1. What is the projected Compound Annual Growth Rate (CAGR) of the Eco Friendly Cosmetic Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Eco Friendly Cosmetic Packaging

Eco Friendly Cosmetic PackagingEco Friendly Cosmetic Packaging by Type (Bamboo Packaging, Paper Packaging, Recycled Plastic, Other), by Application (Skincare, Makeup, Haircare, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

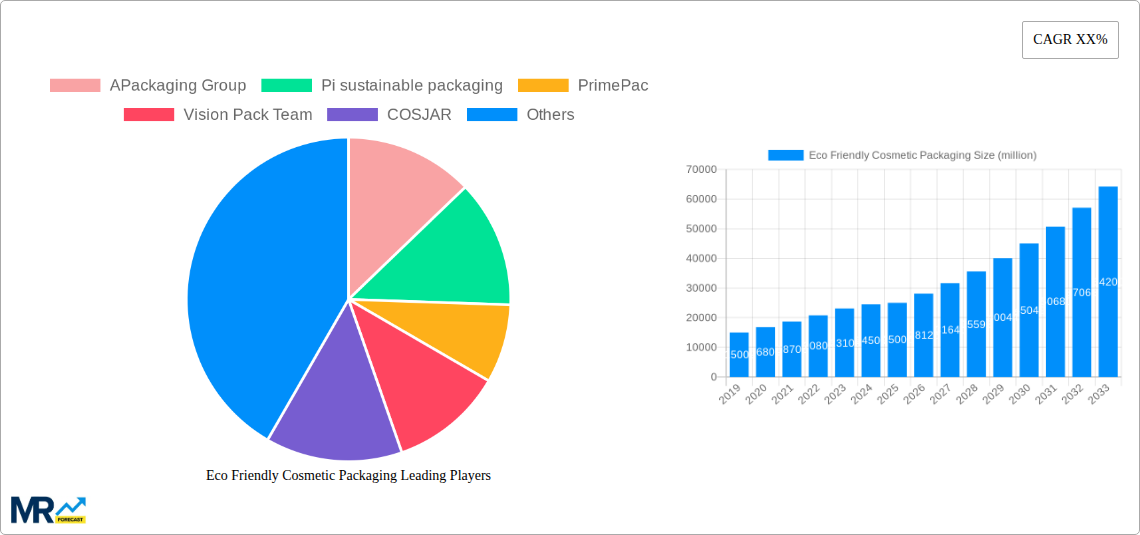

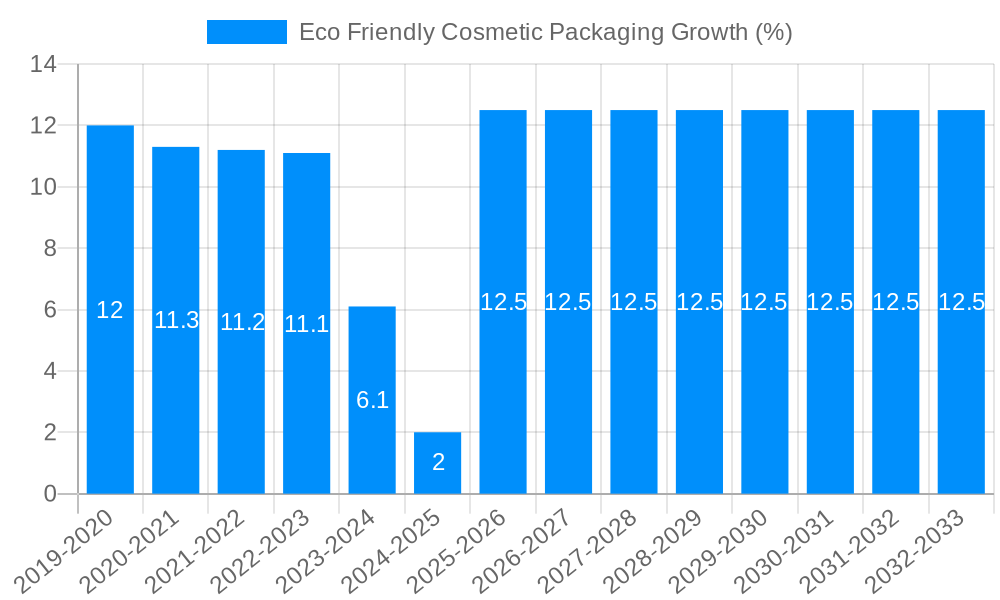

The global Eco-Friendly Cosmetic Packaging market is experiencing robust expansion, projected to reach an estimated USD 25,000 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 12.5% anticipated throughout the forecast period of 2025-2033. This impressive growth is primarily fueled by a heightened consumer consciousness regarding environmental sustainability and a growing demand for biodegradable and recyclable packaging solutions within the beauty industry. Brands are increasingly prioritizing the adoption of materials like bamboo and recycled plastics to align with eco-conscious consumer preferences and meet stringent environmental regulations. Key drivers include advancements in sustainable material innovation, the rising influence of social media campaigns promoting green living, and the proactive initiatives undertaken by leading cosmetic brands to reduce their