1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Truck-Mounted Concrete Line Pump?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electric Truck-Mounted Concrete Line Pump

Electric Truck-Mounted Concrete Line PumpElectric Truck-Mounted Concrete Line Pump by Type (Power-sharing Typee Fuel Truck-Mounted Concrete Line Pump, Power-separation Type Type Fuel Truck-Mounted Concrete Line Pump, World Electric Truck-Mounted Concrete Line Pump Production ), by Application (Productive Building, Nonproductive Building, World Electric Truck-Mounted Concrete Line Pump Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

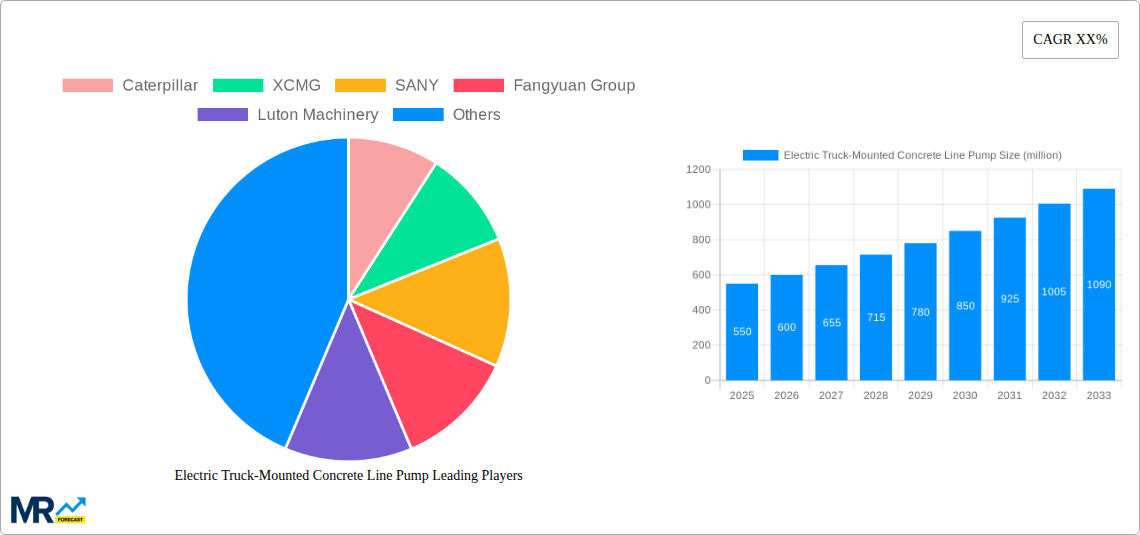

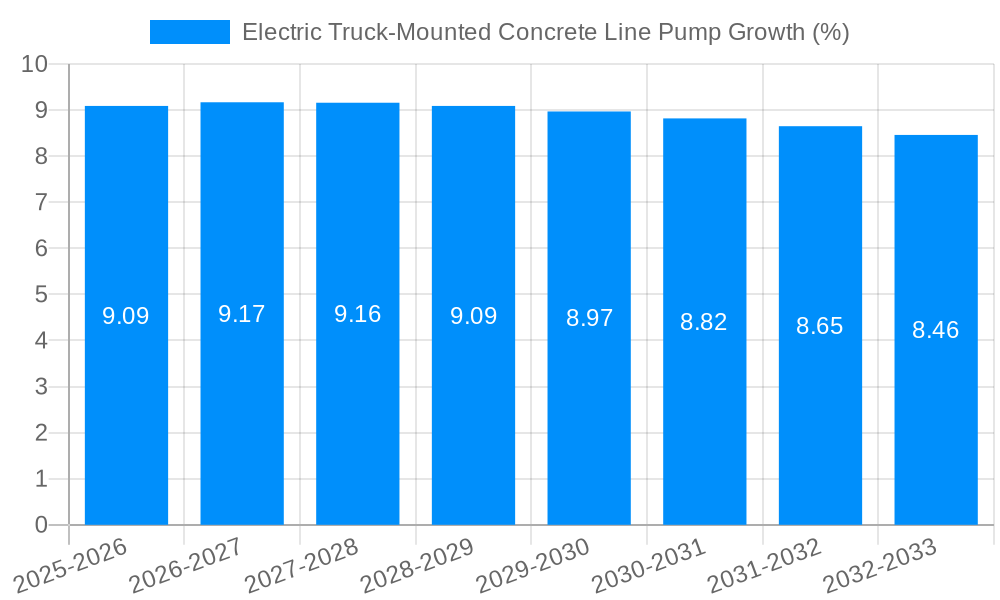

The global Electric Truck-Mounted Concrete Line Pump market is poised for significant expansion, driven by increasing urbanization, robust infrastructure development, and a growing emphasis on sustainable construction practices. While specific market size and CAGR figures are not provided, industry trends suggest a substantial market value likely in the hundreds of millions, with a projected Compound Annual Growth Rate (CAGR) in the high single digits, potentially ranging from 8% to 12%. This growth is primarily fueled by the escalating demand for efficient and eco-friendly concrete placement solutions in productive building projects, such as residential complexes, commercial centers, and industrial facilities, as well as non-productive construction like roads and bridges. The increasing adoption of electric vehicles across