1. What is the projected Compound Annual Growth Rate (CAGR) of the Diabetes Blood Glucose Test Strip?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Diabetes Blood Glucose Test Strip

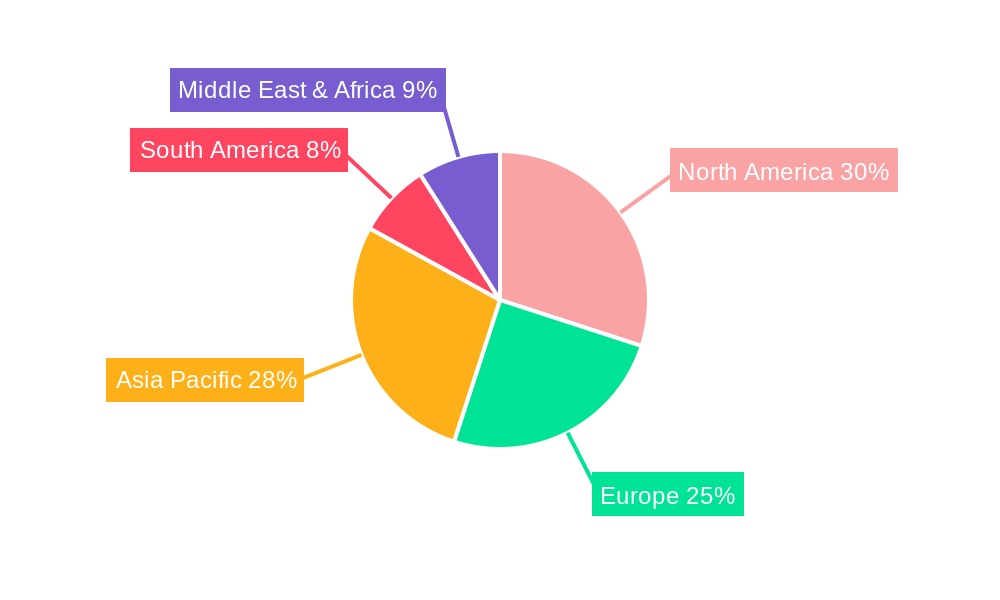

Diabetes Blood Glucose Test StripDiabetes Blood Glucose Test Strip by Type (Veinal Blood, Capillary Blood), by Application (Hospital, Specialty Clinic, Family Care, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

