1. What is the projected Compound Annual Growth Rate (CAGR) of the Earthquake Early Warning Transmitter?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Earthquake Early Warning Transmitter

Earthquake Early Warning TransmitterEarthquake Early Warning Transmitter by Application (Large Buildings, Factories, Others, World Earthquake Early Warning Transmitter Production ), by Type (Internet-based, FM Radio Wave-based, World Earthquake Early Warning Transmitter Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

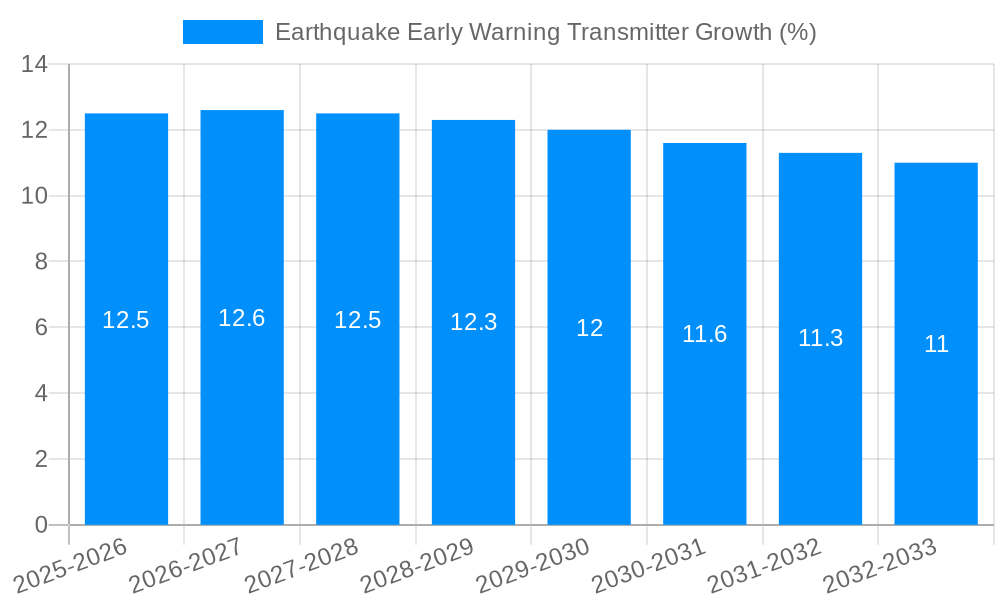

The global Earthquake Early Warning Transmitter market is poised for significant expansion, projected to reach a substantial valuation and exhibit robust growth throughout the forecast period. This surge is primarily propelled by an escalating global concern for seismic safety and a proactive approach to disaster preparedness in seismically active regions. The increasing frequency and intensity of earthquakes worldwide are compelling governments, infrastructure developers, and private entities to invest in advanced warning systems. Key drivers include stringent building codes mandating seismic resilience, coupled with the critical need to minimize human casualties and economic losses associated with seismic events. The development and deployment of more sophisticated transmitter technologies, capable of providing earlier and more accurate alerts, are also fueling market expansion. Furthermore, a growing awareness of the benefits of early warning systems, such as allowing for critical infrastructure shutdown and facilitating timely evacuation procedures, is creating sustained demand.

