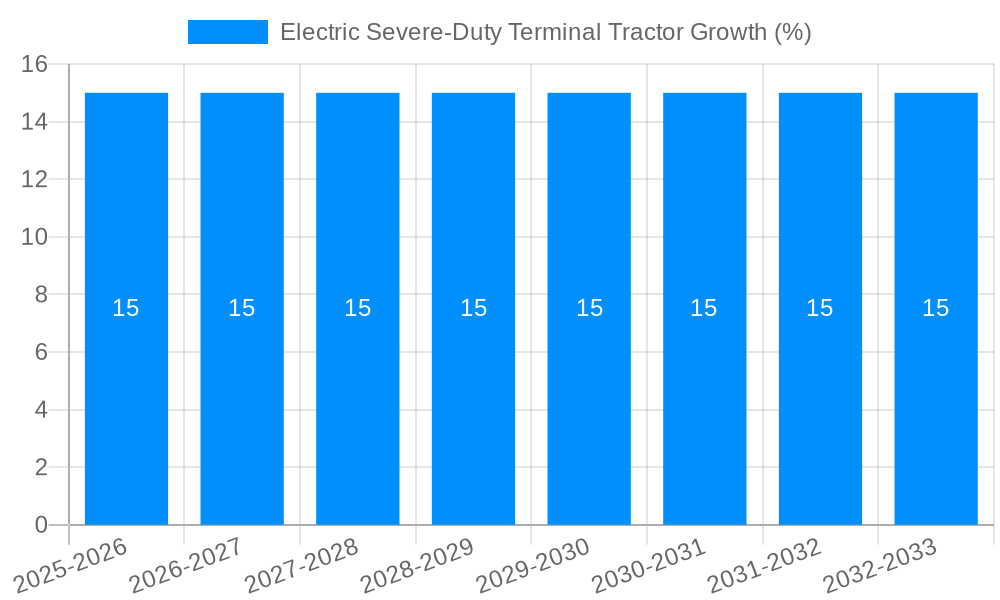

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Severe-Duty Terminal Tractor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electric Severe-Duty Terminal Tractor

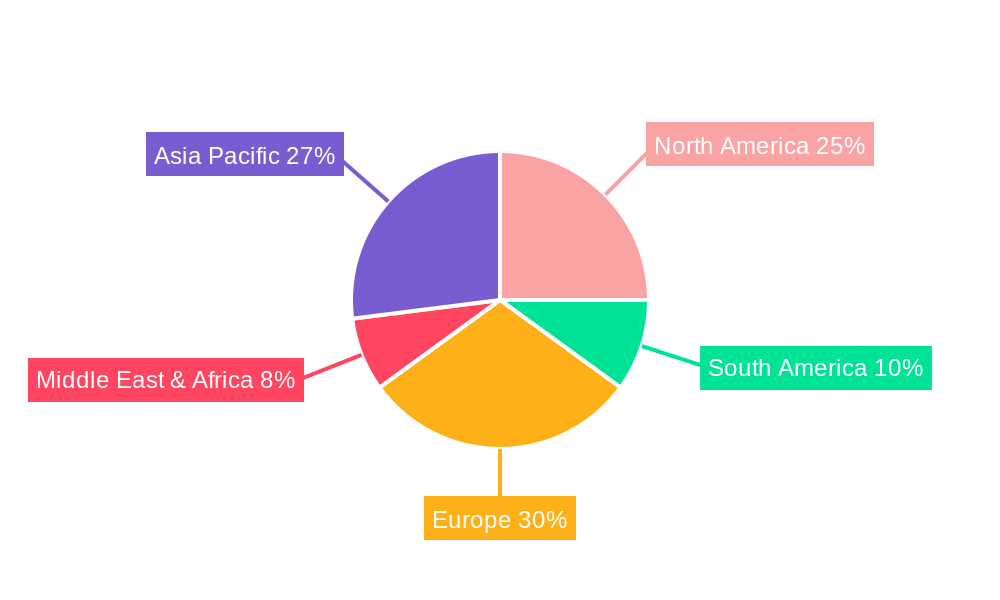

Electric Severe-Duty Terminal TractorElectric Severe-Duty Terminal Tractor by Type (Pure Electric, Hybrid), by Application (Ports, Railroad, Distribution Centers, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

