1. What is the projected Compound Annual Growth Rate (CAGR) of the Duty-free Travel Retail?

The projected CAGR is approximately 6.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Duty-free Travel Retail

Duty-free Travel RetailDuty-free Travel Retail by Type (Watches, Jewellery and Fine Writing, Fashion & Accessories, Fragrances & Cosmetics, Confectionary & Fine Food, Wine & Spirits), by Application (Port Duty-Free Stores, Offshore Duty-Free Stores, Downtown Duty-Free Stores, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global duty-free travel retail market is poised for significant expansion, driven by rising international tourism, burgeoning middle-class populations in emerging economies, and the increasing appeal of duty-free shopping as a distinct travel perk. Projections indicate a market size of $46.3 billion by 2025, with a compound annual growth rate (CAGR) of 6.5%. This growth is underpinned by strategic investments from leading operators such as Dufry, Lagardère Travel Retail, and Lotte Duty Free in new airport concessions and enhanced retail experiences. The sector's broad product assortment, including luxury goods, fashion, beauty, confectionery, and spirits, appeals to a diverse global clientele. Key growth engines include North America, Europe, and Asia-Pacific, leveraging high tourist volumes and robust disposable incomes.

Despite its potential, the duty-free sector navigates challenges including currency volatility, global economic instability, and evolving regulatory frameworks. The COVID-19 pandemic underscored sector vulnerabilities, with recovery varying by region, notably a stronger rebound in Asia-Pacific. The industry is increasingly adopting omnichannel retail strategies, integrating online and offline channels to meet evolving consumer demands. Innovations in loyalty programs, personalized marketing, and mobile payment solutions are central to this adaptation, aiming to deliver a seamless customer experience. Market segmentation by store type—airports, downtown locations, and cruise ships—facilitates customized offerings and geographical diversification to manage risk.