various sectors, including construction, further bolsters the demand for electric truck-mounted concrete line pumps, offering reduced emissions, lower operating costs, and quieter operation compared to their diesel counterparts. Key market players like Caterpillar, XCMG, and SANY are at the forefront of innovation, developing advanced electric models to meet evolving customer needs and stringent environmental regulations.

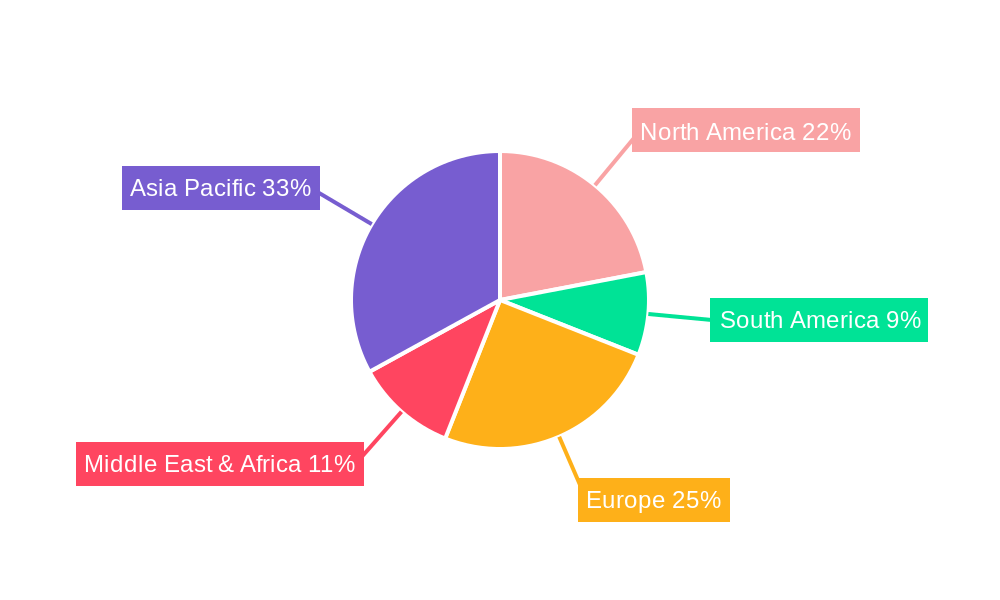

Geographically, Asia Pacific, led by China and India, is expected to dominate the market due to rapid industrialization and large-scale infrastructure projects. North America and Europe are also significant markets, driven by technological advancements, stringent emission standards, and a focus on green building initiatives. The market is segmented by type into Power-sharing Type and Power-separation Type Fuel Truck-Mounted Concrete Line Pumps, with both offering distinct advantages in terms of operational efficiency and power management. While the market enjoys strong growth drivers, potential restraints include the higher initial cost of electric pumps compared to traditional models and the availability of charging infrastructure. However, the long-term benefits of reduced operational expenditure and environmental advantages are expected to outweigh these initial challenges, paving the way for sustained market growth. The forecast period from 2025 to 2033 indicates a trajectory of consistent and accelerated adoption of electric truck-mounted concrete line pumps.

