1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Particle Counter?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Particle Counter

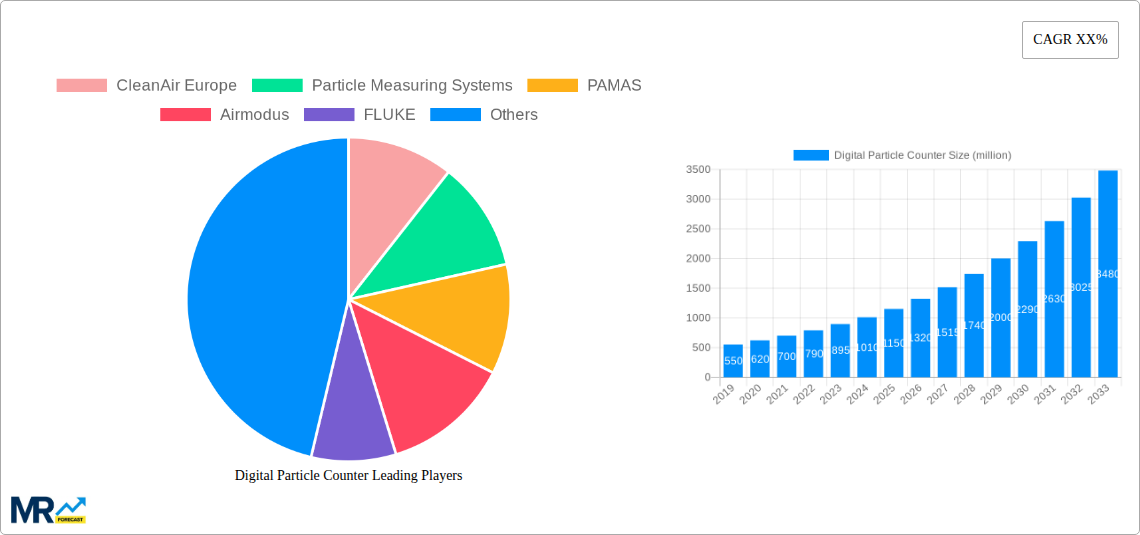

Digital Particle CounterDigital Particle Counter by Application (Pharmaceutical Industry, Electronics Industry, Aerospace Industry, Others), by Type (Air Particle Counters, Liquid Particle Counters, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

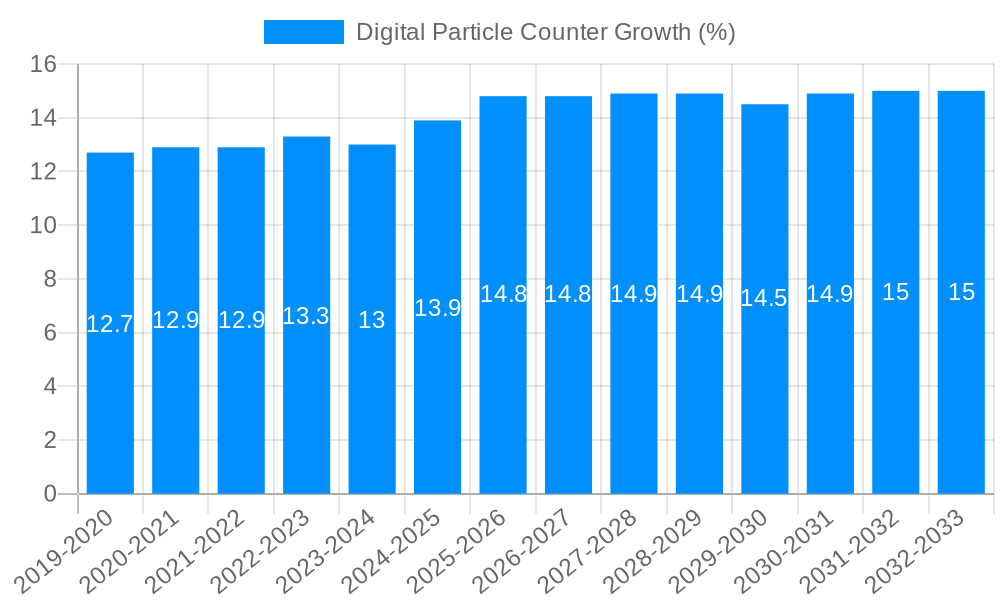

The global Digital Particle Counter market is poised for significant expansion, projected to reach an estimated $1,200 million by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 15%. This robust growth is underpinned by increasing stringent regulatory compliance mandates across various industries, particularly pharmaceuticals and electronics, where precise environmental monitoring is paramount. The demand for accurate and real-time particle counting is escalating due to the growing sophistication of manufacturing processes and the critical need to ensure product purity and quality, thereby minimizing contamination risks. Furthermore, the burgeoning growth in the aerospace sector, with its exacting standards for cleanroom environments, and the expanding applications in other specialized fields are acting as significant catalysts for market expansion.

