1. What is the projected Compound Annual Growth Rate (CAGR) of the Dual Element Holder?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Dual Element Holder

Dual Element HolderDual Element Holder by Type (Hydraulic Dual Element Clamping Frame, Motorized Dual Element Clamping Frame, Pneumatic Dual Element Clamping Frame, Magnetic Dual Element Holder, World Dual Element Holder Production ), by Application (Consumer Electronics Industry, Medical Industry, Automobile Industry, Aviation Industry, World Dual Element Holder Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

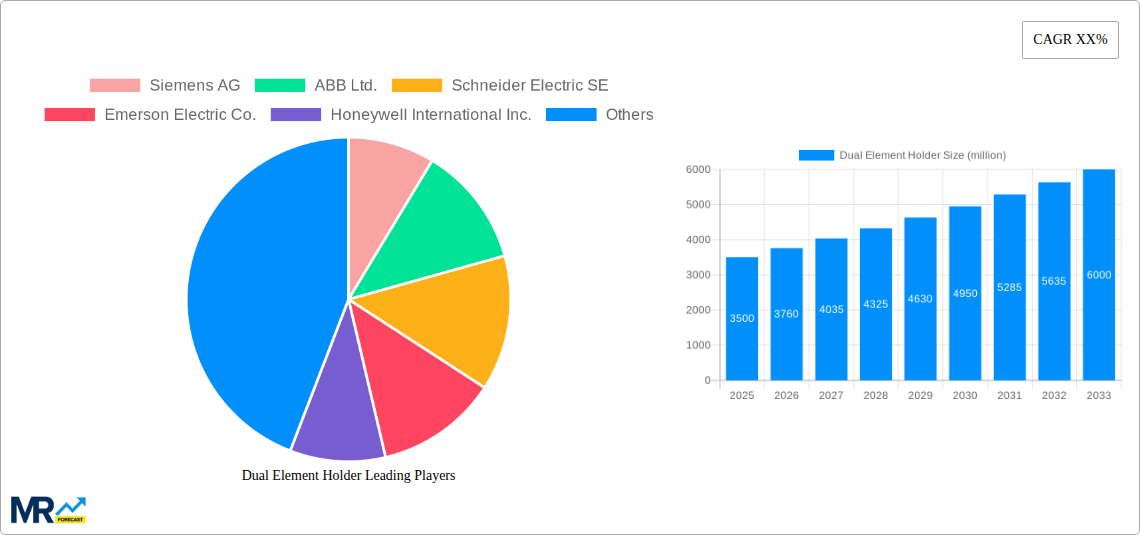

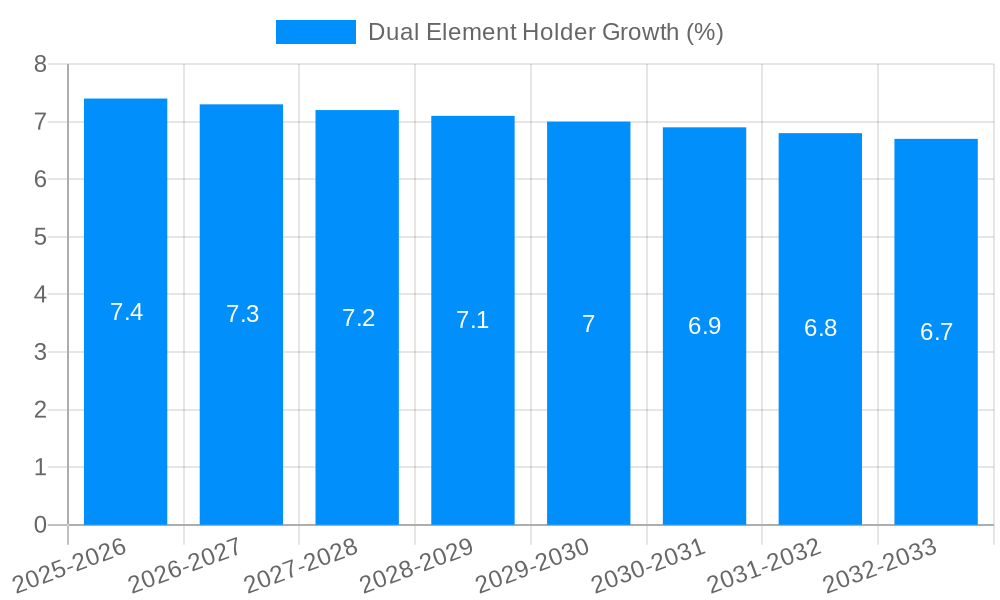

The global Dual Element Holder market is projected to experience significant growth, reaching an estimated market size of approximately USD 3,500 million in 2025 and expanding at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust expansion is primarily fueled by the increasing adoption of advanced automation solutions across key industries such as consumer electronics, automotive, medical, and aviation. The rising demand for sophisticated manufacturing processes requiring precise and reliable component handling is a major driver. Furthermore, the growing emphasis on miniaturization and higher performance in electronic devices necessitates the use of specialized holders that can accommodate dual elements, thereby enhancing functionality and efficiency. The market is witnessing a surge in innovation, with companies investing in the development of more intelligent and adaptable dual element holder systems.

