1. What is the projected Compound Annual Growth Rate (CAGR) of the Eagle's Minimal Essential Medium?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Eagle's Minimal Essential Medium

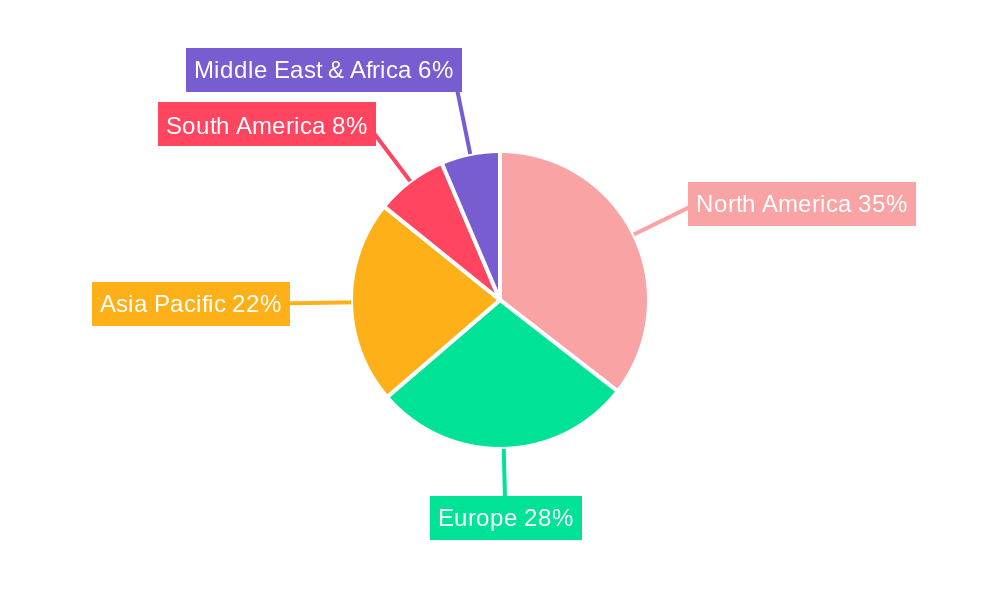

Eagle's Minimal Essential MediumEagle's Minimal Essential Medium by Type (500 ml, 1 L, Other), by Application (Cell Culture, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