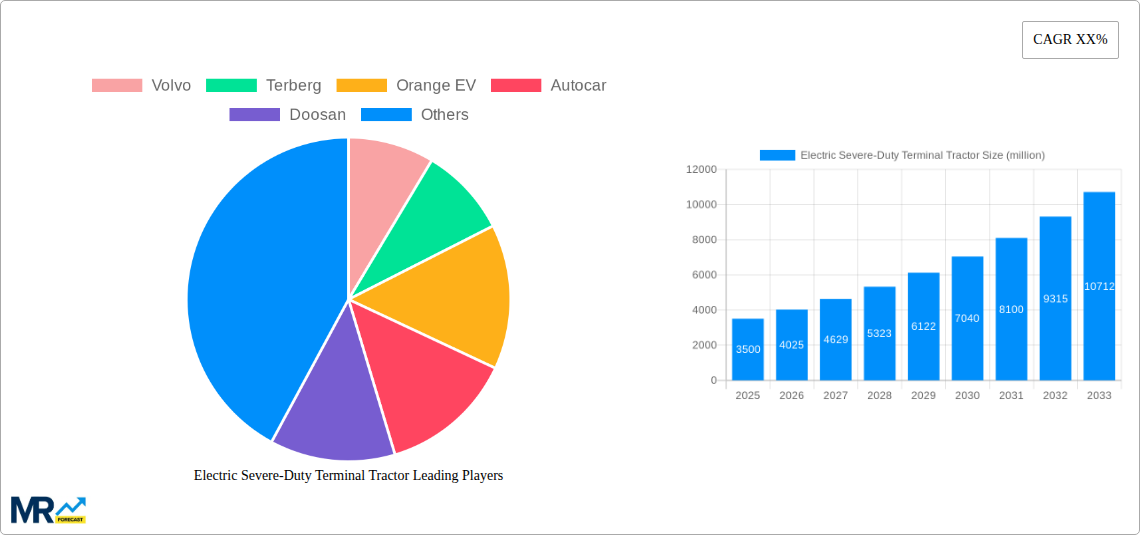

The global Electric Severe-Duty Terminal Tractor market is experiencing robust expansion, projected to reach approximately \$3,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 15% during the forecast period of 2025-2033. This significant growth is propelled by a confluence of factors, including increasingly stringent environmental regulations mandating the reduction of emissions in port and industrial operations, and a growing industry-wide commitment to sustainability and corporate social responsibility. The inherent operational efficiencies and lower total cost of ownership associated with electric terminal tractors, such as reduced fuel and maintenance expenses, are also strong drivers attracting fleet operators. Furthermore, advancements in battery technology, leading to improved range and faster charging times, are addressing previous concerns and enhancing the practicality of electric solutions for demanding, round-the-clock terminal operations. The push towards smart logistics and automation within ports and distribution centers also favors the adoption of electric terminal tractors, which are often integrated with advanced telematics and control systems.

The market is poised for substantial growth across its key segments. The Pure Electric segment is expected to dominate due to its zero-emission capabilities and the continuous innovation in battery performance. In terms of applications, Ports are anticipated to represent the largest share, followed by Distribution Centers, as these sectors are at the forefront of adopting greener technologies to meet regulatory requirements and operational demands. Geographically, Asia Pacific, particularly China, is emerging as a significant growth hub, driven by its extensive industrial base and government initiatives promoting electric vehicle adoption. North America and Europe are also strong markets, fueled by existing sustainability mandates and a mature logistics infrastructure. While the high initial investment cost can be a restraining factor, the long-term economic and environmental benefits are increasingly outweighing this concern, paving the way for widespread adoption of electric severe-duty terminal tractors across global logistics and industrial landscapes.

This comprehensive report provides an in-depth analysis of the global Electric Severe-Duty Terminal Tractor market, offering insights into market dynamics, growth drivers, challenges, and future projections. The study covers the Historical Period (2019-2024), the Base Year (2025), and the Forecast Period (2025-2033), with an extensive analysis extending to 2033. The report quantifies market opportunities and trends in million units.

The global Electric Severe-Duty Terminal Tractor market is experiencing a transformative shift, moving towards greater adoption of electric powertrains driven by a confluence of regulatory pressures, operational cost efficiencies, and a growing corporate commitment to sustainability. The Study Period (2019-2033) illustrates a clear upward trajectory, with the Base Year (2025) marking a significant inflection point for market penetration. Historically, diesel-powered terminal tractors have dominated the sector, but the increasing availability of reliable and powerful electric alternatives, coupled with declining battery costs, is fundamentally altering the competitive landscape. This evolution is not merely an incremental upgrade; it represents a paradigm shift in the material handling industry, especially within demanding environments like ports, distribution centers, and rail yards. The trend towards electrification is further amplified by advancements in battery technology, leading to improved range, faster charging times, and enhanced operational uptime, thereby addressing some of the initial concerns surrounding electric vehicle deployment in heavy-duty applications. Furthermore, the emergence of sophisticated telematics and fleet management solutions specifically designed for electric terminal tractors is optimizing their integration into existing logistics operations, making them a more attractive and viable option for businesses. This growing acceptance is reflected in the increasing order volumes and the expanding product portfolios from key manufacturers. The market is witnessing a diversification of offerings, from pure electric solutions to hybrid models that cater to a broader range of operational needs and infrastructure readiness, all contributing to a robust and dynamic market environment poised for substantial growth. The increasing focus on reducing Scope 1 emissions from on-site logistics operations is a powerful secular trend that will continue to underpin the adoption of electric severe-duty terminal tractors over the forecast period.