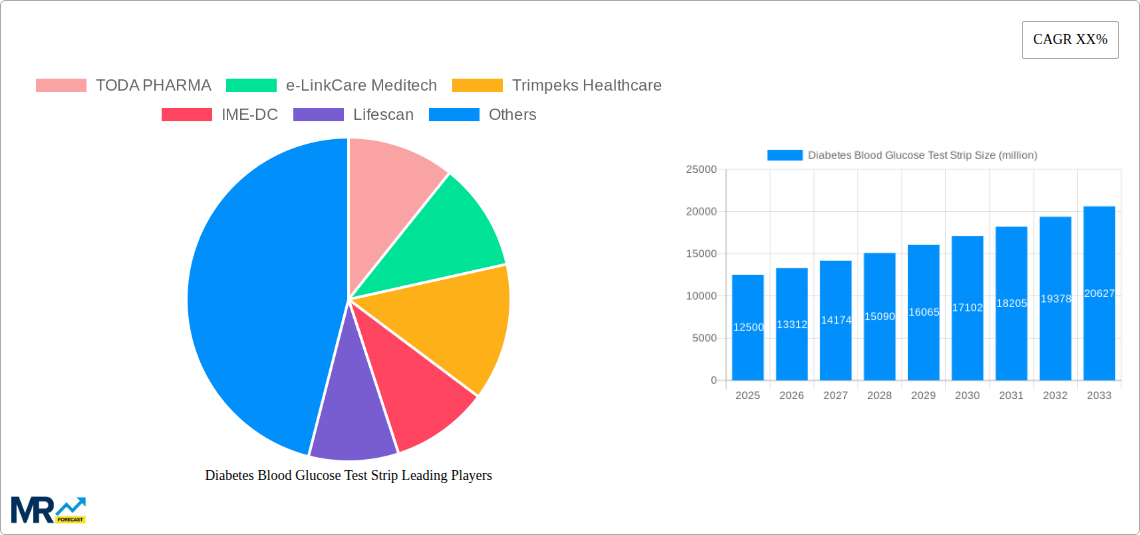

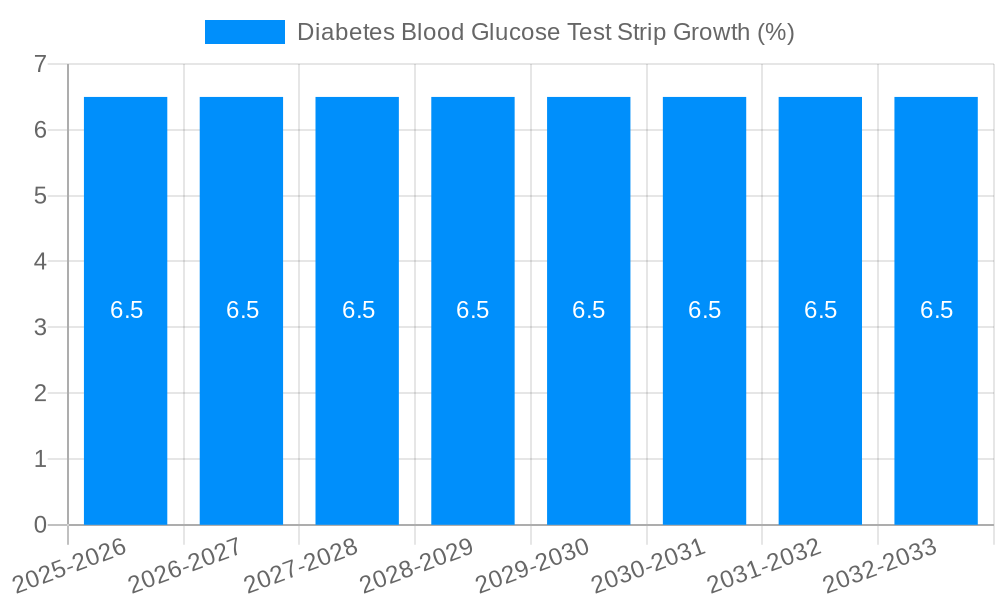

The global market for Diabetes Blood Glucose Test Strips is projected to experience robust growth, estimated to reach a substantial market size of approximately $12,500 million by 2025, and is set to expand at a Compound Annual Growth Rate (CAGR) of around 6.5% during the forecast period of 2025-2033. This significant market valuation is driven by a confluence of factors, chief among them being the escalating global prevalence of diabetes. As lifestyle-related diseases become more common, the need for regular blood glucose monitoring, especially among the growing diabetic population, intensifies. Technological advancements in test strip accuracy, portability, and user-friendliness further fuel market expansion. The increasing demand for home-based monitoring solutions, driven by convenience and the desire for proactive health management, is a significant trend. Furthermore, the growing awareness campaigns by healthcare organizations and government bodies regarding diabetes management and early detection contribute to a sustained demand for these essential diagnostic tools.

The market's trajectory is further shaped by emerging trends such as the integration of blood glucose monitoring systems with smart devices and mobile applications, facilitating better data management and personalized insights for patients and healthcare providers. The development of advanced test strips requiring smaller blood samples and offering faster results is also gaining traction, enhancing patient comfort and compliance. However, certain restraints may influence market dynamics, including the initial cost of advanced monitoring devices and the availability of alternative diabetes management technologies like continuous glucose monitors (CGMs), which, while offering different functionalities, compete for market share. Despite these challenges, the core need for accessible and reliable blood glucose testing ensures a promising future for test strips. Key players are actively investing in research and development to innovate and capture a larger share of this growing and critical healthcare segment. The market's segmentation includes venous blood and capillary blood types, with applications spanning hospitals, specialty clinics, family care, and other healthcare settings, highlighting the broad reach and necessity of this product.

