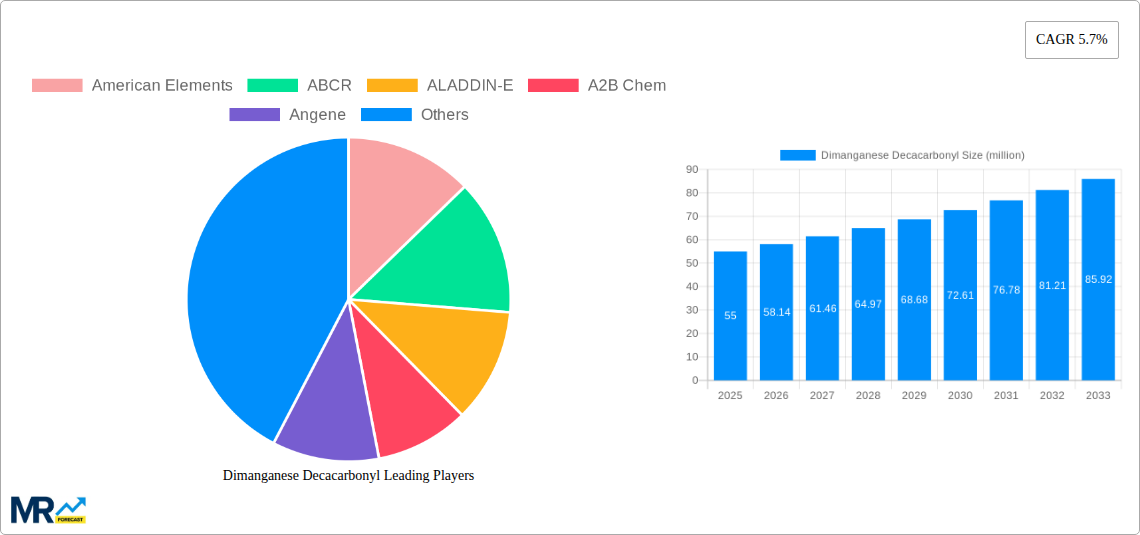

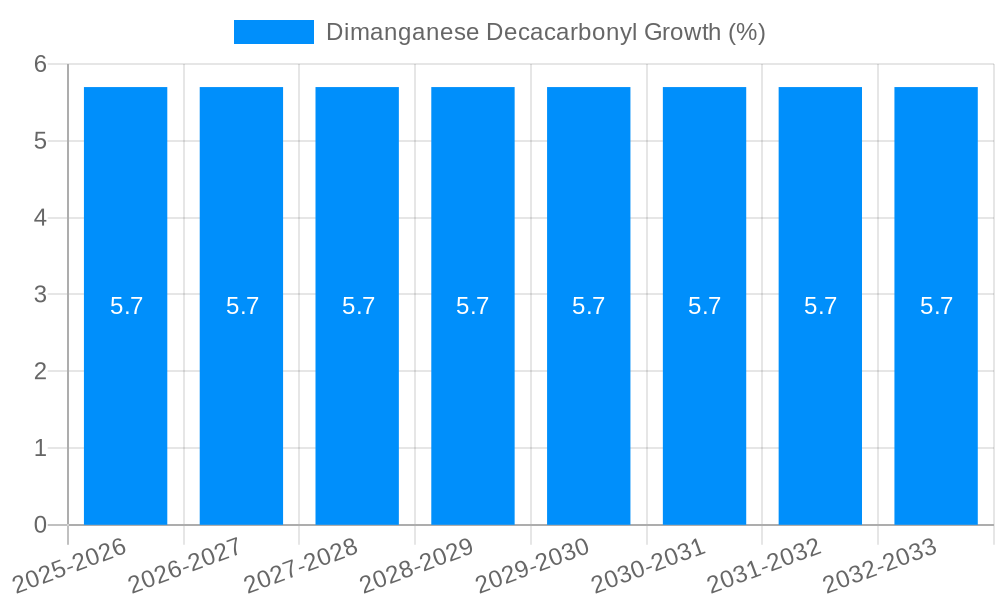

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dimanganese Decacarbonyl?

The projected CAGR is approximately 5.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Dimanganese Decacarbonyl

Dimanganese DecacarbonylDimanganese Decacarbonyl by Type (Minimum 95% Purity, 98% Purity, 99% Purity Minimum), by Application (Thin Film Deposition, Experimental Study, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Dimanganese Decacarbonyl market is poised for significant expansion, projected to reach a substantial size of \$55 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 5.7%. This growth trajectory is underpinned by increasing demand across key applications such as thin film deposition and experimental studies, where Dimanganese Decacarbonyl serves as a crucial precursor and research chemical. The purity segments, particularly Minimum 95% Purity, 98% Purity, and 99% Purity Minimum, highlight the specialized nature of its applications, catering to industries that require high-grade materials for advanced manufacturing and scientific research. The expansion of research and development activities globally, coupled with advancements in materials science, are expected to further fuel market adoption.