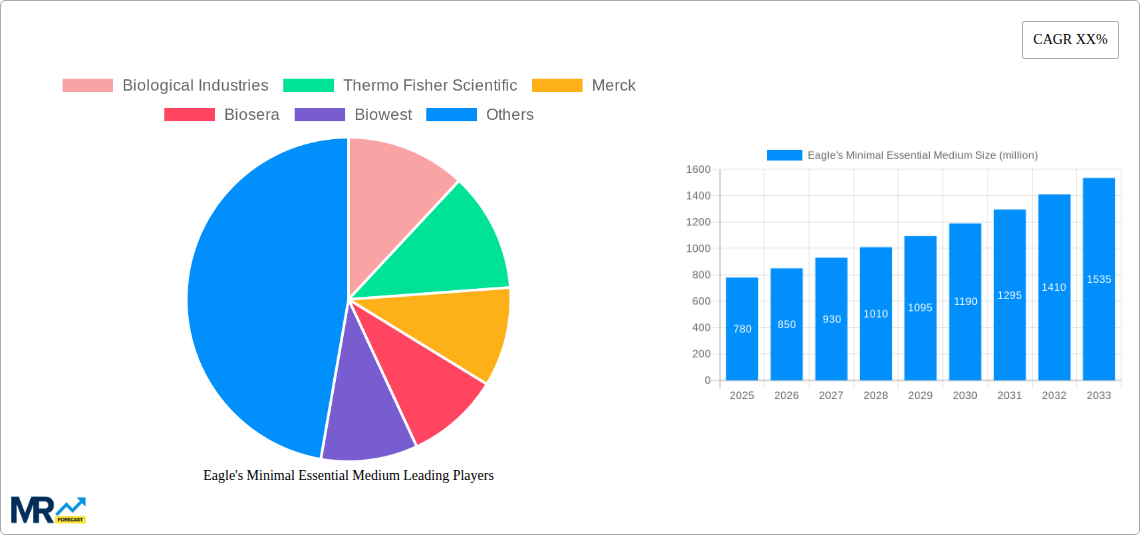

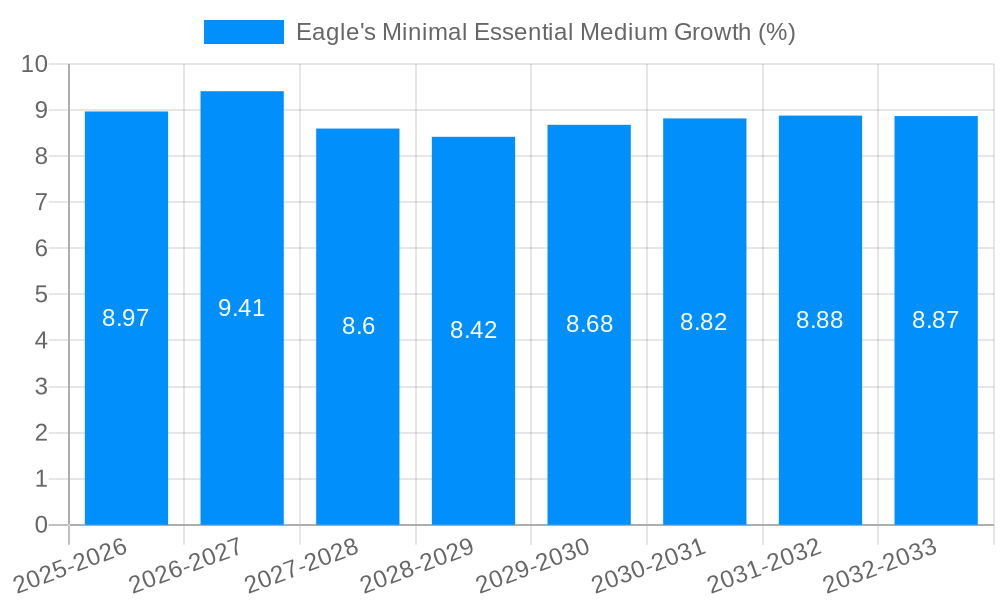

The global Eagle's Minimal Essential Medium (EMEM) market is poised for substantial growth, projected to reach an estimated market size of $XXX million by 2025, with a Compound Annual Growth Rate (CAGR) of XX% expected to propel it to approximately $YYY million by 2033. This robust expansion is primarily fueled by the escalating demand in cell culture applications, which are fundamental to advancements in biopharmaceutical research, drug discovery, and the development of novel therapeutics. The increasing prevalence of chronic diseases and the growing focus on personalized medicine further underscore the critical role of EMEM in these research endeavors, driving consistent market penetration.

The market's growth trajectory is further supported by emerging trends such as the rising adoption of serum-free and chemically defined media, offering enhanced reproducibility and reducing batch-to-batch variability in cell culture experiments. Innovations in media formulations designed for specific cell types and advanced research applications are also contributing to market expansion. However, challenges such as the high cost of raw materials and stringent regulatory hurdles in certain regions could potentially moderate the growth pace. Despite these restraints, the concerted efforts of key players like Thermo Fisher Scientific, Merck, and Corning, coupled with the expanding research and development activities across North America, Europe, and the Asia Pacific, are expected to sustain a positive market outlook for EMEM. The dominant segments are expected to be the 1 L packaging size for widespread laboratory use and the cell culture application, reflecting the core utility of EMEM.

The global Eagle's Minimal Essential Medium (MEM) market, a foundational component in cell culture, is poised for significant expansion over the study period of 2019-2033, with the base year of 2025 reflecting an estimated market valuation exceeding $500 million. This robust growth is underpinned by an ever-increasing demand for cell-based research and biopharmaceutical production. During the historical period (2019-2024), the market demonstrated a steady upward trajectory, fueled by advancements in life sciences and the growing adoption of cell therapies. The estimated year of 2025 is projected to witness continued momentum, with the forecast period (2025-2033) anticipating an accelerated growth rate, potentially reaching values well into the hundreds of millions of dollars. XXX The critical role of MEM in a myriad of applications, ranging from fundamental biological research to the development of novel therapeutics and vaccines, solidifies its indispensable position in the scientific landscape. The expansion of the biotechnology sector, particularly in emerging economies, is a key driver of this growth, as more research institutions and biopharmaceutical companies establish or expand their cell culture capabilities. Furthermore, the increasing focus on personalized medicine and regenerative therapies necessitates a reliable and consistent supply of high-quality cell culture media, directly impacting the demand for MEM. The market is characterized by a dynamic interplay of established players and emerging innovators, each contributing to the refinement and availability of MEM formulations. Innovations in media optimization, aimed at enhancing cell viability, proliferation, and specific product yields, are also playing a crucial role in shaping market trends. The increasing complexity of cell-based assays and the need for specialized media for different cell types are driving product diversification, leading to a broader range of MEM formulations tailored to specific research and production needs. The ongoing shift towards single-use technologies in biopharmaceutical manufacturing is also influencing packaging and supply chain dynamics within the MEM market.

