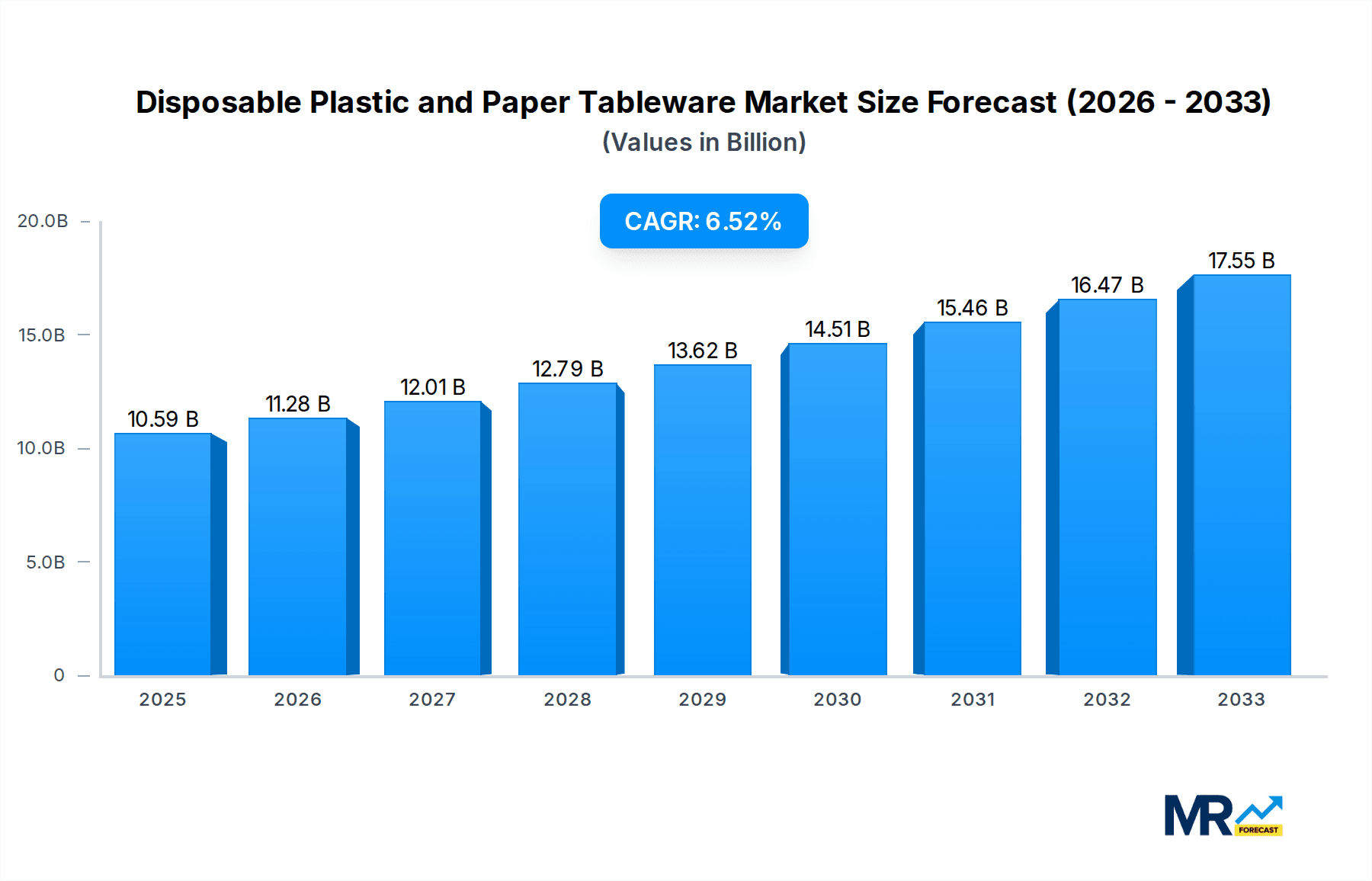

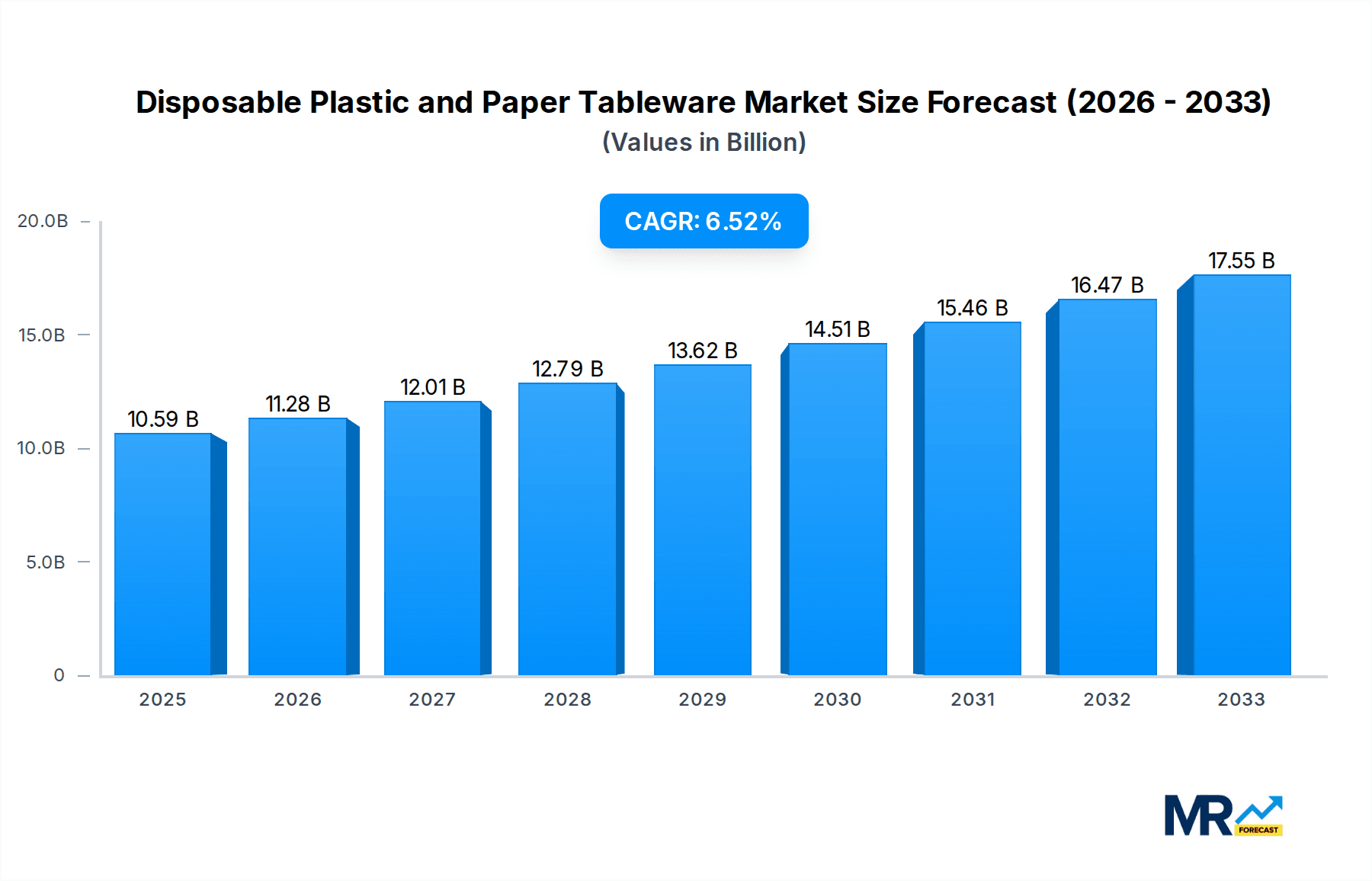

1. What is the projected Compound Annual Growth Rate (CAGR) of the Disposable Plastic and Paper Tableware?

The projected CAGR is approximately 6.47%.

