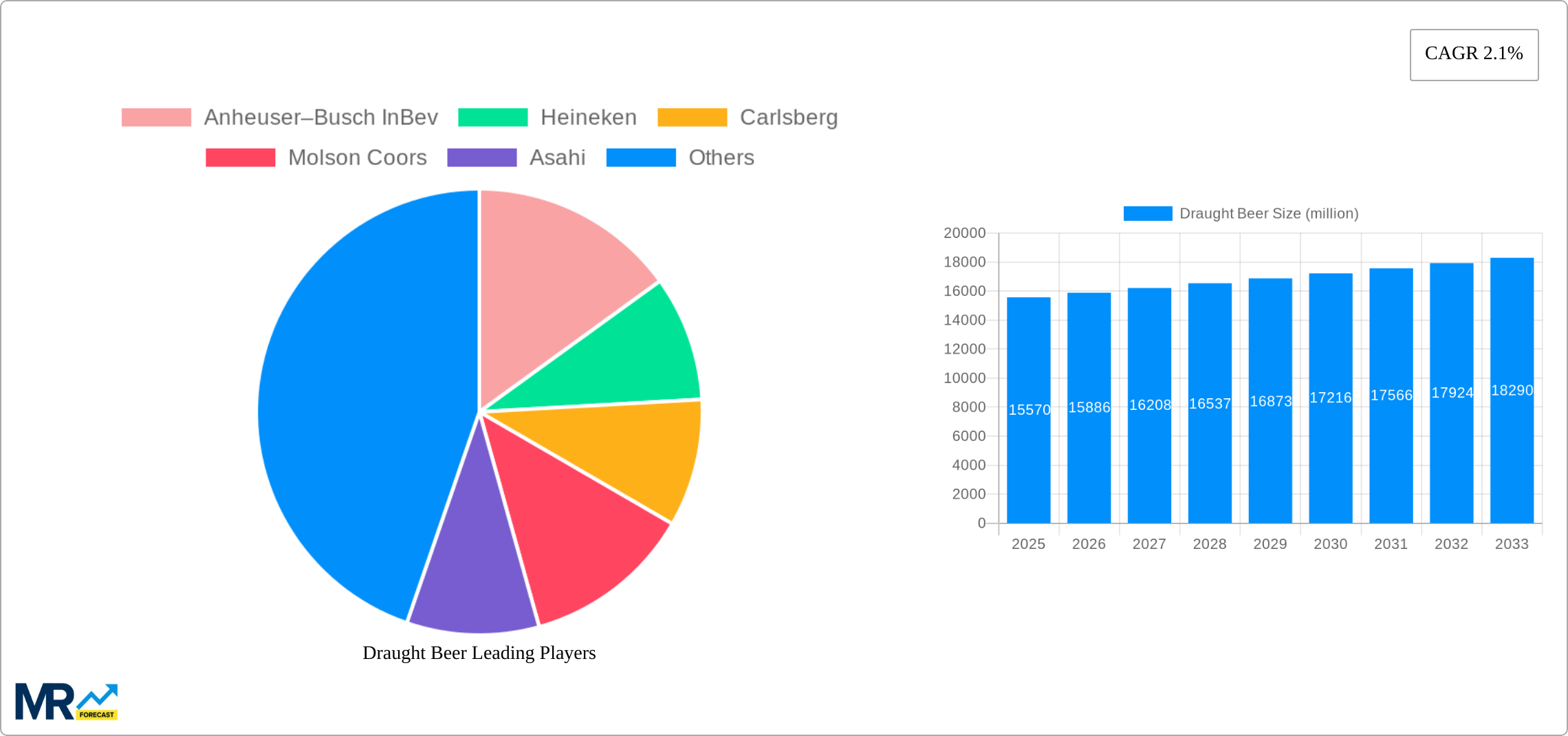

1. What is the projected Compound Annual Growth Rate (CAGR) of the Draught Beer?

The projected CAGR is approximately 2.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Draught Beer

Draught BeerDraught Beer by Type (Discount, Mainstream, Premium, Superpremium, Commercial Use, Home Use), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