ecological footprint. The market is witnessing a significant shift away from traditional, less sustainable packaging, creating substantial opportunities for companies offering innovative and environmentally responsible alternatives.

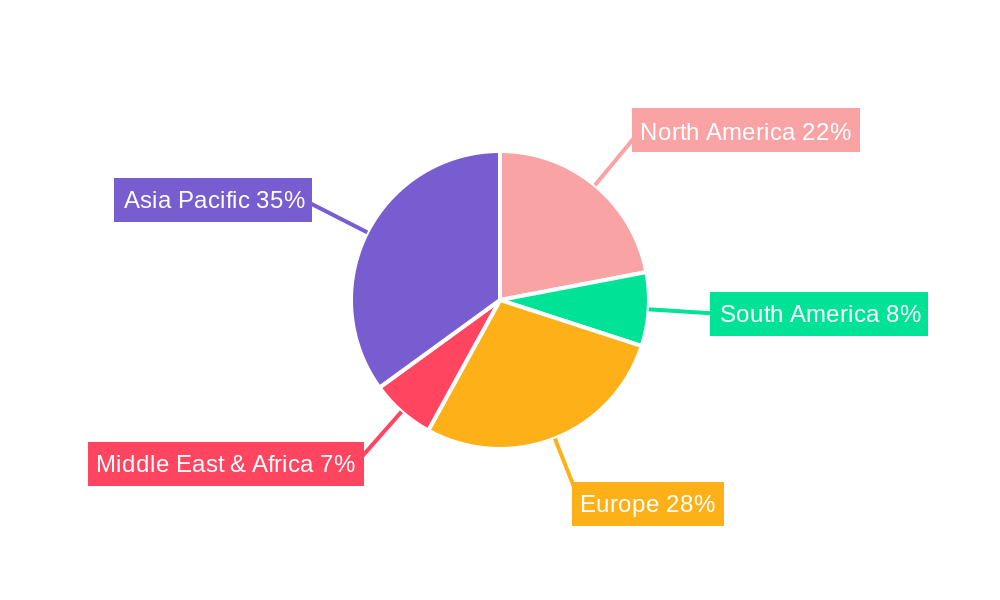

The market's trajectory is further shaped by emerging trends such as the increasing use of refillable packaging systems, the development of compostable and plant-based materials, and a greater emphasis on minimalist design that reduces material waste. While the transition to eco-friendly packaging presents immense potential, certain restraints, including the higher initial cost of some sustainable materials and the need for robust recycling infrastructure, are being addressed through technological advancements and industry-wide collaborations. The dominant segments in this market are expected to be Bamboo Packaging and Paper Packaging, driven by their widespread availability and perceived sustainability benefits. In terms of applications, Skincare and Makeup packaging are leading the charge, reflecting the strong consumer demand for sustainable options in these high-volume beauty categories. Geographically, the Asia Pacific region, particularly China and India, is emerging as a key growth engine due to its rapidly expanding cosmetics market and increasing environmental awareness.