Several potent forces are driving the accelerated adoption of Electric Severe-Duty Terminal Tractors. Paramount among these is the escalating global regulatory push for reduced greenhouse gas emissions and improved air quality, particularly in urban and semi-urban logistics hubs. Governments worldwide are implementing stricter emission standards and offering incentives for the adoption of electric vehicles, making electric terminal tractors a more financially and environmentally appealing choice. This is directly impacting operational costs, as electricity is generally a more stable and predictable energy source compared to diesel, and electric powertrains require significantly less maintenance due to fewer moving parts. The total cost of ownership (TCO) for electric terminal tractors is becoming increasingly competitive, even surpassing that of their diesel counterparts over the lifecycle of the vehicle, a key consideration for fleet managers. Moreover, operational benefits such as reduced noise pollution in busy terminals and distribution centers contribute to a better working environment, leading to improved employee satisfaction and potentially reduced labor turnover. The growing corporate social responsibility (CSR) mandates and sustainability goals of major logistics and manufacturing companies are also playing a crucial role. These organizations are actively seeking ways to decarbonize their supply chains, and the electrification of terminal operations is a tangible step towards achieving these ambitious targets. The innovation pipeline from manufacturers, continually improving battery technology, charging infrastructure, and vehicle performance, further bolsters confidence and accelerates market penetration.

Despite the compelling growth trajectory, the Electric Severe-Duty Terminal Tractor market faces several significant challenges and restraints that temper its immediate widespread adoption. The high upfront purchase cost of electric terminal tractors remains a primary barrier, often exceeding that of comparable diesel models, which can be a deterrent for businesses with tight capital expenditure budgets. While TCO is favorable in the long run, the initial investment can be substantial. Furthermore, the availability and robustness of charging infrastructure present a critical hurdle. Many ports, distribution centers, and rail yards lack the necessary electrical capacity and charging equipment to support a full transition to electric fleets, necessitating significant infrastructure investment. Range anxiety, although diminishing with technological advancements, can still be a concern for operations requiring continuous, long-haul movements within large facilities. Charging times, even with fast-charging technology, can lead to operational downtime if not meticulously planned and managed within a 24/7 operational cycle. The availability of skilled technicians for maintenance and repair of electric powertrains and battery systems can also be a limiting factor in some regions. Finally, the lifecycle management of batteries, including their disposal and recycling, is an emerging concern that requires standardized solutions and responsible practices to ensure true environmental sustainability. The integration of these electric vehicles into existing operational workflows also requires significant planning and potential reconfiguration of yard layouts and driver training.

The Pure Electric segment within the Ports application is poised to dominate the Electric Severe-Duty Terminal Tractor market over the forecast period.

Dominant Segment: Pure Electric Type

Dominant Application: Ports

Key Regions/Countries Driving Dominance

Several key catalysts are propelling the growth of the Electric Severe-Duty Terminal Tractor industry. The most impactful is the increasing global emphasis on sustainability and the reduction of carbon footprints, leading to favorable government regulations and incentives for electric vehicle adoption. Advancements in battery technology, resulting in higher energy density, faster charging capabilities, and reduced costs, are making electric terminal tractors more practical and economically viable. Furthermore, the growing awareness of the long-term total cost of ownership (TCO) benefits, including lower energy and maintenance expenses compared to diesel counterparts, is encouraging fleet operators to invest in electric solutions. The expansion of charging infrastructure and the development of smart grid solutions are also critical in supporting widespread deployment.

This report offers a comprehensive and granular analysis of the Electric Severe-Duty Terminal Tractor market, providing actionable insights for stakeholders. It delves into the intricate market dynamics, covering crucial aspects such as market size and segmentation by Type (Pure Electric, Hybrid) and Application (Ports, Railroad, Distribution Centers, Others). The analysis is underpinned by robust historical data from 2019-2024 and forward-looking projections up to 2033, with a keen focus on the Base Year (2025) and Forecast Period (2025-2033). Key regions and countries are meticulously evaluated for their market potential and growth trends. The report also identifies and analyzes the leading players in the industry, including companies such as Volvo, Terberg, Orange EV, Autocar, BYD, and many others. Furthermore, it highlights significant industry developments, technological innovations, and the regulatory landscape that shapes market growth. The report aims to equip businesses with the strategic intelligence needed to navigate this evolving market, capitalizing on emerging opportunities and mitigating potential challenges.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Volvo, Terberg, Orange EV, Autocar, Doosan, CNH Global, Kubota, BYD, TTM, Gaussin, Kalmar, SANY, XCMG.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Electric Severe-Duty Terminal Tractor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electric Severe-Duty Terminal Tractor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.