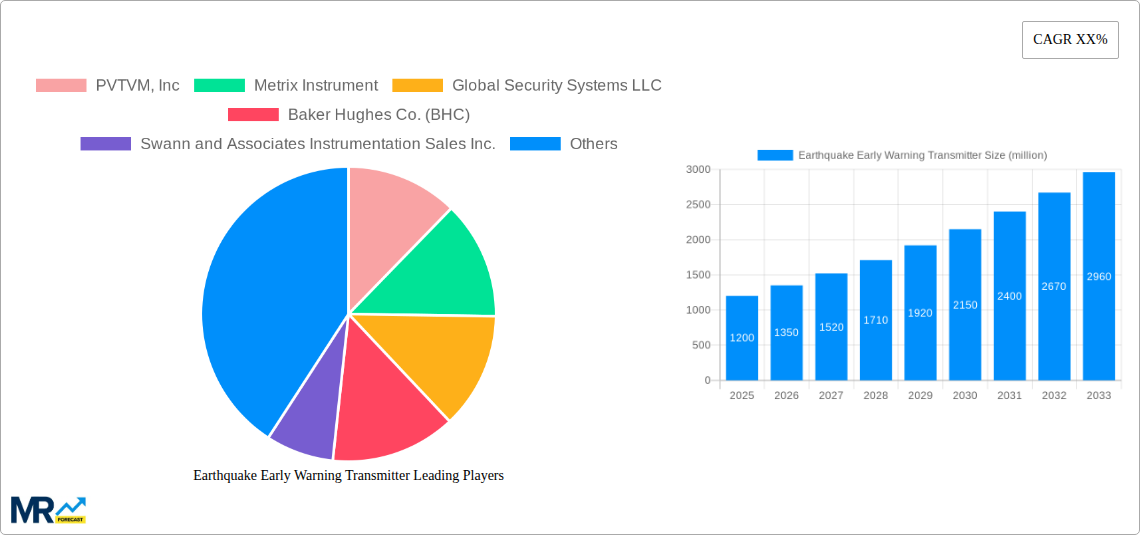

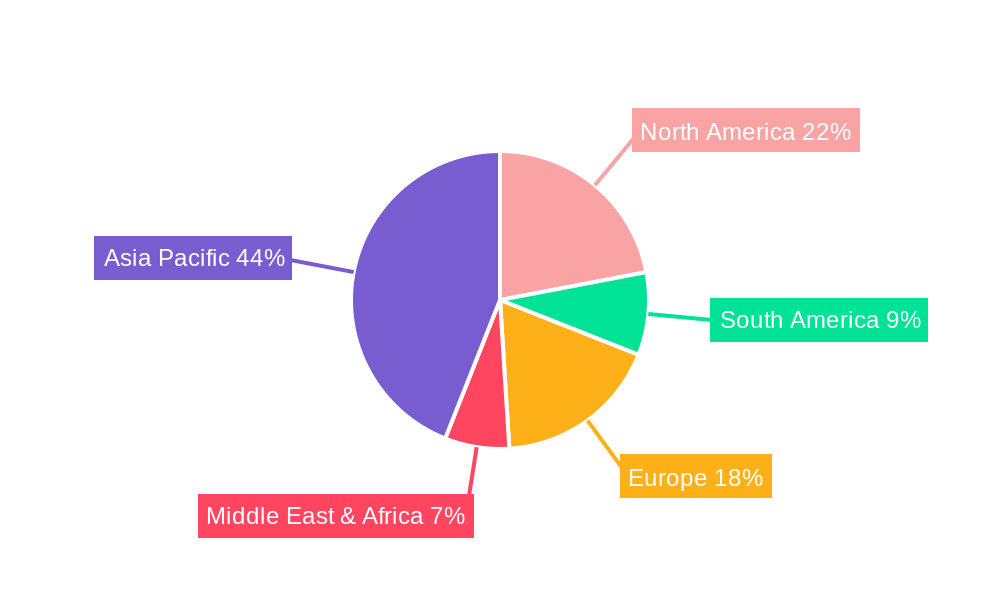

The market is segmented by application into Large Buildings, Factories, and Others, with a notable emphasis on integrating these transmitters into critical infrastructure like high-rise buildings and industrial facilities to safeguard lives and assets. By type, Internet-based and FM Radio Wave-based transmitters are gaining traction, reflecting a trend towards more reliable and widespread communication channels for disseminating warnings. The competitive landscape features key players like PVTVM, Inc., Metrix Instrument, and Baker Hughes Co. (BHC), among others, who are actively engaged in research and development to enhance product capabilities and expand their market reach. Geographically, Asia Pacific, with its high seismic activity, is expected to dominate the market, followed by North America and Europe, where investments in resilient infrastructure and disaster management are on the rise. Emerging economies are also presenting significant growth opportunities as they prioritize seismic safety initiatives.

This comprehensive report provides an in-depth analysis of the global Earthquake Early Warning Transmitter market, offering valuable insights for stakeholders, investors, and industry participants. Covering the historical period of 2019-2024, the base year of 2025, and an extended forecast period from 2025 to 2033, this report delves into market dynamics, key trends, growth drivers, and challenges shaping the future of seismic alert systems. The analysis is meticulously segmented by application (Large Buildings, Factories, Others) and transmission type (Internet-based, FM Radio Wave-based), offering a granular view of market penetration and demand across diverse end-use sectors. Furthermore, the report examines global production trends and pivotal industry developments, providing a holistic understanding of the market landscape. With a projected market value in the hundreds of millions and anticipated significant growth, this report is an indispensable resource for navigating this critical and evolving industry.

The global Earthquake Early Warning Transmitter market is experiencing a significant upward trajectory, driven by an increasing awareness of seismic risks and a growing emphasis on public safety infrastructure. Over the study period of 2019-2033, with a base year of 2025, the market is projected to witness a substantial expansion, likely reaching hundreds of millions in value by the end of the forecast period. A key trend is the escalating adoption of advanced technologies within these warning systems. Internet-based transmitters are rapidly gaining prominence due to their speed, reliability, and ability to integrate with broader communication networks, offering near real-time alerts to a wider populace. This shift is particularly evident in urbanized areas and regions prone to seismic activity. The demand for these transmitters is not solely driven by public safety agencies but also by private entities, including large corporations with extensive facilities and owners of critical infrastructure. The sophistication of these systems, moving beyond simple alarm mechanisms to integrated response protocols, is another defining trend. This includes features like automated shutdown of industrial processes in factories, controlled evacuation procedures for large buildings, and seamless integration with smart city initiatives. The historical period of 2019-2024 has laid the groundwork for this accelerated growth, characterized by increasing investment in research and development and a gradual but steady expansion of deployment. The estimated year of 2025 represents a critical juncture, signaling a period of intensified market activity and technological refinement. Looking ahead into the forecast period of 2025-2033, continued innovation in sensor technology, data processing, and communication protocols will further solidify the market's expansion, making Earthquake Early Warning Transmitters an indispensable component of disaster preparedness. The market's value, estimated to be in the hundreds of millions, is poised for further significant growth as more nations and organizations recognize the indispensable role these systems play in mitigating the devastating impact of earthquakes. The evolution from basic alert mechanisms to sophisticated, integrated safety solutions is a hallmark of this market's current and future trajectory.

