1. What is the projected Compound Annual Growth Rate (CAGR) of the Desktop Calculators?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Desktop Calculators

Desktop CalculatorsDesktop Calculators by Application (Household, Commercial), by Type (Basic Calculators, Financial Calculators, Scientific Calculators, Graphical Calculators), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

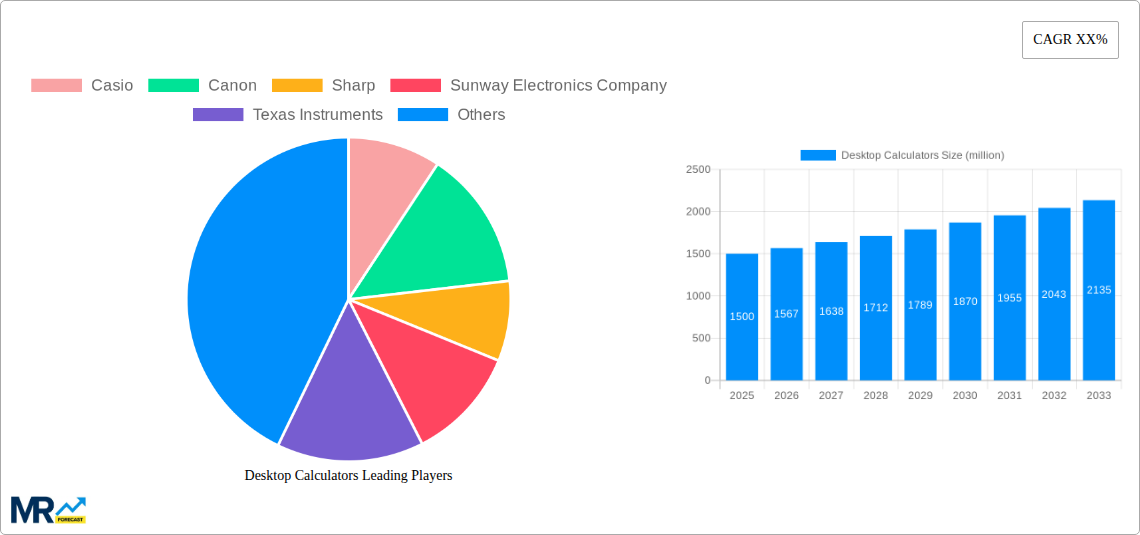

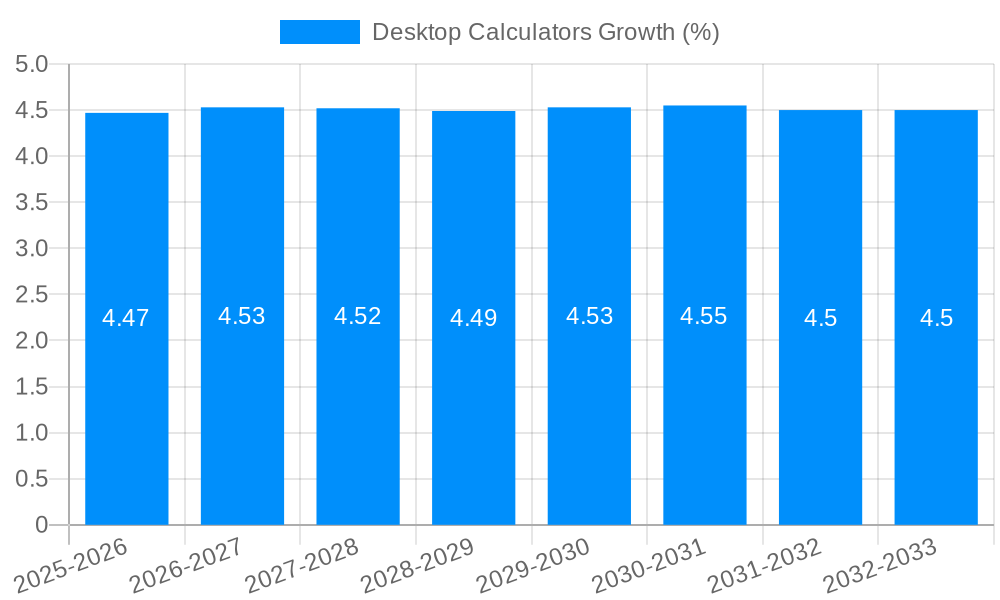

The global desktop calculator market, while seemingly mature, exhibits consistent growth driven by several key factors. The enduring need for accurate and reliable calculations in various sectors, from education and small businesses to accounting and engineering, forms a robust foundation for market demand. Technological advancements, such as solar-powered models and enhanced functionality including scientific calculations and currency conversions, continue to attract new users and upgrade existing equipment. While the rise of smartphones and computer software provides alternative calculation tools, the inherent simplicity, reliability, and portability of dedicated desktop calculators maintain a strong niche. The market is segmented by features (basic, scientific, printing), power source (solar, battery, dual), and target user (students, professionals, businesses). Key players, including Casio, Canon, and Texas Instruments, dominate the market through a combination of brand recognition, established distribution channels, and continuous product innovation. However, emerging brands offering cost-effective alternatives are also gaining traction, particularly in developing economies. Overall, the market is expected to experience steady growth, driven by continued demand in traditional sectors and gradual technological enhancements, resulting in a projected market value increase over the forecast period.

The market's growth, however, faces some challenges. The increasing penetration of smartphones and tablets with built-in calculators poses a significant threat to traditional desktop calculators. Furthermore, the economic climate can influence purchasing decisions, particularly for non-essential items such as specialty calculators. Price competition, especially from lower-cost manufacturers, is another factor impacting the profitability of established players. The market's response to these challenges involves a focus on specialized features, such as durable construction for harsh environments, enhanced scientific capabilities, and improved user interfaces, to maintain its relevance and competitiveness. Regional differences in purchasing power and technological adoption rates also contribute to the varied growth trajectory across geographical markets. The projected growth reflects the balance between these challenges and the continued demand for specialized, reliable, and simple calculation tools. We anticipate a steady but modest increase in the market size driven by these factors.

The global desktop calculator market, valued at approximately 150 million units in 2024, is projected to witness a moderate yet steady growth trajectory throughout the forecast period (2025-2033). While the rise of digital technologies and smartphones equipped with calculator functionalities has undeniably impacted the market, a resilient core demand persists. This enduring demand stems from specific professional sectors and individual preferences that necessitate the tangible functionality and reliability of dedicated desktop calculators. The historical period (2019-2024) saw a slight decline in overall unit sales, primarily driven by the increased accessibility of digital alternatives. However, the market has demonstrated remarkable resilience, indicating a stable base of loyal customers who value the features offered by traditional desktop calculators. This includes features such as