Disposable Plastic and Paper Tableware

Disposable Plastic and Paper TablewareDisposable Plastic and Paper Tableware by Type (Plastic Tableware, Paper Tableware), by Application (Commercial, Residential), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

The global disposable plastic and paper tableware market is poised for robust expansion, projected to reach an estimated USD 10.59 billion by 2025, exhibiting a compelling Compound Annual Growth Rate (CAGR) of 6.47% through 2033. This sustained growth is primarily fueled by escalating demand from both commercial and residential sectors. The convenience offered by disposable tableware, coupled with its cost-effectiveness, continues to drive its adoption in food service establishments, catering events, and households worldwide. Furthermore, evolving consumer lifestyles, characterized by increased on-the-go consumption and a preference for hassle-free dining solutions, significantly contribute to market penetration. The inherent advantages of disposability, including reduced labor costs for cleaning and enhanced hygiene, further cement its position in various end-use applications.

Despite the market's upward trajectory, certain factors present strategic considerations. While plastic tableware remains a dominant segment due to its durability and low cost, increasing environmental concerns and stringent regulations are prompting a notable shift towards more sustainable alternatives. Paper tableware, leveraging advancements in eco-friendly materials and production processes, is witnessing a surge in demand as consumers and businesses prioritize greener options. This trend is further amplified by growing government initiatives and corporate social responsibility programs aimed at curbing plastic waste. Nonetheless, the market is expected to navigate these challenges through innovation in biodegradable and compostable materials, alongside the development of efficient recycling infrastructure. Key players are actively investing in R&D to offer a wider array of sustainable solutions, ensuring continued market relevance and catering to the evolving preferences of a more environmentally conscious global consumer base.

This report delves into the dynamic and evolving landscape of the disposable plastic and paper tableware market. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, and a detailed forecast from 2025 to 2033, this analysis provides critical insights into market trends, driving forces, challenges, regional dominance, growth catalysts, key players, and significant developments. The market, valued in the billions, is segmented by type into Plastic Tableware and Paper Tableware, and by application into Commercial, Residential, and Industry Developments.

XXX paints a compelling picture of the global disposable plastic and paper tableware market, a sector poised for significant transformation and sustained growth. The historical period from 2019 to 2024 has witnessed a considerable expansion, driven by the convenience and cost-effectiveness offered by these products across various applications, from everyday residential use to large-scale commercial and industrial events. The base year of 2025 highlights a market currently valued in the tens of billions of dollars, reflecting its widespread adoption. Looking ahead to the forecast period of 2025-2033, a steady upward trajectory is anticipated. While plastic tableware continues to hold a dominant share due to its durability and low cost, the paper tableware segment is experiencing remarkable growth, fueled by escalating environmental consciousness and a growing preference for sustainable alternatives. This shift is not merely a trend but a fundamental market recalibration. The "commercial" application segment, encompassing food service establishments, catering companies, and event organizers, remains a cornerstone of demand, leveraging the practicality of disposable options for hygiene and efficiency. However, the "residential" segment is also showing robust expansion, as busy lifestyles and a desire for effortless cleanup continue to drive adoption. Furthermore, the "industry developments" segment, which includes institutional settings like hospitals and schools, presents an undercurrent of consistent demand. The market is characterized by a dual narrative: the enduring utility of plastic and the surging popularity of eco-friendlier paper alternatives, signaling an industry adapting to consumer demands for both convenience and sustainability. Innovations in material science and product design are increasingly shaping the offerings, with manufacturers focusing on biodegradable, compostable, and recyclable options to cater to a more discerning and environmentally aware consumer base. This intricate interplay of convenience, cost, and conscience will define the market's trajectory in the coming years.

