1. What is the projected Compound Annual Growth Rate (CAGR) of the Direct-lit LED TV?

The projected CAGR is approximately 1.84%.

Direct-lit LED TV

Direct-lit LED TVDirect-lit LED TV by Type (Below 52 Inches, 52 – 65 Inches, Above 65 Inches, World Direct-lit LED TV Production ), by Application (Commercial Use, Private Use, World Direct-lit LED TV Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

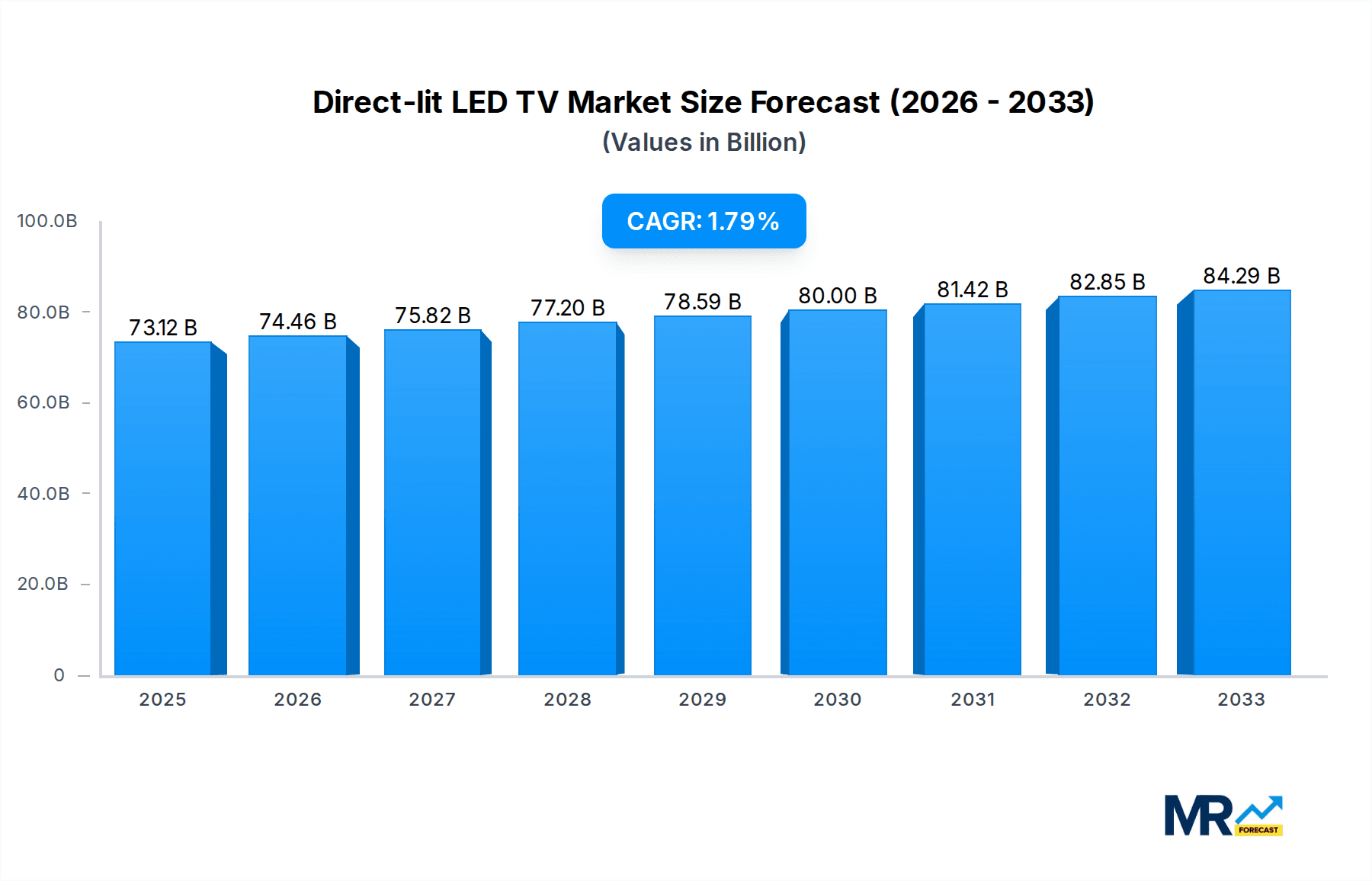

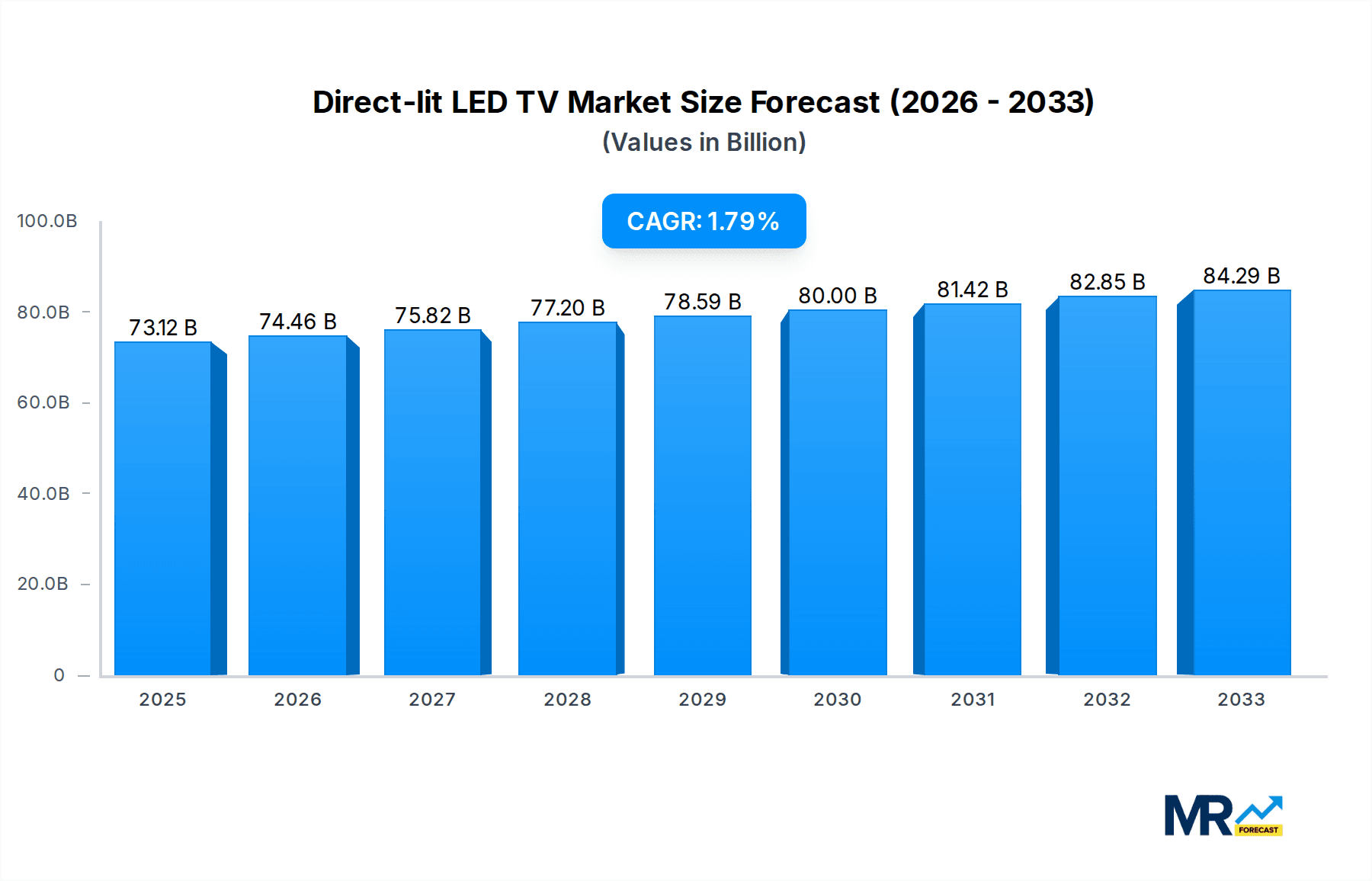

The global Direct-lit LED TV market is poised for steady growth, projected to reach an estimated market size of $73,118.04 million by 2025. This moderate expansion is underpinned by a compound annual growth rate (CAGR) of 1.84% expected throughout the forecast period of 2025-2033. While the market is mature, continuous innovation in display technology, coupled with evolving consumer preferences for enhanced viewing experiences, will fuel demand. The increasing adoption of larger screen sizes, particularly above 65 inches, signifies a shift towards more immersive home entertainment setups, directly benefiting the direct-lit LED TV segment. Furthermore, the growing demand for energy-efficient display solutions and the increasing penetration of smart TV features continue to drive market adoption across both commercial and private use applications.

