1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Solutions for Automotive Retail?

The projected CAGR is approximately 21.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Solutions for Automotive Retail

Digital Solutions for Automotive RetailDigital Solutions for Automotive Retail by Type (Cloud Based, On Premises), by Application (SMEs, Large Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

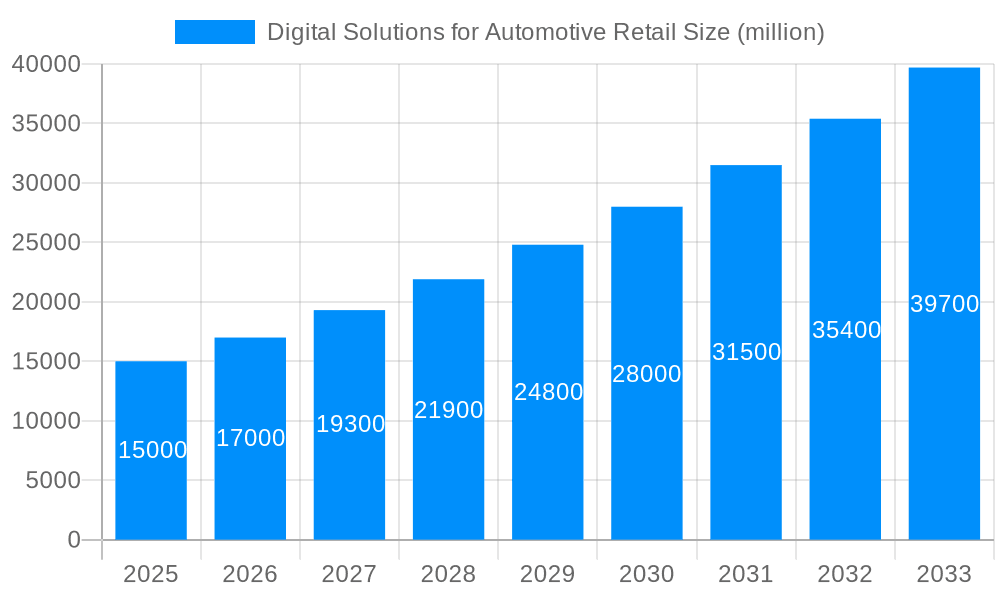

The digital automotive retail market is experiencing significant expansion, propelled by the widespread adoption of online tools and services by both dealerships and consumers. This digital transformation enhances customer experiences, streamlines operations, and boosts efficiency across the automotive sales lifecycle. Key growth drivers include the increasing popularity of online car purchasing, the demand for robust inventory management solutions, and the desire for personalized customer engagement. Projections indicate a Compound Annual Growth Rate (CAGR) of 21.5%, leading to a projected market size of 74.96 billion by 2025. This substantial market valuation is supported by the active participation of numerous key players offering both cloud-based and on-premises solutions for small and medium-sized enterprises (SMEs) and large enterprises, signifying considerable investment in automotive retail technology. The market is expected to maintain its upward trajectory throughout the forecast period (2025-2033), though economic volatility and technological advancements may influence growth rates. Geographically, North America and Europe lead in digital adoption, complemented by robust automotive sectors. The Asia-Pacific region presents significant growth potential, driven by increasing internet penetration and a burgeoning middle class. The competitive environment features a dynamic interplay between established automotive brands and innovative technology firms.

The competitive landscape is highly dynamic, characterized by a blend of established entities such as Cox Automotive and agile startups like Upstart Auto Retail. This diversity stimulates innovation and drives the development of more sophisticated and user-friendly digital solutions. Market segmentation includes deployment models (cloud-based vs. on-premises) and customer segments (SMEs vs. large enterprises), facilitating tailored offerings. Cloud-based solutions are anticipated to outpace on-premises alternatives due to their inherent scalability, cost-effectiveness, and accessibility. Large enterprises are also expected to lead the adoption of advanced digital solutions, leveraging their substantial budgets and technological capabilities. Continuous investment in research and development, coupled with strategic partnerships and acquisitions, will be pivotal in shaping future market dynamics. The integration of emerging technologies, including artificial intelligence (AI), big data analytics, and blockchain, holds immense potential to elevate the customer journey and revolutionize various facets of automotive retail.

The automotive retail landscape is undergoing a dramatic transformation, driven by the rapid adoption of digital solutions. Over the study period (2019-2033), the market has witnessed exponential growth, exceeding several million units in sales of digital solutions across various segments. By the estimated year 2025, the market is poised for continued expansion, with projections indicating significant growth throughout the forecast period (2025-2033). This surge in demand is fueled by several factors, including the increasing need for enhanced customer experience, improved operational efficiency, and data-driven decision-making. Dealerships are increasingly recognizing the value of digital tools in streamlining processes, from inventory management and marketing to sales and financing. The shift towards online car buying and the expectation of seamless digital experiences from consumers have further accelerated this trend. The historical period (2019-2024) saw substantial investment in and development of these digital solutions, laying the groundwork for the current expansion. The base year, 2025, represents a crucial point, marking a significant inflection in the market's trajectory as many new technologies and strategies enter the market at scale. This report will delve into the specifics of this dynamic market, analyzing key trends, challenges, and opportunities, and identifying the major players shaping its future. The market is characterized by a diverse range of solutions, from cloud-based platforms to on-premise systems, catering to both SMEs and large enterprises. This diversity reflects the varied needs and resources within the automotive retail sector, leading to a competitive but dynamic market landscape. The increasing sophistication of these digital tools, driven by advancements in AI and machine learning, is adding another layer of complexity and opportunity. The focus on data analytics allows dealers to gain valuable insights into customer preferences, purchasing behavior, and market trends. This enhances their ability to personalize marketing campaigns, optimize pricing strategies, and enhance overall customer satisfaction. This data-driven approach is transforming how dealerships operate and compete in the modern market.

