impedance spectroscopy, pulse testing, and high-speed cycling, are becoming increasingly sophisticated to capture nuanced battery behaviors and identify potential defects early in the formation process. The growing complexity of battery management systems (BMS) also necessitates extensive electrical testing to ensure seamless integration and optimal operation. As battery chemistries become more diverse, the demand for versatile and highly accurate electrical testing solutions will only intensify.

Application: Passenger Car: The Passenger Car application segment will continue to be the leading driver of demand for EV battery formation and testing. The sheer volume of passenger EVs being produced globally far surpasses other applications, directly translating into a massive requirement for battery formation and testing services. As consumer adoption of EVs accelerates, driven by environmental concerns, government incentives, and improving vehicle performance and range, the production of batteries for passenger cars will remain at the forefront. The stringent safety and performance expectations for passenger vehicles necessitate rigorous testing to ensure occupant safety and a positive ownership experience. Manufacturers are heavily investing in scalable and efficient formation and testing lines to meet this demand, aiming to produce millions of high-quality batteries annually. The continuous innovation in passenger EV battery technology, including higher energy densities and faster charging capabilities, further propels the need for advanced and specialized testing solutions within this segment.

Several key factors are catalyzing significant growth in the EV battery formation and testing industry. The accelerating global shift towards electric mobility, driven by environmental regulations and consumer preference, is the most potent catalyst. This surge in EV sales directly translates to a massive and growing demand for batteries, consequently increasing the need for their formation and testing. Furthermore, advancements in battery technology, such as higher energy densities and faster charging capabilities, necessitate more sophisticated and precise formation and testing processes to unlock their full potential and ensure safety. The increasing focus on battery safety and reliability, driven by regulatory bodies and consumer awareness, mandates rigorous testing protocols. Investments in gigafactories and the expansion of battery manufacturing capacity worldwide are also creating substantial opportunities for equipment and service providers.

This comprehensive report offers an in-depth analysis of the global electric vehicle battery formation and testing market, spanning from 2019 to 2033, with a detailed Base Year analysis in 2025 and an Estimated Year projection for the same year, followed by an extensive Forecast Period of 2025-2033, building upon Historical Period data from 2019-2024. The report meticulously examines key market insights, including market size (in millions of units for equipment and services), segmentation by test type (Mechanical Tests, Thermal Tests, Electrical Tests, Others), application (Passenger Car, Commercial Vehicle, Industry), and region. It delves into the driving forces, challenges, and restraints impacting the market, identifying dominant regions and segments. Furthermore, it highlights growth catalysts, profiles leading players like Siemens AG, ABB, and SAP SE, and details significant developments and future projections, providing a holistic view of this critical sector for stakeholders in the rapidly evolving EV ecosystem.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15.9%.

Key companies in the market include Siemens AG, ABB, SAP SE, Dassault Systemes, Rockwell Automation, Inc., General Electric, AVEVA Group Limited, Tulip Batteries, TUV SUD, Cognex Corporation, Emerson Electric Co., Infineon Technologies AG, Analog Devices, Inc., HORIBA, Ltd., Element Materials Technology, .

The market segments include Type, Application.

The market size is estimated to be USD 1463.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Electric Vehicle Battery Formation and Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electric Vehicle Battery Formation and Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.