1. What is the projected Compound Annual Growth Rate (CAGR) of the DVD Players & DVD Recorders?

The projected CAGR is approximately 4.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

DVD Players & DVD Recorders

DVD Players & DVD RecordersDVD Players & DVD Recorders by Application (Residential, Commercial, World DVD Players & DVD Recorders Production ), by Type (DVD Players, DVD Recorders, World DVD Players & DVD Recorders Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

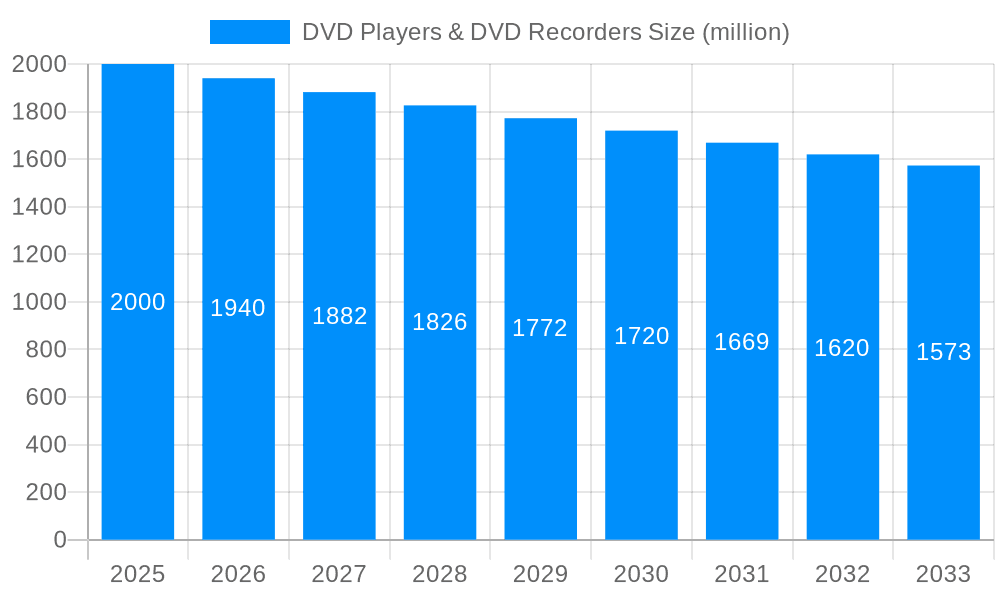

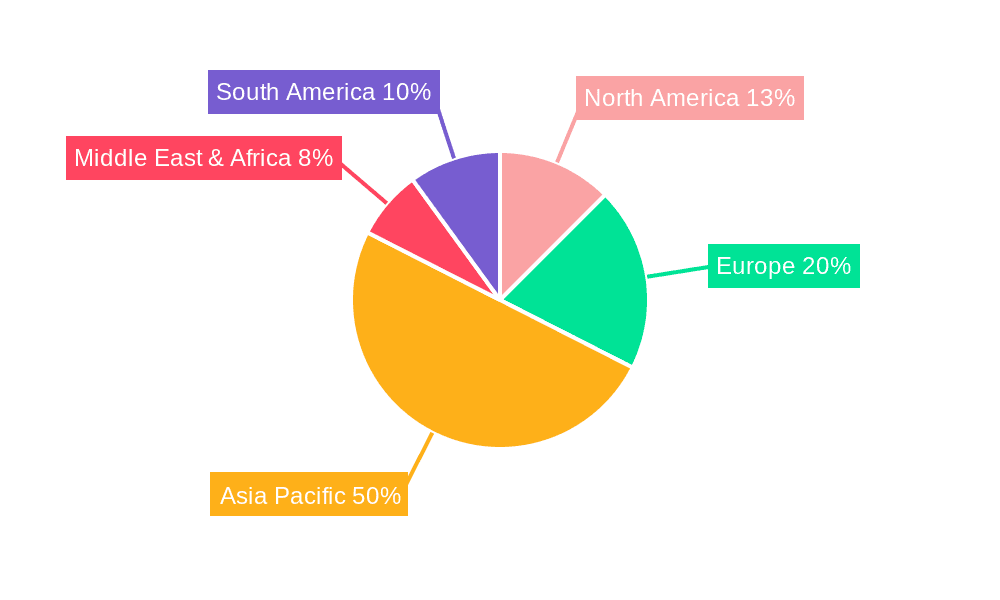

The global DVD player and recorder market, while facing a decline in recent years due to the rise of streaming services, still holds a niche market share, particularly in regions with limited broadband access or a preference for physical media. The market size in 2025 is estimated at $2 billion, reflecting a consistent, albeit slow, decline from its peak. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at -3%, indicating a gradual contraction. This contraction is primarily driven by the continued shift towards digital streaming platforms like Netflix, Hulu, and Amazon Prime Video. However, factors such as the affordability of DVD players and recorders compared to high-bandwidth internet subscriptions, the robustness of the technology (no internet required for playback), and the continued demand for physical media in certain regions, particularly in developing economies and among collectors, are mitigating the rate of decline. The residential segment accounts for a larger portion of the market than the commercial segment, as the demand for DVD players and recorders is primarily driven by personal consumption. Further segmentation by product type shows that DVD players maintain a larger market share compared to DVD recorders, due to their simpler functionality and lower cost. Key players like Sony, Panasonic, LG, and Philips continue to compete in the market, primarily focusing on cost-effective models and niche functionalities such as upscaling or improved audio output catering to specific user demands. Geographic analysis reveals that Asia Pacific, particularly China and India, contributes a significant portion of the market share due to large populations and developing economies.