The global diabetes blood glucose test strip market is on a significant upward trajectory, projected to reach an impressive valuation of over 8,500 million USD by the end of the forecast period in 2033. This substantial growth is underpinned by a confluence of factors, including the escalating global prevalence of diabetes, particularly Type 2, and a burgeoning awareness among patients and healthcare providers regarding the critical importance of regular glucose monitoring for effective diabetes management. The historical period of 2019-2024 witnessed a steady expansion, driven by increased diagnosis rates and a greater adoption of self-monitoring blood glucose (SMBG) devices. The base year of 2025 is expected to mark a pivotal point, with the market poised for accelerated growth in the subsequent estimated year of 2025 and beyond into the forecast period of 2025-2033. This trend is further amplified by advancements in strip technology, offering enhanced accuracy, reduced blood sample requirements, and improved user convenience. The shift towards home-based care and the increasing demand for portable and user-friendly diagnostic tools are also major contributors to this optimistic market outlook. As the population ages and lifestyle-related chronic diseases continue to rise, the demand for accessible and reliable glucose monitoring solutions will remain consistently high. Innovations in biosensor technology and the integration of test strips with digital health platforms are expected to further revolutionize the market, offering personalized insights and improved patient engagement in diabetes care. The sheer volume of individuals diagnosed with diabetes worldwide, numbering in the hundreds of millions, directly translates into a sustained and growing demand for these essential diagnostic tools. The market is characterized by intense competition, with numerous players vying for market share, which in turn fosters continuous innovation and competitive pricing strategies, ultimately benefiting end-users. The projected market size signifies not just a financial valuation, but a testament to the critical role these test strips play in the daily lives of millions globally, empowering them to take proactive control of their health.

The diabetes blood glucose test strip market is experiencing robust growth primarily due to the relentless rise in diabetes prevalence worldwide. This epidemic of diabetes, affecting hundreds of millions of individuals, directly fuels the demand for reliable and accessible glucose monitoring solutions. The increasing awareness campaigns and educational initiatives by health organizations and governments have empowered patients to take a more proactive role in managing their condition, leading to a higher adoption rate of self-monitoring blood glucose (SMBG) devices and, consequently, test strips. Furthermore, technological advancements have been instrumental in driving this market. Modern test strips are more accurate, require smaller blood samples, and offer faster results, enhancing user experience and compliance. The development of advanced biosensor technologies has paved the way for more sensitive and specific readings. The aging global population also contributes significantly, as the risk of developing diabetes increases with age, thereby expanding the potential user base. The increasing focus on preventative healthcare and early diagnosis further bolsters the market, encouraging individuals to monitor their glucose levels regularly even before symptoms become pronounced. The growing acceptance and integration of these test strips with digital health platforms and smartphone applications also provide a significant impetus, offering patients seamless data tracking, analysis, and sharing capabilities with their healthcare providers, fostering a more connected and efficient approach to diabetes management.

Despite the optimistic growth trajectory, the diabetes blood glucose test strip market is not without its challenges. One of the primary restraints is the intense price pressure within the market. The presence of a large number of manufacturers, particularly in emerging economies, leads to fierce competition and often drives down prices, impacting profit margins for some players. Reimbursement policies and insurance coverage also play a crucial role; inconsistent or inadequate coverage in certain regions can limit accessibility for a significant portion of the population, thereby acting as a brake on market expansion. The issue of counterfeit and substandard test strips is another concern that can undermine market trust and patient safety. Ensuring the quality and authenticity of these medical devices is paramount, and the prevalence of fake products can deter users and lead to inaccurate readings, potentially causing harm. Furthermore, the advent of continuous glucose monitoring (CGM) systems presents a potential disruptive force. While CGMs offer a more comprehensive picture of glucose trends and eliminate the need for frequent finger pricks, their higher cost and the learning curve associated with their use currently limit their widespread adoption, especially in price-sensitive markets. However, as CGM technology matures and becomes more affordable, it could gradually reduce the reliance on traditional test strips for certain patient segments. The regulatory landscape, with varying approval processes and standards across different countries, can also pose a challenge for manufacturers seeking to enter and expand in global markets.

