1. What is the projected Compound Annual Growth Rate (CAGR) of the Eco-Friendly Tape?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Eco-Friendly Tape

Eco-Friendly TapeEco-Friendly Tape by Type (Biodegradable, Kraft Paper), by Application (Office Supply, Package Shipping, Gift Packaging, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

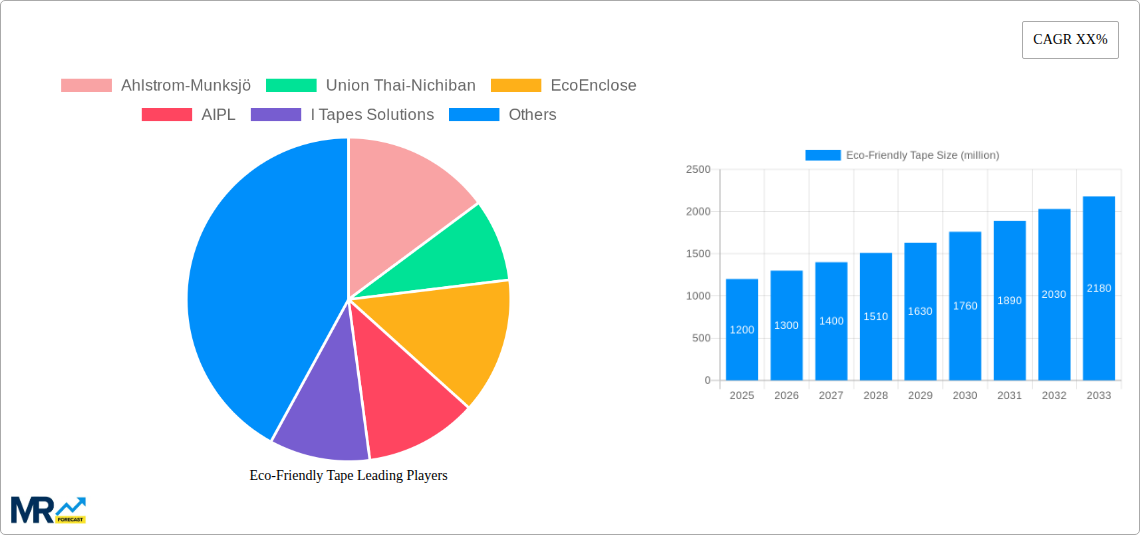

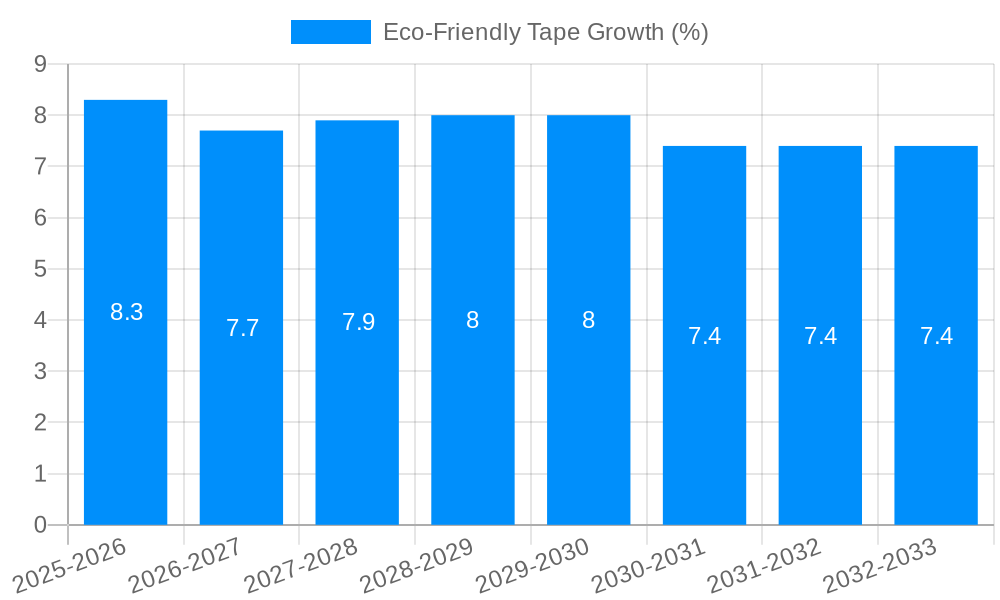

The eco-friendly tape market is experiencing robust growth, projected to reach a substantial market size of approximately $1,200 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of around 8.5% throughout the forecast period of 2025-2033. This expansion is primarily fueled by increasing global awareness of environmental sustainability and a growing demand for biodegradable and recyclable packaging solutions. Consumers and businesses alike are actively seeking alternatives to conventional plastic tapes, driving innovation and adoption of materials like biodegradable paper tape and Kraft paper tape. Key drivers include stringent government regulations promoting sustainable packaging, corporate social responsibility initiatives, and a rising preference for conscious consumerism. The convenience and aesthetic appeal of eco-friendly tapes are also contributing to their market penetration.

The market is further segmented by application, with package shipping and office supplies representing significant segments due to their widespread use in logistics and daily operations. Gift packaging also presents a burgeoning opportunity as consumers look for sustainable options to enhance their gift presentations. However, certain restraints, such as the potentially higher initial cost compared to traditional tapes and the need for widespread consumer education regarding the benefits of eco-friendly alternatives, need to be addressed. Despite these challenges, the overarching trend towards a circular economy and a reduced carbon footprint will continue to propel the eco-friendly tape market forward. Companies are investing in research and development to enhance the performance and cost-effectiveness of these sustainable tapes, ensuring their long-term viability and widespread adoption across diverse industries globally.

This report delves into the dynamic and rapidly evolving global market for eco-friendly tapes. Analyzing the period from 2019 to 2033, with a strong focus on the base and estimated year of 2025, and extending through a detailed forecast period of 2025-2033, this study provides invaluable insights for stakeholders. The historical period of 2019-2024 has laid the groundwork for understanding current market trajectories. The market is segmented by Type, including Biodegradable and Kraft Paper tapes, and by Application, encompassing Office Supply, Package Shipping, Gift Packaging, and Others. Furthermore, critical Industry Developments are meticulously examined to offer a holistic view of the sector's landscape. The report is expected to reach a global market value of over $5,000 million by 2025, with projections indicating a significant upward trajectory throughout the forecast period. This comprehensive analysis equips businesses with the strategic intelligence needed to navigate and capitalize on the burgeoning demand for sustainable adhesive solutions.