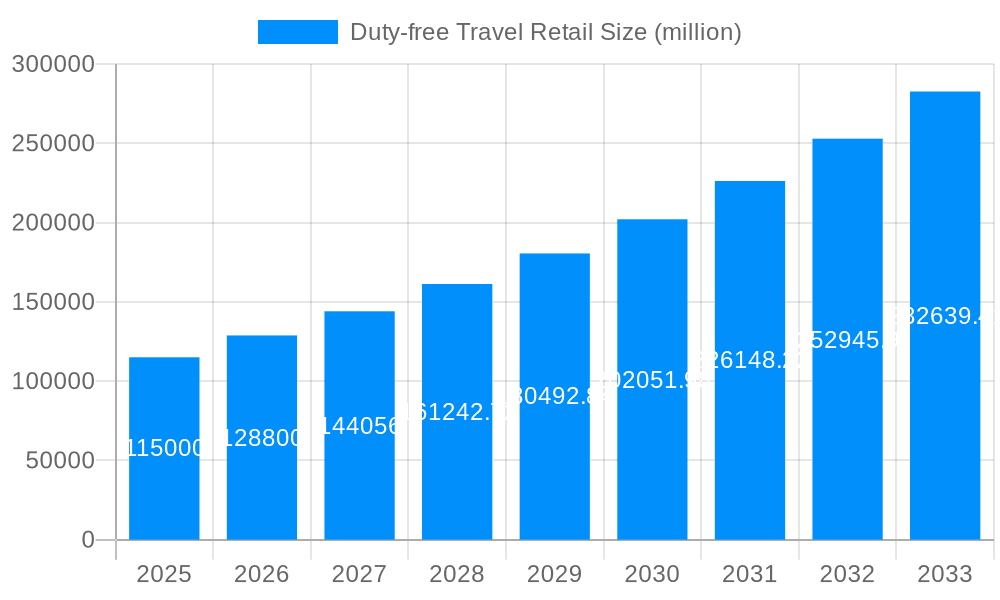

The duty-free travel retail market, valued at XXX million units in 2025, is poised for significant growth throughout the forecast period (2025-2033). Driven by a resurgence in international travel post-pandemic and evolving consumer preferences, the industry is witnessing a shift towards experiential retail and the integration of technology. The historical period (2019-2024) showed considerable volatility due to global events, but the market demonstrates strong resilience and a capacity for adaptation. Consumers are increasingly seeking unique and high-quality products, driving demand for luxury goods and personalized services within duty-free environments. The rise of omnichannel strategies, incorporating online pre-ordering and in-store collection, is enhancing convenience and attracting a wider customer base. Furthermore, the market is witnessing increasing competition, with both established players and new entrants vying for market share through innovative offerings and strategic partnerships. This competitive landscape is pushing the industry towards greater efficiency, enhanced customer experience, and a focus on sustainability, aligning with growing consumer consciousness. The increasing popularity of travel experiences, especially among millennials and Gen Z, further fuels demand for duty-free goods, especially in categories like cosmetics, fragrances, and spirits. The convergence of physical and digital experiences is reshaping how brands engage with customers, with augmented reality applications and personalized recommendations becoming more prevalent. The study period (2019-2033) showcases a clear evolution, from a period marked by uncertainty to one of recovery and strategic repositioning within the duty-free travel retail sector.

Several key factors are driving the growth of the duty-free travel retail market. The primary driver is the rebound in international air travel after the COVID-19 pandemic. As passenger numbers increase, so too does the demand for duty-free goods. This is further amplified by the growing middle class in emerging economies, who are increasingly traveling internationally and engaging in luxury purchases. The increasing popularity of experiential travel, where consumers seek unique experiences rather than just destinations, also positively impacts duty-free sales. Duty-free retailers are capitalizing on this trend by offering curated product assortments and immersive shopping experiences. Furthermore, the rise of e-commerce and omnichannel strategies allows consumers to browse and purchase duty-free products before their journey, enhancing convenience and driving sales. Strategic partnerships between duty-free operators and luxury brands are also contributing to market growth, providing consumers with exclusive product offerings and personalized service. Finally, the ongoing expansion of airport infrastructure and the development of new duty-free stores in emerging markets are creating additional opportunities for market growth.

Despite the positive outlook, the duty-free travel retail market faces several challenges. Economic downturns and global uncertainties can significantly impact consumer spending, particularly on discretionary items like luxury goods. Fluctuations in currency exchange rates can also affect profitability for both retailers and brands. Increasing competition among duty-free operators necessitates continuous innovation and differentiation to maintain market share. Stricter regulations and customs procedures in various countries can complicate operations and increase costs. Maintaining a sustainable and ethical supply chain is crucial for long-term success, especially with increasing consumer awareness of environmental and social issues. The evolving regulatory landscape surrounding alcohol and tobacco products, along with increasing concerns around counterfeit goods, present ongoing challenges. Lastly, maintaining a strong brand reputation and protecting against security risks are critical elements that can severely impact the sector.

The Asia-Pacific region is projected to dominate the duty-free travel retail market throughout the forecast period (2025-2033). This is largely due to the significant growth in outbound travel from countries like China and India, coupled with rising disposable incomes and a preference for luxury goods.

Dominant Segments:

The paragraph above highlights the key regional and segment drivers. The strong performance of Fragrances & Cosmetics and Wine & Spirits, combined with the significant growth potential in the Asia-Pacific region, positions these as the dominant market forces. The luxury segment (Watches, Jewellery and Fine Writing) also holds significant potential, contingent on broader economic stability. The consistent performance of Port Duty-Free Stores highlights the ongoing importance of strategically located retail outlets within airport environments.

The duty-free travel retail industry's growth is further fueled by several key catalysts. These include the increasing adoption of technology to enhance the shopping experience, personalized marketing strategies targeting specific consumer segments, and strategic partnerships between duty-free operators and global brands to offer exclusive products and experiences. Furthermore, the expansion into emerging markets and the development of innovative retail formats, such as downtown duty-free stores, provide new opportunities for growth. Finally, a focus on sustainability and corporate social responsibility is increasingly influencing consumer choices and shaping the industry's direction.

(Further specific development details would require accessing current market reports)

This report provides a comprehensive overview of the duty-free travel retail market, covering key trends, drivers, challenges, and leading players. The detailed analysis includes historical data (2019-2024), an estimated view for 2025, and forecasts extending to 2033. This allows for a thorough understanding of the market's evolution and future prospects, helping stakeholders make informed decisions and navigate the dynamic landscape of the industry. The report segments the market by product type and retail application, providing granular insights into specific categories and regional performance.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.5%.

Key companies in the market include Dufry, Lagardère Travel Retail, Lotte Duty Free, LVMH, Aer Rianta International (ARI), China Duty Free Group, Dubai Duty Free, Duty Free Americas, Gebr. Heinemann, King Power International Group (Thailand), The Shilla Duty Free.

The market segments include Type, Application.

The market size is estimated to be USD 46.3 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Duty-free Travel Retail," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Duty-free Travel Retail, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.