1. What is the projected Compound Annual Growth Rate (CAGR) of the Dispensary Point-of-sale Software?

The projected CAGR is approximately 10.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Dispensary Point-of-sale Software

Dispensary Point-of-sale SoftwareDispensary Point-of-sale Software by Type (On-Premise, Cloud-Based), by Application (Hospital, Pharmacy, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global cannabis dispensary point-of-sale (POS) software market is poised for substantial growth, propelled by expanding cannabis legalization and evolving industry needs. Key growth drivers include the imperative for efficient inventory management, streamlined sales operations, and robust regulatory compliance. The market is projected to reach $11.86 billion by 2025, exhibiting a CAGR of 10.7%. This expansion is significantly influenced by the increasing adoption of scalable, accessible, and data-rich cloud-based POS solutions. Enhanced features such as age verification, detailed inventory tracking, and comprehensive reporting are crucial contributors. The market is segmented by deployment (on-premise and cloud-based) and application, with cloud solutions demonstrating rapid adoption due to their flexibility and cost-efficiency. Leading providers are investing in R&D to innovate product offerings, focusing on mobile POS, seamless third-party payment integration, and advanced analytics dashboards to empower dispensary owners with critical business intelligence.

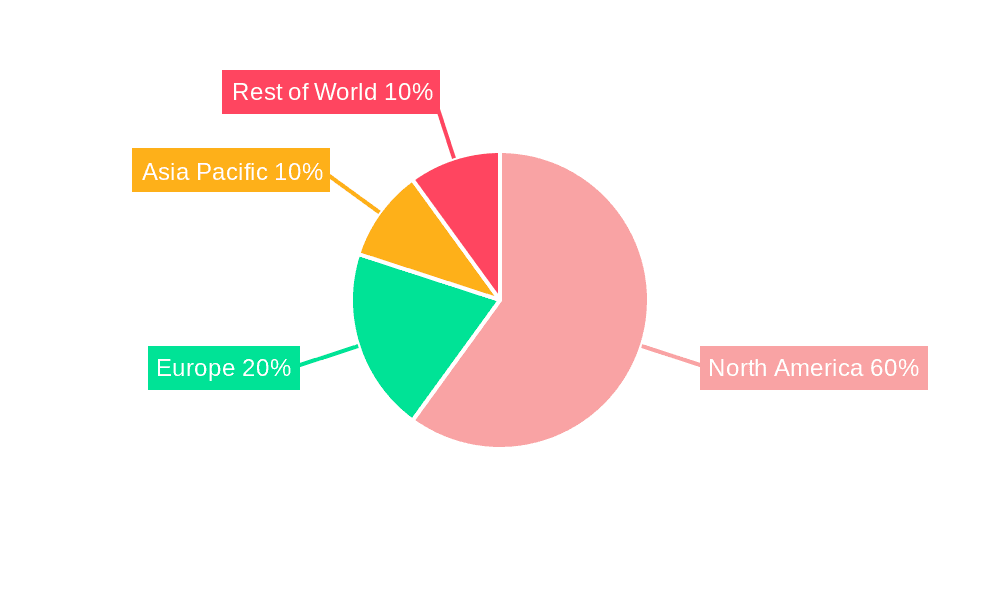

North America currently leads the market, driven by established legalization frameworks in the United States and Canada. However, Europe and Asia-Pacific present significant growth opportunities as regulatory landscapes evolve. The market navigates challenges including stringent compliance mandates and the necessity for advanced data security. Despite these hurdles, the long-term outlook for dispensary POS software remains highly positive, fueled by ongoing technological advancements, continued legalization, and the escalating demand for compliant and efficient sales solutions. Emerging market players and strategic alliances are expected to further intensify competition and foster innovation.