The global eco-friendly tape market is experiencing a significant paradigm shift, moving beyond niche applications to become a mainstream alternative for a wide array of consumers and industries. This transformation is being driven by a confluence of heightened environmental consciousness, stringent regulatory pressures, and evolving consumer preferences. A key trend observed is the escalating demand for biodegradable and compostable tapes, which are designed to decompose naturally, minimizing their impact on landfill waste and marine ecosystems. This segment, projected to grow at a CAGR of over 12% between 2025 and 2033, is increasingly favored by businesses aiming to bolster their sustainability credentials. Kraft paper tapes also continue to gain traction, prized for their natural appearance, recyclability, and inherent strength. Their organic aesthetic aligns perfectly with the growing demand for aesthetically pleasing and environmentally responsible packaging, particularly in the premium consumer goods and e-commerce sectors. The market is witnessing a surge in innovation, with manufacturers exploring novel bio-based adhesives and plant-derived substrates to further enhance the eco-credentials of their products. For instance, research and development efforts are focused on creating tapes that offer comparable performance to traditional plastic-based options without compromising on their environmental benefits. The rise of the circular economy principles is also influencing tape design, with an emphasis on tapes that can be easily recycled along with their packaging materials, thereby reducing the need for separate waste disposal streams. Furthermore, the integration of digital technologies, such as QR codes for traceability and sustainability information, is becoming a notable trend, empowering consumers to make informed purchasing decisions. The market is projected to witness an investment of over $700 million in research and development for next-generation eco-friendly tapes in the next five years. The increasing adoption by large corporations across various sectors, including food and beverage, pharmaceuticals, and electronics, for their packaging needs, signifies a maturing market and a broader acceptance of sustainable alternatives. The demand for specialized eco-friendly tapes for specific applications, such as high-strength tapes for industrial shipping or aesthetically pleasing tapes for luxury gift packaging, is also on the rise, indicating a diversification within the market. The global market size for eco-friendly tapes, estimated at $3,200 million in 2024, is on a robust growth path, expected to reach approximately $7,500 million by 2033. This growth is underpinned by a sustained increase in consumer and corporate demand for sustainable solutions.