Technological advancements are playing a pivotal role in shaping the digital particle counter landscape. The development of more compact, portable, and intelligent devices, coupled with enhanced data analytics and connectivity features, is broadening their appeal and utility. Air particle counters and liquid particle counters represent the primary segments, each catering to distinct industrial needs, with the pharmaceutical and electronics sectors dominating their application. While the market exhibits strong momentum, potential restraints such as the high initial cost of advanced systems and the need for skilled personnel for operation and maintenance could pose challenges. However, the overarching trend towards digitalization and the increasing emphasis on proactive quality control measures are expected to outweigh these limitations, propelling sustained market growth through 2033.

This report provides an in-depth analysis of the global Digital Particle Counter market, encompassing market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments. The study period spans from 2019 to 2033, with a base year of 2025, an estimated year also of 2025, and a forecast period from 2025 to 2033. Historical data from 2019 to 2024 is also considered. The market is valued in the millions, with projections indicating substantial growth.

The digital particle counter market is experiencing a dynamic evolution, driven by an ever-increasing demand for stringent contamination control across various industries. In the Pharmaceutical Industry, the imperative for sterile manufacturing environments and the production of highly pure active pharmaceutical ingredients (APIs) has fueled a consistent and substantial demand for sophisticated particle counting solutions. This segment alone is projected to contribute several hundred million dollars to the global market value within the forecast period. The strict regulatory frameworks governing drug manufacturing, such as those mandated by the FDA and EMA, necessitate precise and reliable particle detection to ensure product safety and efficacy. Consequently, pharmaceutical companies are investing heavily in advanced air and liquid particle counters to monitor particulate contamination from the micro-level upwards. This includes monitoring cleanrooms, isolators, and the critical raw materials and finished products themselves. The trend towards continuous manufacturing processes within pharmaceuticals further amplifies the need for real-time, automated particle counting, reducing manual intervention and increasing efficiency.

The Electronics Industry is another significant contributor to the digital particle counter market, with its own set of stringent requirements for clean environments. The miniaturization of electronic components and the increasing complexity of semiconductor manufacturing processes demand ultra-clean production facilities to prevent defects and ensure product reliability. The market for particle counters in this sector is estimated to be in the hundreds of millions of dollars. Semiconductor fabrication plants, in particular, are prime locations for the deployment of advanced particle counting technologies. Airborne and surface contamination, even at very low levels, can lead to significant yield losses and costly product failures. Therefore, manufacturers are increasingly adopting high-precision air particle counters and liquid particle counters to monitor critical manufacturing areas, including cleanrooms, wafer processing equipment, and packaging lines. The growing demand for advanced electronic devices, such as smartphones, high-performance computing systems, and Internet of Things (IoT) devices, directly translates into an increased need for cleaner manufacturing processes, thereby boosting the demand for digital particle counters.

Furthermore, the Aerospace Industry also presents a burgeoning market for digital particle counters. The critical nature of aerospace components, where even microscopic debris can compromise safety and performance, drives the need for meticulous contamination control. This segment is expected to contribute tens of millions of dollars to the market. The manufacturing of aircraft engines, avionics, and structural components requires exceptionally clean environments to prevent material fatigue, component failure, and potential safety hazards. Both air and liquid particle counters are deployed in various stages of aerospace manufacturing, from raw material inspection to the assembly and testing of critical parts. The stringent quality control standards in this industry, coupled with the high cost of component failure, make investment in advanced particle counting solutions a necessity.

Beyond these core applications, the "Others" segment, encompassing areas like medical device manufacturing, food and beverage processing, and environmental monitoring, also contributes significantly to the overall market, collectively adding several tens of millions of dollars. The increasing awareness of air quality and its impact on human health is also driving demand for personal and portable particle counters for environmental and occupational health monitoring. The continuous advancements in sensor technology, data analytics, and connectivity are further shaping the trends in the digital particle counter market, paving the way for more intelligent and integrated contamination control solutions.

