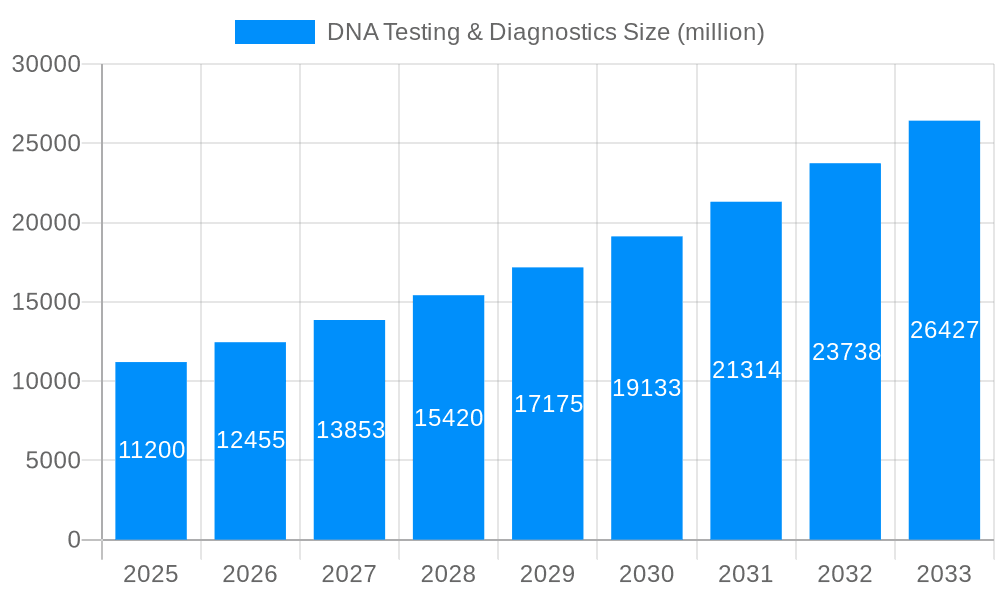

1. What is the projected Compound Annual Growth Rate (CAGR) of the DNA Testing & Diagnostics?

The projected CAGR is approximately 8.81%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

DNA Testing & Diagnostics

DNA Testing & DiagnosticsDNA Testing & Diagnostics by Type (/> PCR-Based Diagnostics, ISH Diagnostics, NGS DNA Diagnosis), by Application (/> Hospital, Medical Research, Pharmacogenomics Diagnostic Testing), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

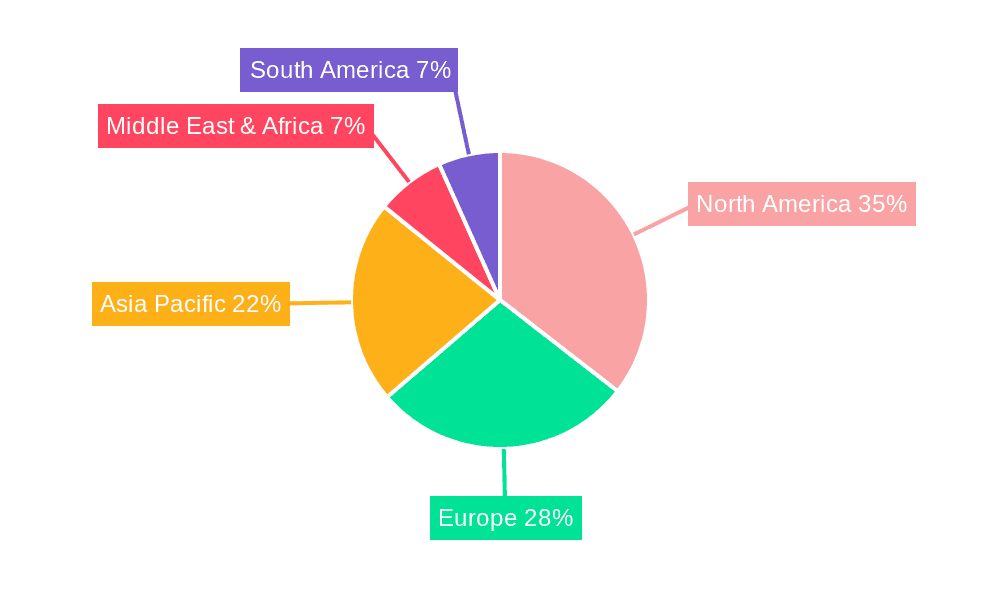

The global DNA testing and diagnostics market, currently valued at approximately $23.4 billion (2025 estimate), is poised for substantial growth over the next decade. Driven by advancements in sequencing technologies like Next-Generation Sequencing (NGS), increasing prevalence of genetic disorders, personalized medicine initiatives, and the growing adoption of PCR-based diagnostics, the market is expected to experience a significant Compound Annual Growth Rate (CAGR). While precise CAGR data is unavailable, considering market trends and technological advancements in the field, a conservative estimate of 8-10% CAGR seems plausible for the forecast period of 2025-2033. The application segments, notably hospital diagnostics, medical research, and pharmacogenomics testing, are all experiencing robust growth. Hospital settings are the largest consumers, followed by research institutions increasingly relying on DNA analysis for drug discovery and disease understanding. Pharmacogenomics, focusing on individual genetic variations affecting drug response, is a fast-growing segment, boosting market expansion. The market is segmented geographically, with North America currently holding the largest market share due to high technological advancements, robust healthcare infrastructure, and increased awareness among consumers. However, the Asia-Pacific region is projected to witness faster growth in the coming years, fueled by rising disposable incomes, expanding healthcare infrastructure, and growing awareness about genetic testing in developing economies.