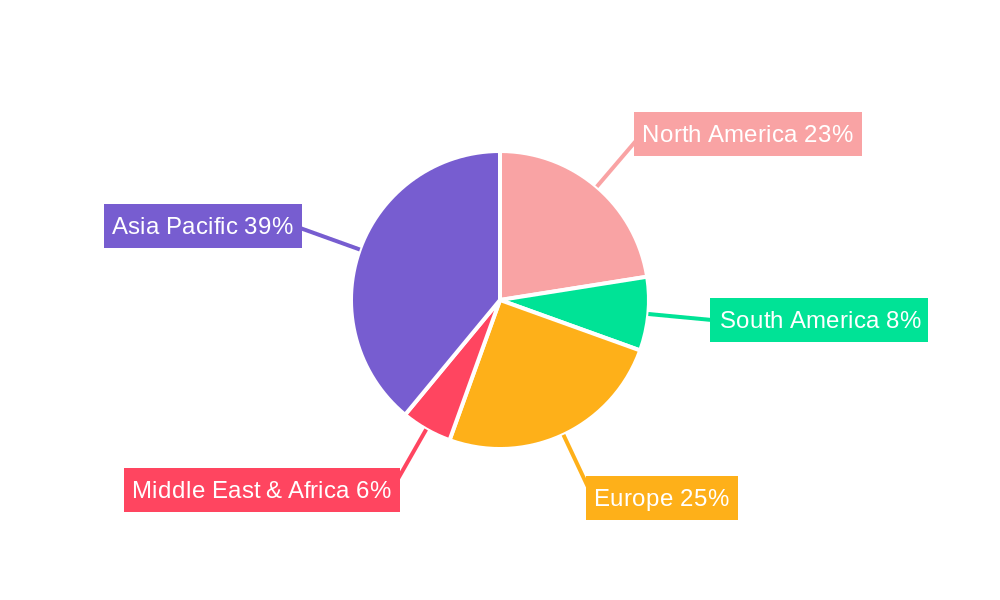

The market is segmented by type into Hydraulic Dual Element Clamping Frames, Motorized Dual Element Clamping Frames, Pneumatic Dual Element Clamping Frames, and Magnetic Dual Element Holders. Motorized and Pneumatic types are expected to lead in market share due to their widespread application in automated assembly lines requiring high precision and speed. The Consumer Electronics Industry stands out as the largest application segment, driven by the relentless pace of product innovation and the need for efficient, high-volume production. However, the Medical and Automobile industries are rapidly emerging as significant growth areas, owing to the increasing complexity of devices and vehicles and the stringent quality control requirements. Geographically, Asia Pacific, led by China and India, is anticipated to dominate the market, supported by its strong manufacturing base and increasing investments in advanced industrial technologies. North America and Europe also represent substantial markets, driven by established industries and a focus on Industry 4.0 initiatives. Challenges such as the high initial investment cost for advanced systems and the need for skilled labor may present some restraints, but the overwhelming benefits in terms of productivity and quality are expected to outweigh these.

XXX analysis of the global Dual Element Holder market reveals a dynamic landscape characterized by robust growth and evolving technological integration. The market, valued at over $500 million in the base year 2025, is projected to witness a significant CAGR of 7.8% during the forecast period of 2025-2033, reaching an estimated $900 million by 2033. This expansion is driven by an increasing demand for precision and efficiency in various industrial applications, particularly in sectors like automotive, aerospace, and medical devices, where the reliable and simultaneous holding of two distinct elements is critical for complex assembly and testing processes. The historical period from 2019-2024 laid the foundation for this growth, with a steady upward trajectory driven by nascent adoption in emerging economies and advancements in material science that improved the durability and functionality of dual element holders.

Key market insights indicate a pronounced shift towards more sophisticated and automated dual element holder solutions. The rising complexity of modern manufacturing, coupled with stringent quality control requirements, necessitates holders that offer superior clamping force consistency, ergonomic designs, and compatibility with advanced robotic systems. The proliferation of Industry 4.0 initiatives further fuels this trend, as manufacturers seek to integrate smart technologies into their production lines. This includes the development of dual element holders with embedded sensors for real-time monitoring of clamping pressure, temperature, and vibration, enabling predictive maintenance and optimizing operational efficiency. Furthermore, the increasing focus on miniaturization in consumer electronics and medical devices is creating a demand for smaller, lighter, and more adaptable dual element holders capable of handling delicate components with exceptional accuracy. The market is also experiencing a growing interest in specialized holders designed for specific material types, such as heat-sensitive or highly abrasive substances, prompting manufacturers to invest in research and development to offer tailored solutions. The global dual element holder production is not merely about quantity but increasingly about the quality and intelligence embedded within these critical components, ensuring the reliability and performance of end-user products. The continuous innovation in clamping mechanisms, material compositions, and integration capabilities will shape the trajectory of the market, making it a key area of interest for stakeholders across various industries.