Several powerful forces are propelling the growth of digital solutions in automotive retail. The escalating consumer demand for online car-buying experiences, characterized by transparency, convenience, and personalized service, is a primary driver. Consumers are increasingly comfortable conducting research and even purchasing vehicles online, expecting a seamless transition from digital engagement to the physical dealership experience. This shift in consumer behavior necessitates the adoption of advanced digital tools by dealerships to stay competitive. Furthermore, the relentless pressure on dealerships to enhance operational efficiency and reduce costs plays a crucial role. Digital solutions offer significant advantages in streamlining various processes, such as inventory management, customer relationship management (CRM), and marketing automation, ultimately leading to cost savings and improved profitability. The growing availability of sophisticated data analytics tools provides dealerships with invaluable insights into customer behavior and market trends, enabling data-driven decision-making across various aspects of their business. The ability to personalize marketing efforts, optimize pricing strategies, and forecast demand accurately contributes significantly to the bottom line. Finally, the advancements in technology, such as artificial intelligence (AI) and machine learning (ML), are constantly enhancing the capabilities of digital solutions, making them increasingly valuable and indispensable for automotive retailers. This constant evolution pushes dealerships towards adopting cutting-edge technology to maintain a competitive edge in the market.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of digital solutions in automotive retail. One key obstacle is the high initial investment cost associated with implementing and maintaining these systems. This can be particularly challenging for smaller dealerships with limited budgets. The complexity of integrating new digital solutions with existing legacy systems also poses a significant hurdle. Seamless integration is crucial for optimal functionality, but achieving it can be technically complex and time-consuming. Furthermore, the need for ongoing training and support for dealership staff is essential for maximizing the benefits of these systems. A lack of technical expertise within the dealership can lead to underutilization or even failure of the implemented systems. Data security and privacy concerns are also paramount. The increasing reliance on digital platforms necessitates robust security measures to protect sensitive customer data and comply with evolving regulations. Finally, resistance to change within some dealerships can be a significant barrier to adoption. Overcoming this resistance often requires a strong leadership commitment and a clear demonstration of the value proposition of digital solutions. Addressing these challenges requires a strategic approach, including careful planning, investment in training, and the selection of robust and user-friendly solutions that are easily integrated into existing workflows.

The North American and European markets are projected to dominate the global digital solutions for automotive retail market, with significant contributions also expected from Asia-Pacific. Within these regions, large enterprises are anticipated to be the primary adopters of these solutions due to their greater resources and capacity to invest in advanced technology. This segment is projected to represent the largest market share during the forecast period (2025-2033).

Dominant Segment: Large Enterprises & Cloud-Based Solutions

Large enterprises have the financial resources and technical expertise needed to implement and effectively utilize sophisticated digital solutions. Cloud-based solutions are favored due to their scalability, cost-effectiveness, and ease of access. The flexibility and accessibility offered by cloud platforms are essential for efficiently managing large volumes of data and catering to diverse needs within the large enterprise structures.

The combination of large enterprises adopting cloud-based solutions is therefore projected to dominate the market, driving significant growth throughout the forecast period. Smaller enterprises will certainly benefit from these solutions, but the higher adoption rate within large organizations will result in greater overall market volume and revenue. The increasing capabilities of these cloud solutions, including AI and machine learning advancements, provide further impetus for their continued dominance.

The automotive retail industry’s growth is being fueled by several key catalysts. These include the rising demand for personalized customer experiences, the increasing need for enhanced operational efficiency, and the continuous advancements in technology, such as AI and machine learning. The ability of digital solutions to provide accurate data-driven insights is also a critical factor. The expanding adoption of online car-buying platforms and the growing preference for seamless digital experiences further drive the demand for advanced digital solutions. Government initiatives and regulations aimed at promoting digitalization within the automotive sector also play a significant role.

This report provides a comprehensive overview of the digital solutions for automotive retail market, offering detailed analysis of market trends, growth drivers, challenges, and opportunities. It includes in-depth profiles of leading players, along with a forecast for the market's future trajectory. The report is designed to provide valuable insights for stakeholders in the automotive retail industry, enabling informed decision-making and strategic planning. This detailed assessment covers various segments including cloud-based and on-premise solutions, and their application across SMEs and large enterprises. Regional breakdowns offer valuable insights into market dynamics in key geographical areas.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 21.5%.

Key companies in the market include Upstart Auto Retail, Driverama, Cox Automotive, OTIONE, Gubagoo, AnantaTek, AutoFi, CarNow, Keyloop, Superior Integrated Solutions, FUSE Autotech, TotalLoop, Slashdot, Digital Motors Corporation, Epicor, Intice, Market Scan Information Systems, Modal, PureCars, .

The market segments include Type, Application.

The market size is estimated to be USD 74.96 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Digital Solutions for Automotive Retail," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Solutions for Automotive Retail, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.