Major players such as GE Healthcare, Illumina, Roche Diagnostics, and Thermo Fisher Scientific are actively shaping the market landscape through continuous innovation, strategic acquisitions, and partnerships. The competitive landscape is highly dynamic, with companies focusing on developing advanced, high-throughput technologies and expanding their geographical presence. While regulatory hurdles and high costs associated with certain advanced technologies remain as restraints, the overall market outlook is optimistic, driven by escalating demand for precise and personalized healthcare solutions. The increasing focus on early disease detection and proactive healthcare is a significant factor furthering this growth. Continued technological innovations, coupled with favorable government initiatives aimed at promoting genomic research and personalized medicine, will further stimulate the market's growth trajectory in the long term.

The global DNA testing and diagnostics market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The period from 2019 to 2024 witnessed significant advancements, setting the stage for even more dramatic expansion in the forecast period (2025-2033). Key market insights reveal a shift towards personalized medicine, driven by the increasing affordability and accessibility of advanced DNA sequencing technologies like Next-Generation Sequencing (NGS). This trend is fueled by a rising prevalence of chronic diseases, an aging global population, and a growing understanding of the role of genetics in disease development. The market is characterized by intense competition among numerous players, including established giants like Thermo Fisher Scientific and Roche Diagnostics, and innovative smaller companies specializing in niche applications. The base year of 2025 serves as a pivotal point, marking a transition from established technologies to the widespread adoption of more sophisticated and cost-effective methods. The market's growth is further propelled by escalating demand for rapid and accurate diagnostic solutions across various applications, ranging from oncology and infectious disease diagnosis to pharmacogenomics. The increasing integration of artificial intelligence (AI) and machine learning (ML) in data analysis and interpretation is streamlining workflows and enhancing the accuracy of diagnostic results. This, coupled with ongoing research and development, promises even more sophisticated and personalized diagnostic tools in the coming years, further boosting market growth and driving value well into the millions. The historical period (2019-2024) provided a strong foundation for the estimated year (2025) and the subsequent projected growth.

Several factors are driving the remarkable expansion of the DNA testing and diagnostics market. Firstly, the decreasing cost of sequencing technologies, particularly NGS, is making DNA testing more accessible to a wider population, leading to increased diagnostic testing across various healthcare settings. Secondly, the rising prevalence of chronic diseases, such as cancer and cardiovascular diseases, is creating a significant demand for accurate and early diagnosis, where DNA testing plays a crucial role. Thirdly, the growing awareness among consumers regarding the benefits of preventative healthcare and personalized medicine is encouraging individuals to undergo DNA testing for disease risk assessment and tailored treatment plans. Pharmacogenomics, the study of how genes affect a person's response to drugs, is gaining traction, leading to the development of targeted therapies and personalized medicine approaches. This, in turn, is driving demand for DNA testing in drug development and clinical trials. Government initiatives and funding supporting genomic research and the development of diagnostic tools also contribute to the market's expansion. Finally, the increasing availability of advanced bioinformatics tools and data analysis techniques enables the efficient processing and interpretation of large-scale genomic data, further accelerating the growth of the market.

Despite the immense potential, the DNA testing and diagnostics market faces several challenges. The high cost of advanced technologies, especially NGS, remains a barrier to entry for many smaller companies and limits the accessibility of such tests in resource-constrained settings. The complexity of genomic data interpretation and the need for skilled professionals to analyze results present a bottleneck in the widespread adoption of DNA-based diagnostics. Ethical concerns related to data privacy and security, especially concerning genetic information, require stringent regulatory frameworks and robust data protection measures. The regulatory landscape surrounding DNA testing and diagnostics varies across different countries, creating challenges for companies operating internationally. Furthermore, the reimbursement policies for DNA-based tests by healthcare payers differ widely, influencing the accessibility and affordability of these tests. Finally, the continuous evolution of genomic knowledge and technologies necessitates ongoing investment in research and development to keep pace with the latest advancements and maintain the accuracy and reliability of diagnostic tests.

The North American market, specifically the United States, is expected to dominate the DNA testing and diagnostics market due to its robust healthcare infrastructure, advanced technological capabilities, and high adoption rates of personalized medicine. However, significant growth is anticipated in other regions, including Europe and Asia-Pacific, driven by increasing healthcare expenditure and the rising prevalence of chronic diseases.

