1. What is the projected Compound Annual Growth Rate (CAGR) of the Deodorants and Antiperspirants?

The projected CAGR is approximately 6.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Deodorants and Antiperspirants

Deodorants and AntiperspirantsDeodorants and Antiperspirants by Application (Male, Female, World Deodorants and Antiperspirants Production ), by Type (Deodorants, Antiperspirants, World Deodorants and Antiperspirants Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

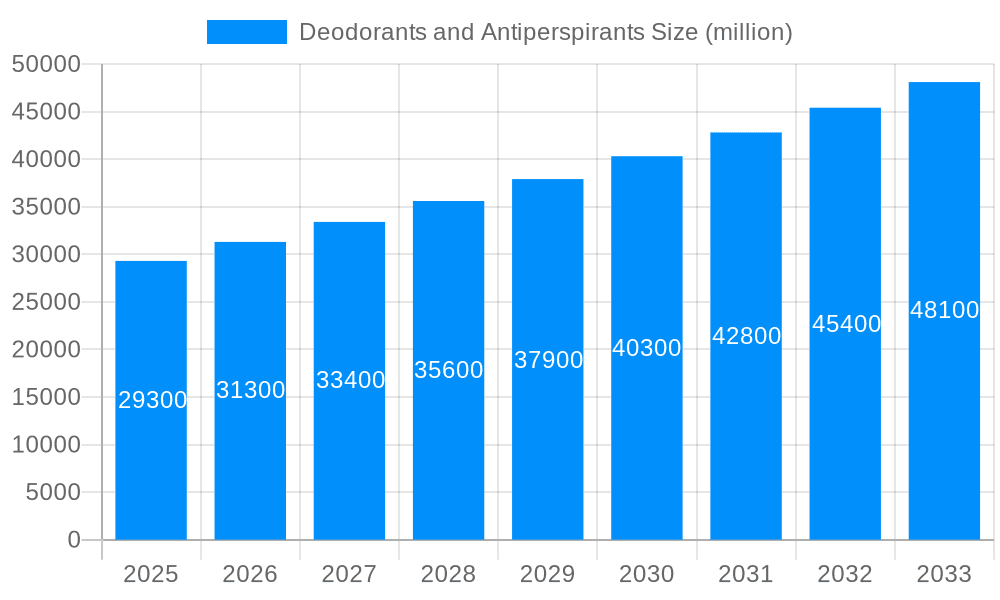

The global deodorants and antiperspirants market is poised for significant expansion, projected to reach a substantial valuation of $29.3 billion by 2025. This robust growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 6.6% expected to persist through 2033. A primary driver behind this upward trajectory is the increasing global emphasis on personal hygiene and grooming, particularly among younger demographics and across emerging economies. Consumers are becoming more health-conscious and are willing to invest in products that enhance their well-being and confidence. The rising disposable incomes in developing regions are further fueling demand, making these essential personal care items more accessible. Furthermore, innovative product formulations, including natural and organic ingredients, as well as specialized solutions for sensitive skin, are attracting a wider consumer base and driving market penetration. The persistent influence of social media and celebrity endorsements also plays a crucial role in shaping consumer preferences and driving the adoption of advanced deodorant and antiperspirant products.