Here's a unique report description on Eco-Friendly Cosmetic Packaging, incorporating the requested elements:

The global eco-friendly cosmetic packaging market is poised for unprecedented expansion, driven by a confluence of consumer consciousness and evolving regulatory landscapes. Our comprehensive analysis, spanning from 2019-2033, with a Base Year and Estimated Year of 2025, and a robust Forecast Period of 2025-2033, reveals a dynamic shift away from conventional, single-use plastics towards sustainable alternatives. During the Historical Period of 2019-2024, the market witnessed nascent adoption, with early movers experimenting with biodegradable materials and recycled content. However, the Estimated Year of 2025 marks a pivotal point where "green" packaging is transitioning from a niche offering to a mainstream expectation.

Consumers, increasingly armed with information about environmental degradation, are actively seeking out brands that align with their values. This has translated into a significant demand for packaging that is not only aesthetically pleasing but also demonstrably sustainable. The market is experiencing a surge in innovation across various material types, with Bamboo Packaging, Paper Packaging, and Recycled Plastic leading the charge. These materials offer compelling alternatives, reducing reliance on virgin fossil fuels and minimizing landfill waste. The Application segments of Skincare and Makeup are at the forefront of this transformation, as these industries often prioritize visually appealing and tactile packaging that can effectively convey a brand's premium and ethical positioning. Projections indicate a substantial increase in the unit volume of eco-friendly cosmetic packaging, with estimates suggesting a market volume in the tens of millions of units by 2025 and an upward trajectory throughout the Forecast Period. The underlying trend is a fundamental reshaping of the packaging value chain, encouraging circular economy principles and incentivizing the development of closed-loop systems. This evolution is not merely about substituting materials but about rethinking the entire lifecycle of packaging, from sourcing and production to end-of-life management. The market is moving towards a future where "eco-friendly" is not an add-on but an intrinsic component of product design and brand identity, promising substantial growth in units manufactured and utilized.

The exponential growth of the eco-friendly cosmetic packaging market is a multifaceted phenomenon, powered by a potent combination of escalating consumer awareness, stringent environmental regulations, and innovative material science. Consumers, particularly Millennials and Gen Z, are increasingly prioritizing sustainability in their purchasing decisions, actively scrutinizing brands' environmental impact. This heightened demand is a primary catalyst, compelling manufacturers and cosmetic brands to invest heavily in eco-conscious packaging solutions. Furthermore, a growing number of governments worldwide are implementing policies and legislation aimed at reducing plastic waste and promoting the use of sustainable materials. These regulations, ranging from single-use plastic bans to extended producer responsibility schemes, create a compelling business imperative for adopting eco-friendly packaging. The research and development efforts in material science have also played a crucial role, leading to the creation of innovative and cost-effective sustainable packaging alternatives. The Study Period of 2019-2033 has seen continuous advancements in areas like biodegradable polymers, compostable materials, and advanced recycling technologies, making these options more viable and scalable for the cosmetic industry. This dynamic interplay between consumer preference, regulatory pressure, and technological innovation is the bedrock upon which the burgeoning eco-friendly cosmetic packaging market is built, promising sustained growth and a paradigm shift in how beauty products are presented to the world.

Despite the undeniable momentum, the eco-friendly cosmetic packaging market faces several significant challenges and restraints that temper its growth trajectory. One of the primary hurdles is the cost of implementation. Sustainable materials and manufacturing processes can often be more expensive than conventional ones, leading to higher product costs for consumers or reduced profit margins for manufacturers. This price sensitivity can be a major deterrent, especially in a competitive market where consumers may opt for cheaper, less sustainable options. Another significant challenge lies in the scalability and availability of raw materials. While innovative materials are emerging, the widespread adoption of certain eco-friendly options is hampered by limited production capacity and inconsistent supply chains, impacting the ability to meet the large-scale demands of the cosmetic industry. Furthermore, consumer education and perception remain critical. While awareness is growing, a lack of clear labeling, varying recycling infrastructure, and skepticism about the true "eco-friendliness" of certain materials can lead to confusion and hinder adoption. The performance and aesthetic limitations of some sustainable materials can also be a restraint. For instance, achieving the same level of barrier protection, durability, or visual appeal as traditional plastics might be challenging with certain eco-friendly alternatives, particularly for sensitive formulations or premium cosmetic products. The regulatory landscape, while a driver, can also present a challenge if it's fragmented or inconsistent across different regions, creating complexity for global brands.