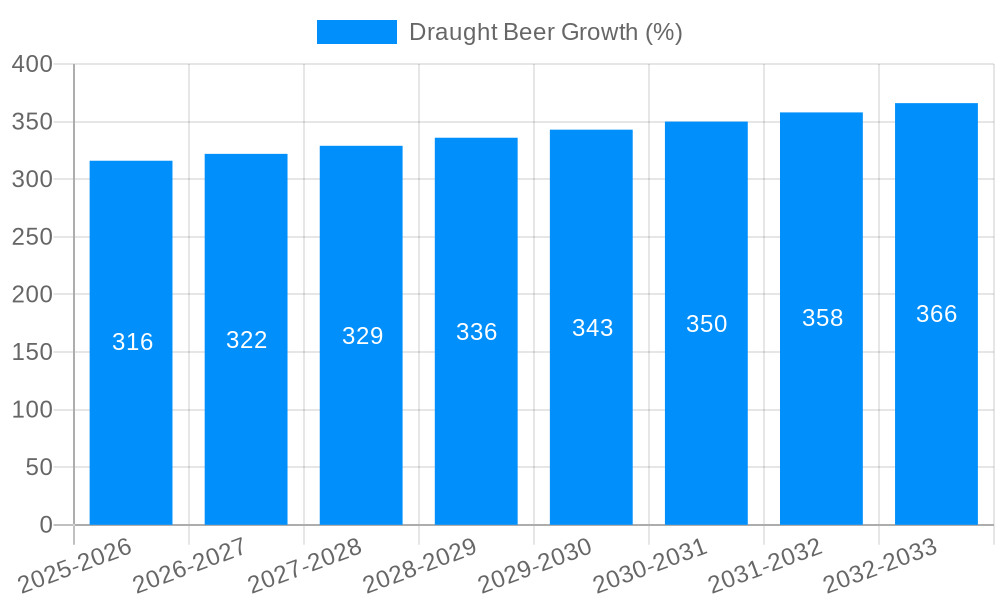

The global draught beer market, valued at $15,570 million in 2025, is projected to exhibit a steady compound annual growth rate (CAGR) of 2.1% from 2025 to 2033. This growth is driven by several factors. The increasing popularity of craft breweries and the resurgence of traditional pub culture in many regions contribute significantly to market expansion. Consumer preference for premium and super-premium draught beers, offering a superior taste experience, fuels higher-value segment growth. Furthermore, strategic partnerships between breweries and hospitality venues, combined with targeted marketing initiatives emphasizing the social and experiential aspects of draught beer consumption, are fostering market expansion. However, the market faces some challenges. Fluctuations in raw material costs (such as barley and hops) and potential excise tax increases can impact profitability. Additionally, evolving consumer preferences towards healthier beverage options and the increasing popularity of ready-to-drink (RTD) alcoholic beverages present potential restraints. The market segmentation reveals a diverse landscape, with discount, mainstream, premium, and super-premium segments catering to various consumer preferences. The commercial use segment (bars, restaurants) remains the largest, although home use is also a substantial contributor, influenced by trends in home entertainment and upscale home bars. The leading players, including Anheuser-Busch InBev, Heineken, Carlsberg, and others, are constantly innovating with new beer styles and distribution strategies to maintain their market positions in this competitive environment.

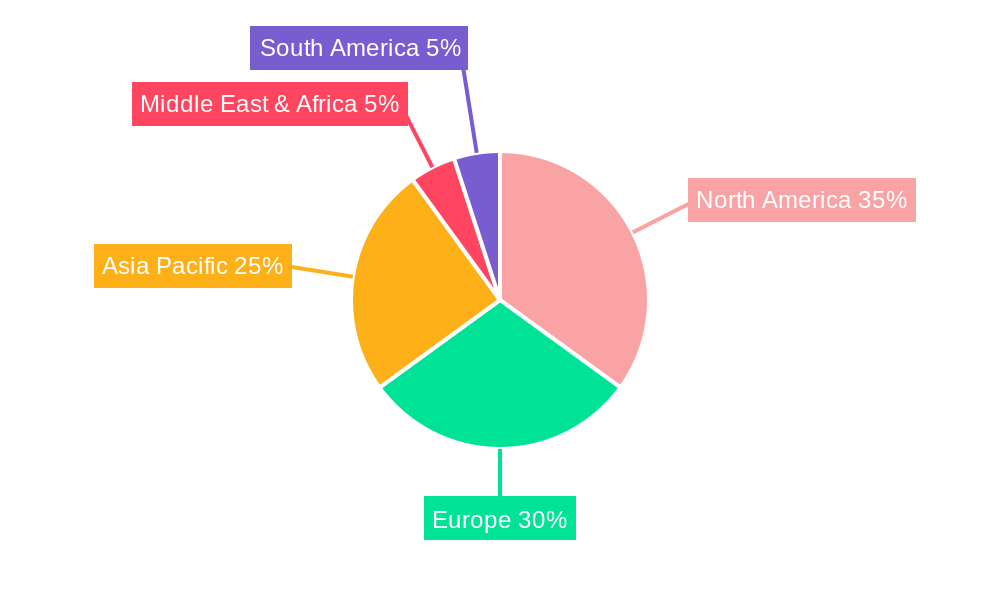

The geographical distribution of the draught beer market is broad, with North America, Europe, and Asia Pacific representing the major regions. Within these regions, variations in per capita consumption, cultural preferences, and economic conditions influence growth patterns. For example, mature markets like Europe may exhibit moderate growth, while regions with rising disposable incomes and expanding middle classes, such as certain parts of Asia, may experience more substantial growth. Competition among the major players is intense, characterized by strategic acquisitions, brand extensions, and marketing campaigns. The future of the draught beer market will likely hinge on the companies’ ability to adapt to changing consumer tastes, optimize supply chains, and innovate with sustainable brewing practices to address environmental concerns. Specific regional breakdowns would require more detailed data; however, based on the established market players and regional economic indicators, it's reasonable to expect higher growth in regions with robust economies and increasing disposable incomes.

