1. What is the projected Compound Annual Growth Rate (CAGR) of the Edible Coating and Film?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Edible Coating and Film

Edible Coating and FilmEdible Coating and Film by Type (Protein-based, Polysaccharide-based, Lipid-based, Others), by Application (Food, Pharmaceutical, Animal Feed, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

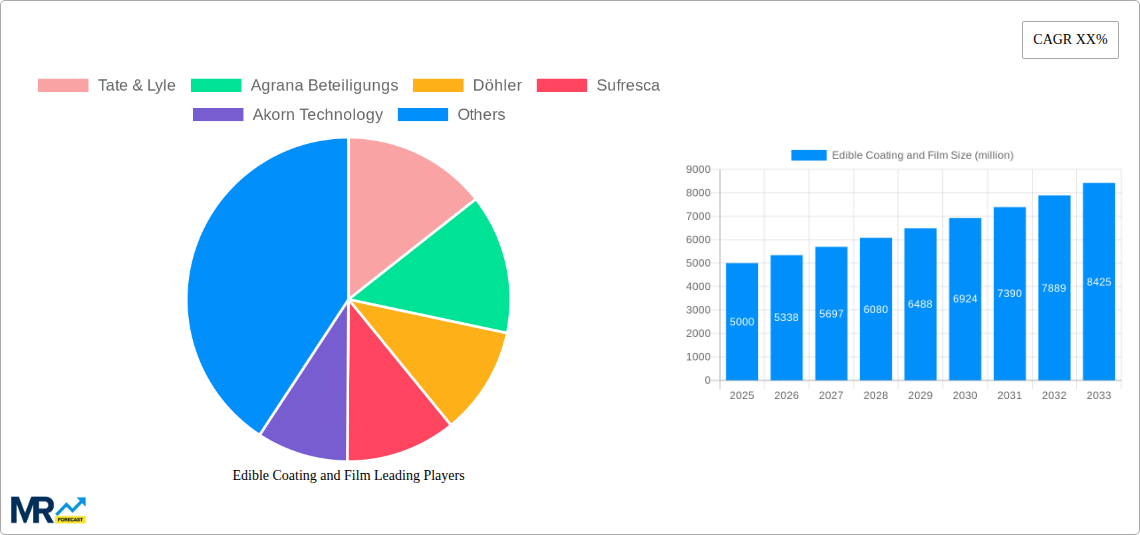

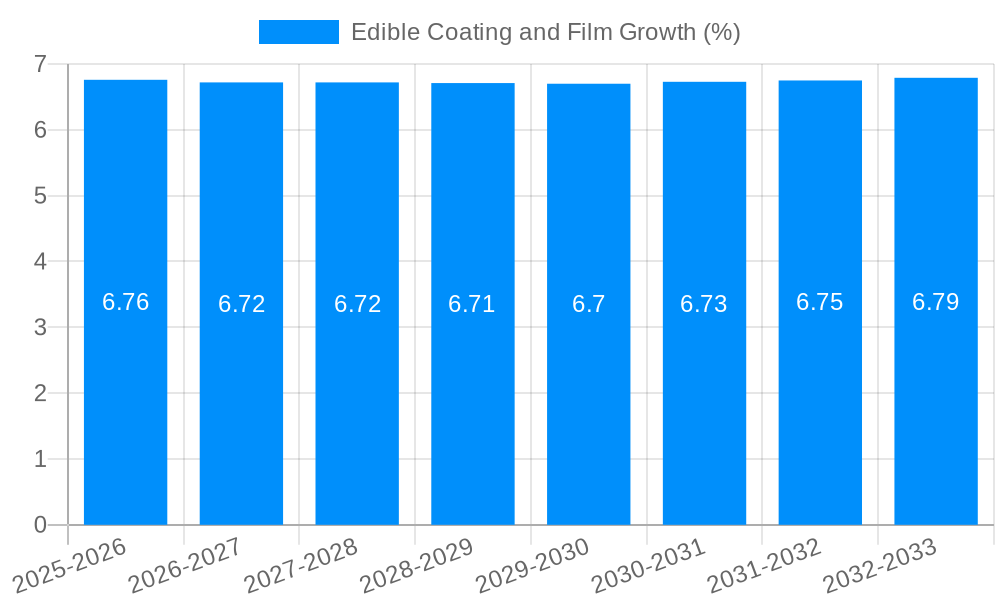

The global Edible Coating and Film market is poised for significant expansion, projected to reach approximately $5,000 million in 2025 with a robust Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This burgeoning market is primarily driven by the escalating consumer demand for extended shelf-life products, reduced food waste, and enhanced nutritional profiles. The growing awareness surrounding the benefits of edible coatings, such as improved texture, flavor retention, and barrier properties against moisture and oxygen, is fueling their adoption across diverse applications, most notably in the food sector. Furthermore, the pharmaceutical industry is increasingly leveraging these coatings for controlled drug release and improved delivery systems, contributing to market growth. Innovations in sustainable and bio-based coating materials are also playing a crucial role, aligning with global environmental consciousness and regulatory trends.