Despite the overall downward trend, the market for DVD players and recorders is expected to remain stable over the forecast period due to the continued presence of specific market segments such as budget-conscious consumers, collectors, and regions with limited internet access. The evolution of the market will likely involve consolidation among manufacturers, a focus on improved features at lower price points and potentially exploring niche markets such as retro gaming or specialized applications. The market's long-term viability hinges on identifying and catering to these resilient pockets of demand.

The global DVD player and recorder market, while facing significant headwinds from the rise of streaming services, continues to exhibit surprising resilience, particularly in specific niche segments. The study period from 2019 to 2033 reveals a complex picture. While overall production numbers have declined from the peak years, the market hasn't collapsed. Instead, it's undergoing a transformation. The historical period (2019-2024) showed a steady decrease in overall unit sales, driven primarily by the shift towards digital streaming platforms and on-demand content. However, the estimated year 2025 shows a stabilization, with production hovering around a certain level. This suggests a potential bottoming out, with the forecast period (2025-2033) suggesting a slow and steady decline rather than a precipitous fall. This stabilization is likely attributable to several factors, including the continued demand for physical media in certain regions and demographics, the affordability of DVD players compared to high-end streaming setups, and the use of DVDs in specific commercial applications like archiving and educational settings. The market is not driven by significant technological innovation in the devices themselves but rather by the persistence of existing demand and the relatively low cost of entry for both consumers and manufacturers. The market segmentation plays a crucial role in understanding these trends. While the residential segment is shrinking, the commercial sector maintains some stability, highlighting the distinct needs and uses for DVD technology in various applications. The production numbers, both for players and recorders, mirror this pattern, showing a steady decline yet maintaining a non-negligible market share. Millions of units are still being produced annually, underscoring the continued relevance of this technology. Understanding these nuanced trends is vital for accurately assessing future market projections and identifying the most promising areas for investment and growth within this evolving sector.