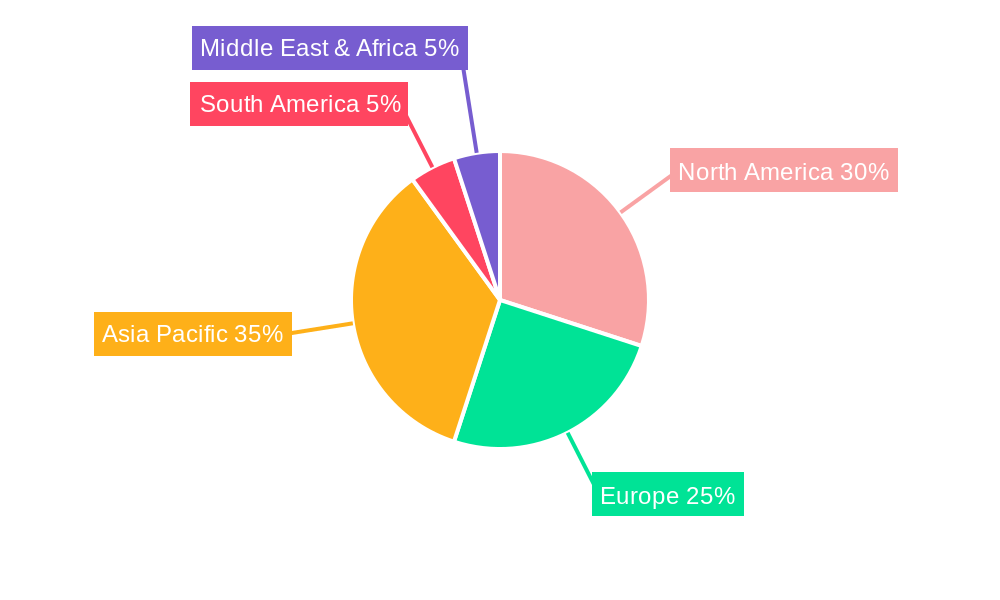

The market is characterized by a dynamic competitive landscape with key players like American Elements, ABCR, and ALADDIN-E actively involved in production and distribution. Geographically, North America and Asia Pacific are anticipated to be leading regions, owing to their strong industrial base, significant R&D investments, and the presence of numerous end-user industries. While the market benefits from strong drivers, potential restraints such as the fluctuating cost of raw materials and stringent environmental regulations associated with certain chemical processes could pose challenges. However, ongoing innovation in synthesis methods and a growing emphasis on niche applications are expected to offset these restraints, ensuring continued market evolution and value creation throughout the forecast period up to 2033.

The global Dimanganese Decacarbonyl market, a niche yet increasingly vital segment of the advanced materials landscape, is poised for significant expansion, projected to reach multi-million dollar valuations in the coming years. The Study Period, spanning from 2019 to 2033, with a Base Year and Estimated Year of 2025, and a Forecast Period from 2025 to 2033, reveals a dynamic trajectory. Historical data from 2019-2024 indicates a steady foundational growth, primarily driven by its applications in specialized chemical synthesis and emerging material science research. In the historical period, the market's expansion was fueled by increasing academic interest and preliminary industrial investigations into its unique catalytic and material properties. The anticipated market size, estimated to be in the tens of millions of USD in 2025, is expected to more than double by 2033, reaching hundreds of millions of USD. This growth is attributed to a confluence of factors, including advancements in purification techniques, leading to the availability of higher purity grades, and the exploration of novel applications beyond traditional laboratory settings. The increasing demand for high-performance materials in sectors like electronics and catalysis is a primary driver. Furthermore, the ongoing refinement of manufacturing processes for dimanganese decacarbonyl is contributing to its greater accessibility and cost-effectiveness, thereby broadening its appeal to a wider industrial base. The trend towards miniaturization in electronics, demanding increasingly sophisticated precursor materials for thin-film deposition, also plays a crucial role. As research continues to uncover new functionalities and cost-effective production methods, the market for dimanganese decacarbonyl is set to experience an accelerated growth phase. The report will delve into the granular details of these trends, analyzing price fluctuations, regional demand patterns, and the impact of technological innovations on market penetration across various purity levels and application segments.

The propulsion behind the Dimanganese Decacarbonyl market is multifaceted, stemming from continuous innovation in material science and an expanding array of specialized applications. The increasing demand for high-purity grades, particularly those exceeding 99% minimum purity, is a significant driver. These ultra-pure forms are essential for critical applications such as thin-film deposition, where even trace impurities can lead to performance degradation in electronic devices and advanced coatings. The unique chemical and physical properties of dimanganese decacarbonyl, including its behavior as a precursor in chemical vapor deposition (CVD) and atomic layer deposition (ALD) processes, are fueling its adoption in the manufacturing of semiconductors, advanced catalysts, and specialized optical materials. Furthermore, ongoing research into novel catalytic applications, leveraging its manganese-containing structure, is opening up new avenues for its use in organic synthesis and industrial chemical processes. The development of more efficient and environmentally friendly synthetic routes for producing dimanganese decacarbonyl is also contributing to its market growth by reducing production costs and improving sustainability. As industries continually seek materials that offer enhanced performance, durability, and novel functionalities, dimanganese decacarbonyl is increasingly being recognized as a key enabler of next-generation technologies, thereby creating a robust demand pipeline.

