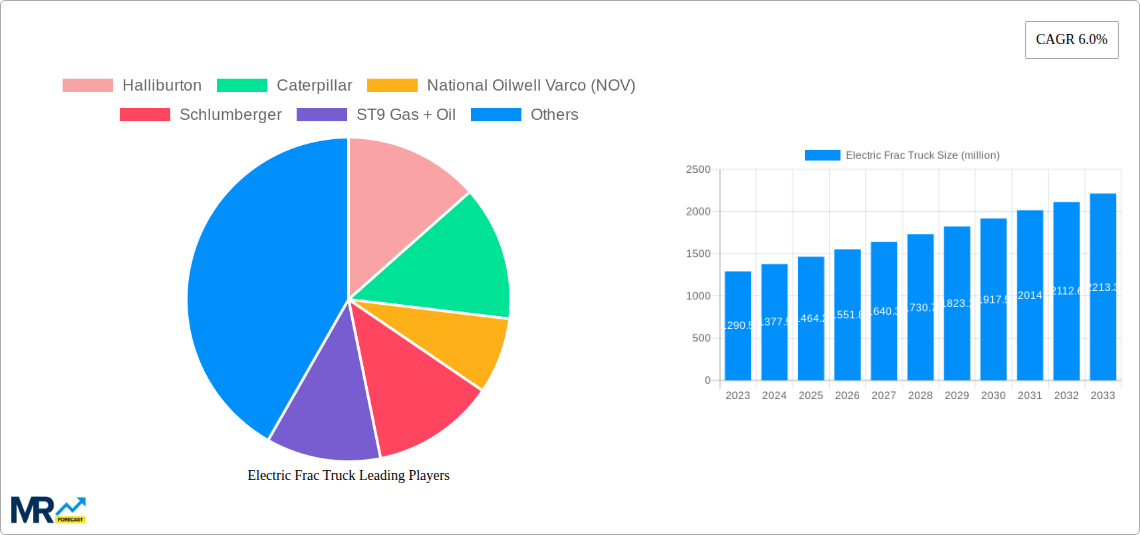

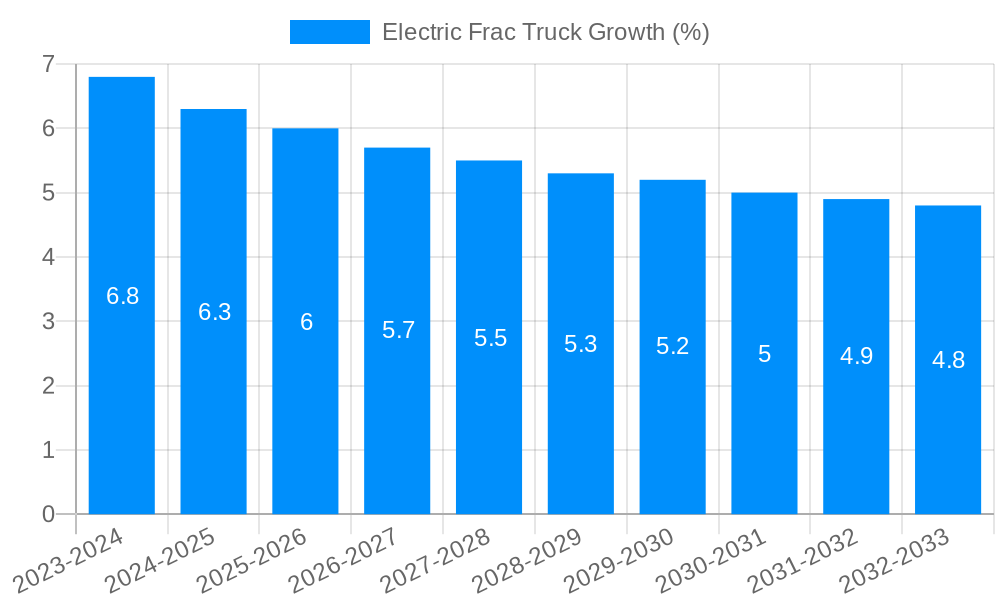

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Frac Truck?