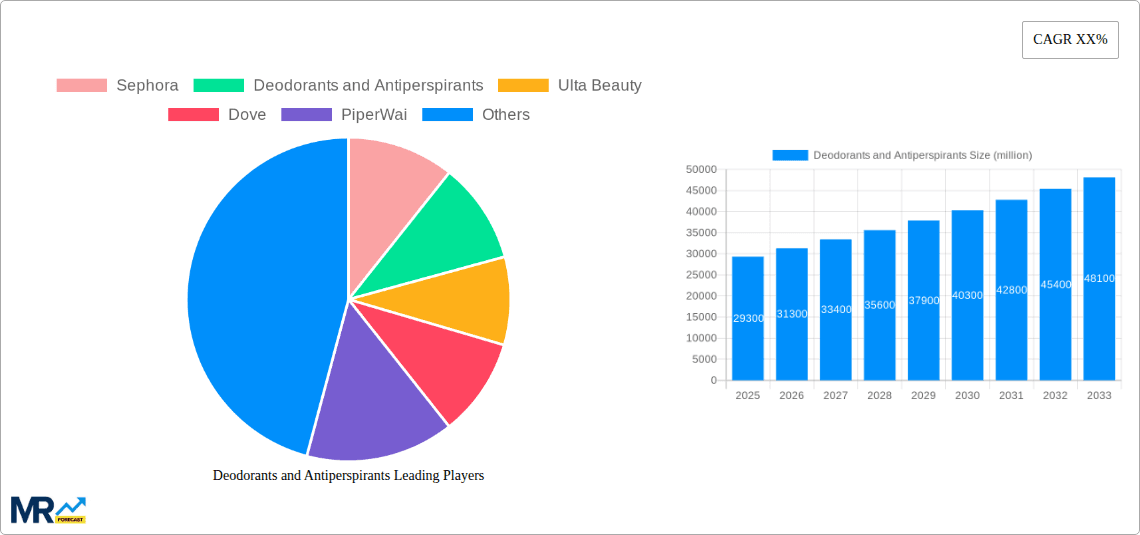

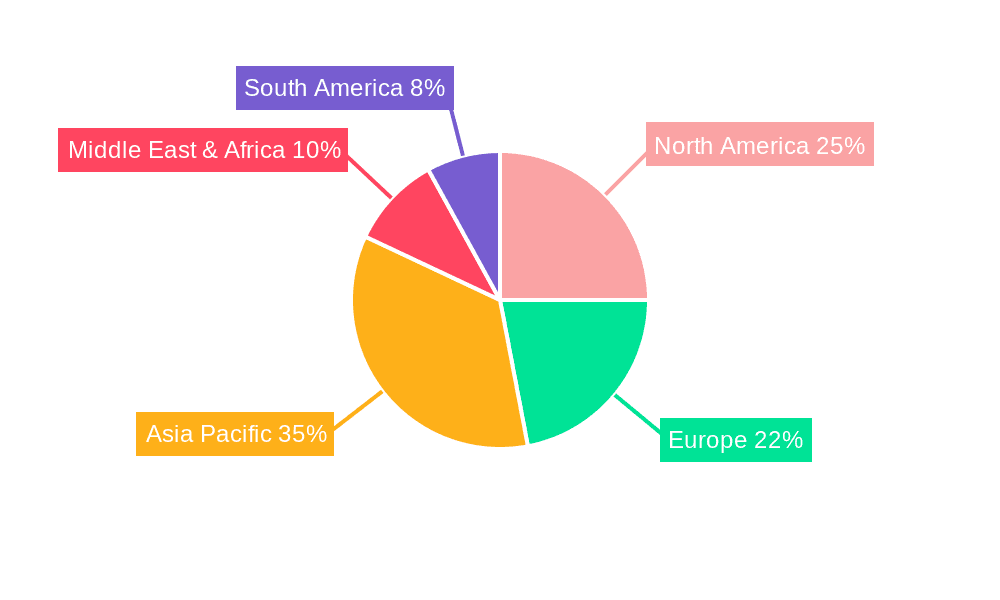

The market segmentation reveals distinct opportunities within both application and product types. The male and female segments are the primary consumers, with product innovation catering to specific needs and preferences within each. The distinction between deodorants and antiperspirants also allows for targeted marketing and product development, addressing consumers' varied requirements for odor control and sweat reduction. Key industry players like Unilever, Procter & Gamble, and Godrej are actively investing in research and development to introduce novel offerings and expand their market reach. The competitive landscape is characterized by a blend of established multinational corporations and emerging niche brands, each striving to capture market share through product differentiation and strategic marketing campaigns. Geographically, Asia Pacific is expected to emerge as a dominant region, driven by its large population, growing middle class, and increasing adoption of Western grooming standards. North America and Europe continue to be mature yet significant markets, with a strong emphasis on premium and specialized products.

The global deodorants and antiperspirants market is experiencing a dynamic evolution, driven by a confluence of evolving consumer preferences, technological advancements, and a heightened focus on personal well-being. During the historical period from 2019 to 2024, the market demonstrated consistent growth, a trend projected to accelerate significantly. As of the base year 2025, the market valuation is estimated to be in the tens of billions of dollars, with the forecast period of 2025-2033 anticipating a surge in market size, potentially reaching figures in the high double-digit or even triple-digit billions by the end of the study period in 2033. This remarkable expansion is underpinned by several key insights. The increasing emphasis on natural and organic ingredients has reshaped product formulations, with consumers actively seeking out deodorants and antiperspirants free from harsh chemicals, aluminum salts, and parabens. This trend is particularly pronounced among millennials and Gen Z, who are more aware of the potential health implications of certain ingredients and are willing to invest in premium, ethically sourced products. The rise of the "wellness economy" has further propelled the demand for products that not only offer efficacy but also contribute to a holistic sense of well-being. This translates into a demand for products with soothing properties, beneficial botanicals, and pleasant, long-lasting fragrances. Furthermore, the growing awareness of personal hygiene and grooming as integral components of professional and social success is contributing to a sustained demand across all demographics. The market is witnessing a bifurcation, with a segment of consumers opting for budget-friendly, high-volume options, while another segment gravitates towards niche, artisanal, and specialized products that offer unique benefits such as extended protection, sensitive skin formulations, or distinct scent profiles. The influence of social media and online retail channels cannot be overstated, as these platforms facilitate the discovery and adoption of new brands and product innovations, further intensifying competition and driving market expansion.