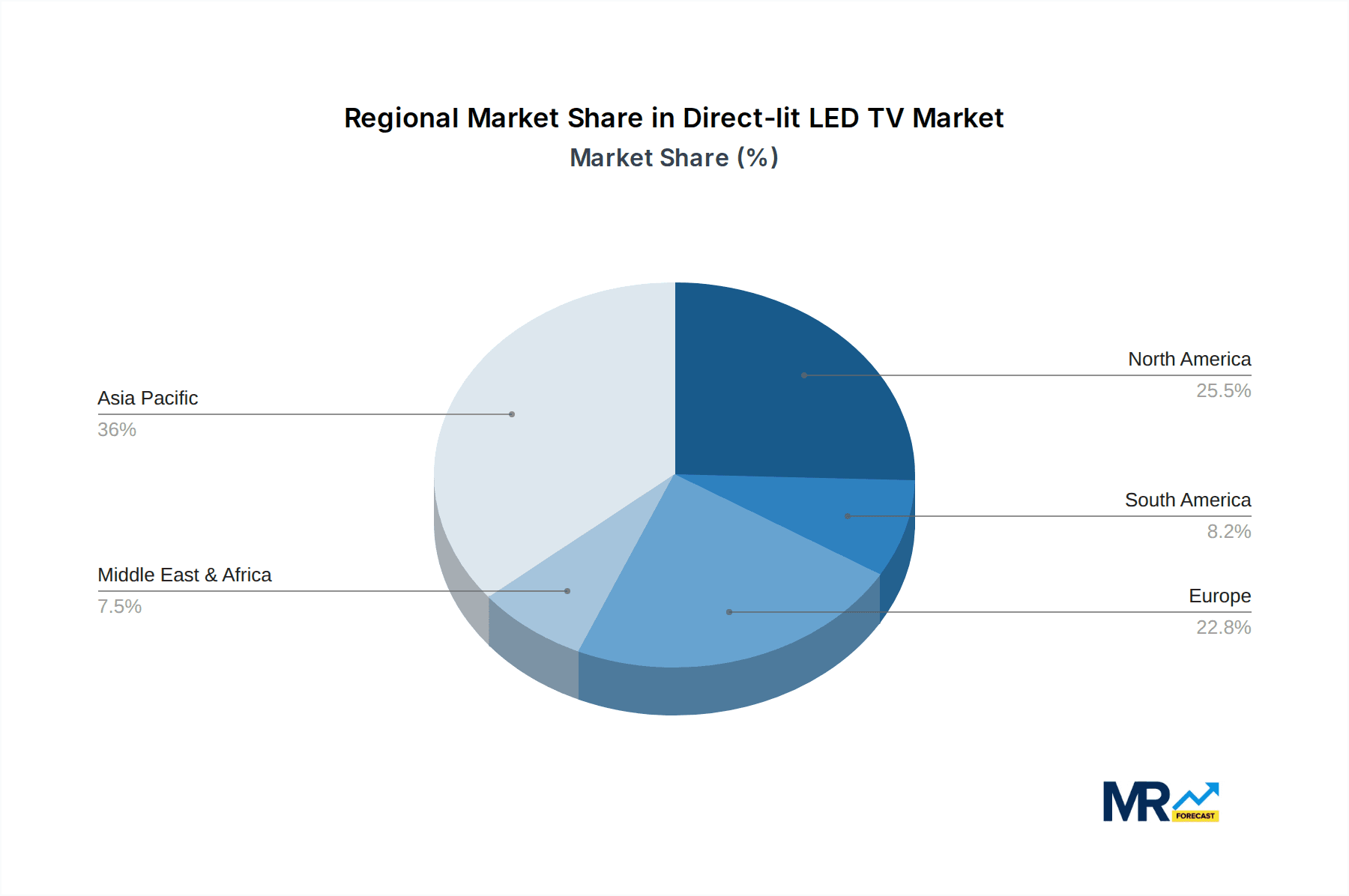

Despite the generally stable growth, certain factors could influence the market's trajectory. The competitive landscape features established global players like Samsung, TCL, LG, and Hisense, constantly introducing new models and features. Price sensitivity among consumers and the ongoing development of alternative display technologies, such as OLED, represent potential restraints. However, the cost-effectiveness and superior brightness often associated with direct-lit LED technology, especially in larger formats, ensure its continued relevance. Regional variations in economic development and consumer spending power will also shape market dynamics, with Asia Pacific expected to remain a significant contributor due to its vast population and growing middle class. The market's segmentation by screen size and application reveals distinct growth opportunities within these categories, guiding strategic investments and product development efforts.

Here is a unique report description on Direct-lit LED TVs, incorporating your specified details and structure.

This report provides an in-depth analysis of the global Direct-lit LED TV market, offering a detailed outlook on its trajectory from the historical period of 2019-2024, through the estimated year of 2025, and extending to a robust forecast period of 2025-2033. The study focuses on production volumes in the millions of units, examining key market segments and the influential companies shaping this dynamic industry. With the base year set at 2025, this research aims to equip stakeholders with actionable insights into market trends, growth drivers, potential challenges, and strategic opportunities within the direct-lit LED TV landscape.

The global Direct-lit LED TV market is experiencing a significant evolution, characterized by a steady rise in production volumes, projected to reach over 250 million units by 2025. This upward trend is underpinned by a confluence of technological advancements and shifting consumer preferences. The market is witnessing a pronounced move towards larger screen sizes, with the "Above 65 Inches" segment emerging as a dominant force, expected to account for over 40% of total production by 2025. This growth is fueled by increased disposable incomes and a desire for more immersive home entertainment experiences, often mirroring the appeal of cinema. Simultaneously, the "52 – 65 Inches" segment continues to hold substantial ground, serving as a popular sweet spot for consumers seeking a balance between screen size and room compatibility, projected to contribute around 35% of the market share in 2025. While smaller screen sizes, "Below 