durability, ease of use for complex calculations (particularly for those less comfortable with digital interfaces), lack of reliance on battery power or internet connectivity, and the inherent security of not storing sensitive data digitally. The estimated market size for 2025 is pegged at around 145 million units, reflecting a slight contraction from the previous year, but the forecast suggests a gradual recovery and expansion throughout the forecast period, potentially reaching 160 million units by 2033. This growth will likely be fueled by niche markets and regions where digital alternatives have yet to fully penetrate, alongside the ongoing demand from specific professional settings where physical calculators remain essential tools. The market is also seeing subtle shifts in design and functionality, with manufacturers introducing models incorporating features like solar power, improved ergonomics, and specialized functions catering to specific industries.

Several factors continue to propel the desktop calculator market, despite the ubiquitous nature of digital alternatives. The enduring appeal of these devices is rooted in their practicality and reliability in specific professional contexts. In sectors like accounting, finance, and engineering, the need for precise, quick calculations, often offline and without the risk of technological glitches, is paramount. The tangible nature of a desktop calculator offers an uninterruptible and trustworthy computing experience, invaluable in high-pressure situations where digital device malfunctions could be catastrophic. Furthermore, certain demographics, especially older generations or individuals less technologically proficient, still favor the simplicity and intuitive design of a physical calculator. This preference transcends purely practical considerations and extends to a sense of familiarity and comfort with a well-understood device. The continued availability of affordable, robust, and reliable desktop calculators also ensures access for a wide range of users, regardless of their digital literacy or financial constraints. The resistance to rapid technological obsolescence further contributes to the market's sustainability. Unlike rapidly evolving digital devices, desktop calculators offer a consistent and stable solution, requiring minimal ongoing maintenance or upgrades, reducing long-term costs for consumers and businesses. Finally, niche features tailored to specific professional calculations and industries also add to the sustained demand.

The primary challenge faced by the desktop calculator market is the pervasive availability of digital alternatives. Smartphones, tablets, and computers all offer built-in calculator applications, often for free, posing a significant competitive threat. This accessibility and the inherent convenience of integrating calculations into various digital workflows are undeniably attractive to many users. The increasing digitalization of workplaces and the integration of sophisticated software for accounting and data analysis further diminishes the perceived need for dedicated desktop calculators. The decreasing cost of digital devices also makes them a compelling alternative for individual consumers, particularly students and those who only occasionally require calculation functionality. Another challenge involves the need for manufacturers to innovate and add value to maintain competitiveness. Simple, basic desktop calculators are becoming more commoditized, with price competition eroding profit margins. Manufacturers are under pressure to introduce new features, designs, and functionalities to justify the purchase price and differentiate themselves from readily available digital alternatives. Finally, fluctuating raw material costs and supply chain disruptions can also impact the production costs and market stability of desktop calculators.