The disposable plastic and paper tableware market is being propelled by a confluence of powerful forces, each contributing significantly to its sustained expansion. Foremost among these is the increasing global population and the corresponding growth in urbanization. As more people reside in cities, the demand for convenient food service solutions, including ready-to-eat meals and takeaway options, surges, directly translating into a higher demand for disposable tableware. Furthermore, the expanding food service industry, encompassing restaurants, cafes, fast-food chains, and catering services, serves as a consistent engine of growth. The inherent benefits of disposable tableware, such as enhanced hygiene, reduced labor costs associated with washing, and improved operational efficiency, make it an indispensable component of modern food service operations. Economic growth in developing regions also plays a crucial role, leading to increased disposable incomes and a greater propensity for consumers to opt for convenient and affordable solutions like disposable tableware for both everyday use and special occasions. The rise of the gig economy and the proliferation of food delivery services have further amplified demand, as these platforms rely heavily on disposable packaging and tableware to facilitate seamless and hygienic deliveries to consumers' doorsteps. The convenience factor, coupled with the relatively low cost of these products, continues to resonate with a broad spectrum of consumers and businesses alike.

Despite its robust growth, the disposable plastic and paper tableware market faces significant challenges and restraints that could temper its expansion. The most prominent restraint is the escalating global concern over environmental sustainability and plastic pollution. Governments worldwide are implementing stricter regulations, including outright bans on certain single-use plastic items and the imposition of taxes or levies on disposable products. This regulatory pressure is forcing manufacturers and consumers to seek more eco-friendly alternatives. Consumer awareness regarding the environmental impact of disposable tableware, particularly plastic, is also on the rise. This growing consciousness is leading to a shift in consumer preference towards reusable or compostable options, even if they come at a higher cost or inconvenience. The volatility of raw material prices, especially for petroleum-based plastics and pulp for paper production, can also pose a significant challenge. Fluctuations in these costs can directly impact the profitability of manufacturers and the final price of the products, potentially affecting demand. Additionally, the infrastructure for effective waste management and recycling of disposable tableware is still lacking in many regions, leading to accumulation in landfills and oceans, further exacerbating environmental concerns. The perception of disposables as being less premium or sophisticated compared to traditional tableware can also be a restraint in certain high-end commercial applications.