Several potent forces are propelling the Eagle's Minimal Essential Medium market forward, ensuring its continued expansion and relevance. Foremost among these is the unparalleled growth in biopharmaceutical research and development. The relentless pursuit of novel drugs, vaccines, and advanced therapies, particularly those leveraging cell-based methodologies, directly translates into a heightened demand for reliable cell culture media like MEM. The increasing prevalence of chronic diseases and the global aging population are further stimulating investment in life sciences, thereby magnifying the need for advanced cell culture solutions. Moreover, the burgeoning field of regenerative medicine, with its focus on stem cells, tissue engineering, and cell-based therapies, is a significant growth catalyst. MEM serves as a fundamental nutrient source for these delicate cells, making it an indispensable component in their cultivation and expansion. The expanding applications of MEM beyond traditional pharmaceutical research, including its use in academic research for fundamental biological studies, diagnostics, and even in the food industry for microbial cultivation, contribute to its widespread adoption and market resilience. The increasing global investment in healthcare infrastructure and scientific research, particularly in developing nations, is also a crucial driving factor, opening up new markets and increasing the overall demand for laboratory consumables. The continuous innovation in cell culture techniques and the development of more complex cell models, such as 3D cultures and organoids, require increasingly sophisticated and optimized media formulations, further boosting the demand for high-quality MEM.

Despite its robust growth trajectory, the Eagle's Minimal Essential Medium market is not without its challenges and restraints. One significant hurdle is the increasing complexity and specialization within cell culture applications. While MEM is a foundational medium, many advanced cell lines and specific research protocols require highly customized or specialized media formulations that go beyond the standard MEM composition. This necessitates a shift towards more bespoke solutions, potentially impacting the market share of generic MEM. Furthermore, the stringent regulatory landscape governing biopharmaceutical production and research can pose challenges. Ensuring the consistent quality, purity, and sterility of MEM, along with adherence to good manufacturing practices (GMP), requires substantial investment in quality control and assurance, which can increase production costs and potentially impact pricing. The procurement and sourcing of high-quality raw materials, which are essential for the production of premium MEM, can also be a limiting factor. Fluctuations in the availability and cost of these raw materials, driven by global supply chain disruptions or geopolitical events, can affect production volumes and profit margins. Competition from alternative cell culture media, such as DMEM, RPMI-1640, and serum-free media, also presents a restraint. While MEM remains a popular choice, these alternatives may offer specific advantages for certain cell types or experimental designs, leading to market segmentation. Finally, the cost-sensitivity of academic research institutions and smaller biotechnology firms can limit their purchasing power, particularly for high-volume orders of specialized MEM formulations, thus impacting overall market penetration in certain segments.

The Cell Culture application segment is projected to be a dominant force in the Eagle's Minimal Essential Medium market. This dominance stems from the fundamental role MEM plays in virtually all facets of biological research and biopharmaceutical development that involve living cells. The sheer volume of research activities, from academic investigations into cellular mechanisms to the preclinical testing of new drug candidates, relies heavily on the availability of reliable cell culture media.

Dominance of Cell Culture Application:

Leading Regions in Demand:

The 1 L packaging size is anticipated to capture a significant share of the market, reflecting its widespread utility and cost-effectiveness for a broad range of laboratory needs. While smaller and larger formats cater to specific niche requirements, the 1-liter bottle strikes a balance, serving the needs of both routine research and larger-scale production efforts efficiently.

The Eagle's Minimal Essential Medium industry is fueled by several critical growth catalysts. The escalating global demand for biopharmaceuticals, particularly biologics and vaccines, necessitates robust cell culture infrastructure, directly increasing MEM consumption. Advancements in stem cell research and regenerative medicine are creating new avenues for MEM application, as these therapies rely heavily on precise cell cultivation. Furthermore, increased government funding for life sciences research and an expanding network of academic institutions globally are creating a continuous need for essential laboratory reagents like MEM. The growing outsourcing trend in drug discovery and development to Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) also contributes to market expansion, as these entities are major consumers of cell culture media.

This comprehensive report delves into the intricate dynamics of the Eagle's Minimal Essential Medium market, providing an exhaustive analysis of its present landscape and future trajectory. It meticulously examines market trends, identifies key driving forces, and scrutinizes potential challenges and restraints. The report offers an in-depth regional and segmental analysis, highlighting dominant areas and segments within the market, supported by extensive quantitative data reaching into the millions of dollars. Furthermore, it pinpoints crucial growth catalysts and profiles the leading industry players, offering strategic insights into their market positioning. Significant past and anticipated future developments within the sector are also detailed, providing a holistic view of the market's evolution. This report is an indispensable resource for stakeholders seeking to understand and navigate the complex and expanding global MEM market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Biological Industries, Thermo Fisher Scientific, Merck, Biosera, Biowest, Corning, Lonza, Procell Life Science&Technology Co., FUJIFILM Irvine Scientific, Cytiva, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Eagle's Minimal Essential Medium," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Eagle's Minimal Essential Medium, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.