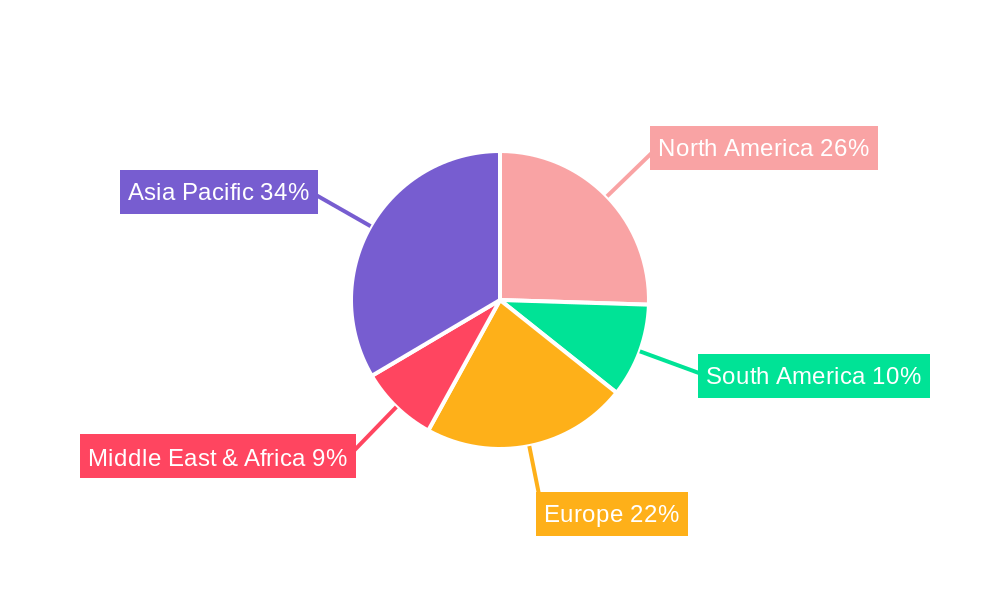

Asia-Pacific: This region consistently dominates the global market due to high population density, significant manufacturing activity, and a large base of both individual and commercial consumers. Countries like China, India, and Japan are key contributors to this market share. The strong presence of numerous manufacturing companies in this region further reinforces its dominance. Growth in developing economies within the region also contributes significantly to the demand for affordable and reliable desktop calculators.

North America: While exhibiting lower unit sales than the Asia-Pacific region, North America displays a higher average price point due to higher disposable incomes and the presence of a substantial professional market (accounting, finance, engineering).

Europe: Europe presents a comparatively smaller market, but steady growth is expected, particularly in segments demanding specialized functionalities. The regulatory environment and high labor costs might influence the overall growth trajectory here.

Segments: The segment focusing on professional-grade calculators with specialized functionalities (e.g., scientific, financial, engineering) is expected to outperform the basic calculator segment. This is due to the irreplaceable value these calculators provide in professional workflows. These professional models tend to be more expensive, positively impacting overall market revenue.

In summary, while the Asia-Pacific region's sheer volume of sales determines overall market size, North America and Europe's segments with specialized features yield higher revenue per unit. The overall market strategy for manufacturers should incorporate both high-volume sales in Asia-Pacific with margin-enhancing sales in higher-priced market segments within North America and Europe.

Continued demand from niche professional sectors, alongside a persistent preference among certain demographic groups for the tangible, reliable functionality of physical calculators, fuels consistent, albeit moderate, growth in the desktop calculator industry. The introduction of innovative features, such as enhanced ergonomics, solar power, and specialized functions, offers growth opportunities for manufacturers to capture a larger market share by improving the user experience and adding value beyond basic calculations.

This report provides a detailed analysis of the desktop calculator market, encompassing historical data, current market dynamics, and future growth projections. It offers valuable insights into key market trends, driving forces, challenges, and opportunities, providing a comprehensive understanding of the industry landscape. This data-driven analysis is ideal for businesses seeking to navigate the market, understand consumer behavior, and strategize for future growth.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Casio, Canon, Sharp, Sunway Electronics Company, Texas Instruments, Hewlett Packard, Lyreco, Citizen Systems, Victor Technology, Deli, Newsunda Stationery, Kenko International Company, Shantou Eates Electronic Industrial, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Desktop Calculators," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Desktop Calculators, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.