The projected CAGR is approximately 6.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Electric Frac Truck

Electric Frac TruckElectric Frac Truck by Application (Oil Exploitation, Gas Exploitation, Coalbed Methane Exploitation, Others), by Type (Truck Mounted, Semi Trailer, Skid Mounted), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Electric Frac Truck market is poised for significant expansion, projected to reach a valuation of USD 1464.2 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 6.0% through 2033. This dynamic growth is propelled by a confluence of factors, including the increasing demand for efficient and environmentally conscious oil and gas exploitation. The industry is witnessing a pronounced shift towards electrification in hydraulic fracturing operations, driven by a desire to reduce operational costs, minimize emissions, and enhance workplace safety. As regulatory landscapes evolve and energy companies prioritize sustainable practices, the adoption of electric frac trucks is becoming a strategic imperative, fostering innovation and investment in this specialized equipment segment.

Key segments within the market are characterized by diverse applications and mounting technological advancements. Oil and gas exploitation continue to be the primary drivers, with a growing emphasis on optimizing recovery from existing reserves and developing new frontiers. The development of electric frac trucks is being shaped by critical trends such as the integration of advanced power management systems, the utilization of high-performance electric motors, and the development of robust battery or grid-connected power solutions. While the transition to electric frac trucks offers substantial benefits, certain restraints, such as the initial capital investment and the need for robust charging infrastructure in remote operational areas, are being addressed through ongoing technological refinements and industry collaborations. The market's trajectory indicates a strong future for electric fracturing solutions, with companies actively investing in R&D to meet evolving industry demands and regulatory requirements.

This comprehensive report delves into the burgeoning Electric Frac Truck market, offering an in-depth analysis of trends, driving forces, challenges, and future projections. Spanning the historical period of 2019-2024 and extending through a robust forecast period of 2025-2033, with 2025 serving as both the base and estimated year, this study provides critical intelligence for stakeholders navigating this dynamic sector. The global market, valued in the millions, is undergoing a significant transformation, driven by technological advancements, evolving environmental regulations, and the persistent demand for efficient energy extraction.

The electric frac truck market is experiencing a seismic shift, moving from a nascent concept to a significant disruptive force in the oil and gas industry. During the study period of 2019-2033, the transition from traditional diesel-powered fracturing fleets to their electric counterparts is accelerating, driven by a confluence of factors including stringent environmental mandates, a growing focus on operational efficiency, and significant technological breakthroughs. The historical period (2019-2024) witnessed initial pilot programs and early adoption by pioneering companies, primarily driven by the potential for reduced emissions and lower operational costs. As we move into the estimated year of 2025 and the subsequent forecast period, the market is poised for exponential growth.

Key market insights reveal that the primary driver for this transformation is the desire to mitigate the substantial carbon footprint associated with conventional hydraulic fracturing operations. Electric frac trucks offer a compelling solution by significantly reducing direct emissions of greenhouse gases and particulate matter at well sites. This aligns with global efforts to decarbonize the energy sector and meet increasingly ambitious environmental, social, and governance (ESG) targets. Furthermore, the reduction in noise pollution from electric fleets is becoming a significant consideration, especially in areas with proximity to residential communities.

The market is also observing a trend towards greater integration of advanced technologies. This includes the development of sophisticated battery management systems, efficient power electronics, and smart grid connectivity for charging infrastructure. Companies are investing heavily in research and development to enhance battery longevity, charging speeds, and overall operational reliability of electric fracturing units. This technological evolution is crucial for overcoming initial concerns regarding range, power output, and the availability of charging solutions in remote oil and gas fields. The projected growth indicates that by the forecast period's end in 2033, electric frac trucks will represent a substantial portion of the global fracturing fleet, moving beyond niche applications to become a mainstream solution. The evolving regulatory landscape, coupled with increasing investor and public pressure for sustainable energy practices, will continue to shape the adoption trajectory of these innovative vehicles. The economic viability is also improving, with a projected decrease in total cost of ownership due to lower fuel and maintenance expenses.