Here's a unique report description for "Electric Truck-Mounted Concrete Line Pump," incorporating the provided details and aiming for a comprehensive overview.

The global electric truck-mounted concrete line pump market is on an upward trajectory, driven by a confluence of technological advancements, environmental regulations, and evolving construction practices. XXX, a leading market research firm, projects significant growth in this sector, with production anticipated to reach approximately 35 million units by 2033. The study period, spanning 2019-2033, with a base and estimated year of 2025, highlights a clear shift towards electrification in the construction equipment industry. Key insights reveal that the increasing focus on sustainability and reducing carbon footprints at construction sites is a primary catalyst. Governments worldwide are implementing stricter emission standards, pushing manufacturers to develop and adopt cleaner alternatives. Electric concrete pumps, in particular, offer a compelling solution by eliminating tailpipe emissions, thereby improving air quality in urban environments and creating healthier working conditions for operators. Furthermore, the operational cost advantages, stemming from lower energy consumption and reduced maintenance needs compared to their diesel-powered counterparts, are becoming increasingly attractive to construction firms. The base year 2025 marks a crucial point where the market is expected to see accelerated adoption rates. The forecast period 2025-2033 indicates a sustained and robust expansion, fueled by ongoing research and development in battery technology, charging infrastructure, and overall pump efficiency. The historical period 2019-2024 laid the groundwork for this growth, witnessing initial market entries and gradual consumer acceptance. The demand for electric concrete line pumps is being further bolstered by the growing trend of modular construction and prefabrication, which often require more precise and efficient concrete placement solutions. The market is also characterized by a growing emphasis on smart features, including remote monitoring, GPS tracking, and advanced control systems, enhancing operational productivity and safety.

The surge in demand for electric truck-mounted concrete line pumps is propelled by a multifaceted set of drivers, primarily centered around environmental consciousness and economic viability. Increasingly stringent government regulations worldwide concerning emissions and noise pollution are a significant impetus. As urban areas grapple with air quality issues and strive for greener infrastructure development, the appeal of zero-emission construction equipment like electric concrete pumps becomes undeniable. This regulatory push compels manufacturers and end-users to invest in sustainable technologies. Beyond environmental mandates, the economic advantages are substantial. While the initial investment for electric models might be higher, the total cost of ownership is demonstrably lower due to reduced fuel expenses (electricity is generally cheaper than diesel), significantly less maintenance required (fewer moving parts in electric powertrains), and the potential for longer operational lifespans. Furthermore, the growing global focus on corporate social responsibility and sustainable building practices is influencing purchasing decisions. Companies are actively seeking to align their operations with environmental goals, and adopting electric construction machinery serves as a visible commitment to these principles. The technological advancements in battery technology are also playing a crucial role, offering longer runtimes, faster charging capabilities, and improved power output, making electric pumps a more practical and reliable option for demanding construction applications.

Despite the promising growth trajectory, the electric truck-mounted concrete line pump market faces several critical challenges and restraints that could temper its expansion. A primary hurdle remains the initial capital investment. Electric concrete pumps, with their advanced battery systems and specialized electric drivetrains, often carry a higher upfront cost compared to their traditional diesel-powered counterparts. This can be a significant deterrent for smaller construction companies or those with tight project budgets. Secondly, the availability and infrastructure of charging stations present a logistical challenge. For large-scale construction projects or those in remote areas, ensuring consistent and efficient charging for electric pumps can be problematic, potentially leading to downtime and impacting project timelines. The limited range and charging times of current battery technologies, while improving, can still be a concern for operations requiring continuous, long-duration use without readily accessible charging points. Furthermore, the perception and awareness surrounding the reliability and performance of electric construction equipment among some traditional users could also act as a restraint. Overcoming this inertia and building confidence in the capabilities of electric pumps requires extensive demonstration and education. Finally, the disposal and recycling of large-capacity batteries pose an emerging environmental consideration that the industry needs to proactively address to maintain its sustainability credentials.