The rapid growth and increasing importance of the Earthquake Early Warning Transmitter market are fueled by a confluence of powerful driving forces. Paramount among these is the escalating global concern for seismic hazard mitigation. As seismic events continue to pose a significant threat to life, property, and economic stability in numerous regions, governments and organizations worldwide are prioritizing the implementation and enhancement of effective early warning systems. The inherent limitations of traditional disaster response mechanisms, which often react after an event has occurred, have underscored the critical need for proactive measures. Earthquake Early Warning Transmitters offer a crucial window of time, however brief, that can be leveraged for critical actions such as shutting down hazardous industrial processes, securing infrastructure, and initiating emergency response protocols, thereby significantly reducing casualties and damage. Furthermore, technological advancements play a pivotal role. The evolution of sensor technology, improvements in data transmission speeds and reliability (particularly with the expansion of internet infrastructure and 5G networks), and advancements in algorithms for seismic wave detection and analysis have made early warning systems more accurate and accessible. The increasing integration of these transmitters into smart city frameworks and critical infrastructure management systems also acts as a significant propellant, creating a network effect and expanding their utility beyond simple public alerts. The value of the market, projected to be in the hundreds of millions, is a direct reflection of the increasing recognition of these systems as essential components of national and corporate safety strategies.

Despite the robust growth and undeniable importance of the Earthquake Early Warning Transmitter market, several challenges and restraints can impact its full potential. One of the primary hurdles is the significant cost associated with the deployment and maintenance of comprehensive early warning systems. This includes the expense of acquiring and installing sophisticated sensors, transmitters, and the necessary communication infrastructure, as well as ongoing operational costs for monitoring, calibration, and system upgrades. For developing nations or smaller municipalities, these financial outlays can be prohibitive, limiting widespread adoption. Another significant challenge lies in the technological limitations and inherent complexities of seismic prediction. While early warning systems provide valuable lead time, they cannot predict the exact timing, magnitude, or location of an earthquake with absolute certainty. False alarms, though increasingly rare with advanced technology, can erode public trust and lead to complacency. Conversely, a failure to issue a warning when an event occurs can have catastrophic consequences. The effective dissemination of alerts also presents a challenge, especially in areas with limited internet connectivity or in regions with diverse populations requiring multi-lingual communication strategies. Furthermore, regulatory frameworks and standardization efforts are still evolving in many parts of the world, leading to inconsistencies in system requirements and interoperability issues between different providers and regions. The market's value, though substantial and growing into the hundreds of millions, can be further constrained by these practical and technical considerations that necessitate careful planning and continuous investment.

The global Earthquake Early Warning Transmitter market is poised for significant growth, with specific regions and segments expected to lead this expansion.

Key Regions/Countries:

Key Segments:

The combined influence of these regions and segments, driven by escalating seismic threats, technological advancements, and a proactive approach to disaster management, will continue to propel the global Earthquake Early Warning Transmitter market, projected to reach hundreds of millions in value by 2033.

Several key factors are acting as significant growth catalysts for the Earthquake Early Warning Transmitter industry. The increasing frequency and intensity of seismic events globally are a primary driver, heightening the urgency for effective early warning solutions. This has led to greater government investment and policy support for disaster preparedness. Technological advancements, particularly in sensor accuracy, data processing speeds, and reliable, low-latency communication networks like 5G, are making systems more effective and accessible. The growing emphasis on smart cities and critical infrastructure protection, where integrated safety systems are becoming standard, also provides a substantial boost. Furthermore, a growing global awareness among the public and private sectors regarding the economic and human cost of earthquakes is fostering a proactive approach to risk mitigation, thereby fueling demand for these life-saving technologies.

This report offers a comprehensive and unparalleled examination of the global Earthquake Early Warning Transmitter market, providing deep insights into its intricate dynamics. It meticulously analyzes historical market data from 2019-2024, establishes a solid baseline with the 2025 base year, and projects future growth through an extensive forecast period of 2025-2033. The report delves into the market's projected value, anticipated to reach hundreds of millions, and details the key drivers fueling this expansion, including technological advancements and increasing seismic risk awareness. It also thoroughly explores the challenges and restraints that may influence market development. The analysis is further enriched by a detailed segmentation of the market by application (Large Buildings, Factories, Others) and transmission type (Internet-based, FM Radio Wave-based), offering a granular understanding of demand across various sectors and technologies. Furthermore, the report provides critical insights into global production trends and significant industry developments, alongside an overview of leading market players. This detailed coverage ensures that stakeholders are equipped with the essential knowledge to make informed strategic decisions within this vital and evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PVTVM, Inc, Metrix Instrument, Global Security Systems LLC, Baker Hughes Co. (BHC), Swann and Associates Instrumentation Sales Inc..

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Earthquake Early Warning Transmitter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Earthquake Early Warning Transmitter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.