The remarkable growth of the eco-friendly tape market is propelled by a potent combination of intensifying environmental awareness and supportive legislative frameworks. Consumers are increasingly making purchasing decisions based on a brand's commitment to sustainability, leading businesses to actively seek out eco-friendly packaging solutions like tapes. This growing consumer demand acts as a significant catalyst, influencing corporate procurement strategies and fostering innovation within the industry. Governments worldwide are also playing a crucial role by implementing regulations and incentives aimed at reducing plastic waste and promoting the use of sustainable materials. Bans on single-use plastics and Extended Producer Responsibility (EPR) schemes are compelling manufacturers to transition away from traditional, petroleum-based tapes towards biodegradable, compostable, or recyclable alternatives. The growing emphasis on the circular economy, where resources are kept in use for as long as possible, further fuels the demand for tapes that can be easily integrated back into the material lifecycle. This shift is not merely a trend but a fundamental reorientation of how businesses approach packaging and material management, driven by both ethical considerations and economic imperatives. The drive to reduce carbon footprints across supply chains is another major impetus. Companies are recognizing that their packaging choices contribute significantly to their overall environmental impact, and adopting eco-friendly tapes is a tangible step towards achieving their sustainability goals. The market is projected to see an increase in partnerships between tape manufacturers and raw material suppliers, aiming to secure sustainable input materials and drive down costs. This collaborative approach is essential for scaling up production and making eco-friendly tapes more accessible. The increasing availability of diverse eco-friendly tape options, catering to various needs and price points, is also contributing to market expansion. The estimated market size for eco-friendly tapes is projected to grow from $3,200 million in 2024 to exceed $7,500 million by 2033, showcasing the powerful influence of these driving forces. The sector is witnessing substantial investments, with companies allocating over $500 million annually towards research and development in sustainable adhesive technologies.

Despite the promising growth trajectory, the eco-friendly tape market encounters several significant challenges and restraints that warrant careful consideration. A primary concern revolves around the cost differential compared to conventional petroleum-based tapes. While prices are gradually decreasing due to economies of scale and technological advancements, eco-friendly alternatives can still be perceived as more expensive, particularly for large-scale industrial applications. This cost sensitivity can hinder widespread adoption, especially in price-driven markets or for businesses with tight margins. Furthermore, performance parity remains a critical hurdle for some eco-friendly tapes. While significant progress has been made, certain applications may still require the superior strength, adhesion, or durability offered by traditional tapes. Ensuring that biodegradable or compostable tapes can withstand demanding conditions, such as extreme temperatures or heavy loads during shipping, is an ongoing area of research and development. The availability and accessibility of raw materials for eco-friendly tapes can also pose a challenge. The sourcing of sustainable substrates and bio-based adhesives needs to be reliable, consistent, and scalable to meet growing demand. Fluctuations in the supply chain or competition for these resources could impact production and pricing. Consumer education and awareness about the proper disposal of eco-friendly tapes are also crucial. While a tape may be biodegradable or compostable, its environmental benefits are only realized if it is disposed of correctly. Misinformation or lack of proper composting infrastructure can lead to these materials ending up in landfills, negating their intended purpose. The market is estimated to face a potential constraint of $1,000 million in lost revenue if performance limitations are not adequately addressed across all key applications by 2028. The regulatory landscape, while generally supportive, can also be fragmented across different regions, creating complexities for manufacturers operating internationally. Navigating these varied regulations adds to operational costs and can slow down market penetration. The development of robust, standardized testing and certification processes for eco-friendly tapes is also an ongoing necessity to build consumer trust and ensure product claims are accurate. The market's total potential value, estimated at over $8,000 million by 2033, could be capped at around $7,500 million if these restraints are not effectively mitigated.