The digital particle counter market is experiencing robust growth primarily driven by an escalating global emphasis on quality control and regulatory compliance across a multitude of industries. The pharmaceutical sector, in particular, is a monumental driver, with its unwavering commitment to producing safe and effective medications. Stringent regulations from bodies like the FDA and EMA mandate highly controlled environments, necessitating the continuous monitoring of particulate matter to prevent contamination. This regulatory pressure alone is responsible for a significant portion of the market's expansion, with investments in particle counting equipment expected to reach hundreds of millions of dollars.

Similarly, the electronics industry, characterized by its pursuit of ever-smaller and more sophisticated components, relies heavily on ultra-clean manufacturing facilities. Even the slightest airborne particle can render a microchip useless, leading to substantial financial losses. This has prompted widespread adoption of advanced particle counters to maintain the integrity of semiconductor fabrication and other delicate electronic manufacturing processes, contributing tens of millions to the market.

Beyond these, the aerospace industry’s paramount concern for safety and reliability in its critical components further propels the demand for precise particle detection. The growing awareness surrounding air quality and its impact on public health, coupled with the increasing prevalence of allergies and respiratory conditions, is also fueling the market for personal and environmental monitoring devices, adding tens of millions to the overall market value. The constant innovation in sensor technology and the development of more sophisticated, user-friendly digital particle counters are also key factors, making these devices more accessible and effective for a wider range of applications and enabling real-time data acquisition and analysis, further accelerating market growth.

Despite the positive growth trajectory, the digital particle counter market faces several headwinds that temper its expansion. A primary challenge lies in the high initial cost of sophisticated digital particle counters, particularly those designed for ultra-low particle detection or specialized applications. These advanced instruments, capable of detecting particles in the single-digit micron range and beyond with high accuracy, can represent a significant capital expenditure for small and medium-sized enterprises (SMEs) or research institutions with limited budgets. This financial barrier can lead to a preference for less precise or older technologies, or even delayed adoption of essential monitoring equipment, impacting the market's overall penetration. The market for these advanced units is expected to be in the hundreds of millions.

Another significant restraint is the complexity of operation and data interpretation associated with some high-end digital particle counters. While manufacturers are continuously working to enhance user-friendliness, some instruments still require specialized training for proper operation, calibration, and maintenance. Furthermore, the vast amounts of data generated by these devices necessitate robust data management and analysis capabilities. Without adequate training or software solutions, users may struggle to extract meaningful insights from the data, hindering the effective implementation of contamination control strategies. This complexity can also lead to potential errors in measurement or interpretation, undermining the reliability of the results.

Furthermore, the lack of standardized protocols for certain applications and regions can pose challenges. While general standards exist, specific industry requirements or emerging application areas may not have universally adopted guidelines for particle counting. This can lead to inconsistencies in measurement methodologies and comparability issues across different facilities or even within the same industry, creating confusion and potential non-compliance for some businesses. The market for less standardized applications is expected to be in the tens of millions. Moreover, the continuous evolution of technology necessitates frequent upgrades and recalibrations, adding to the total cost of ownership and potentially slowing down the adoption of new systems.

The Pharmaceutical Industry is poised to be a dominant segment in the global digital particle counter market, projected to contribute several hundred million dollars to the market value by the forecast period. This dominance is driven by several interconnected factors:

Stringent Regulatory Landscape: The pharmaceutical industry operates under some of the most rigorous regulatory frameworks globally. Agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and others mandate strict environmental monitoring to ensure the purity, safety, and efficacy of pharmaceutical products. Compliance with Good Manufacturing Practices (GMP) and ISO standards necessitates continuous and precise measurement of particulate contamination in cleanrooms, manufacturing areas, and during the production of sterile injectables and other critical drug formulations. The need to prevent cross-contamination and ensure the integrity of APIs (Active Pharmaceutical Ingredients) directly translates into a sustained demand for high-quality particle counting equipment.

Growing Biologics and Advanced Therapies: The surge in the development and manufacturing of biologics, vaccines, and advanced cell and gene therapies, which are highly sensitive to microbial and particulate contamination, further amplifies the demand for sophisticated particle counting solutions. These complex products require sterile manufacturing environments, making particle detection a non-negotiable aspect of their production. The market for particle counters catering to these specialized segments is expected to be in the tens of millions.

Expansion of Global Pharmaceutical Manufacturing: With the increasing global demand for pharmaceuticals, especially in emerging economies, there's a corresponding expansion of pharmaceutical manufacturing facilities. This expansion necessitates the installation of new, state-of-the-art particle counting systems to meet the required cleanroom classifications and quality standards.

Advancements in Manufacturing Technologies: The adoption of continuous manufacturing processes and isolator technology in pharmaceuticals also requires real-time, automated particle monitoring for efficient process control and immediate detection of deviations.

