1. What is the projected Compound Annual Growth Rate (CAGR) of the Desk Calendar?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Desk Calendar

Desk CalendarDesk Calendar by Type (Electronic Desk Calendar, Paper Desk Calendar, Other), by Application (Factory Direct Sales, Store Sales, Online Sales, World Desk Calendar Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

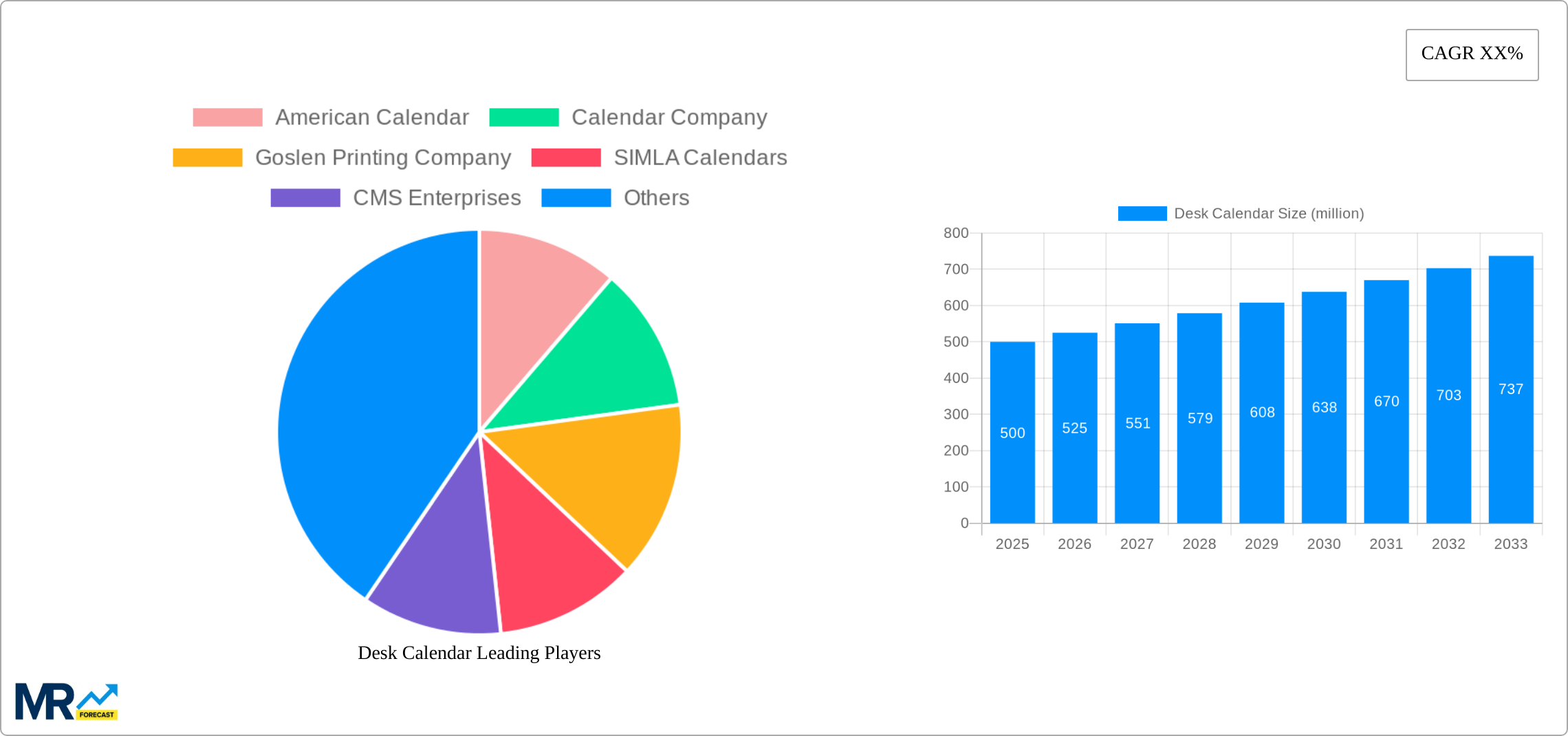

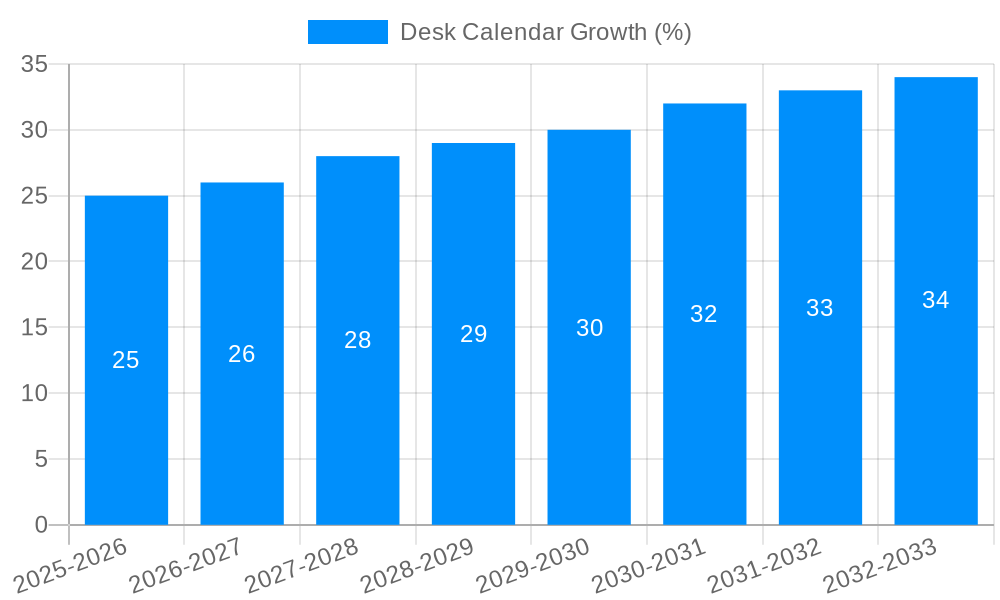

The desk calendar market, encompassing both electronic and paper varieties, presents a dynamic landscape with significant growth potential. While precise market size figures are unavailable, considering a global market, we can reasonably estimate the 2025 market size to be around $500 million, based on industry reports of similar stationery segments and extrapolating from available data. This market is projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately 5%, driven primarily by increasing corporate demand for promotional items, and the continued relevance of paper calendars for personal organization despite digital alternatives. Key trends include the rise of eco-friendly materials and sustainable manufacturing practices in response to growing environmental concerns. Further growth is fueled by the incorporation of innovative features, such as digital integrations and personalized designs, in both electronic and paper calendars, catering to a wider range of consumer preferences. However, restraints include the growing popularity of digital calendar applications and scheduling software, posing a competitive threat to traditional desk calendars.