The deodorants and antiperspirants market is being propelled by a powerful combination of socio-economic and consumer-driven factors. A primary driver is the increasing disposable income across emerging economies, allowing a larger segment of the population to prioritize personal care products that were once considered luxuries. This enhanced purchasing power directly translates into higher sales volumes for deodorants and antiperspirants. Complementing this is the growing global awareness of personal hygiene and grooming standards. As societies become more interconnected and professional environments more competitive, maintaining a fresh and odor-free presence has become paramount for social acceptance and career advancement. This psychological imperative fuels consistent demand. Furthermore, the expanding product portfolios and innovative formulations offered by leading manufacturers are significant catalysts. Companies are investing heavily in research and development to create products that cater to specific needs, such as sensitive skin, enhanced sweat protection, or unique fragrance experiences. The introduction of natural, organic, and vegan options addresses the growing consumer demand for healthier and more sustainable choices, opening up new market segments and driving innovation. The ubiquity of e-commerce and direct-to-consumer (DTC) models has also played a crucial role, making these products more accessible and facilitating brand discovery for a wider audience.

Despite the robust growth trajectory, the deodorants and antiperspirants market faces several significant challenges and restraints that could temper its expansion. One of the most prominent is the increasing consumer scrutiny regarding ingredient safety and environmental impact. Growing concerns about the potential health risks associated with aluminum compounds in antiperspirants and the environmental persistence of certain chemicals have led to a demand for "clean" formulations. This necessitates substantial investment in research and reformulation by manufacturers, which can increase production costs and potentially slow down product launches. The intense competition and market saturation are also considerable hurdles. With numerous global and local players vying for market share, price wars and aggressive promotional activities can erode profit margins. Differentiating brands and products in such a crowded landscape requires continuous innovation and effective marketing strategies. Furthermore, the fluctuations in raw material prices can impact production costs and, consequently, the final price of products. Supply chain disruptions, geopolitical events, and currency volatility can all contribute to price instability, affecting both manufacturers and consumers. The regulatory landscape also presents a challenge, with varying standards and approval processes for cosmetic and personal care products across different regions, adding complexity to global market entry and expansion. Finally, counterfeit products pose a threat to brand reputation and consumer trust, requiring robust anti-counterfeiting measures.

The deodorants and antiperspirants market's dominance is poised to be significantly influenced by both regional dynamics and specific product segments. From a regional perspective, Asia-Pacific is emerging as a powerhouse, driven by a rapidly growing middle class with increasing disposable incomes and a heightened awareness of personal grooming. Countries like China, India, and Southeast Asian nations are witnessing substantial growth in demand, fueled by urbanization and a desire to adopt Western lifestyle trends. The sheer population size and the expanding consumer base in this region present unparalleled opportunities for market expansion.

However, North America and Europe are expected to continue their strong performance, characterized by mature markets with a high penetration rate of deodorants and antiperspirants. These regions are at the forefront of innovation, with consumers readily adopting premium, specialized, and natural products. The demand for sophisticated formulations, eco-friendly packaging, and niche brands is particularly strong here, driving market value.

Focusing on the Segment: Application: Female, this segment is a consistent and substantial contributor to the global deodorants and antiperspirants market. Historically, and projected into the forecast period of 2025-2033, the female segment has often represented a larger market share compared to the male segment. This dominance can be attributed to several factors:

While the male segment is experiencing rapid growth and closing the gap, the established patterns of consumption, the breadth of product offerings, and the ongoing marketing efforts dedicated to female consumers are likely to ensure the Female application segment continues to be a dominant force in the global deodorants and antiperspirants market throughout the study period (2019-2033).

Several key growth catalysts are fueling the expansion of the deodorants and antiperspirants industry. The increasing consumer focus on health and wellness is a significant driver, leading to a rising demand for natural, organic, and aluminum-free formulations. Innovations in product technology, such as long-lasting formulas and multi-functional products offering skincare benefits, also play a crucial role. The growing disposable income in emerging economies, coupled with a rising awareness of personal hygiene, is opening up new consumer bases. Furthermore, strategic marketing campaigns and the expansion of e-commerce channels are enhancing product accessibility and driving consumer adoption.

This comprehensive report delves into the intricate landscape of the deodorants and antiperspirants market, offering an in-depth analysis from the historical period of 2019-2024 through to the projected growth until 2033. It meticulously examines market trends, identifies the driving forces behind the industry's expansion, and critically evaluates the challenges and restraints that shape its trajectory. The report further highlights key regions and segments poised for significant market dominance, with a detailed focus on factors contributing to their ascendancy. It illuminates the growth catalysts that are propelling the industry forward and provides an exhaustive list of leading global players. Furthermore, significant developments and innovations within the sector are charted chronologically, offering a valuable perspective on the industry's evolution. This report serves as an indispensable resource for stakeholders seeking a holistic understanding of the global deodorants and antiperspirants market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.6%.

Key companies in the market include Sephora, Deodorants and Antiperspirants, Ulta Beauty, Dove, PiperWai, AVON, Unilever, Cavinkare, Addidas, Procter & Gamble, Godrej, Garnier.

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Deodorants and Antiperspirants," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Deodorants and Antiperspirants, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.