The ascent of the electric frac truck is being propelled by a powerful synergy of economic, environmental, and technological forces. At the forefront is the undeniable push towards decarbonization within the global energy sector. Governments worldwide are implementing stricter environmental regulations, mandating reduced emissions from industrial operations, including oil and gas extraction. Electric frac trucks offer a direct and effective way for companies to comply with these regulations, significantly lowering their carbon footprint and improving their ESG scores. This environmental imperative is not merely regulatory; it's increasingly a market demand, with investors and consumers alike favoring companies committed to sustainable practices.

Beyond environmental benefits, economic advantages are proving to be a significant motivator. While the initial capital investment for electric frac trucks can be higher, the total cost of ownership is projected to be substantially lower over their lifecycle. This is primarily due to reduced operational expenditures, including lower fuel costs (electricity being cheaper and more stable in price than diesel), and significantly decreased maintenance requirements. Electric powertrains have fewer moving parts compared to internal combustion engines, leading to less wear and tear, fewer breakdowns, and extended service intervals. This translates directly into improved uptime and increased profitability for fracturing service providers. Furthermore, the integration of electric fracturing units allows for more precise control of pumping operations, leading to enhanced efficiency in the hydraulic fracturing process itself, potentially reducing the overall volume of water and proppant required for a given well completion.

Despite the promising trajectory, the widespread adoption of electric frac trucks is not without its hurdles. A primary concern revolves around the significant upfront capital investment required to transition from existing diesel fleets. The cost of electric fracturing units, including the advanced battery systems and charging infrastructure, can be considerably higher than their conventional counterparts, posing a barrier for smaller operators or those with tighter capital budgets. Moreover, the development and deployment of robust, reliable, and readily available charging infrastructure in remote and often challenging oil and gas field locations remain a logistical and technical challenge. Ensuring adequate power supply for rapid charging of large fracturing fleets in these areas requires substantial investment and strategic planning.

Another significant restraint is the current range and charging time limitations of battery technology. While battery technology is rapidly advancing, the extended operational demands of hydraulic fracturing operations, which can last for days on end, necessitate either extremely large and heavy battery packs or frequent and lengthy charging intervals. This can impact operational flexibility and well site efficiency. Furthermore, the availability of skilled technicians trained in the maintenance and repair of electric powertrains and complex battery systems is crucial. The industry will need to invest in specialized training programs to ensure adequate support for these new technologies. Finally, the perceived reliability and durability of electric fracturing equipment in the harsh and demanding environment of oilfield operations are still being proven on a large scale, leading to a degree of hesitancy for some operators.

Dominant Segments and Regions:

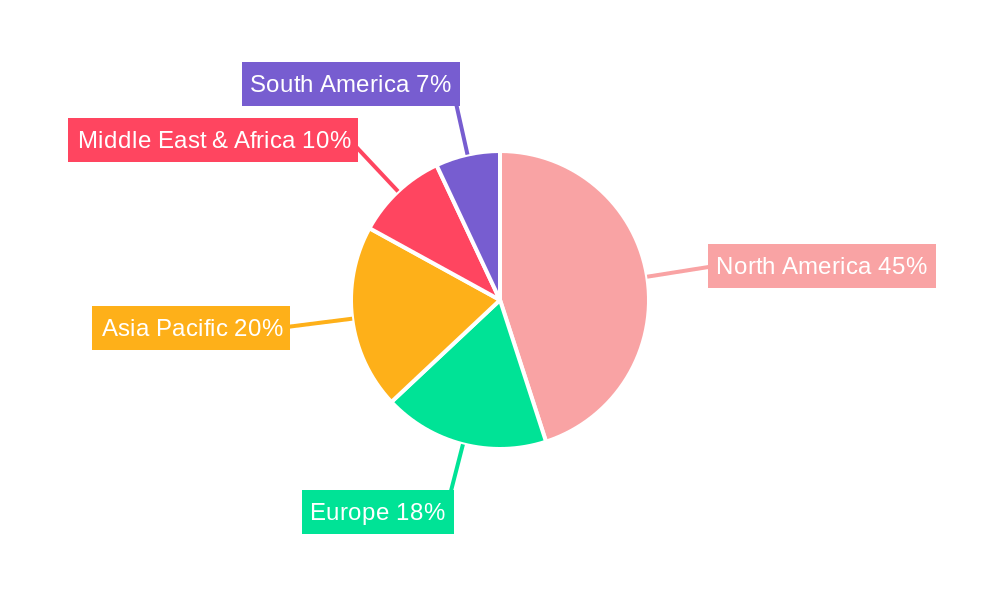

The electric frac truck market is poised for significant growth, with certain segments and geographical regions expected to lead this expansion. Analysis of the market indicates that the Oil Exploitation application segment will likely dominate the market during the study period. This is primarily driven by the sheer volume and scale of oil extraction activities globally, which historically have been the largest consumers of hydraulic fracturing services. As oil prices remain a critical factor in exploration and production investments, companies are continuously seeking ways to optimize their operations and reduce costs, making the economic and environmental benefits of electric frac trucks particularly attractive in this segment.

While North America is expected to lead, the Asia-Pacific region, driven by countries like China with its significant state-owned enterprises like Sinopec Group and Honghua Group, is also anticipated to witness substantial growth. The burgeoning energy demand and government initiatives promoting technological advancement in their domestic oil and gas sectors will contribute to this expansion. However, the established infrastructure, proactive industry players, and sheer volume of fracturing activities currently position North America as the frontrunner in the electric frac truck market.

The growth of the electric frac truck industry is being significantly accelerated by a combination of powerful catalysts. The increasing global emphasis on sustainability and decarbonization is a primary driver, pushing oil and gas companies to adopt cleaner technologies to meet environmental targets and social license to operate. Advancements in battery technology, leading to improved energy density, faster charging capabilities, and reduced costs, are making electric frac trucks more practical and economically viable for extended operations. Furthermore, the rising price volatility of traditional fossil fuels makes electricity a more stable and predictable energy source, offering long-term cost savings for operators. Growing investor pressure and the demand for strong ESG (Environmental, Social, and Governance) performance are also compelling companies to invest in and deploy environmentally friendly fracturing solutions, creating a positive feedback loop for innovation and adoption.

This report offers a comprehensive examination of the electric frac truck market, providing stakeholders with critical insights and data-driven forecasts from 2019 to 2033. The analysis extends beyond market size and growth projections to encompass a granular understanding of the driving forces, including the imperative for environmental sustainability and operational cost efficiencies. We meticulously detail the challenges and restraints, such as the high initial capital expenditure and the need for robust charging infrastructure, offering potential mitigation strategies. Furthermore, the report identifies the dominant application segments, with a particular focus on the oil exploitation sector, and the key regional markets, highlighting North America's leading position due to its extensive shale reserves and proactive technological adoption. The report also delves into the crucial role of industry developments and technological advancements in shaping the market landscape. With detailed company profiles and a thorough analysis of significant market developments, this report serves as an indispensable tool for strategic decision-making in the evolving electric frac truck industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.0%.

Key companies in the market include Halliburton, Caterpillar, National Oilwell Varco (NOV), Schlumberger, ST9 Gas + Oil, Liberty Oilfield Services, ProFrac, Evolution Well Services, Ideal Electric, NexTier, TOPS Well Services, SPM Oil & Gas, Baker Hughes, Weir Oil & Gas, KCF Technologies, NOV Inc, U.S. Well Services, Inc., Yantai Jereh Petroleum, Sinopec Group, Honghua Group, BaoShi JiXie, .

The market segments include Application, Type.

The market size is estimated to be USD 1464.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Electric Frac Truck," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Electric Frac Truck, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.