The global draught beer market exhibited robust growth throughout the historical period (2019-2024), exceeding several million units in annual sales. This surge is primarily attributed to the increasing popularity of craft beers and the resurgence of traditional pub and bar cultures in many regions. However, the market faced temporary setbacks during the COVID-19 pandemic (2020-2021) due to widespread lockdowns and restrictions on hospitality venues. Despite this disruption, the market showed remarkable resilience, demonstrating a strong recovery in 2022 and beyond. The estimated market value for 2025 surpasses previous years' figures, signifying a significant return to growth. Consumer preferences are shifting towards premium and super-premium draught beers, driven by a growing appreciation for diverse flavors and higher quality ingredients. The market's growth is also influenced by evolving consumption patterns; on-premise consumption remains strong, particularly in established markets, but off-premise consumption via growlers and draught beer systems for home use is gaining traction, presenting new opportunities for expansion. The forecast period (2025-2033) anticipates continued growth, fueled by factors such as expanding distribution networks, innovative packaging solutions, and the increasing appeal of draught beer among younger demographics. This optimistic projection considers the ongoing economic recovery and sustained interest in premium quality beverages. However, potential challenges like fluctuating raw material prices, changing consumer tastes, and intensifying competition will require strategic adaptation from market players to sustain this predicted trajectory. The market is likely to see consolidation among players as larger breweries acquire smaller craft brewers.

Several factors contribute to the draught beer market's continued growth. The rising disposable incomes in developing economies have fueled higher consumer spending on premium beverages, including draught beers. The craft beer revolution has significantly broadened the variety and appeal of draught beers, catering to a more discerning palate. Increased focus on marketing and branding by major players has created stronger brand awareness and loyalty. The expansion of the food service industry, including restaurants, pubs, and bars, is a major driver, providing more opportunities for draught beer consumption. The introduction of innovative draught dispensing systems for both commercial and home use has further enhanced market expansion. Moreover, the growing popularity of beer festivals and events promotes brand awareness and increases overall market visibility. This holistic approach towards draught beer, from sourcing the finest ingredients to showcasing creativity in flavor profiles and distribution, contributes to the positive outlook for the market's future. Sustainability initiatives adopted by some breweries also resonate with environmentally conscious consumers, further boosting market appeal.

Despite the positive outlook, several challenges hamper the draught beer market's growth. Fluctuations in raw material prices (barley, hops, etc.) significantly impact production costs and profitability. Stringent government regulations regarding alcohol consumption and advertising can limit market expansion and increase operational costs. Intense competition from other alcoholic beverages, such as wine and spirits, necessitates constant innovation and marketing efforts. The rising health consciousness among consumers is leading to a preference for healthier alternatives, potentially impacting draught beer consumption. Environmental concerns regarding water usage and carbon emissions in the brewing process are also generating pressure on breweries to adopt sustainable practices. Furthermore, economic downturns can significantly impact consumer spending on discretionary items like premium draught beers. Addressing these challenges effectively will be crucial for sustaining the long-term growth of the draught beer market.

The Commercial Use segment is poised to dominate the draught beer market during the forecast period. This segment encompasses sales to restaurants, bars, pubs, hotels, and other commercial establishments.

North America and Europe are expected to remain the largest regional markets, driven by a mature beer culture, strong economies, and established distribution networks. However, Asia-Pacific is projected to witness significant growth, fuelled by increasing disposable incomes and a rising middle class.

Reasons for Commercial Use Segment Dominance: The vast majority of draught beer is consumed on-premise. Established distribution networks already exist within the hospitality sector. The commercial segment has a higher average price per unit, generating greater revenue for producers. The commercial setting lends itself to brand building and promotional activities. Commercial establishments often offer a wider variety of draught beers compared to retail settings.

Regional Breakdown:

The draught beer industry's growth is further catalyzed by several factors. The increasing popularity of craft beer, with its diverse flavors and unique brewing styles, significantly broadens the market appeal. Innovative packaging solutions, such as keg rentals and growlers, are expanding access to draught beer beyond traditional on-premise consumption. Marketing and promotional activities, focusing on premium experiences and brand image, further drive sales. The expanding food service sector, coupled with the rise of gastropubs and craft beer bars, provides new avenues for consumption. Finally, growing consumer interest in unique brewing styles and flavor profiles continues to fuel demand.

This report provides a thorough analysis of the draught beer market, encompassing historical data, current market trends, and future projections. It delves into key drivers, challenges, and significant developments shaping the industry landscape. The report offers valuable insights into market segmentation, regional variations, and competitive dynamics. The detailed analysis will be helpful for businesses looking to enter or expand their presence in this vibrant and dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.1%.

Key companies in the market include Anheuser–Busch InBev, Heineken, Carlsberg, Molson Coors, Asahi, Kirin, Groupé Castel, Grupo Petrópolis, Constellation Brands, Anadolu Efes, Gold Star, San Miguel, CR Beer, Duvel, Tsingtao Brewery, Yanjing, .

The market segments include Type.

The market size is estimated to be USD 15570 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Draught Beer," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Draught Beer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.