NGS DNA Diagnosis: This segment is poised for rapid growth due to its ability to provide comprehensive genomic information for faster and more accurate diagnostics. The increasing affordability of NGS is further fueling its market penetration. NGS's higher throughput and ability to identify a broader range of genetic variants compared to traditional methods are key advantages. Millions of dollars are being invested in research and development to improve NGS technology and expand its applications.

Hospital Application: Hospitals are the primary users of DNA testing and diagnostics, driving significant demand for these services. This segment's dominance stems from the high concentration of patients requiring diagnostic testing and the readily available infrastructure for sophisticated testing procedures. The integration of DNA testing into routine clinical workflows within hospitals is accelerating market growth. The increasing investment in hospital infrastructure and the growing adoption of advanced technologies in hospitals are further supporting the growth of this segment.

Pharmacogenomics Diagnostic Testing: This burgeoning segment is fueled by the personalized medicine revolution. Pharmacogenomics provides crucial insights into how individuals respond to different medications, enabling clinicians to prescribe the most effective and safest drugs based on a patient's genetic makeup. The increasing focus on reducing adverse drug reactions and improving treatment outcomes is driving the growth of pharmacogenomics testing. The ongoing development of new drugs and therapies tailored to specific genetic profiles is further boosting the demand for these tests.

The market is witnessing an increasing adoption of PCR-based diagnostics across various applications. However, the relatively high cost associated with NGS might hinder its widespread adoption initially, particularly in resource-constrained regions. Nevertheless, the continuous advancements in NGS technology are predicted to make it increasingly affordable and accessible in the long term, driving its growth and potential to surpass other segments in the future.

Several factors are catalyzing the growth of the DNA testing and diagnostics industry. Technological advancements, particularly in NGS and PCR technologies, are constantly reducing costs and improving speed and accuracy. This, coupled with the increasing demand for personalized medicine and the growing prevalence of chronic diseases, is driving the adoption of DNA testing across various healthcare settings. Furthermore, favorable regulatory environments and increased funding for research and development are fostering innovation and accelerating market expansion. The growing integration of AI and machine learning in data analysis is further enhancing the speed and accuracy of diagnosis, contributing to faster treatment decisions.

This report provides a comprehensive analysis of the DNA testing and diagnostics market, covering market trends, driving forces, challenges, key players, and significant developments. It offers valuable insights into the market dynamics, enabling businesses to make informed strategic decisions and capitalize on growth opportunities in this rapidly evolving sector. The report's detailed segmentation and regional analysis provide a granular view of the market landscape, allowing stakeholders to identify high-growth segments and regions. The projections extending to 2033 offer a long-term perspective on market evolution, aiding in long-term strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.81% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.81%.

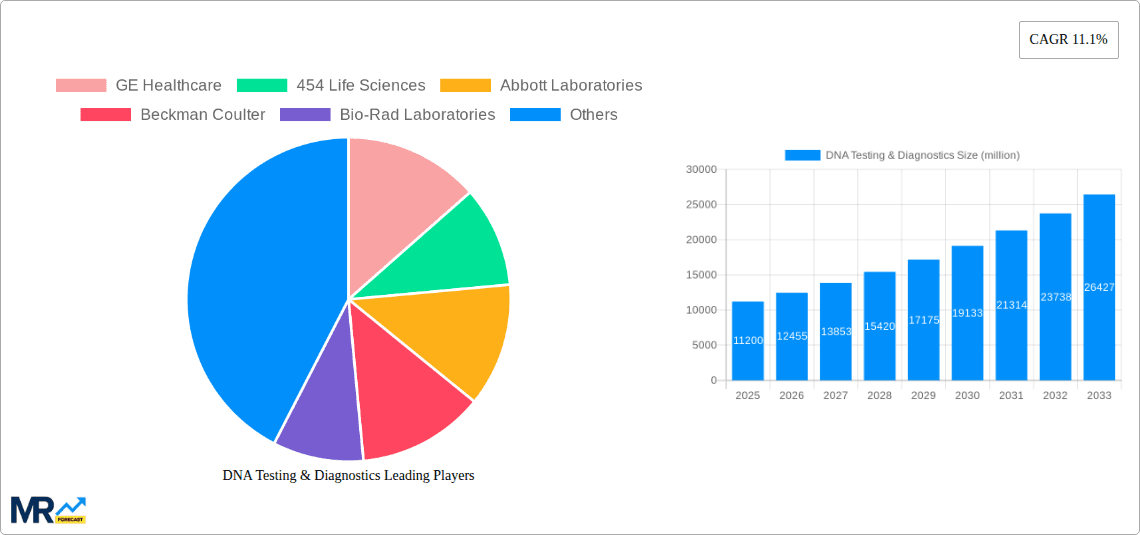

Key companies in the market include GE Healthcare, 454 Life Sciences, Abbott Laboratories, Beckman Coulter, Bio-Rad Laboratories, Thermo Fisher Scientific, Illumina, Cephide, Hologic, Transgenomic, Siemens Healthcare, Roche Diagnostics, Qiagen, Affymetrix, Agilent Technologies.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "DNA Testing & Diagnostics," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the DNA Testing & Diagnostics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.