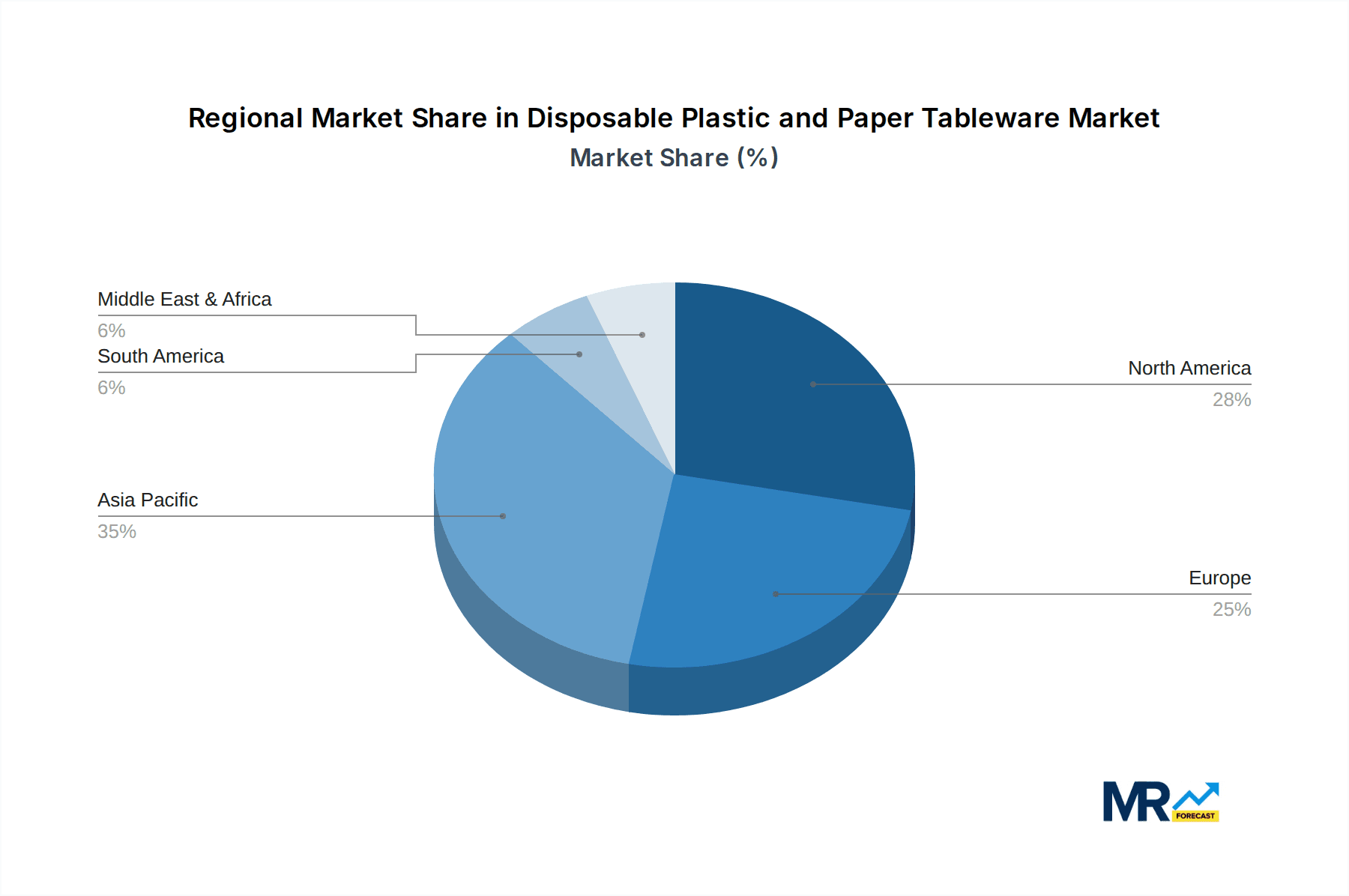

The disposable plastic and paper tableware market is characterized by a dynamic interplay of regional dominance and segment popularity, with specific areas and product types poised to lead the market throughout the forecast period.

Dominant Segments:

Plastic Tableware: Despite increasing environmental scrutiny, Plastic Tableware is projected to maintain a significant market share, particularly in the forecast period of 2025-2033. Its dominance is driven by its inherent advantages of durability, cost-effectiveness, and water resistance. In the Commercial application segment, fast-food chains, catering services, and institutional food providers will continue to be major consumers due to the high volume of service and the need for hygienic, disposable solutions. The low per-unit cost of plastic tableware makes it an economically viable choice for businesses operating on tight margins. For Industry Developments, such as large-scale events, outdoor festivals, and temporary food stalls, the practicality and ease of deployment of plastic options remain unmatched. While regulatory pressures are pushing for alternatives, the widespread availability and established supply chains for plastic tableware ensure its continued prominence in these sectors. The innovation within the plastic segment also includes the development of more recyclable and even bio-based plastics, attempting to mitigate some of the environmental concerns.

Paper Tableware: The Paper Tableware segment is experiencing robust and accelerated growth, set to be a major driver of market expansion in the coming years. This surge is directly attributable to increasing environmental awareness and governmental initiatives promoting sustainable alternatives. In the Commercial sector, many food service businesses are voluntarily switching to paper-based products to align with corporate social responsibility goals and to appeal to environmentally conscious consumers. The ease with which paper tableware can be composted or recycled, when properly managed, presents a significant advantage. Within the Residential application segment, the demand for paper tableware is escalating as consumers seek convenient yet eco-friendly options for home use, parties, and picnics. The availability of aesthetically pleasing and well-designed paper plates, cups, and cutlery is further enhancing its appeal. As production technologies improve and economies of scale are achieved, the cost differential between paper and plastic tableware is narrowing, making the switch more feasible for a wider audience. Emerging markets, in particular, are witnessing a rapid adoption of paper tableware as a sustainable first-choice solution, bypassing some of the historical reliance on less eco-friendly plastic alternatives.