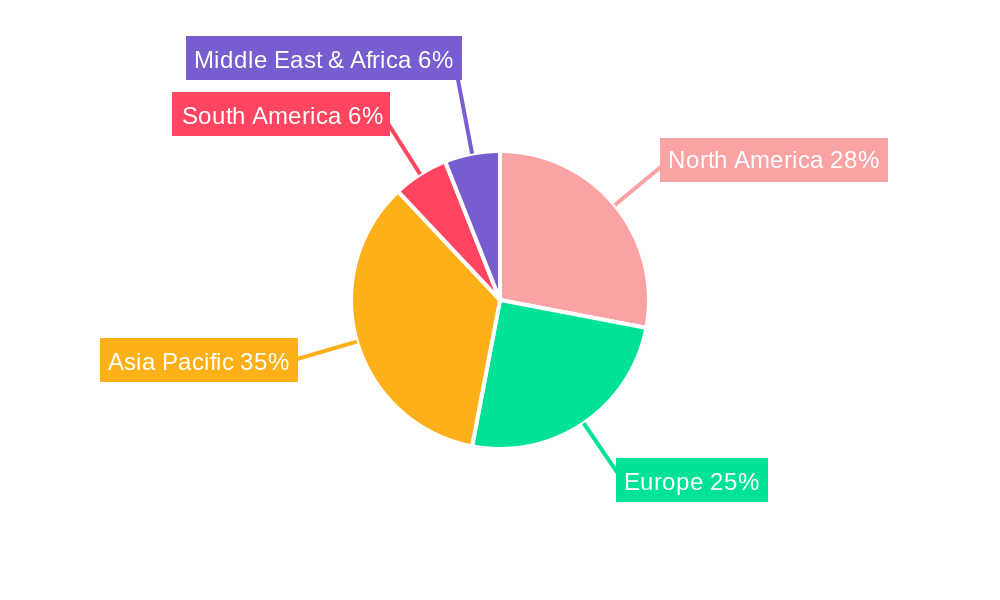

The eco-friendly tape market is characterized by a dynamic interplay of dominant regions and segments, each contributing to the overall market growth and evolution. Among the various segments, Package Shipping is poised to be a significant dominator in the eco-friendly tape market. This surge is directly linked to the exponential growth of e-commerce and the increasing number of businesses prioritizing sustainable packaging to align with their brand values and meet consumer expectations. As online retail continues its upward trajectory, the demand for secure, reliable, and environmentally responsible packaging tapes for shipping parcels is escalating rapidly. Companies are actively seeking alternatives to conventional plastic tapes, which contribute to plastic pollution. Kraft paper tapes, with their robust adhesive properties and natural aesthetic, are becoming a preferred choice for package shipping. Biodegradable and compostable tapes are also gaining traction in this segment, especially for brands that want to emphasize their commitment to a circular economy and zero-waste initiatives. The application of eco-friendly tapes in package shipping is projected to account for over 50% of the total market revenue by 2028, signifying its immense potential. The market size for eco-friendly tapes in the package shipping segment alone is estimated to reach $3,500 million by 2025.