The global diabetes blood glucose test strip market is anticipated to witness dominance by Capillary Blood as a type of blood sample, and Family Care as an application segment.

Capillary Blood: This segment is expected to be the dominant force due to its widespread use in self-monitoring blood glucose (SMBG) devices. Capillary blood, typically obtained via a finger prick, is the most accessible and common method for glucose testing by individuals managing diabetes at home. The ease of obtaining a capillary blood sample makes it the preferred choice for routine monitoring, especially for patients with Type 1 and Type 2 diabetes who need to check their glucose levels multiple times a day. The historical period from 2019-2024 and the base year of 2025 have already established the prominence of capillary blood testing. The forecast period of 2025-2033 will only see this dominance solidify as more individuals opt for home-based monitoring solutions. The accessibility and convenience offered by capillary blood sampling for the hundreds of millions of individuals managing diabetes globally makes it a cornerstone of glucose testing.

Family Care: This application segment is projected to be the largest contributor to market growth. As diabetes prevalence rises, so does the need for convenient and affordable glucose monitoring solutions within the home environment. Family Care encompasses self-testing by individuals, as well as monitoring by caregivers and family members at home. The increasing awareness of diabetes management and the growing trend of aging populations with chronic conditions necessitate robust home-care solutions. The convenience of performing tests at home, without the need for frequent clinic visits, makes Family Care a highly sought-after segment. The affordability of traditional test strips, compared to some advanced monitoring technologies, further drives their adoption in this segment, particularly in price-sensitive markets. The shift towards a decentralized healthcare model, with a greater emphasis on managing chronic conditions outside of hospital settings, further propels the Family Care segment forward. The sheer volume of individuals managing diabetes at home, in the hundreds of millions, directly translates into a substantial and enduring demand for test strips within the Family Care application.

While Capillary Blood and Family Care are expected to lead, it is important to acknowledge the contributions of other segments. Hospitals and Specialty Clinics will continue to be significant end-users, particularly for diagnostic purposes and in managing acute diabetic conditions. However, the sheer volume of home-based testing driven by Family Care, utilizing capillary blood, will establish their overarching dominance.

The diabetes blood glucose test strip industry is propelled by several key growth catalysts. The escalating global prevalence of diabetes, affecting hundreds of millions of individuals, creates a perpetually expanding market for glucose monitoring tools. Technological advancements, leading to more accurate, faster, and user-friendly test strips, significantly boost adoption rates. Increased patient awareness and the proactive approach to diabetes management further fuel demand for regular testing. Moreover, the growing trend of home-based healthcare and the need for convenient self-monitoring solutions are powerful drivers. The development of integrated digital health platforms that connect test strip data to mobile applications enhances patient engagement and provides valuable insights for healthcare providers, fostering a more connected approach to diabetes management.

The comprehensive report on the diabetes blood glucose test strip market provides an in-depth analysis of its current landscape and future projections, covering the study period of 2019-2033 with a base year of 2025. It meticulously details market trends, driving forces such as the escalating global diabetes prevalence affecting hundreds of millions, and key challenges including price pressures and regulatory hurdles. The report highlights dominant segments like Capillary Blood testing and Family Care applications, supported by substantial market value projections. It also identifies significant growth catalysts, including technological advancements and increasing patient awareness. Furthermore, it offers insights into the competitive landscape by listing leading players and significant developments, ensuring a holistic understanding of this vital sector in diabetes management.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TODA PHARMA, e-LinkCare Meditech, Trimpeks Healthcare, IME-DC, Lifescan, Siemens Diagnostics, 77 Elektronika, Medisana, Trividia Health, Sanofi Diabetes, Bremed, iHealth, Pharma Supply, Prodigy Meter, EasyMax® Diabetes Care, Betachek, Romed Holland, Easy Healthcare, SmartLAB, L-Tac Medicare, Thesyspharma, Nova Diabetes Care, Bioland Technology, Wuhan J.H.Bio-Tech, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Diabetes Blood Glucose Test Strip," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Diabetes Blood Glucose Test Strip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.