Despite its promising growth trajectory, the Dimanganese Decacarbonyl market faces several challenges and restraints that could temper its expansion. The inherent complexity and cost associated with synthesizing and purifying dimanganese decacarbonyl to high-grade specifications are significant hurdles. Achieving minimum purities of 98% or 99% often requires sophisticated and energy-intensive processes, contributing to a higher price point compared to more common chemical compounds. This cost factor can limit its widespread adoption, particularly in applications where cost-effectiveness is paramount and alternative, less expensive materials can suffice. Furthermore, the handling and storage of dimanganese decacarbonyl require specialized expertise and infrastructure due to its potential sensitivity to air and moisture, as well as its classification as a chemical substance that necessitates careful safety protocols. Regulatory compliance related to the production, transportation, and use of such specialized chemicals can also add to operational complexities and costs for manufacturers and end-users. The relatively niche nature of its current applications, though growing, means that the market size, while expanding, remains smaller than that of bulk chemicals, limiting economies of scale for some producers. The availability of substitutes, though often not offering the same precise performance characteristics, can also pose a challenge in certain application areas. Overcoming these obstacles will be crucial for unlocking the full market potential of dimanganese decacarbonyl.

The global Dimanganese Decacarbonyl market is projected to witness significant dominance by key regions and specific segments, driven by technological advancements and industrial demand.

Dominant Segments:

99% Purity Minimum Type: This segment is poised for substantial growth and market leadership. The increasing sophistication of industries like semiconductor manufacturing and advanced materials research necessitates materials with exceptionally low impurity levels. Dimanganese Decacarbonyl with a minimum purity of 99% is crucial for processes like thin-film deposition, where even minute contaminants can compromise the integrity and performance of the final product. The demand for this high-purity grade is directly correlated with the expansion of the electronics industry, particularly in the production of microchips, advanced displays, and next-generation solar cells. The development of advanced CVD and ALD techniques, which rely heavily on ultra-pure precursors, will further amplify the demand for 99% purity dimanganese decacarbonyl. The intricate requirements of these cutting-edge technologies necessitate a premium on material quality, making the 99% purity segment the vanguard of market value and volume.

Thin Film Deposition Application: This application segment will be the primary engine of market growth and dominance. The rapid advancements in microelectronics, including the development of smaller and more powerful semiconductor devices, are heavily dependent on the precise deposition of thin films. Dimanganese Decacarbonyl serves as a critical precursor material in CVD and ALD processes used to create these ultra-thin layers, enabling the fabrication of complex integrated circuits, memory devices, and advanced sensors. The burgeoning demand for 5G technology, artificial intelligence, and the Internet of Things (IoT) all require increasingly sophisticated semiconductor components, thus driving the need for high-quality thin-film deposition materials. Beyond electronics, thin-film deposition is also critical in the development of advanced coatings for optics, aerospace, and energy applications, further solidifying the dominance of this application. The ability of dimanganese decacarbonyl to form uniform and well-controlled films at the atomic level makes it indispensable for these high-tech sectors.

Dominant Regions:

The synergy between the demand for high-purity dimanganese decacarbonyl, its critical role in thin-film deposition, and the manufacturing and research capabilities within Asia Pacific and North America will undoubtedly lead to their dominance in this specialized market.

Several key factors are acting as powerful catalysts for the growth of the Dimanganese Decacarbonyl industry. The relentless pursuit of miniaturization and enhanced performance in the semiconductor industry is a primary driver, creating an insatiable demand for high-purity precursors for thin-film deposition. Furthermore, the burgeoning field of advanced catalysis, where dimanganese decacarbonyl's unique properties are being explored for more efficient and selective chemical reactions, presents a significant growth avenue. Ongoing research and development efforts by academic institutions and private companies are continuously uncovering new applications and improving synthesis methods, thereby reducing costs and expanding market accessibility.

This comprehensive report offers an in-depth analysis of the global Dimanganese Decacarbonyl market, providing invaluable insights for stakeholders. It meticulously examines market trends, driving forces, and challenges, offering a nuanced understanding of the industry landscape. The report delves into the key regions and dominant segments, such as the high-demand 99% purity grade and its critical role in thin-film deposition. Furthermore, it highlights the leading players and significant developments, painting a complete picture of the market's evolution. This detailed coverage, spanning the historical, base, estimated, and forecast periods, is designed to equip businesses with the strategic intelligence needed to navigate this dynamic and rapidly growing sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.7%.

Key companies in the market include American Elements, ABCR, ALADDIN-E, A2B Chem, Angene, Chemwill Asia, Ereztech, NBInno, Strem, Santa Cruz Biotechnology, Volatec, HENAN BON INDUSTRIAL, DC Chemicals, Arctom, BLDpharm, .

The market segments include Type, Application.

The market size is estimated to be USD 55 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Dimanganese Decacarbonyl," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Dimanganese Decacarbonyl, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.