52 Inches," are seeing a relative decline in dominance, they remain crucial for specific applications and budget-conscious consumers, expected to represent approximately 25% of production in 2025. The increasing adoption of direct-lit technology over edge-lit alternatives is a key trend, driven by its superior contrast ratios, more uniform brightness, and enhanced local dimming capabilities, which translate to a significantly better viewing experience. This technological advantage is pushing manufacturers to innovate and refine their direct-lit offerings, leading to a steady increase in production output. The "World Direct-lit LED TV Production" metric itself serves as a crucial indicator of market health, with projections suggesting sustained year-on-year growth throughout the forecast period, driven by both the increasing demand for premium home entertainment and the expanding reach of television technology in developing economies. The ongoing development of more energy-efficient LED components and advanced display processing technologies will further bolster these positive trends, ensuring that direct-lit LED TVs remain a cornerstone of the global display market for the foreseeable future.

Several powerful forces are propelling the growth and adoption of direct-lit LED TVs. Foremost among these is the relentless pursuit of superior picture quality by consumers. Direct-lit technology, with its ability to implement local dimming zones more effectively than edge-lit counterparts, offers unparalleled contrast ratios and deeper blacks, a critical factor for an enhanced viewing experience, especially for high-definition and 4K content. This drive for visual fidelity is a primary catalyst, pushing consumers towards direct-lit solutions. Furthermore, the increasing affordability of large-format displays has significantly broadened the market's appeal. What was once a premium feature is now becoming accessible to a wider demographic, making larger screen sizes, a hallmark of direct-lit technology, more attainable. This democratization of premium viewing experiences directly fuels production and sales. The proliferation of high-quality streaming content, including 4K HDR (High Dynamic Range) movies and series, also plays a pivotal role. Consumers actively seek TVs that can accurately reproduce the detail and vibrancy of this content, and direct-lit LED TVs are inherently better equipped to deliver on this promise. As more households invest in home entertainment systems and connectivity, the demand for TVs that offer a cinematic experience within the home continues to surge, acting as a significant tailwind for the direct-lit LED TV market.