The global Dual Element Holder market is propelled by a confluence of powerful driving forces that underscore its increasing indispensability across a multitude of industries. Foremost among these is the escalating complexity of modern manufacturing processes, particularly in sectors demanding high precision and reliability. As products become more intricate, requiring the simultaneous manipulation or holding of multiple components, the need for dual element holders that can securely and accurately manage two distinct elements becomes paramount. This is especially evident in the automotive industry, where the assembly of advanced drivetrains and intricate electronic systems relies on precise positioning and holding of various parts. Similarly, the aviation industry, with its stringent safety and performance standards, benefits immensely from dual element holders in the assembly of sophisticated aircraft components.

Furthermore, the relentless pursuit of enhanced operational efficiency and reduced production costs is a significant catalyst. Dual element holders streamline assembly lines by consolidating the function of two individual holders into one, thereby reducing the footprint on the production floor, minimizing setup times, and optimizing material flow. This efficiency gain translates directly into cost savings, making them an attractive investment for manufacturers looking to maintain a competitive edge. The growing adoption of automation and robotics in manufacturing environments further amplifies this trend. Dual element holders are increasingly being designed for seamless integration with robotic arms and automated assembly systems, enabling precise and repeatable operations that were previously impossible or prohibitively expensive. The demand for higher quality and more reliable end products across all sectors, from consumer electronics to medical devices, also plays a crucial role. The ability of dual element holders to maintain consistent clamping force and precise alignment directly impacts the quality of the final product, minimizing defects and rework.

Despite the robust growth trajectory, the Dual Element Holder market is not without its challenges and restraints that could temper its expansion. A primary concern revolves around the high initial investment cost associated with advanced dual element holders, particularly those incorporating sophisticated technologies like motorized actuation or integrated sensor systems. For small and medium-sized enterprises (SMEs), this capital expenditure can be a significant barrier to adoption, leading them to opt for less advanced or manual clamping solutions. This cost factor is particularly pronounced in regions with less developed industrial infrastructures or where economic volatility is a persistent issue. The complexity of integration with existing legacy systems also presents a hurdle. While newer dual element holders are designed for Industry 4.0 compatibility, retrofitting them into older manufacturing lines can be time-consuming, require specialized technical expertise, and incur additional costs, thus slowing down widespread adoption.

Moreover, technical limitations and material compatibility issues can sometimes constrain the application of dual element holders. For instance, certain highly sensitive materials or applications requiring extreme temperature variations might necessitate specialized materials or designs that are not readily available or are prohibitively expensive. The lack of standardization across different manufacturers and applications can also create interoperability issues, making it challenging for users to find compatible solutions for their specific needs. This fragmentation in the market can lead to increased research and development costs for manufacturers aiming to cater to diverse requirements. Furthermore, the availability of skilled labor capable of operating, maintaining, and troubleshooting advanced dual element holder systems can be a limiting factor in some regions. Insufficient training or expertise can lead to inefficient use or even damage to the equipment, thereby hindering market growth. Finally, geopolitical uncertainties and supply chain disruptions, as witnessed in recent years, can impact the availability of raw materials and the timely delivery of finished products, creating volatility in production and pricing, which can affect market growth.

The global Dual Element Holder market is characterized by significant regional dominance and segment specialization, with certain areas and product types leading the charge in innovation and adoption.

Dominating Regions/Countries:

North America: This region, encompassing the United States and Canada, is projected to maintain a leading position in the global Dual Element Holder market. The strong presence of advanced manufacturing industries, particularly in the automotive, aerospace, and medical device sectors, drives a consistent demand for high-precision clamping solutions. The well-established industrial infrastructure, coupled with a strong emphasis on technological adoption and automation, creates a fertile ground for sophisticated dual element holders. Significant investments in research and development within these key sectors further fuel the demand for innovative and specialized holders. The presence of major global players like Siemens AG, ABB Ltd., and Emerson Electric Co. with robust sales and support networks further solidifies North America's market leadership. The robust adoption of Industry 4.0 principles across manufacturing facilities in this region ensures a continuous demand for intelligent and integrated dual element holders.