Key segments contributing to this growth include protein-based and polysaccharide-based coatings, favored for their effectiveness and natural origins. Protein-based coatings, derived from sources like whey and soy, offer excellent oxygen barrier properties, while polysaccharide-based options, such as starches and gums, provide moisture resistance and film-forming capabilities. The food application segment is expected to dominate, encompassing bakery, confectionery, fruits, vegetables, and dairy products. The animal feed sector is also emerging as a significant application area, where edible films can be used for nutrient encapsulation and palatability enhancement. While the market benefits from strong growth drivers, restraints such as the cost of specialized application technologies and the need for extensive regulatory approvals for novel ingredients may present challenges, though these are anticipated to be mitigated by ongoing research and development and the clear economic and environmental advantages offered by edible coatings and films.

This comprehensive report delves into the dynamic and rapidly evolving global edible coating and film market, offering an in-depth analysis of market trends, driving forces, challenges, regional dynamics, and key industry players. The study encompasses a Study Period: 2019-2033, with a Base Year: 2025 and Estimated Year: 2025, providing a robust outlook for the Forecast Period: 2025-2033, building upon the foundation of the Historical Period: 2019-2024. The report provides a projected market size in millions of USD, offering valuable insights for strategic decision-making. We will meticulously examine various segments, including Type (Protein-based, Polysaccharide-based, Lipid-based, Others) and Application (Food, Pharmaceutical, Animal Feed, Others), alongside critical Industry Developments.

XXX reveals a burgeoning global edible coating and film market, projected to reach substantial figures in the millions by 2025 and witness continued robust expansion throughout the forecast period. This growth is intrinsically linked to the increasing consumer demand for enhanced food preservation, improved product aesthetics, and the development of functional food ingredients. A significant trend is the rising popularity of polysaccharide-based coatings and films, driven by their excellent barrier properties against moisture and oxygen, and their generally low cost. Polysaccharides like starches, celluloses, and alginates are finding widespread application in extending the shelf life of fruits, vegetables, and baked goods, thereby reducing food waste and enhancing consumer convenience.

Furthermore, protein-based edible coatings and films are gaining traction, particularly those derived from whey, casein, and soy. Their ability to encapsulate active ingredients, such as vitamins, probiotics, and antimicrobials, positions them as valuable tools for fortifying food products and delivering targeted health benefits. The pharmaceutical industry is also a significant driver, utilizing edible films for controlled drug release, taste masking, and the development of novel dosage forms. Lipid-based coatings and films are experiencing a surge in demand for their ability to impart gloss, improve texture, and provide moisture barriers in confectionery and dairy products. The "clean label" movement is also influencing market trends, with a growing preference for coatings derived from natural and sustainable sources, pushing innovation towards plant-based and biodegradable options. The integration of smart technologies, such as indicators for spoilage or freshness, within edible films is another emerging trend that promises to revolutionize food safety and traceability. This multifaceted growth is underpinned by a global market projected to expand significantly, with specific regional markets demonstrating particularly strong performance.

The global edible coating and film market is experiencing a significant upswing, propelled by a confluence of powerful drivers that are reshaping the food, pharmaceutical, and animal feed industries. Foremost among these is the escalating global demand for extended shelf-life products, driven by an ever-growing population and the need to mitigate substantial food waste. Consumers are increasingly seeking convenience and longer-lasting produce, a demand that edible coatings and films effectively address by creating protective barriers against moisture, oxygen, and microbial spoilage. This not only reduces the economic losses associated with discarded food but also contributes to global food security.

The burgeoning health and wellness trend is another crucial catalyst. Manufacturers are leveraging edible coatings and films to encapsulate functional ingredients, such as vitamins, probiotics, antioxidants, and antimicrobials. This allows for the creation of fortified foods and dietary supplements with enhanced nutritional profiles and targeted health benefits, catering to the growing consumer interest in proactive health management. The pharmaceutical sector is also a significant beneficiary, employing these coatings for improved drug delivery systems, taste masking, and the development of more patient-friendly dosage forms. Moreover, the increasing focus on sustainable and natural ingredients is steering innovation towards bio-based and biodegradable coatings, aligning with environmental consciousness and regulatory pressures. The ability of these coatings to reduce or replace synthetic packaging further enhances their appeal, positioning them as a key component of a more sustainable future.

Despite the promising growth trajectory, the edible coating and film market is not without its challenges and restraints. A primary hurdle is the inherent complexity and cost associated with developing and implementing these advanced coating technologies. The research and development phase can be extensive and capital-intensive, requiring specialized expertise and sophisticated equipment, which can deter smaller players from entering the market. Furthermore, scaling up production from laboratory settings to industrial levels while maintaining consistent quality and efficacy can be a significant technical challenge.