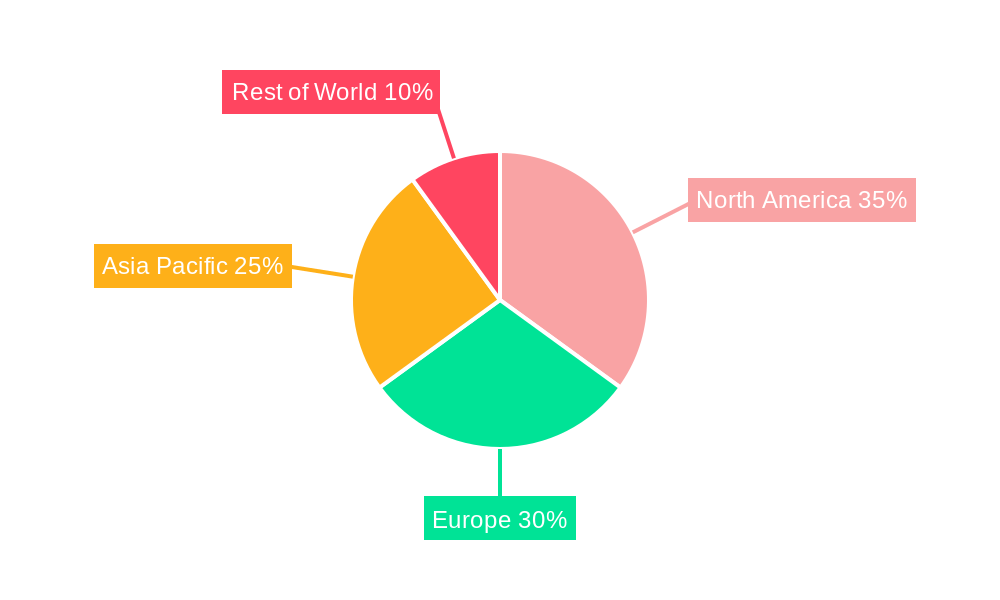

The segmentation within the market reflects diverse consumer and business needs. The paper desk calendar segment maintains a dominant market share due to its affordability and tangible nature, particularly beneficial for quick reference and note-taking. The electronic desk calendar segment is experiencing a slow but steady growth trajectory, driven by the integration of smart functionalities. Sales channels are distributed across factory direct sales, store sales, and online sales, with the latter gaining traction due to the convenience and wide reach of e-commerce platforms. Geographically, North America and Europe currently hold significant market shares, but rapid growth is expected in the Asia Pacific region, particularly in China and India, fueled by increasing disposable incomes and rising corporate demand. Key players in the market include both large-scale manufacturers and smaller regional producers, fostering competition and innovation. Looking forward to 2033, the desk calendar market is poised for continued growth, albeit at a moderate pace, shaped by adapting to evolving technological trends and maintaining appeal in a digital world.

The global desk calendar market, valued at over 20 million units in 2024, is poised for continued growth, reaching an estimated 30 million units by 2025 and projected to surpass 50 million units by 2033. This expansion is driven by a complex interplay of factors, including shifting consumer preferences, technological advancements, and evolving business practices. While traditional paper desk calendars maintain a significant market share, fueled by their tactile appeal and widespread familiarity, the rise of electronic desk calendars is creating a dynamic market segment. Electronic calendars, offering features like digital scheduling, reminders, and seamless integration with other devices, appeal to a technologically savvy consumer base. However, the continued success of paper calendars highlights a persistent demand for tangible, aesthetically pleasing planning tools. The market also demonstrates a diversity in distribution channels, with factory direct sales, store sales, and online sales all contributing to overall volume. The historical period (2019-2024) witnessed a steady growth trajectory, largely influenced by increasing office and home-based workforces. Looking ahead to the forecast period (2025-2033), continued innovation in both paper and electronic desk calendar design, along with strategic marketing initiatives targeting diverse user segments, will be pivotal in maintaining market momentum and expanding the overall market size. The shift in consumer preference towards personalization and customization is also driving demand for bespoke desk calendar designs. Businesses are increasingly recognizing the value of branded desk calendars as promotional tools, contributing significantly to the growth of the paper desk calendar segment. The increasing digitalization of workplaces, however, poses a subtle challenge, prompting manufacturers to innovate and integrate digital functionalities into paper designs to bridge the gap between tradition and technological advancements. This blending of analog and digital elements is likely to characterize the future of the desk calendar market.

Several key factors are fueling the growth of the desk calendar market. Firstly, the persistent need for effective time management and organization remains a primary driver. Desk calendars, both electronic and paper-based, provide a readily accessible and visual method of planning, scheduling appointments, and tracking deadlines. Secondly, the ongoing popularity of personalized and customized calendars caters to a growing demand for unique and aesthetically pleasing stationery items. Businesses leverage branded desk calendars as a cost-effective marketing and promotional tool, further driving market demand. This is especially true for small-medium businesses who find calendars to be a cost-effective way of reaching their customers. The rise of hybrid work models, where individuals work both remotely and in the office, has also contributed to increased demand for desk calendars, as they facilitate better organization across different work locations. The continued evolution of design and functionality in both paper and electronic calendars caters to evolving consumer preferences, broadening the market's appeal across different age groups and professional sectors. Furthermore, the availability of a variety of distribution channels, including online sales platforms, expands market accessibility and ensures a wider reach for manufacturers and retailers alike. These combined forces contribute to the steady expansion of the desk calendar market, demonstrating its resilience and adaptability in the face of technological change.