Dominant Regions/Countries:

The global landscape of the disposable plastic and paper tableware market is heavily influenced by regional economic development, regulatory frameworks, and consumer behavior.

Asia-Pacific: This region is poised to be a dominant force in the disposable plastic and paper tableware market throughout the study period of 2019-2033, with its forecast period of 2025-2033 indicating continued leadership. The sheer size of its population, coupled with rapid economic growth and increasing disposable incomes, fuels a massive demand for convenient food service solutions. Countries like China and India, with their burgeoning middle class and expanding food service industries, represent significant consumption hubs. The increasing adoption of Western lifestyle habits, including the rise of fast-food chains and increased dining out, directly translates into higher demand for both plastic and paper tableware. Furthermore, a growing awareness of environmental issues, particularly in nations like China and Japan, is driving the adoption of paper tableware and innovative biodegradable plastics. The extensive manufacturing capabilities within the Asia-Pacific region also position it as a key supplier to the global market.

North America: North America, encompassing the United States and Canada, is another key region that will continue to exert considerable influence on the disposable plastic and paper tableware market. The established food service infrastructure, characterized by a high density of restaurants, cafes, and delivery services, ensures a consistent and substantial demand for disposable tableware. The presence of major market players headquartered in this region also contributes to market dynamics. While plastic tableware has historically held a strong position due to convenience and cost, there is a notable and accelerating shift towards sustainable alternatives, driven by stringent regulations and heightened consumer awareness regarding plastic waste. This trend is significantly bolstering the growth of the paper tableware segment. The region's advanced waste management and recycling initiatives, though facing their own challenges, are also more developed than in many other parts of the world, facilitating the adoption of more environmentally friendly options.

Several key factors are acting as significant growth catalysts for the disposable plastic and paper tableware industry. The burgeoning food delivery and takeaway services sector is a primary driver, providing a consistent demand for convenient and hygienic packaging solutions. The increasing adoption of sustainable and eco-friendly alternatives, such as biodegradable and compostable tableware, is creating new market opportunities and attracting environmentally conscious consumers. Furthermore, the growing global tourism and hospitality industry, especially in emerging economies, fuels demand for disposable tableware in hotels, restaurants, and event venues. Technological advancements leading to improved product design, enhanced durability, and cost reduction in the manufacturing of paper and alternative materials also contribute to market expansion.

This comprehensive report offers an in-depth analysis of the disposable plastic and paper tableware market, covering all critical aspects from market dynamics to future projections. It meticulously details the historical trends from 2019-2024 and provides an exhaustive forecast for 2025-2033, with 2025 serving as the base and estimated year. The report delves into the driving forces, including the convenience of use and expansion of the food service industry, while also scrutinizing the challenges posed by environmental concerns and regulatory shifts. It identifies key regional and segmental dominance, highlighting the impact of factors like economic growth and sustainability initiatives. Furthermore, the report outlines significant growth catalysts such as the booming food delivery sector and innovations in eco-friendly materials. With detailed insights into leading players and significant market developments, this report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving opportunities within the global disposable plastic and paper tableware industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.47% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.47%.

Key companies in the market include Dart Container Corporation, Huhtamaki, Graphic Packaging, Pactiv Evergeen, Koch Industries(Georgia-Pacific), SOLO Cup Company, CHUO KAGAKU, FULING, Ningbo Homelink Eco-itech, Hefei Hengxin Life Science and Technology, Zhe Jiang Pando EP Technology, Csicpacli(nanjing) Technology, CKF Inc, FUJIAN NANWANG ENVIRONMENT PROTECTION SCIEN-TECH, Novolex, Tianjin Yihsin Packing Plastic, YJS Environmental Technologies (Xiamen Great Pledge Environmental protection Material), Shuangtong Daily Necessities, Solia, Guangdong Huasheng Meto, TrueChoicePack (TCP).

The market segments include Type, Application.

The market size is estimated to be USD 10.59 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Disposable Plastic and Paper Tableware," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Disposable Plastic and Paper Tableware, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.