Geographically, North America is emerging as a key region to dominate the eco-friendly tape market. This dominance is fueled by a strong consumer demand for sustainable products, stringent environmental regulations, and a proactive approach by businesses to embrace green initiatives. The United States, in particular, is a frontrunner, with a significant portion of its population actively seeking out eco-conscious brands and products. The increasing adoption of sustainable packaging practices by major retailers and e-commerce giants operating in North America further propels the demand for eco-friendly tapes. Government policies promoting waste reduction and the use of recycled materials have also created a conducive environment for market growth. Companies are investing heavily in research and development to produce innovative eco-friendly tapes, and the market is witnessing a robust inflow of capital. The presence of leading manufacturers and a well-established distribution network further solidify North America's position. The estimated market value for eco-friendly tapes in North America is projected to reach $2,200 million by 2025.

Another significant region expected to exhibit strong growth is Europe. European countries have long been at the forefront of environmental consciousness and policy implementation. The European Union's Green Deal initiative, coupled with individual member states' ambitious sustainability targets, is driving the demand for eco-friendly packaging solutions, including tapes. Regulations aimed at reducing single-use plastics and promoting recyclability are compelling businesses to shift towards sustainable alternatives. The strong presence of environmentally conscious consumers and a well-developed circular economy framework contribute to the rapid adoption of eco-friendly tapes. Countries like Germany, the United Kingdom, and France are leading the charge in this region. The estimated market value for eco-friendly tapes in Europe is projected to reach $1,800 million by 2025.

The Other application segment, encompassing niche markets like food-grade packaging, medical packaging, and specialized industrial applications, is also showing considerable potential for growth. As environmental regulations become more comprehensive, even these specialized sectors are beginning to explore and adopt eco-friendly tape solutions, albeit at a slower pace. The market size for eco-friendly tapes in the "Other" application segment is expected to reach $500 million by 2025.

The eco-friendly tape industry is experiencing robust growth primarily driven by a powerful combination of increasing consumer demand for sustainable products and evolving regulatory landscapes. Consumers' growing environmental consciousness is compelling businesses to adopt greener packaging solutions, thereby stimulating the market for eco-friendly tapes. Furthermore, stringent government regulations aimed at reducing plastic waste and promoting circular economy principles are acting as significant catalysts. The development of innovative biodegradable and compostable materials, coupled with advancements in adhesive technology, is also making eco-friendly tapes more competitive in terms of performance and cost. The expansion of e-commerce and the associated surge in shipping further amplifies the need for sustainable packaging, directly benefiting the eco-friendly tape sector. The market is projected to witness investments exceeding $600 million in R&D by 2027 to enhance the performance and cost-effectiveness of these tapes.

This comprehensive report provides an in-depth analysis of the global eco-friendly tape market, covering critical aspects from market trends and driving forces to challenges and regional dominance. It meticulously examines the market's evolution from 2019 to 2033, with a detailed focus on the base year of 2025 and the subsequent forecast period. The report delves into key segments such as Biodegradable and Kraft Paper tapes, and applications including Office Supply, Package Shipping, and Gift Packaging, offering insights into their respective growth trajectories. Furthermore, it highlights significant Industry Developments and identifies the leading players actively shaping the market landscape. The estimated market value is projected to exceed $7,500 million by 2033, underscoring the substantial growth potential. This report is an indispensable resource for businesses seeking to understand and capitalize on the burgeoning demand for sustainable adhesive solutions, providing strategic intelligence and market foresight for informed decision-making. The report is expected to offer a comprehensive market valuation of over $5,500 million by the end of the forecast period.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ahlstrom-Munksjö, Union Thai-Nichiban, EcoEnclose, AIPL, I Tapes Solutions, Tesa, Husky Tape, Pro Tapes, Minliving, Net Zero Co, Shanghai Huayi Packaging, Life Without Plastic, Noissue Tape, Enviro Packaging.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Eco-Friendly Tape," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Eco-Friendly Tape, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.