Despite its promising outlook, the direct-lit LED TV market is not without its challenges and restraints. A primary concern revolves around the manufacturing complexity and associated costs of direct-lit panels. The intricate design and precise placement of LEDs across the entire panel can lead to higher production expenses compared to simpler edge-lit architectures. This cost differential can sometimes translate into higher retail prices, potentially limiting adoption among price-sensitive consumers, especially in emerging markets. Another significant challenge is the ongoing competition from alternative display technologies. While direct-lit LED offers strong performance, emerging technologies like OLED and Mini-LED continue to push the boundaries of picture quality, offering even deeper blacks and higher contrast ratios, albeit often at a premium price point. This competitive pressure necessitates continuous innovation and cost optimization from direct-lit LED manufacturers to maintain market share. Furthermore, the increasing demand for thinner and lighter TV designs poses a hurdle for direct-lit technology. The presence of a more substantial LED backlight structure can make direct-lit TVs inherently thicker and heavier than some of their edge-lit or other display counterparts, which can be a deterrent for consumers prioritizing ultra-slim aesthetics. Finally, the global supply chain disruptions, particularly those impacting electronic components and semiconductors, can pose a significant risk to consistent production volumes and timely delivery of direct-lit LED TVs, affecting both manufacturers and consumers.

The direct-lit LED TV market's dominance will be shaped by a combination of key regions and specific market segments, with a particular emphasis on Asia Pacific and the "Above 65 Inches" segment for Private Use.

Asia Pacific Region: This region is poised to emerge as a dominant force in the direct-lit LED TV market. Several factors contribute to this:

"Above 65 Inches" Segment (Private Use): This segment is projected to be the leading driver of growth and market share in direct-lit LED TVs.

The synergy between the manufacturing prowess and burgeoning consumer demand in Asia Pacific and the strong consumer preference for immersive viewing experiences offered by "Above 65 Inches" direct-lit LED TVs for Private Use will undoubtedly define the dominant landscape of the global Direct-lit LED TV market throughout the forecast period (2025-2033).

The Direct-lit LED TV industry is experiencing robust growth fueled by several key catalysts. The relentless advancement in LED technology, leading to more efficient and brighter panels, directly translates into improved picture quality and energy efficiency, appealing to a broader consumer base. The increasing availability of high-resolution content, particularly 4K and 8K, demands better display capabilities, which direct-lit technology is well-positioned to provide. Furthermore, the growing consumer awareness and appreciation for superior contrast ratios and local dimming features offered by direct-lit solutions are significant drivers. The expansion of the middle-class population in emerging economies, coupled with rising disposable incomes, is opening up new markets and increasing the demand for premium home entertainment devices.

This report offers unparalleled coverage of the Direct-lit LED TV market, encompassing a detailed analysis of production volumes in the millions and segment-specific breakdowns. It delves into the historical trends from 2019-2024, providing a solid foundation before projecting market dynamics through to 2033, with a critical focus on the estimated year of 2025. The research meticulously examines key growth drivers, potential challenges, and the strategic landscape shaped by leading industry players. It provides actionable intelligence for stakeholders seeking to understand market segmentation by screen size (Below 52 Inches, 52 – 65 Inches, Above 65 Inches) and application (Commercial Use, Private Use), offering a holistic view of production and industry developments.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.84% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 1.84%.

Key companies in the market include Samsung, TCL, LG, Hisense, Skyworth, Sony, Phillips, Xiaomi, Sharp, Panasonic, Changhong, Haier, Vizio, Konka, Funai, Toshiba, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Direct-lit LED TV," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Direct-lit LED TV, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.