Several factors contribute to the continued, albeit diminished, presence of DVD players and recorders in the market. Firstly, cost remains a significant driver. DVD players offer a significantly cheaper entry point to home entertainment compared to sophisticated streaming systems, especially in regions with limited high-speed internet access. This affordability makes them appealing to budget-conscious consumers and those in developing economies. Secondly, the robustness and reliability of DVD technology continue to be advantageous. Unlike streaming services that rely on internet connectivity, DVDs offer a guaranteed method of playback, irrespective of network issues or outages. This reliability is crucial in situations where uninterrupted playback is essential, like educational settings or for preserving archival material. Thirdly, a large existing library of DVDs remains a substantial driving force. Many consumers own substantial DVD collections, eliminating the need for further investment in acquiring digital copies of movies and shows already in their possession. This existing inventory ensures continued demand for compatible playback devices. Finally, despite the rise of streaming, DVDs still hold a unique advantage for certain commercial applications. Businesses might use DVDs for data archiving, presentations, and training materials, benefiting from the physical storage and ease of distribution that digital alternatives often lack. These factors, though not powerful enough to drive significant growth, ensure that the market persists and even finds pockets of resilience in its slow decline.

The primary challenge facing the DVD player and recorder market is the undeniable dominance of streaming services. The convenience, vast content libraries, and on-demand nature of streaming platforms significantly outweigh the limitations of physical media for many consumers. This shift towards digital consumption has resulted in a dramatic reduction in the demand for DVD players and recorders. Furthermore, the lack of technological innovation in the DVD sector itself presents a major obstacle. Compared to the constantly evolving landscape of streaming devices and smart TVs, DVD players remain largely static in terms of features and functionality. This lack of innovation makes them less appealing to consumers accustomed to the constant upgrades and feature enhancements offered by competing technologies. The declining availability of new DVD releases also contributes to the market's stagnation. Major studios are prioritizing digital distribution, resulting in a smaller number of new titles released on physical media. This reduced supply further erodes the demand for DVD players and recorders. Finally, the environmental concerns associated with physical media production and disposal are also becoming increasingly relevant. The manufacturing and shipping of DVDs contribute to carbon emissions, while their disposal creates waste, making environmentally conscious consumers more inclined to choose digital alternatives. These factors collectively pose significant challenges to the long-term viability of the DVD player and recorder market.

The residential segment, although shrinking, remains the largest market for DVD players and recorders. While the commercial segment provides some level of stability, the sheer volume of residential units sold historically makes this the dominant application.

Residential Segment: The continued affordability and reliability of DVD players make them a significant presence in many households, particularly in developing countries and among budget-conscious consumers. This segment is projected to decline gradually but still represents a significant portion of the total market. Millions of units are still sold annually within this segment, making it the most important factor in understanding market trends.

Geographic Regions: While the North American and European markets have seen the most significant decline, developing regions in Asia and parts of Africa continue to show some level of demand, driven by factors like lower internet penetration and affordability of DVD players. These regions might become increasingly important for manufacturers seeking to sustain production in the coming years.

DVD Players vs. DVD Recorders: The demand for DVD recorders is declining at a faster rate compared to DVD players. This difference stems from the convenience of digital recording and storage offered by alternatives like hard drives and cloud services. The majority of the market is focused on the continued demand for DVD playback devices.

The dominance of the residential segment is predicted to continue, albeit with diminishing numbers. The continued presence of the commercial sector ensures that the DVD market is not entirely obsolete, but the overall trend indicates a gradual decline for both segments. It is important to remember the significant difference in the volume between these segments, with the residential segment always holding the greatest volume and influencing the overall market value. The geographic distribution is also significant, showing the importance of emerging markets in influencing the future shape of the industry.

Despite the challenges, a few factors could act as modest growth catalysts. Niche markets, such as educational institutions or businesses with specialized archiving needs, might continue to sustain demand. The development of more energy-efficient DVD players could also attract environmentally conscious consumers. However, significant growth is unlikely; any such catalysts would only serve to slow the already established downward trend.

This report provides a comprehensive overview of the DVD player and recorder market, encompassing historical data, current market trends, and future projections. It analyzes the various market segments, identifies key players, and examines the driving forces and challenges shaping the industry. This detailed analysis offers valuable insights for businesses operating within the sector and investors seeking to understand the dynamics of this evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.2%.

Key companies in the market include JVCKENWOOD, Magnavox, Panasonic, Philips, Toshiba, Sony, Sumsung, Pansonic, Pioneer, LG.

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "DVD Players & DVD Recorders," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the DVD Players & DVD Recorders, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.