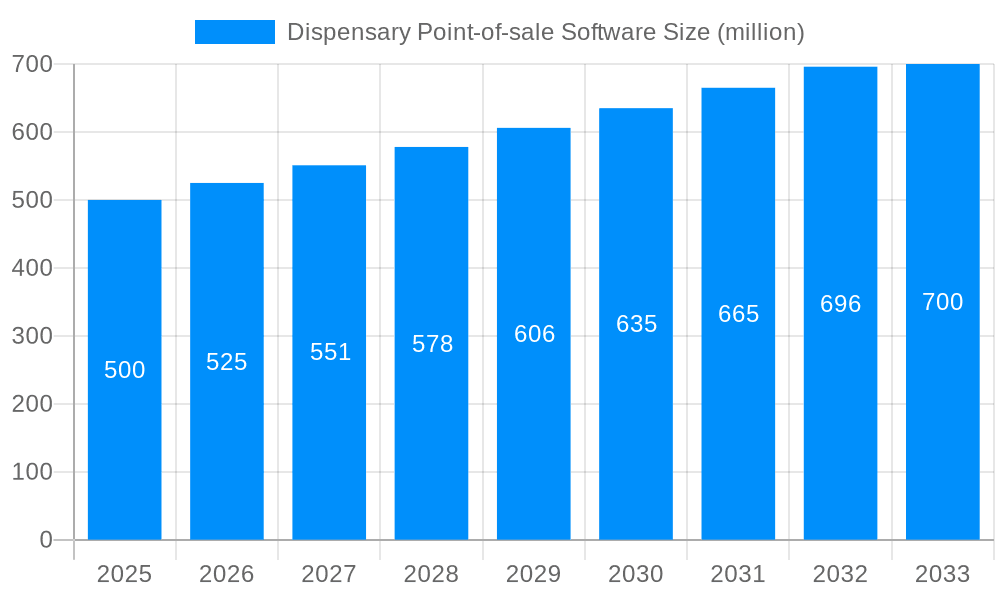

The dispensary point-of-sale (POS) software market is experiencing explosive growth, projected to reach multi-million unit sales by 2033. Driven by the burgeoning cannabis industry's legalization and expansion across numerous jurisdictions, the demand for robust and compliant POS systems is soaring. The market is witnessing a significant shift towards cloud-based solutions, offering scalability, accessibility, and remote management capabilities that are highly attractive to dispensary operators. This trend is further fueled by the increasing need for real-time inventory management, sales tracking, and customer relationship management (CRM) features, all crucial for efficient dispensary operations and regulatory compliance. The integration of advanced features like barcode scanning, biometric authentication, and sophisticated reporting tools is becoming increasingly common, enhancing operational efficiency and minimizing human error. Furthermore, the market is observing a growing trend toward specialized solutions tailored to specific dispensary needs, such as those focusing on medical cannabis or recreational sales, reflecting the diverse landscape of the cannabis industry. The historical period (2019-2024) saw significant adoption of basic POS systems, while the forecast period (2025-2033) promises rapid adoption of more sophisticated and integrated solutions. The estimated market size in 2025 reflects this accelerating growth trajectory. Competition is fierce, with established players and new entrants vying for market share through innovative features, strategic partnerships, and competitive pricing. The market's evolution is closely tied to evolving regulations and technological advancements, ensuring its continued dynamism.

Several key factors are driving the remarkable growth of the dispensary POS software market. Firstly, the ongoing legalization and expansion of the cannabis industry globally are creating a substantial demand for compliant and efficient point-of-sale systems. Dispensaries need reliable software to manage inventory, track sales, and ensure adherence to complex regulations, making POS systems a necessity rather than a luxury. Secondly, the increasing sophistication of consumer expectations is driving the need for advanced features. Consumers expect seamless transactions, personalized experiences, and loyalty programs, all of which require robust POS systems capable of handling such demands. Thirdly, the competitive landscape within the cannabis industry itself is fueling the adoption of advanced POS solutions. Dispensaries are leveraging data analytics and CRM capabilities to enhance customer engagement and gain a competitive edge. Finally, technological advancements in areas like cloud computing, mobile accessibility, and data security are continuously improving the functionality and reliability of dispensary POS software, making it a more attractive investment for businesses of all sizes.

Despite the significant growth potential, the dispensary POS software market faces certain challenges. Firstly, the highly regulated nature of the cannabis industry presents significant compliance hurdles. Software providers must ensure their solutions are compliant with varying state and local regulations, which can be complex and constantly evolving. This necessitates substantial investment in legal expertise and software updates. Secondly, the relatively nascent nature of the market means that some dispensaries may lack the technical expertise to implement and utilize these sophisticated systems effectively. This can lead to difficulties in training staff and maximizing the return on investment. Thirdly, security concerns regarding sensitive customer and financial data are paramount. Robust security measures are crucial to prevent data breaches and maintain customer trust. Finally, the cost of implementing and maintaining advanced POS systems can be a barrier for smaller dispensaries, particularly those operating on tight margins.

The cloud-based segment is poised to dominate the dispensary POS software market. This is driven by several key factors:

This dominance is particularly pronounced in regions with high rates of cannabis legalization and a thriving dispensary market. North America, specifically the United States and Canada, represent significant markets, driven by the increasing number of legal dispensaries and a strong demand for efficient and compliant POS solutions. However, expanding legalization efforts in other regions, such as Europe and parts of Latin America, indicate a significant potential for future growth beyond North America. Furthermore, the cloud-based solutions are proving increasingly popular in medical cannabis dispensaries, as these facilities prioritize efficient patient management and data security. The cloud also offers advantages in terms of remote access to patient records for collaborating healthcare professionals. This segment's share is projected to increase significantly during the forecast period (2025-2033).

Several factors are catalyzing growth in this sector. Increased legalization efforts are creating a larger market for compliant POS systems. Technological advancements, such as improved integration with inventory management and CRM, are enhancing the functionality of these systems, attracting more dispensaries to adopt them. The competitive landscape is also driving innovation, with companies constantly striving to offer better features and more cost-effective solutions.

This report provides a comprehensive overview of the dispensary point-of-sale software market, analyzing key trends, driving forces, challenges, and leading players. It offers detailed insights into market segmentation (by type, application, and geography), providing valuable information for businesses operating in, or considering entry into, this rapidly growing sector. The report leverages historical data (2019-2024) and utilizes robust forecasting models to predict market growth until 2033, offering a detailed and actionable perspective for strategic decision-making. It includes market sizing (in million units) and assesses the competitive landscape, providing valuable insights into the strengths and weaknesses of key players.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.7% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.7%.

Key companies in the market include BioTrack, MJ Freeway, Greenbits, Cova POS, IndicaOnline, WebJoint, CannaLogic, MMJ Menu, Nature Pay, Bindo POS, THSuite, Shuup, OMMPOS, Flowhub, Meadow, POSaBIT, .

The market segments include Type, Application.

The market size is estimated to be USD 11.86 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Dispensary Point-of-sale Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dispensary Point-of-sale Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.