Despite the positive growth outlook, the desk calendar market faces certain challenges. The increasing digitalization of workplaces and the widespread adoption of digital calendars and scheduling apps pose a significant threat to traditional paper desk calendars. This shift towards digital solutions is particularly prominent among younger demographics who are more comfortable with technology-based planning tools. The competition from digital calendars that provide features like automatic reminders, meeting scheduling, and cross-platform synchronization puts pressure on traditional calendar manufacturers to innovate and offer unique value propositions to retain their market share. Maintaining cost-effectiveness in production and distribution while ensuring high-quality materials and designs is another challenge. Fluctuations in raw material prices, particularly paper and ink, can impact profitability and potentially affect the overall competitiveness of the market. Finally, maintaining market relevance and appeal requires continuous adaptation to evolving consumer trends and technological advancements. Failure to innovate and cater to changing preferences could lead to a decline in demand for both paper and electronic desk calendars, creating a need for strategic adaptability and diversification among manufacturers.

Dominant Segments:

Paper Desk Calendars: This segment continues to hold the largest market share, driven by its inherent tactile appeal, widespread familiarity, and adaptability to personalization. The enduring popularity of physical planning tools emphasizes the enduring value of tangible products in an increasingly digital world. Businesses particularly favor paper calendars as a powerful marketing tool, leading to a substantial portion of sales.

Online Sales: E-commerce platforms provide a highly accessible and convenient channel for purchasing desk calendars. This segment is experiencing significant growth, fueled by the increasing preference for online shopping and the ability to reach a vast customer base. The accessibility of online stores reduces geographical limitations and expands market reach for calendar manufacturers.

Dominant Regions:

Asia (Specifically, China): Countries like China, with their large populations and robust manufacturing infrastructure, play a significant role in the global desk calendar market. China houses a substantial number of desk calendar manufacturers, including Guangzhou Bailing Color Printing, Ningbo Baiyun printing, and Shenzhen JinHaoYi Color Printing, which contribute significantly to global production volumes. The cost-effectiveness of manufacturing in these regions makes them highly competitive in the global market.

North America: Despite the increasing use of digital calendars, the demand for desk calendars, especially personalized and custom-designed ones, remains high in North America, reflecting a preference for both physical and digital planning tools.

Paragraph Expansion:

The dominance of paper desk calendars is expected to continue, particularly in business-to-business sales, where branded calendars serve as effective marketing tools. However, the online sales channel is witnessing the fastest growth rate due to its efficiency and expanded market reach. China's dominance is rooted in its massive manufacturing capabilities and cost-effectiveness, making it a key player in global supply chains. The large population also creates a substantial domestic market. However, North America's significant demand for customized and branded desk calendars signals the continued appeal of the product even in advanced economies with high digital adoption. The interaction between these segments and regions creates a complex and dynamic market landscape, requiring manufacturers to adapt to varying demands and preferences across different locations and product types.

The desk calendar industry's growth is fueled by several catalysts, including the ongoing demand for efficient time management tools, the increasing popularity of personalized and customized designs, the effectiveness of branded calendars as marketing tools, and the expansion of online sales channels. These combined factors create a robust market environment capable of sustained growth, with innovation in design and functionality ensuring continued relevance in the face of digital competition.

This report provides a comprehensive analysis of the global desk calendar market, covering historical performance, current market dynamics, and future growth projections. It examines key market segments, including paper and electronic calendars, and various distribution channels, such as factory direct sales, store sales, and online sales. The report also analyzes leading players in the market, explores growth catalysts and challenges, and offers insights into significant market developments. This detailed analysis equips stakeholders with the necessary information for informed decision-making and strategic planning within the dynamic desk calendar industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include American Calendar, Calendar Company, Goslen Printing Company, SIMLA Calendars, CMS Enterprises, Calendars from India, Surya Offset Printers, Kalai Calendars, Cangnan County,Zhejiang, Guangzhou Bailing Color Printing, Ningbo Baiyun printing, Shenzhen JinHaoYi Color Printing, American Calendar, Calendar Company, Goslen Printing Company, SIMLA Calendars, CMS Enterprises, Calendars from India, Surya Offset Printers, Kalai Calendars, Cangnan County,Zhejiang, Guangzhou Bailing Color Printing, Ningbo Baiyun printing, Shenzhen JinHaoYi Color Printing.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Desk Calendar," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Desk Calendar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.