Consumer perception and acceptance also play a crucial role. While many consumers are becoming more open to the concept of edible coatings, some may still harbor concerns regarding their safety, taste, or texture. Educating consumers about the benefits and natural origins of these coatings is essential to overcome any lingering hesitations. Regulatory hurdles can also pose a significant challenge. Navigating the diverse and often stringent food safety regulations across different regions requires thorough testing, documentation, and compliance, which can be a time-consuming and costly process. The stability of certain edible coatings under various environmental conditions, such as extreme temperatures or humidity levels, can also limit their applicability in specific applications or during prolonged storage. Finally, the cost-effectiveness of edible coatings compared to traditional packaging solutions remains a critical factor for widespread adoption, particularly in price-sensitive markets.

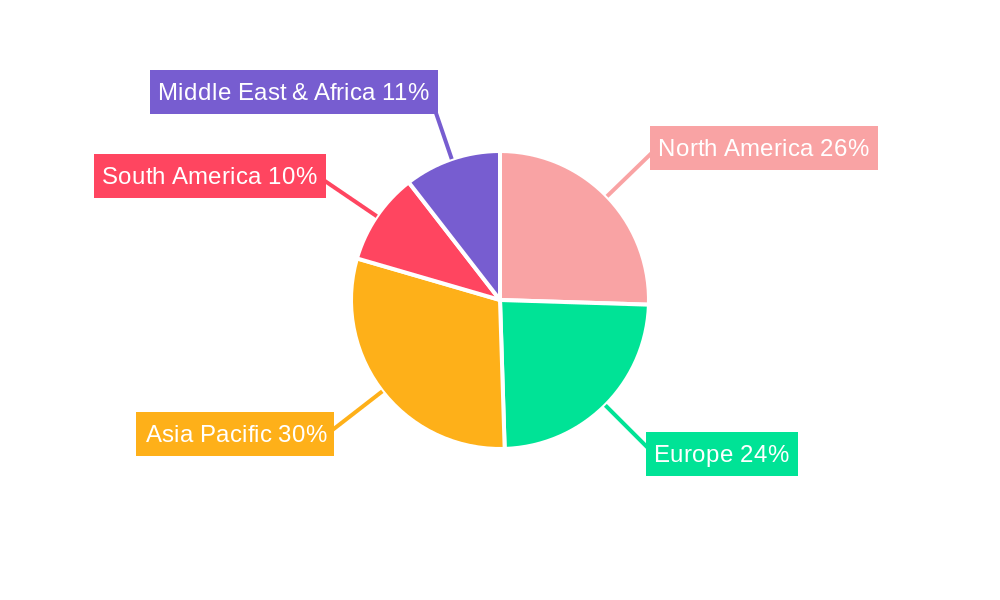

The global edible coating and film market is characterized by significant regional variations and a strong performance in specific segments, pointing towards clear leaders in the coming years.

Dominant Region: North America, particularly the United States, is poised to emerge as a dominant force in the edible coating and film market. This leadership is underpinned by several key factors:

Dominant Segment (by Type): Polysaccharide-based Coatings and Films

Dominant Segment (by Application): Food

The edible coating and film industry is experiencing a significant surge, fueled by several key growth catalysts. The unwavering consumer demand for extended shelf-life products, coupled with a global imperative to reduce food waste, is a primary driver. Manufacturers are increasingly turning to edible coatings as an effective solution for preserving food quality and freshness, thereby minimizing economic losses. Furthermore, the burgeoning health and wellness trend is propelling the use of these coatings to encapsulate functional ingredients like vitamins, probiotics, and antioxidants, transforming everyday foods into health-promoting products. The pharmaceutical sector's adoption for drug delivery and taste masking, along with the growing preference for natural and sustainable ingredients, are further solidifying the market's upward trajectory.

This report offers a comprehensive examination of the global edible coating and film market, providing in-depth insights into its current status and future trajectory. It meticulously analyzes market size projections in millions of USD, segmented by Type (Protein-based, Polysaccharide-based, Lipid-based, Others) and Application (Food, Pharmaceutical, Animal Feed, Others). The study scrutinizes trends and driving forces, shedding light on how increasing consumer demand for extended shelf-life and healthier products is propelling the market. It also addresses the challenges and restraints, including cost-effectiveness and regulatory hurdles, while identifying key regions and dominant segments poised for significant growth. Detailed company profiles and significant industry developments from 2019-2033 are included, offering a complete picture for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Tate & Lyle, Agrana Beteiligungs, Döhler, Sufresca, Akorn Technology, JBT Corporation, Pace International, Cargill, Ingredion, Kerry Group, Mantrose-Haeuser, Lactips, AgroFresh Solutions, Nagase America, Glanbia Nutritionals, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Edible Coating and Film," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Edible Coating and Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.