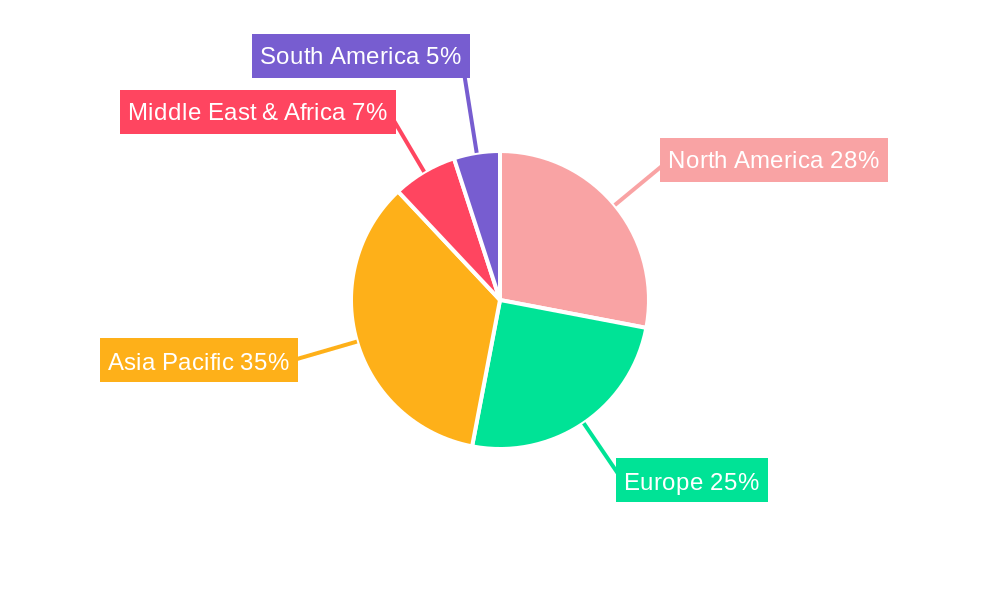

Geographically, North America and Europe are anticipated to continue their dominance in the digital particle counter market, driven by the strong presence of established pharmaceutical giants and advanced electronics manufacturing hubs. These regions have well-developed regulatory bodies and a high degree of technological adoption.

North America: The United States, with its robust pharmaceutical and biotechnology sectors, along with a thriving semiconductor industry, is a key market. Significant investments in R&D and stringent quality control mandates by the FDA ensure a consistent demand for high-precision particle counters. The aerospace sector also contributes to the market in this region, with its own rigorous quality standards.

Europe: Similar to North America, Europe boasts a mature pharmaceutical industry and a significant electronics manufacturing base. Stringent EU regulations and a focus on patient safety drive the adoption of advanced particle counting technologies in pharmaceutical production. The presence of key industry players and research institutions further bolsters market growth in this region. The demand from the pharmaceutical sector is expected to be in the hundreds of millions for these regions.

While these regions are currently leading, Asia-Pacific is expected to witness the fastest growth in the digital particle counter market.

The digital particle counter industry is propelled by several key growth catalysts. Foremost among these is the increasingly stringent regulatory landscape across industries like pharmaceuticals and electronics, which mandates precise contamination control. Furthermore, the growing awareness of air quality's impact on health is expanding the market beyond industrial applications to environmental and personal monitoring. The miniaturization and complexity of electronic components necessitate cleaner manufacturing environments, directly boosting demand. Finally, continuous technological advancements in sensor accuracy, data analytics, and portable device design are making digital particle counters more accessible, sophisticated, and integrated into broader quality management systems.

This report offers an exhaustive examination of the digital particle counter market, meticulously detailing market size, segmentation, and future projections. It delves into the critical trends shaping the industry, analyzes the primary driving forces and significant challenges that impact market dynamics, and identifies the key regions and segments poised for substantial growth. Furthermore, the report highlights crucial growth catalysts and profiles the leading companies actively contributing to market innovation. A dedicated section on significant industry developments, including recent product launches and strategic partnerships, provides insights into the dynamic nature of the sector. This comprehensive coverage ensures that stakeholders gain a thorough understanding of the current market landscape and the future opportunities within the digital particle counter industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CleanAir Europe, Particle Measuring Systems, PAMAS, Airmodus, FLUKE, Beckman, Spectro Scientific, TES Electrical Electronic, U-Therm International, Trotec GmbH, GrayWolf Sensing, Alphasense, DATA Detection Technologies Ltd., e, Altantek Hidrolik, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Digital Particle Counter," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Particle Counter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.