The global electric truck-mounted concrete line pump market is poised for significant dominance by specific regions and product segments in the coming years. From a regional perspective, Asia-Pacific is projected to emerge as the leading market, driven by a burgeoning construction industry, rapid urbanization, and strong government initiatives promoting green infrastructure and technological adoption. Countries like China, with its massive manufacturing capabilities and aggressive push towards electrification, are expected to be at the forefront, both in terms of production and consumption. The presence of major manufacturers like XCMG, SANY, and Fangyuan Group within this region further solidifies its dominant position. The sheer volume of construction projects, including large-scale infrastructure development and residential building, in nations like India and Southeast Asian countries, will also contribute significantly to market growth.

Looking at the segments, the Power-sharing Type Electric Truck-Mounted Concrete Line Pump is anticipated to hold a substantial market share. This type offers a balance between the convenience of a single power source and the efficiency of electric operation. Its versatility in various construction applications, from productive building projects like high-rise apartments and commercial complexes to non-productive building applications such as infrastructure repairs and smaller urban developments, makes it a highly sought-after solution. The ability to integrate seamlessly with existing truck chassis further reduces the barrier to adoption.

The Productive Building application segment will also be a major driver of demand. The increasing need for efficient, precise, and environmentally friendly concrete placement in large-scale residential and commercial construction projects necessitates advanced pumping solutions. Electric truck-mounted concrete line pumps are well-suited for these demanding environments, offering reduced noise pollution, zero emissions, and potentially lower operational costs, aligning with the growing trend of sustainable construction practices. The market size for this segment is expected to grow exponentially as developers prioritize green building certifications and seek to minimize their environmental impact.

Furthermore, the World Electric Truck-Mounted Concrete Line Pump Production itself, as a broad indicator of market activity, will see robust growth. The increasing emphasis on electrifying construction fleets globally, coupled with the evolving regulatory landscape, is compelling manufacturers to scale up their production capacities. Companies like Caterpillar, SANY, and XCMG are heavily investing in R&D and manufacturing infrastructure to meet this anticipated demand. The forecast period 2025-2033 is expected to witness a significant ramp-up in the number of electric truck-mounted concrete line pumps rolling off production lines worldwide, reaching approximately 35 million units by the end of the forecast period, underscoring the global shift towards this cleaner technology.

The electric truck-mounted concrete line pump industry is propelled by several powerful growth catalysts. Paramount among these is the intensified global push for sustainability and reduced carbon emissions, driven by regulatory mandates and increasing environmental awareness. This is directly fostering the adoption of electric construction equipment. Secondly, continuous advancements in battery technology, leading to longer operational ranges and faster charging times, are making electric pumps more practical and competitive. Thirdly, the economic benefits of lower operational and maintenance costs compared to diesel alternatives are a significant draw for construction firms. Finally, the growing demand for smart construction solutions and the increasing number of government incentives and subsidies for green technology further accelerate the market's expansion.

This comprehensive report provides an in-depth analysis of the global electric truck-mounted concrete line pump market, offering a complete picture for stakeholders. The report delves into market trends, meticulously analyzing data from 2019 to 2033, with a detailed examination of the base year 2025. It identifies the key driving forces behind market growth, such as stringent environmental regulations and operational cost savings, alongside critical challenges like high initial investment and charging infrastructure limitations. The report forecasts the market's growth trajectory, projecting an estimated production of 35 million units by 2033. It thoroughly covers major regions and segments, highlighting the expected dominance of Asia-Pacific and the growth potential of power-sharing type pumps and productive building applications. Furthermore, it outlines growth catalysts, lists leading industry players, and details significant technological and regulatory developments. This report is an indispensable resource for understanding the current landscape and future prospects of the electric truck-mounted concrete line pump sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Caterpillar, XCMG, SANY, Fangyuan Group, Luton Machinery, Zhengzhou Hamac Automation Equipment, Hunan Ruiheng Heavy Industry Equipment, Zhengzhou Changcheng Machine Produce, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Electric Truck-Mounted Concrete Line Pump," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electric Truck-Mounted Concrete Line Pump, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.