The eco-friendly cosmetic packaging market is characterized by regional variations in adoption and a clear dominance of specific segments. Among the key regions, Europe is poised to lead the market due to its robust regulatory framework, strong consumer environmental awareness, and well-established recycling infrastructure. Countries like Germany, France, and the UK have implemented aggressive policies to curb plastic waste, fostering a fertile ground for sustainable packaging solutions. North America, particularly the United States, is also a significant and rapidly growing market, driven by increasing consumer demand and the presence of major cosmetic brands actively pursuing sustainability goals. Asia-Pacific, while historically lagging, is showing accelerated growth, with countries like China and South Korea making significant strides in adopting eco-friendly practices and investing in green technologies.

Focusing on the Type segment, Recycled Plastic is expected to hold a dominant position in the market. The established infrastructure for plastic recycling, coupled with ongoing advancements in processing technologies that improve the quality and appearance of recycled materials, makes it a practical and scalable solution. Brands are increasingly incorporating Post-Consumer Recycled (PCR) plastics into their packaging, offering a tangible way to reduce their environmental footprint. Paper Packaging is also experiencing substantial growth, driven by its biodegradability and recyclability. Its versatility in applications, from outer boxes to certain types of inner packaging, makes it an attractive option. While Bamboo Packaging offers a premium, natural aesthetic, its scalability and cost-effectiveness for mass production remain areas of development.

In terms of Application, the Skincare segment is projected to dominate the eco-friendly cosmetic packaging market. Skincare products often have longer shelf lives and may require more complex packaging to protect formulations. The premium nature of many skincare brands also allows for the integration of higher-cost sustainable packaging to reinforce brand values and appeal to environmentally conscious consumers. The Makeup segment follows closely, with brands actively seeking innovative and aesthetically pleasing sustainable packaging that aligns with their trendy and conscious image. The demand for refillable makeup compacts and palettes, a subset of eco-friendly packaging, is also a significant growth driver within this application.

Several powerful growth catalysts are accelerating the expansion of the eco-friendly cosmetic packaging industry. The increasing demand for transparency and traceability from consumers, who want to understand the origin and environmental impact of their products, is a major driver. Brands are responding by adopting packaging that clearly communicates its sustainable attributes. Furthermore, advancements in material science are continuously introducing novel, more sustainable, and cost-effective packaging alternatives, expanding the options available to manufacturers. The growing trend of minimalism and the "less is more" philosophy also favors simpler, more sustainable packaging designs that reduce material usage.

This report offers a granular examination of the global eco-friendly cosmetic packaging market, providing an in-depth analysis from 2019-2033. We delve into the intricate dynamics shaping this evolving landscape, from the foundational Historical Period of 2019-2024 to the projected growth throughout the Forecast Period of 2025-2033, with a specific focus on the Estimated Year of 2025 as a key benchmark. The report provides critical market insights, including projected unit volumes in the millions, and explores the driving forces, challenges, and growth catalysts propelling the industry. Furthermore, it dissects market dominance by key regions and segments, offering a comprehensive overview of leading players and significant industry developments. Our analysis is designed to equip stakeholders with the actionable intelligence necessary to navigate and capitalize on the opportunities within this dynamic and increasingly vital market segment.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include APackaging Group, Pi sustainable packaging, PrimePac, Vision Pack Team, COSJAR, Premi Beauty Industries, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Eco Friendly Cosmetic Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Eco Friendly Cosmetic Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.