Europe: Europe, particularly countries like Germany, the UK, and France, represents another dominant force in the dual element holder market. The region boasts a strong legacy in precision engineering and manufacturing, with a high concentration of automotive manufacturers, industrial equipment producers, and medical technology companies. The stringent quality standards and the focus on innovation within these sectors necessitate the use of reliable and advanced dual element holders. Furthermore, the ongoing digitalization of manufacturing processes and the push towards smart factories across Europe are significantly boosting the adoption of automated and connected clamping solutions. Companies like Schneider Electric SE and Eaton Corporation PLC have a strong presence, catering to the diverse needs of European industries. The emphasis on sustainability and efficiency in manufacturing also drives demand for dual element holders that contribute to reduced waste and optimized resource utilization.

Asia-Pacific: While currently a significant player, the Asia-Pacific region, led by countries such as China, Japan, and South Korea, is poised for the most rapid growth in the dual element holder market. The burgeoning manufacturing sector in China, coupled with substantial investments in advanced technologies, is a primary growth driver. The increasing demand from the rapidly expanding automotive, consumer electronics, and medical device industries in countries like India and Southeast Asian nations further fuels market expansion. Japanese and South Korean companies are at the forefront of technological innovation, developing cutting-edge dual element holders that are being adopted globally. The region's large manufacturing base and its role as a global production hub for various industries create a massive and ever-growing demand for efficient and cost-effective clamping solutions.

Dominating Segments:

Motorized Dual Element Clamping Frame: This segment is expected to witness substantial growth and potentially dominate the market in the coming years. The increasing need for precision, repeatability, and integration with automated systems makes motorized dual element holders highly sought after. Their ability to offer controlled clamping force, adjustable speeds, and remote operation aligns perfectly with the demands of advanced manufacturing and robotic applications. The automotive and aerospace industries, in particular, are increasingly adopting motorized solutions for complex assembly tasks.

Application in the Automobile Industry: The automobile industry stands out as a primary application segment for dual element holders. The intricate assembly of modern vehicles, from engine components and powertrain systems to advanced electronics and interior fittings, requires precise and simultaneous holding of multiple parts. The drive for lighter, more fuel-efficient, and technologically advanced vehicles necessitates higher levels of precision in manufacturing, making dual element holders indispensable. From the assembly of complex engine blocks to the precise mounting of sensors and intricate wiring harnesses, these holders play a critical role in ensuring the quality and reliability of automotive components. The sheer volume of vehicle production globally underscores the massive demand generated by this sector.

World Dual Element Holder Production: The aggregate production of dual element holders globally is a critical indicator of market health. As the demand from various industries grows, so does the need for efficient and scalable production capabilities. Manufacturers are investing in optimizing their production processes, utilizing advanced machinery and automation to meet the increasing global demand. The focus is not just on the quantity of holders produced but also on the quality, customization, and technological sophistication embedded within them. The ability to scale production while maintaining high-quality standards will be crucial for market leaders.

The Dual Element Holder industry is propelled by several key growth catalysts. The escalating complexity of modern products across sectors like automotive, aerospace, and medical devices necessitates highly precise and reliable component handling, directly boosting demand. The global push towards automation and Industry 4.0 integration is a significant driver, as dual element holders are crucial for robotic assembly and smart manufacturing processes, enabling greater efficiency and accuracy. Furthermore, the increasing emphasis on miniaturization in consumer electronics and medical equipment requires specialized holders that can manage smaller, more delicate components with extreme precision. Investments in research and development by leading players are also a catalyst, leading to the creation of more advanced, intelligent, and user-friendly dual element holder solutions.

The comprehensive coverage of the Dual Element Holder market report will delve into the intricate details of market dynamics, providing stakeholders with actionable insights for strategic decision-making. This report will not only analyze the current market size and projected growth but also offer an in-depth examination of the factors influencing these trends. It will dissect the competitive landscape, highlighting the strengths, strategies, and market share of leading companies such as Siemens AG, ABB Ltd., and Schneider Electric SE. Furthermore, the report will provide a granular breakdown of the market by segment, including Type (Hydraulic, Motorized, Pneumatic, Magnetic) and Application (Consumer Electronics, Medical, Automobile, Aviation), offering detailed forecasts for each. Regional analyses will pinpoint key growth pockets and potential challenges across major markets like North America, Europe, and Asia-Pacific, identifying countries poised for significant market expansion. The report will also thoroughly investigate the industry developments, significant innovations, and regulatory landscapes that shape the dual element holder ecosystem, ensuring a holistic understanding for investors, manufacturers, and end-users.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Siemens AG, ABB Ltd., Schneider Electric SE, Emerson Electric Co., Honeywell International Inc., Rockwell Automation, Inc., General Electric Company, Mitsubishi Electric Corporation, Eaton Corporation PLC, Johnson Controls International PLC, Danfoss A/S, Parker-Hannifin Corporation, WEG S.A., Toshiba Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Dual Element Holder," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dual Element Holder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.